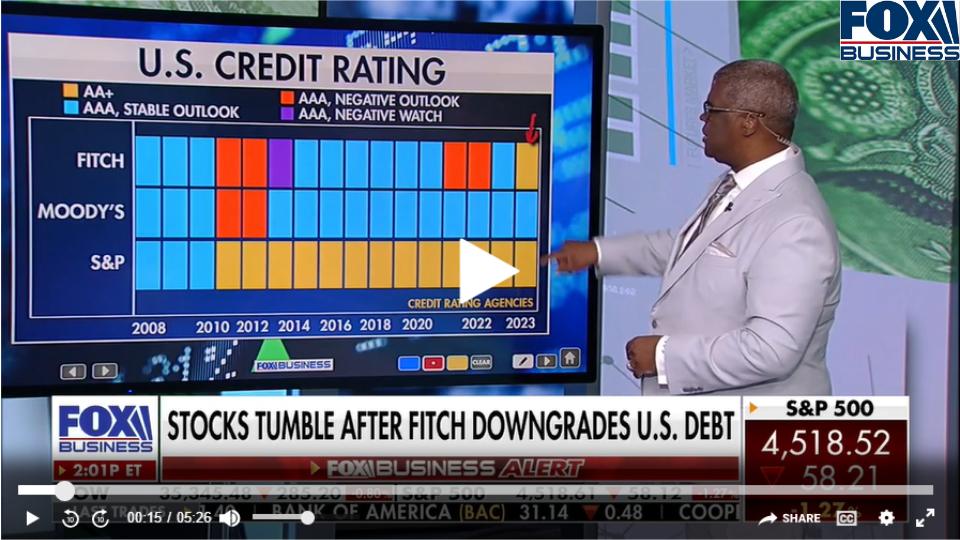

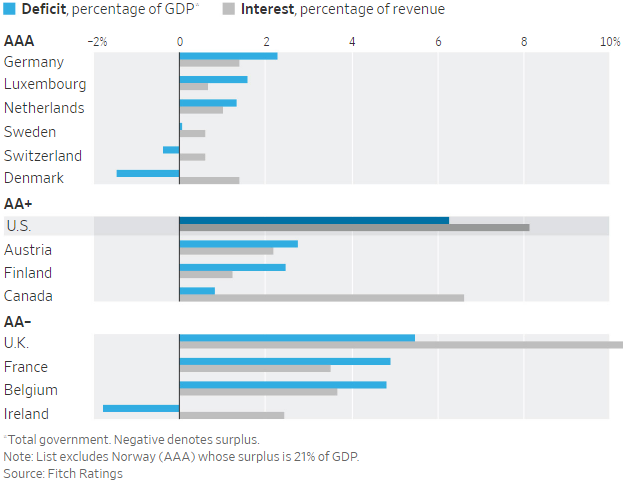

- A Fitch Ratings analyst on Tuesday warned the agency may be forced to cut the credit ratings of more than a dozen banks, including some major Wall Street lenders.

- Another one-notch downgrade of the industry's score, to A+ from AA-, would force Fitch to reassess ratings on each of the more than 70 U.S. banks it covers, analyst Chris Wolfe told CNBC.

- The news comes just one week after Moody's announced it had lowered the ratings of 10 banks by one notch amid concerns over higher interest rates, rising funding costs and increased risk from the commercial real estate sector.

A Fitch Ratings analyst on Tuesday warned the agency may be forced to cut the credit ratings of more than a dozen banks, including some major Wall Street lenders.

Fitch already lowered the score of the "operating environment" for U.S. banks to AA- from AA at the end of June – a move that went largely unnoticed.

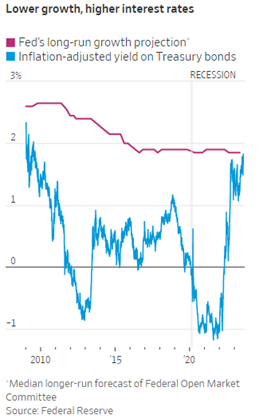

In making that decision, the agency cited downward pressure on the country's sovereign debt rating, gaps in regulatory framework around the "normalization of monetary policy," and uncertainty over the future outlook for interest rates.

"We do not expect the lower OE score to negatively impact the ratings of U.S. banks, although it reduces ratings headroom," Fitch said at the time, but it added: "A multi-notch downgrade would revise Fitch’s financial performance benchmarks for banks and would lead to lower financial profile scores, all else equal."

Another one-notch downgrade of the industry's score, to A+ from AA-, would force Fitch to reassess ratings on each of the more than 70 U.S. banks it covers, analyst Chris Wolfe told CNBC. That could mean banking giants like JPMorgan Chase and Bank of America see a credit cut, because banks cannot have a higher credit rating than the system in which they operate.

"If we were to move it to A+, then that would recalibrate all our financial measures and would probably translate into negative rating actions," Wolfe said.

The news comes just one week after Moody's announced it had lowered the ratings of 10 banks by one notch amid concerns over higher interest rates, rising funding costs and increased risk from the commercial real estate sector. Among the firms that had their ratings cut were M&T Bank, Pinnacle Financial, BOK Financial, Webster Financial, Old National Bancorp and Fulton Financial.

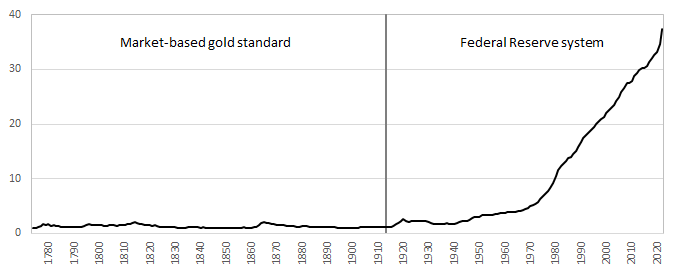

"U.S. banks continue to contend with interest rate and asset-liability management (ALM) risks with implications for liquidity and capital, as the wind-down of unconventional monetary policy drains systemwide deposits and higher interest rates depress the value of fixed-rate assets," Moody’s analysts said of the decision.

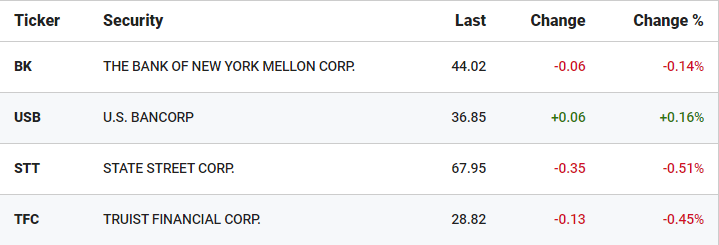

Moody's also placed six banking giants – including U.S. Bancorp, Bank of New York Mellon and Truist Financial – on review for potential downgrades.

"Many banks' second-quarter results showed growing profitability pressures that will reduce their ability to generate internal capital," the firm said. "This comes as a mild U.S. recession is on the horizon for early 2024 and asset quality looks set to decline, with particular risks in some banks’ commercial real estate (CRE) portfolios."

The outlook of 11 other banks, including Capital One, Citizens Financial and Fifth Third Bancorp, was also changed to negative.

Regional banks were at the epicenter of recent upheaval within the financial sector after the stunning collapse of Silicon Valley Bank and Signature Bank triggered a deposit run in early March.

Authorities rushed to shore up confidence in the banking system with the launch of several emergency measures, but Moody's warned that banks with sizable unrealized losses that are not reflected in their regulatory capital ratios remain "vulnerable to a loss of investor confidence."

The downgrade comes in the midst of the most aggressive monetary policy tightening campaign in decades. The Federal Reserve in July approved another interest rate hike, lifting the benchmark rate to the highest level since 2001.

Story by Megan Henney - Redacted bullet points by Jody Davis https://www.foxbusiness.com/economy/fitch-warns-multiple-us-banks-face-credit-downgrade-report