Gold is a Stable Hedge Against Tariff-Driven Inflation and De-Dollarization

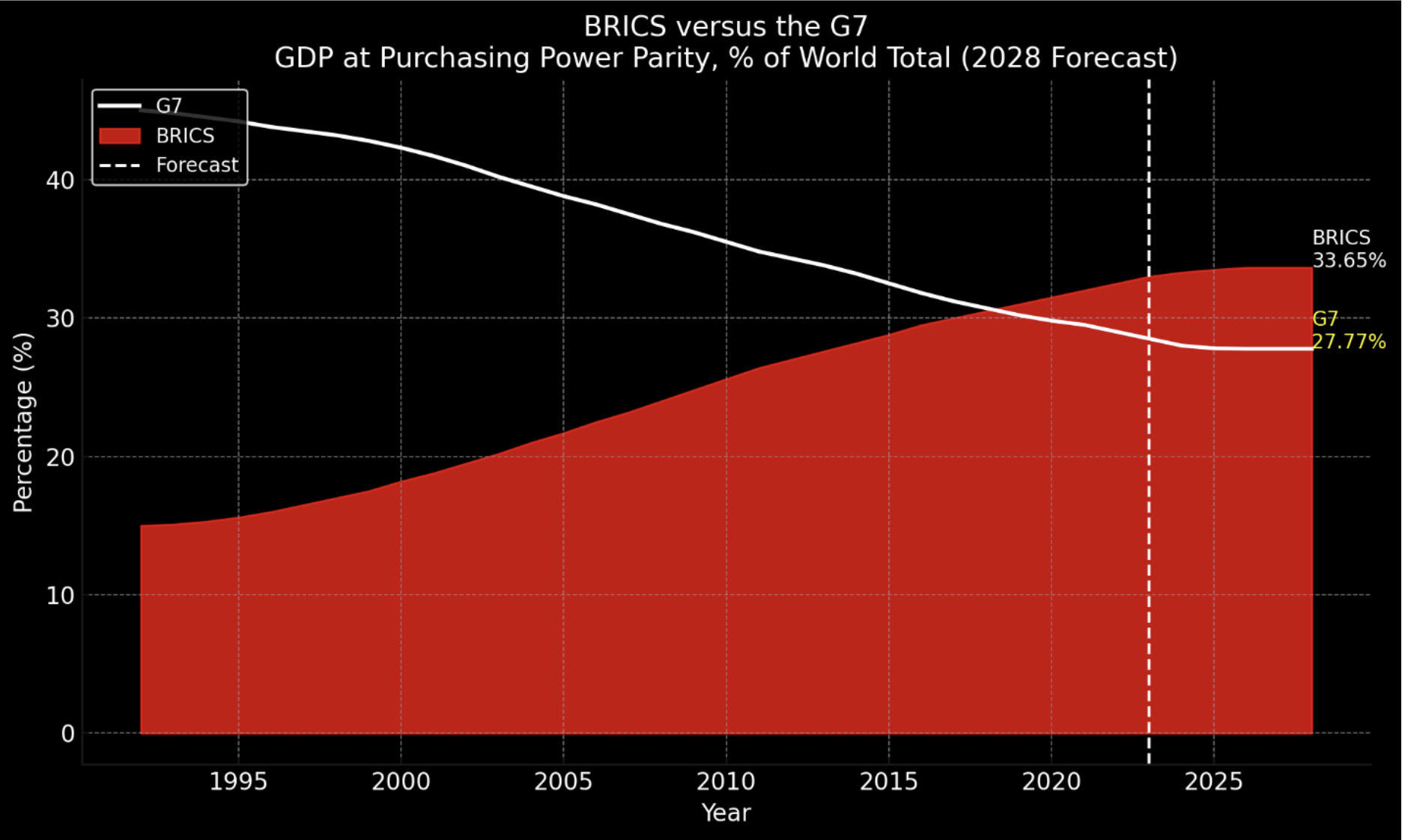

The global economy is experiencing profound changes as nations challenge established trade and currency norms. The BRICS coalition—comprising Brazil, Russia, India, China, South Africa, and recent additions like Iran and the UAE—has taken steps to reduce the U.S. dollar’s influence. In this evolving landscape, gold emerges as a vital asset, offering protection against inflation and the economic shifts brought on by de-dollarization.

BRICS and the Decline of Dollar Dominance

BRICS countries are exploring the introduction of a new currency aimed at minimizing reliance on the dollar. This potential currency, possibly backed by gold and member nations' currencies, threatens to disrupt global demand for U.S. dollars and Treasury bonds, posing economic challenges for the United States. Key initiatives like the BRICS Cross-Border Payment System aim to bypass the dollar in international transactions, accelerating the move toward de-dollarization.

Russian President Vladimir Putin emphasized the need for a deliberate, foundational approach to implementing such transformative changes. While the timeline for a BRICS currency remains shrouded, the alliance’s efforts underscore a growing global desire to reduce dependence on the dollar. This sentiment is fueled by concerns over U.S. economic sanctions and the perceived weaponization of the dollar in geopolitics.

Tariff Responses and Economic Fallout

In response to these developments, President-elect Donald Trump has proposed 100% tariffs on BRICS nations to protect the dollar’s status. Considering that China and India supply significant amounts of imported goods to Americans, such measures could historically trigger tariff-induced inflation and ignite trade conflicts. Tariffs have typically led to higher costs for consumers and businesses, with ripple effects reaching financial markets. Economic analysts suggest that such tensions could increase demand for gold as a safe-haven asset.

Gold as a Hedge in Times of Uncertainty

Gold’s long-standing role as a store of value makes it a reliable hedge against inflation and currency devaluation. In 2024, central banks globally accelerated gold purchases, reflecting a strategic shift in reserve management. This surge in demand highlights gold’s enduring appeal as a financial safeguard.

Gold prices have risen by 28% in 2024, supported by strong central bank buying and expectations of monetary policy easing. Institutions like Goldman Sachs and UBS predict further increases, cementing gold’s position as a critical component of the global monetary system as nations diversify reserves away from the dollar.

Gold’s Role in the BRICS Economic Strategy

Gold’s influence extends beyond personal investment. China established its own platform for gold trading in 2002 and expanded internationally in 2014, offering both its citizens and international investors trading options outside of Western markets. Russia is now working toward the same goal and has proposed a BRICS Precious Metals Exchange that seeks to reshape how gold is priced and traded, reducing reliance on traditional Western markets. This initiative aligns with the broader strategy to reimagine the global economic order, with gold serving as a cornerstone.

Safeguarding Personal Wealth

As geopolitical and economic uncertainties grow, securing financial stability becomes increasingly important. Gold’s resilience during market volatility makes it an essential asset for preserving wealth. Whether through holding physical gold or investing in a Gold-Backed Retirement Account IRA, individuals can protect their assets from inflation, currency fluctuations, and broader economic instability.

Amid the rising wave of de-dollarization and emerging economic alliances, gold continues to demonstrate its enduring value. For those seeking financial security in uncertain times, gold offers a proven means of wealth preservation and stability.

To learn how gold can protect your assets, call us at 844-977-4653.

Source: IMF

Story by Harvard Gold Group