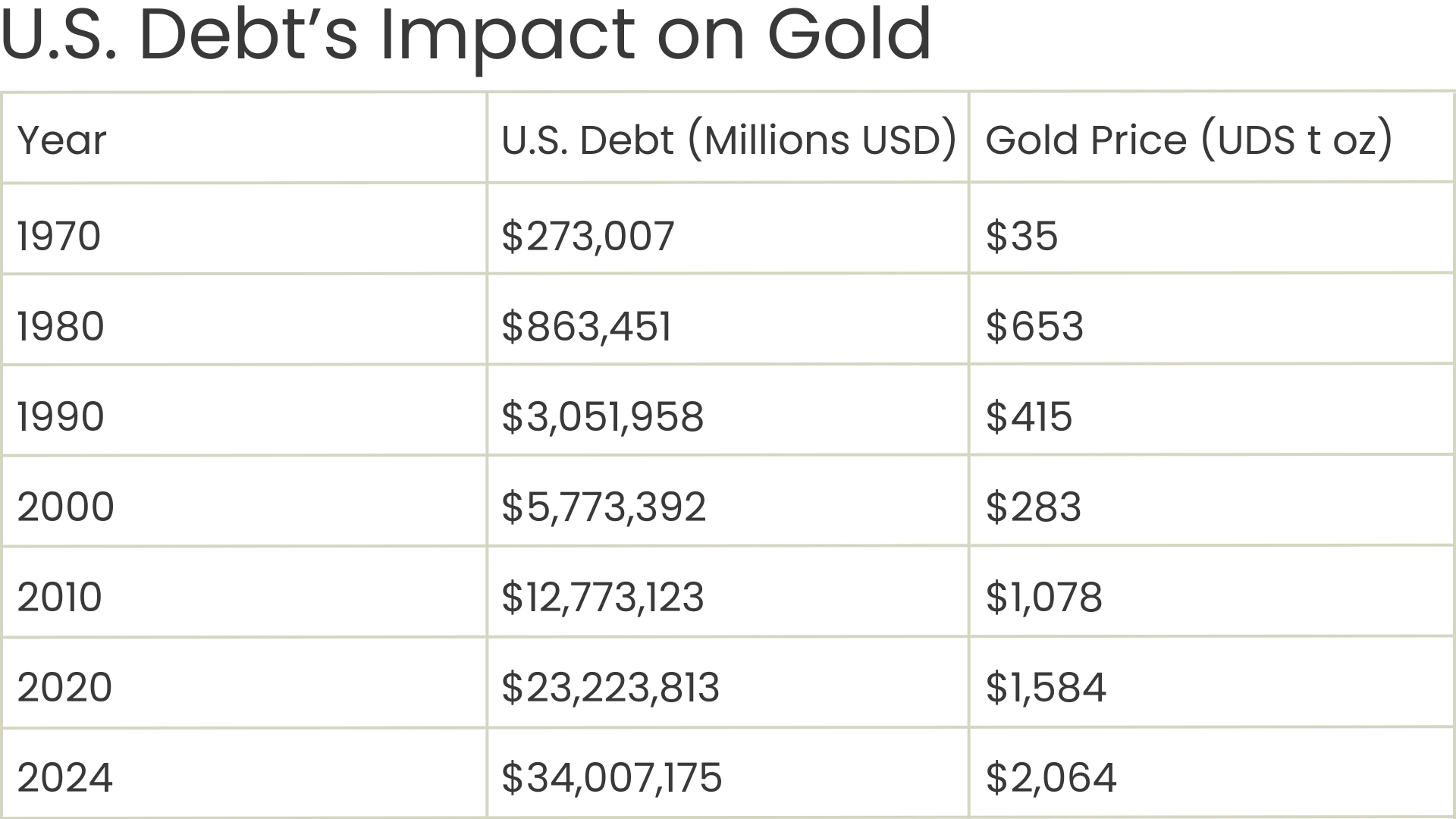

2024 Gold Price Forecasts

*Avg Gold Price Predicted for 2024

$2,693.87 / oz

*Highest Gold Price Predicted in 2024

$5,000 / oz

*Lowest Gold Price Predicted in 2024

$1,825 / oz

See Chart Below for Details

Last updated on January 19, 2024

As Bank of America’s top experts said, in 2023 gold demonstrated a strong performance that defied expectations in a high-interest rate environment. Gold closed 2023 up 13.5%, outperforming commodities, bonds, and most stocks. Gold opened the 2023 year around $1,830 per ounce, saw lows near $1,800, and a record high of $2,135.40, closing the year at $2,064.34 per ounce.

Here are some highlights of the more notable events that propelled gold to higher highs in 2023:

- The March Banking Crisis, the banks that went under had $548.7 billion of combined assets, the largest total ever in a single year.

- The Oct. Bond Market Crash, the worst bond market crash in 150 years. According to Bloomberg, losses on Treasury bonds with maturities of 10 years or more had amounted to a significant 46% decline since March 2020, while the 30-year bond had experienced an even more substantial 53% drop.

- The Israel-Hamas conflict fostered a climate of additional fear and instability that global conflicts could escalate.

Investors sought refuge in gold as a secure asset, reaffirming its role as a safe-haven during times of economic and geopolitical distress.

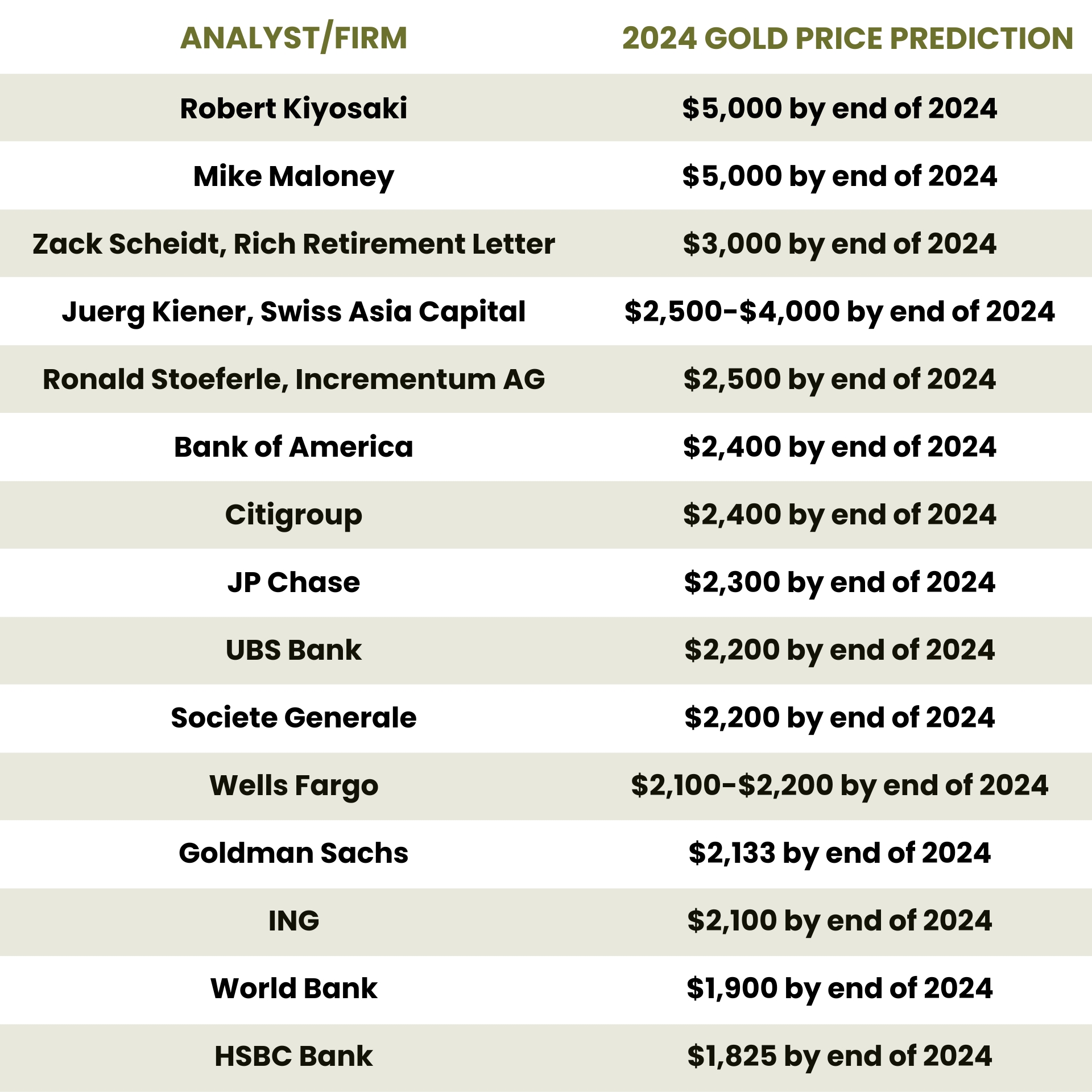

Looking at 2024, there are no shortages of catalysts to catapult the gold price significantly higher. Bank of America’s top experts are forecasting gold to hit $2,400 by year-end and JP Morgan Chase has a target of $2,300.

Experts in gold pricing, including industry leaders, financial analysts, and major banks, highlight multiple elements influencing gold price predictions for 2024.

These factors are:

- Federal Reserve's policy rate cuts

- Election year polarization causing turbulence in the markets

- Countries adding gold to their national reserves

- Gold’s safe-haven appeal during times of uncertainty

- Biden is on track to add $3 trillion to the national debt this fiscal year

- Continuation of the banking crisis

- Potential US/Global recession

- BRICS Nations De-dollarization agenda

- Geopolitical unrest, including continuing conflicts in the Middle East and Europe

U.S. & Global Economic Projections for 2024

As we look to 2024, the U.S. government anticipates a strong year, hoping for a 'soft landing.' However, it's uncertain whether the economy will continue to expand as seen in 2023 or face a possible overdue recession. Regarding the U.S., making predictions is difficult, especially with 2024 being an election year. Recessions typically don't bode well for reelection, suggesting the ruling party might do everything possible to avoid a recession until at least the following year. This approach of 'kicking the can down the road' is a familiar tactic.

Globally, the World Bank predicts economic growth will slow for the third consecutive year in 2024, while Goldman Sachs and others foresee a 2.6% increase in Worldwide GDP. Our view leans towards global economic weakness, influenced by two ongoing wars, the potential for additional conflicts in other volatile regions, and an overall slowing of major countries like China.

Possible Economic Vulnerabilities in 2024

Although the government's outlook on 2024 is generally favorable, there are significant risks ahead. The swift increase in the Federal Reserve's policy rate has resulted in more stringent financing conditions to slow down economic activity and growth. In addition, trillions of dollars are expected to need refinancing for commercial property loans that come due by the end of 2024. With interest rates in some cases up 400%, this leaves many commercial properties looking at default, which raises the risk of additional bank failures.

Major Catalysts for Gold: Uncertainty and Recession

In the event of a U.S./global recession, gold’s historical performance as a safe-haven asset typically sees its demand increase. In these recessionary conditions, economic growth weakens, inflation reduces, and interest rate cuts become likely. Historically, these conditions have been very favorable for gold. During the Great Recession, gold exhibited a 51% price increase from December 2008 to December 2009.

Gold’s Unique Dual Role within Investment Portfolios

Gold is a strategic asset because it is considered both a safe-haven asset and has abundant commercial/industrial uses. As a dual investment vehicle, gold offers benefits you cannot achieve in other assets. Looking back upon the last 24 years, amid U.S. economic and stock market growth and three major crises (2001, 2008, and 2020 COVID-19), gold is up over 700% and has outperformed the broader stock markets and bonds.

De-Dollarization

De-dollarization refers to the global trend of decreasing dependence on the U.S. dollar as the main reserve currency and the dominant currency for international transactions. BRICS countries have worked diligently towards reducing reliance on the US dollar. 2023 marked several major events toward the push away from the dollar:

- In Jan 2023, Saudi Arabia announced its intention to conduct oil trade in currencies other than the U.S. dollar.

- April 2023, Iraq's Central Bank announced its intention to conduct oil trade with China using the yuan.

- March 2023, the United Arab Emirates was part of a historic transaction as China executed the first-ever yuan-settled energy deal involving Emirati liquefied natural gas (LNG).

- August 2023, India and the United Arab Emirates initiated trade in their local currencies, marking a historic moment when the UAE accepted payment in Indian Rupees for over a million barrels of oil, bypassing the U.S. dollar.

For decades, OPEC countries adhered to the agreement of exclusively selling oil in U.S. dollars, solidifying the dollar's status as the world's primary reserve currency. This momentous shift underscores the increasing diversification away from the U.S. dollar as the dominant currency for global trade, serving as a clear signal of the evolving monetary landscape.

Central Bank Demand and Geopolitical Risks

In the face of increased geopolitical tensions and crucial elections in major economies, along with ongoing central bank acquisitions, gold prices are finding further support. These geopolitical uncertainties further solidify gold's position as a reserve asset for nations. Countries' central banks have increased their massive buying of physical gold for 15 consecutive years and there appears to be no end in sight for this demand to diminish.

Geopolitical Landscape

The geopolitical landscape in 2024 is expected to remain volatile and uncertain. Continuing conflicts in the Middle East and Europe should continue to drive investors towards safer assets. Other geopolitical risks include China’s economic adjustments and their threats over the Taiwan Strait.

Sources:

https://www.sbcgold.com/gold-price-forecasts/gold-price-forecast-2024/

https://www.nasdaq.com/articles/gold-prices-forecast-for-2024:-targeting-$2500-as-fed-rate-cuts-loom

World Gold Council

Disclaimer: This is not investment advice. The information provided is for informational purposes only. No information, materials, services, or other content provided on this page is a solicitation, recommendation, endorsement, or any financial, investment, or other advice. Always seek independent consultation from a professional before making any investment.

Top Experts 2024 Gold Price Predictions & Forecasts

Free Retirement Account Rollover/Transfer & Free Direct Delivery Shipping + Insurance