China has launched its CBDC and continues to invest heavily in gold. There is palpable tension among Western central banks to keep up and assert their dominance.

The introduction of central bank digital currencies (CBDCs) seems inevitable, with significant potential repercussions for the gold market. While touted for their convenience and efficiency, CBDCs also herald a broader shift towards increased governmental oversight and control over individual finances. This could include automatic deductions for liabilities like taxes or fines and proactive measures like spending caps or direct withdrawals to combat inflation—tools that grant governments and possibly corporations significant power.

Globally, as countries such as China push forward with their CBDC initiatives and continue to invest heavily in precious metals, there's a palpable tension among Western central banks to not only keep up but also assert their dominance. This dynamic is part of a broader struggle for financial supremacy on the world stage, which may persist for many years.

The move towards a cashless society could usher in stricter regulations and even bans on certain financial practices, including investments in precious metals. The U.S. government's recall of bullion gold during the Great Depression provides a stark historical precedent for such measures in times of economic distress.

Advancements in blockchain and the potential for a global economic downturn could accelerate the adoption of CBDCs. Once operational, these digital currencies will enable central banks to exert an unparalleled level of control over monetary policy and personal financial transactions.

A 2023 report from the Bank for International Settlements discusses how CBDCs could transform the financial landscape by enabling programmable transactions and creating new economic possibilities through a unified ledger system.

“As well as improving existing processes through the seamless integration of transactions, a unified ledger could harness programmability to enable arrangements that are currently not practicable, thereby expanding the universe of possible economic outcomes.”

Zimbabwe's experiment with a gold-backed CBDC is a novel approach that merges digital and traditional monetary systems. However, ensuring the integrity of such a system requires protocols to prevent the falsification of the gold supply.

While it's unlikely that Western CBDCs will incorporate gold backing, central banks are expected to maintain substantial gold reserves as a fallback, highlighting the enduring value of physical gold despite digital advancements. Gold is the third largest reserve currency of central banks.

If CBDCs become widespread and restrictions on private gold ownership are imposed, gold and silver may emerge as essential mediums for barter and trade, providing one of the last refuges for private transactions outside the reach of a centralized financial network.

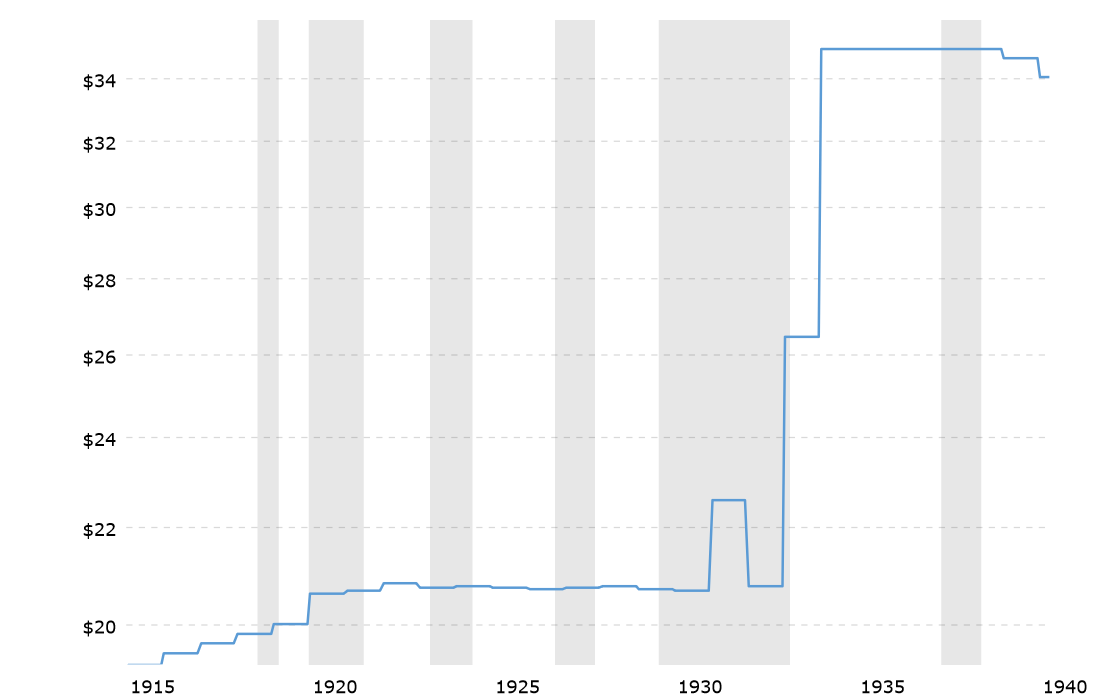

The gold market's reaction to the 1933 Executive Order demanding U.S. citizens hand over their bullion gold—a significant price increase—could be indicative of what might happen with the rollout of CBDCs and the elimination of paper currency.

Gold vs USD Pre and Post-Executive Order 6102

Despite resistance from some legislators who view CBDCs as an overreach, the momentum towards their broad adoption seems likely, perhaps promoted as a stabilizing solution in the aftermath of a major financial crisis. In such a regulated financial landscape, precious metals might not only retain but increase their value, becoming crucial for those seeking to preserve financial autonomy and survival in a digitally dominated economy.

Why Harvard Gold Group?

Harvard Gold Group is America's #1 Conservative Gold Company

As seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The New York Sun, and more. Exceptional customer service and value are the top priorities of Harvard Gold Group (HGG).

HGG is BBB-accredited, holds 5-star ratings across the board, and provides free consultations and metals overviews. We offer tax-free purchases, free 2-day shipping, the best pricing, and direct access to our co-owners, who have over 15 years of experience specializing in precious metals, moving over a hundred million dollars into tangible assets for people's IRAs/retirement accounts and for direct delivery. Customers enjoy lifetime account care and a straightforward buyback program without hassle or liquidation fees.

✔ Tax-Free & Penalty-Free: A Rollover or Transfer of your Retirement Account is almost always tax-free and penalty-free.

✔ Free Metals/Promos: Earn up to $15,000 in FREE Gold/Silver/Promos, on qualifying purchases.

✔ Free Retirement Account Rollover/Transfer: Zero cost to rollover/transfer/move retirement accounts or IRAs to a gold/silver IRA. *You can also earn up to 10 years of Precious Metals IRA yearly maintenance fees*.

✔ Privacy: We protect your privacy and believe it is a commodity as valuable as time, you can't get it back. We do not sell your information to third parties.

✔ HGG Lifetime Account Care: Providing a dedicated account specialist and keeping you updated with market news and trends.

✔ Harvard BuyBack Program: Hassle-free buyback of HGG metals with no liquidation fees.

✔ Guaranteed Precious Metals: We only deal in government-issued coins and branded bars.

✔ Free Shipping: Your precious metals are shipped privately and fully insured to the location of your choice. You can opt to have them delivered directly to your home, business, or an independent depository.

✔ Lowest Pricing: We are committed to offering you the best value possible, with a comprehensive price-match policy.

✔ Customer Satisfaction Guarantee: Harvard Gold Group is a 5-star rated company committed to maintaining exceptional customer service satisfaction.

✔ You work directly with the founders of HGG.

Free Retirement Account Rollover/Transfer & Free Direct Delivery Shipping + Insurance