Against the backdrop of escalating tensions in the Middle East, major financial institutions on Wall Street are revising their gold price forecasts upward. Goldman Sachs holds a bullish outlook, setting a target of $2,700, while Bank of America projects an even higher expectation at $3,000. UBS presents an even bolder forecast, envisioning an impressive $4,000 per ounce—a potential doubling of current values.

In parallel, gold futures reached another record high settlement on Tuesday, bolstered by Citi's forecast of the yellow metal's ascent to $3,000 per ounce within the next 6-18 months. This aligns with a broader trend among Wall Street banks, which have adjusted their forecasts upward.

Echoing Rihanna's lyrics, Citi analysts Aakash Doshi and Arkady Gevorkyan likened gold to shining bright like a diamond. They adjusted their year-end 2024 price target to $2,350 per ounce, marking a 6.8% increase, and made a substantial 40% upward revision to $2,875 per ounce for 2025. They anticipate that the $3,000 level will be reached after regular testing of $2,500 in the second half of this year.

Citi attributes gold's rise to increased flows from managed money players, who are catching up with demand from physical consumers in China and central banks. They also suggest that a potential Fed cutting cycle or recession scenario heading into 2025 will further boost investment demand.

Deutsche Bank also weighed in, forecasting gold prices at $2,400 per ounce by year-end 2024 and at $2,600 by December 2025. According to their analysts, gold is likely to maintain its strength as new investors replace any profit-taking by early investors.

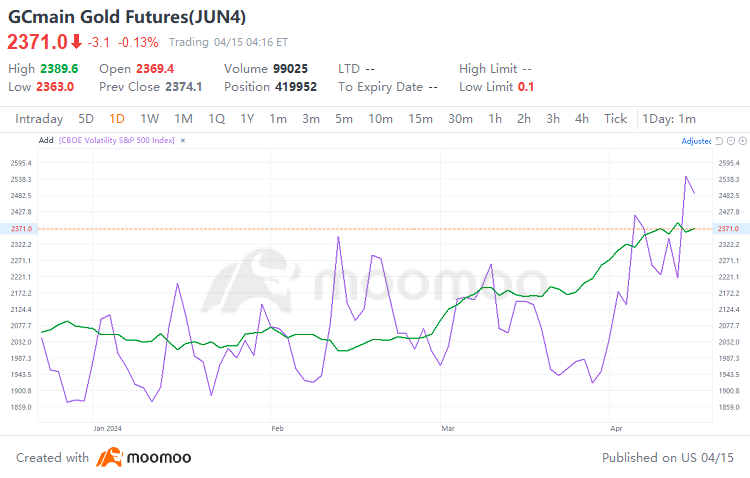

Gold futures (JUN4) (GCmain.US) have consistently been hitting new record highs this year, successively surpassing the $2400 mark. On April 12th, as the CBOE Volatility S&P 500 Index (.VIX.US)—which gauges short-term investor panic—hit its highest point of the year, the international gold price surged to $2448.8, approaching the critical threshold of $2500.

The record-breaking rally in gold prices can be attributed to a confluence of factors including market concerns over persistent inflation in the U.S., escalating geopolitical conflicts, the approaching U.S. elections raising worries about the country's fiscal situation, and a Fear Of Missing Out (FOMO) sentiment among investors.

Amidst these market dynamics, major Wall Street banks have been notably adjusting their gold price forecasts.

Why should you expect Gold to continue to Climb higher?

Gold Delivered 25% Profits Year-On-Year For 25 Years

Gold's enduring status as a timeless store of value has remained steadfast throughout the centuries, with its allure undiminished. Widely regarded as the premier asset worldwide, its value steadily climbs year after year. Serving as a reliable hedge against economic uncertainties and inflation, gold stands tall as a cherished haven for investors, making it one of the most coveted investments in global markets.

Now, let's rewind 25 years and delve into the performance of gold prices over the past quarter-century. For investors with a long-term perspective, gold has consistently delivered substantial returns. In this piece, we'll examine the profits generated by gold investments from 1999 to 2024.

Profits in Gold Between 1999 to April 2024

In 1999, the average price of gold stood at $278 per ounce, rebounding from its historical low of $252 earlier that year. Fast forward to this week, and gold prices have surged past the $2,380 mark, fueling robust bullish sentiment. From April 18th, 2024, profits in gold range from $278 to $2,380 per ounce.

Imagine investing $10,000 in gold back in 1999 at the average price of $278 per ounce. With that investment, you could have accumulated 36 ounces of gold. Fast forward to 2024, where gold prices now hover above $2,380 per ounce. That initial $10,000 investment could have blossomed into a remarkable $85,560 in profits.

This translates to an impressive return on investment (ROI) of approximately 756% from 1999 to April 18, 2024. To put it into perspective, gold has consistently delivered annual profits exceeding

25% over the past 25 years, reaffirming its status as a lucrative investment choice.

Harvard Gold Group specializes in physical gold and silver delivery

We offer two programs: Private Direct Delivery & Precious Metals IRA/retirement accounts. They are BBB-approved, and 5-star rated across the board, offering free consultations and metals overviews. Customers enjoy lifetime account care and a no-hassle/no-liquidation fee buyback program. Perhaps best of all, clients can qualify for tax-free transactions, free shipping, and free insurance.

You can move almost any type of retirement account above $25,000 into a physical precious metals IRA. Retirement accounts like IRAs, 401Ks, Pension Funds, TSPs, 403Bs, and more. Harvard Gold Group offers 100% free conversion, as well as free storage, maintenance, and insurance for up to five years. Qualifying purchases can also receive up to $15,000 in free metals, delivered to your door or location of your choice.

To learn how Harvard Gold Group, America’s Most Conservative Gold Company can help you protect your nest egg, download their free 2024 information guide, or call them today at (844) 977-GOLD. Havard Gold Group is trusted and recommended by Mark Davis, The Babylon Bee, Not The Bee, The Fish, and more. Learn more at harvardgoldgroup.com

Protect Yourself Against These Events by Hedging with Gold & Silver

Article by Harvard Gold Group

Source: U.S. Bureau of Labor Statistics

Source: Dec 30, 2023: https://www.resumebuilder.com/due-to-inflation-1-in-5-retirees-likely-to-go-back-to-work-this-year/