Retirement Accounts - Rollovers - Transfers to a Silver IRA

Silver IRA

Claim Your Free Silver IRA Guide

All submissions agree to the risk disclosure + privacy policy. We respect your privacy & will not sell your information. Unsubscribe anytime.

Transition Beyond Paper with a Silver IRA

Not all investments are the same, nor are the types of IRAs (individual retirement accounts). Regular IRAs and conventional 401k retirement accounts allow for certain paper investments, whereas Silver IRAs can elevate your diversification above and beyond paper investment vehicles.

Why a Physical Silver IRA?

You might be curious about why Silver IRA firms consistently highlight the importance of diversification. Essentially, diversification involves allocating your investments among different types of assets to mitigate risk. No investment is entirely risk-free, as various assets behave differently to ever-changing market conditions. Hence, securing a well-rounded portfolio that includes a variety of assets, such as silver, can protect your wealth.

How a Silver IRA

Elevates Protection & Diversification

A Silver IRA Offers True Diversification

Silver, often considered a sibling to gold, historically rises significantly during recessions, stock market corrections, inflation, and times of global tension, making it an excellent hedge against market calamity. Additionally, like gold, silver has been used as currency throughout the ages, marking it as a good hedge against currency devaluation, which may be the greatest financial challenge facing the U.S. today. This means that all things dollar-denominated have large hurdles to face. Janet Yellen, head of the U.S. Department of the Treasury, stated recently that "the dollar's share of global reserves is continuing to decline as countries look to diversify." Countries have been accumulating physical gold by the ton, increasing each year. Make no mistake, with gold currently holding the title of the third-largest reserve currency in the world, silver is expected to follow gold’s lead and increase in value.

Physical Backed Silver IRA

Beyond preserving purchasing power, tangible silver is portable, offers privacy in transactions, and serves as a valuable means of passing wealth to future generations. Physical silver is one of the most liquid investments. Silver is global money, there are exchanges all over the world for the currency of your choice.

Silver IRAs Offer More Distribution Choices

When it is time for you to take distributions, you can choose precious metals, dollars, or a combination of both. This distinct feature allows you to explore tax strategies that meet your goals and financial objectives to effectively maximize your retirement years.

A Silver IRA is Easy to Establish & Maintain

Harvard Gold makes setting up a Silver IRA simple and easy. We assist with the straightforward paperwork process and make it seamless. Our IRA team is dedicated to answering all your questions and guiding you through every step of the precious metal investment process. You can rely on an effortless process and ongoing support for the lifetime of your investment, including your heirs. We provide market updates, charts, and dedicated account specialists.

You can move almost any type of retirement account above $25,000 into a Silver IRA. HGG offers 100% free conversion, as well as free storage, maintenance, and insurance for up to ten years. Qualifying purchases can also receive up to $15,000 in free metals match, delivered to your door or location of your choice.

★★★★★

Customer Service

Types of Silver IRAs:

Traditional Silver IRA

What Is a Traditional Silver IRA?

A Traditional Silver IRA is a type of self-directed retirement account that allows you to hold physical silver—such as IRS-approved silver coins and bars—within a tax-advantaged Traditional IRA structure. Like other Traditional IRAs, your contributions may be tax-deductible, and your investments grow tax-deferred until you begin making withdrawals in retirement.

- As of 2024, you can contribute up to $7,000 per year (or $8,000 if you're age 50 or older), or the total of your taxable compensation—whichever is less. Contribution limits and deductibility may vary based on your income and whether you're covered by a workplace retirement plan. Check with your CPA.

What is a Roth Silver IRA?

A Roth Silver IRA is a powerful retirement strategy that combines the long-term tax benefits of a Roth IRA with the stability and inflation protection of physical silver. With a Roth Silver IRA, you fund your account using after-tax dollars, which means your contributions are not tax-deductible—but in return, both your account’s growth and qualified withdrawals in retirement are completely tax-free.

With a Roth Silver IRA, you can invest in a range of IRS-approved silver bullion, including select coins and bars that meet purity and fineness standards. This allows you to diversify your retirement savings with a tangible, historically trusted asset that tends to perform well during periods of inflation, recession, market volatility, or currency decline.

- Contributions for Roth IRAs are the same as above for Traditional IRAs.

What Is a SEP Silver IRA?

A SEP Silver IRA (Simplified Employee Pension) is a self-directed retirement plan designed for business owners, self-employed individuals, and small businesses—even those with just one employee. A SEP Silver IRA allows you to hold physical silver, such as IRS-approved silver coins and bars, within a tax-deferred IRA structure.

One of the key advantages of a SEP Silver IRA is its higher contribution limits—employers can contribute up to 25% of each eligible employee’s compensation, significantly more than Traditional or Roth IRAs. This makes it a smart solution for those looking to maximize retirement contributions while diversifying into precious metals like silver.

A SEP Silver IRA is also cost-effective and easy to establish, with minimal administrative requirements. Setting up a SEP is straightforward, requiring only one additional form, which Harvard Gold Group can provide.

Whether you're a sole proprietor or managing a small team, a SEP Silver IRA offers the flexibility, tax advantages, and inflation protection of physical silver—all in one powerful retirement plan.

What is a SIMPLE Silver IRA?

A SIMPLE Silver IRA (Savings Incentive Match Plan for Employees) is a self-directed, tax-deferred retirement plan tailored for small businesses with 100 or fewer employees. It allows both employees and employers to contribute to individual retirement accounts that can hold physical silver, such as IRS-approved silver coins and bars.

A SIMPLE Silver IRA is an excellent option for businesses that don’t yet offer a retirement plan, offering a cost-effective and easy-to-administer solution. Compared to traditional 401(k) plans, SIMPLE IRAs have lower administrative costs, fewer reporting requirements, and straightforward contribution rules.

By incorporating silver into a SIMPLE IRA, small business owners and their employees can diversify retirement savings with a tangible asset known for preserving purchasing power during inflation or economic volatility.

What is an Inherited Silver IRA?

An Inherited Silver IRA— also known as a Beneficiary Silver IRA— is a type of self-directed IRA that allows beneficiaries to hold physical silver (such as IRS-approved silver coins and bars) after inheriting a retirement account from a deceased individual. This option enables you to continue the legacy of the original account while adding the inflation-hedging power of precious metals to your retirement strategy.

Inherited IRAs, including Inherited Silver IRAs, are subject to specific IRS rules, such as required minimum distributions (RMDs) and strict timeframes for account transfers and withdrawals. These rules vary depending on whether the original account holder passed away before or after their required beginning date and whether the beneficiary is a spouse, non-spouse, or eligible designated beneficiary.

Call our Silver IRA team— inherited accounts have some important rules and timelines that must be met: 844-977-4653

3 Steps to Setup a Silver IRA

Transfers/Rollovers/Conversions are Absolutely FREE!

Establish your Silver IRA with Harvard Gold Group, completely free of charge. We're here to assist you in moving your IRA tax-free and penalty-free. Our IRA Specialists are dedicated to helping you every step of the way, ensuring a simple and effective setup. Ask how you can get up to ten years of free annual custodian and depository costs.

1. Open Your Self-Directed Silver IRA

Our IRA Specialists will assist you in completing the paperwork and share a quick overview of the process, cost, and timing.

2. Transfer Funds to Silver IRA Account

We will assist you with the rollover or transfer of funds from your existing retirement account to your new Silver IRA. Funding is completed in as little as 3 days. There is usually no need to call your current custodian.

3. Choose/Receive Your Silver IRA Coins & Bars

Once your account is funded, we can provide you with a simple asset overview. Your chosen assets are then shipped directly to your IRA-designated depository.

Eligible Accounts for Rollover/Transfer Include:

All Types of IRAs, Inherited Retirement Accounts, Pension Plans, 401(k), 403(b), 457, TSPs

*Ask us how you can earn up to 10 years of free Hard Asset IRA yearly maintenance fees*

Protect Your Future with a Silver IRA

Planning is essential when deciding when and how to retire. Harvard Gold, America’s #1 Conservative Gold & Silver Company is here to help you protect and diversify your retirement savings. Avoid letting rising inflation and the next financial crisis shatter your aspirations. Silver can give you peace of mind and help you enjoy the rest of your life.

Call our Precious Metals Specialist today at (844) 977-GOLD

ABOUT SILVER-BACKED IRAS

Self-Directed Silver IRA accounts enable you to invest in silver, offering a valuable avenue for asset diversification and financial safeguarding. However, IRS guidelines dictate specific requirements for approved silver assets.

IRS-approved Silver with a fineness level above .995 can be utilized for a Silver IRA. The American Silver Eagles are the official bullion coin of the United States. Additionally, the Silver Buffalo Coin is a great option for your Silver IRA.

Featured Products for IRS-Approved Silver IRA Assets:

Silver American Eagle

U.S. Mint

Silver British Britannia

Royal Great Britain Mint

Silver Canadian Maple Leaf

Royal Canadian Mint

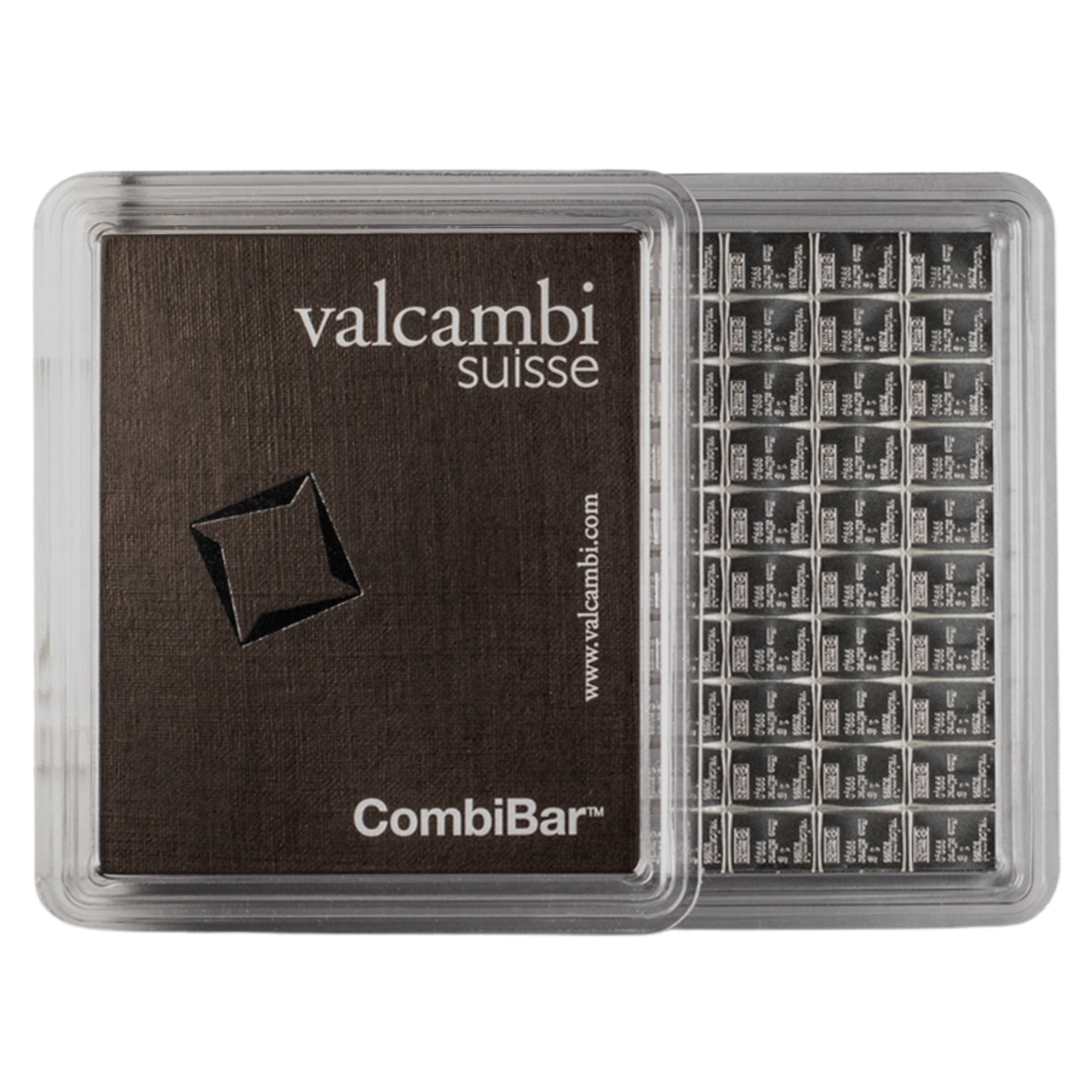

100g Valcambi Silver Bar

Suisse Mint

Why Harvard Gold Group?

America's #1 Christian Gold Company

As seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The Christian Post, The New York Sun, and more— Harvard Gold Group (HGG) is trusted nationwide for exceptional service and unmatched value.

Harvard Gold Group does not employ commissioned salespeople— ensuring that your goals, not sales quotas, are always our top priority. HGG is BBB A + 5-star rated across the board, with zero complaints. Since 2010, our co-owners have helped Americans move over $100 million into tangible gold and silver, whether for retirement accounts or secure direct delivery.

Clients benefit from free consultations and metals overviews, tax-free purchases for eligible accounts, free 2-day insured shipping, a best-pricing policy, and lifetime account care. Every customer has direct access to our experienced co-owners, ensuring your precious metals investment is secure, straightforward, and backed by over a decade of expertise— along with a straightforward buyback program that has no hassle or liquidation fees.

✔ Tax-Free & Penalty-Free: A Rollover or Transfer of your Retirement Account is almost always tax-free and penalty-free.

✔ Free Metals/Promos: Earn up to $15,000 in FREE Gold/Silver/Promos, on qualifying purchases.

✔ Free Retirement Account Rollover/Transfer: Zero cost to rollover/transfer/move retirement accounts or IRAs to a Gold/Silver IRA. *You can also earn up to 10 years of FREE IRA yearly fees*.

✔ Privacy: We protect your privacy and believe it is a commodity as valuable as time— you can't get it back. We do not sell your information to third parties.

✔ HGG Lifetime Account Care: Providing a dedicated account specialist and keeping you updated with market news and trends.

✔ Harvard BuyBack Program: Hassle-free buyback of HGG metals with no liquidation fees.

✔ Guaranteed Precious Metals: We only deal in government-issued coins and qualified branded bars.

✔ Free Shipping: Enjoy free shipping and insurance on orders over $10k. You can opt to have them delivered directly to your home, business, or an independent depository.

✔ What is Our Lowest Price Guarantee? We are committed to offering you the best value possible, with a comprehensive price-match policy.

✔ Customer Satisfaction: Harvard Gold Group is a 5-star rated company committed to maintaining exceptional customer service satisfaction.

✔ You work directly with the founders of HGG.

Ready to Enjoy the

Benefits of a Silver IRA?