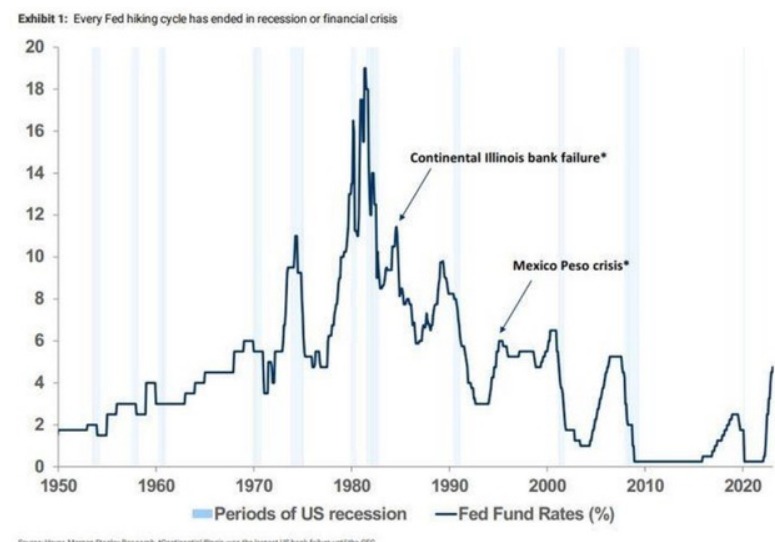

- “Every rate hiking cycle of the last 70 years has ended in recession (c. 80% of the time) and/or a financial crisis...

- His comments came after three U.S. banks have collapsed, as federal authorities organized major banks to deposit $30 billion into First Republic Bank FRC, +3.57% to stave off a fourth.

- “At this stage, we think markets will run with the ‘guilty until proven innocent approach given:

1) The prospect of a material tightening in credit availability and lending standards from banks after recent events;

2) The deeply inverted yield curve going into recent events,” he said.

One of the mysteries for the first two months of the year was the fact that the U.S. economy was seemingly absorbing a wave of Federal Reserve interest-rate hike without a hiccup.

After the events of the last two weeks, that notion can be put to bed. “Every rate hiking cycle of the last 70 years has ended in recession (c. 80% of the time) and/or a financial crisis (in 1984 and 1994),” says Graham Secker, chief European equity strategist for Morgan Stanley in London.

“A week ago it was possible to argue that this observation was theoretical, now we know that it is not going to be different this time,” he added.

His comments came after three U.S. banks have collapsed, as federal authorities organized major banks to deposit $30 billion into First Republic Bank FRC, +3.57% to stave off a fourth. Credit Suisse shares CSGN, -2.36% meanwhile have slumped 22% this week on worries for its survival. Secker did note that financial crises don’t always lead to economic recessions, as evidenced in 1984, 1987, 1994, and 1998. “However, at this stage, we think markets will run with the ‘guilty until proven innocent approach given: 1) the prospect of a material tightening in credit availability and lending standards from banks after recent events;2) the deeply inverted yield curve going into recent events,” he said.

European stocks’ strong performance of the year, before last week, was driven by financials and cyclicals. But now, he says, “We are confident that the economic outlook has deteriorated and that the window for ongoing good/improving macro data is beginning to close.” The firm upgraded the telecom sector to overweight, as it also recommended “re-engaging with quality and other long-duration ideas.”

Banks SX7E, +0.26% will be volatile, but the firm recommended selling into rallies while keeping an overweight on the sector. “It is impossible to determine how much of European Banks’ underperformance is down to concerns around changes to the net interest margin outlook versus contagion risks versus lower bond yields and rate expectations,” said Secker. “We think the latter factor has had a significant contribution and hence any rebound here could lead to some upward volatility in banks.” A popular European exchange-traded fund, the Vanguard FTSE Europe ETF VGK, +0.58%, has gained 5% this year, slightly outperforming the 3% rise for the S&P 500 SPX, +0.37%. Secker however says bank worries undermine the case for European stocks over U.S. ones. “While we still see merit in European equities versus global peers from a valuation and earnings standpoint, a rotation away from ‘cyclical value’ and back towards ‘defensive/quality growth’ would not be consistent with ongoing European outperformance,” he said

Story by Steve Goldstein Last Updated: 3/18/2023, First Published: 3/17/2023 Redacted shorter to keep to important points and bullet points added by HGG. https://www.marketwatch.com/story/every-hiking-cycle-over-the-last-70-years-ends-in-recession-or-a-financial-crisis-its-not-going-to-be-different-this-time-morgan-stanley-strategist-says-f5fddea2