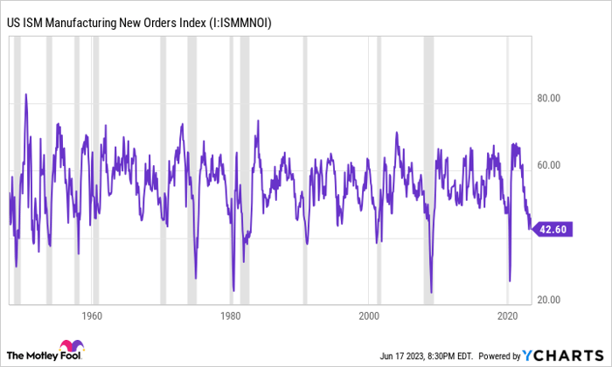

- Over the 70 years, any time the New Orders Index has dipped below 43.5, a recession has followed soon after.

- the monthly reported data, which dates back to 1948, sizable declines in the ISM Manufacturing New Orders Index have coincided with U.S. recessions.

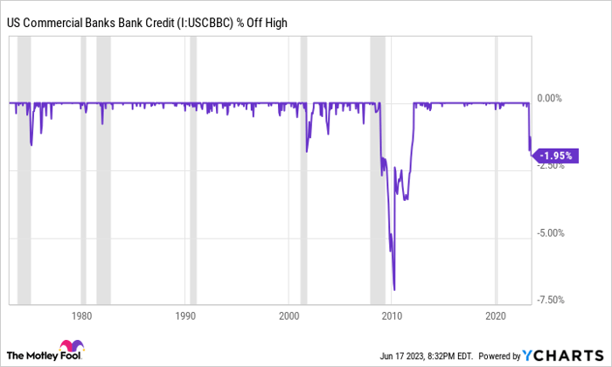

- Since 1973, there have been four instances where commercial bank credit declined by at least 1.5% from an all-time high. Three of these periods coincided with the benchmark S&P 500 losing about half of its value…

- The fourth such instance has been ongoing over the past three months.

- declining money supply with above-average inflation has never been a winning combination. The four previous instances since 1870 where M2 declined by at least 2% resulted in three depressions and one panic.

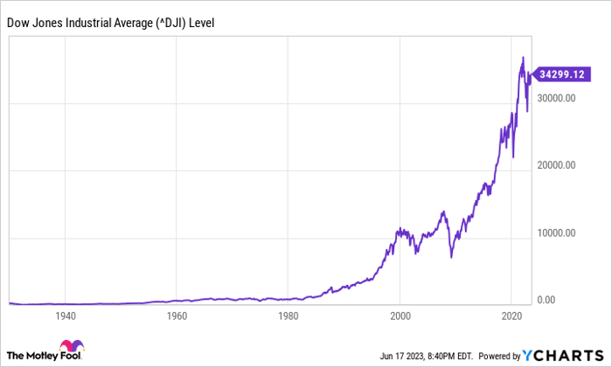

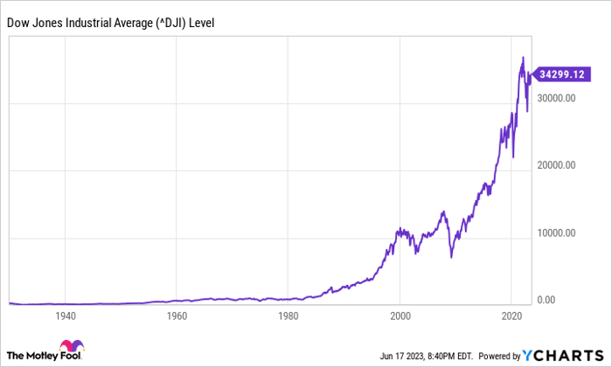

Wall Street can be a fickle thing when it's examined over short timelines. In 2021, the 30-component Dow Jones Industrial Average (DJINDICES: ^DJI), broad-based S&P 500 (SNPINDEX: ^GSPC), and growth-stock-fueled Nasdaq Composite (NASDAQINDEX: ^IXIC) all surged to record-closing highs. This was followed up by the worst performance in 14 years for all three indexes in 2022.

Although a small number of megacap tech stocks have had a phenomenal start to 2023, many investors are still left to wonder when the 2022 bear market will be firmly put into the rear-view mirror and a period of uncertainty will come to a close. In other words, investors would love to know where stocks are headed next.

Truth be told, there is no such thing as a foolproof indicator that can concretely predict the directional movement in stocks 100% of the time. There is, however, an assortment of indicators and metrics with exceptional track records of being right. Those investors who follow these indicators and metrics may have an edge over those who don't.

This economic indicator hasn't been wrong in seven decades

Right now, one economic indicator that's been nothing short of flawless in predicting the directional movement in stocks over the past 70 years has a pretty clear message for where equities are headed next. I'm talking about the ISM Manufacturing New Orders Index.

The ISM Manufacturing New Orders Index is actually a subcomponent of the more popular ISM Manufacturing Index, which is also commonly known as the Purchasing Managers Index. Every month, the Institute of Supply Management (ISM) surveys over 400 industrial executives to gauge the health of new industrial orders, inventories, employment, and a handful of other factors.

Although America's industrial sector isn't the behemoth it was before the rise of the technology sector, it still plays a key role in U.S. employment and serves as a rock-solid indicator of economic growth or contraction to come.

The U.S. ISM Manufacturing New Orders Index is measured on a scale of 0 to 100, where 50 represents a baseline of neither expansion nor contraction. A figure above 50 implies expanding industrial orders, whereas a number below 50 suggests orders are declining.

As you can see from the monthly reported data, which dates back to 1948, sizable declines in the ISM Manufacturing New Orders Index have coincided with U.S. recessions.

According to research from Ed Clissold, the Chief U.S. Strategist at independent research firm Ned Davis Research, no bear market after World War II has bottomed prior to an official recession being declared by an eight-economist panel of the National Bureau of Economic Research. In other words, if a U.S. recession were to occur, history would suggest that the Dow, S&P 500, and Nasdaq Composite have yet to reach their true bear market lows.

While the ISM Manufacturing New Orders Index has had plenty of instances since 1948 where readings fell below 50 and signaled a contraction in new industrial orders, the somewhat arbitrary line in the sand has been a reading below 43.5. Out of the more than one dozen instances where the ISM Manufacturing New Orders Index has produced a reading below 43.5, only one proved to be a false-positive for a U.S. recession. That occurred roughly 70 years ago. Since then, any time the New Orders Index has dipped below 43.5, a recession has followed soon after. Multiple times in 2023, the ISM Manufacturing New Order Index has fallen below 43.5.

Other economic indicators may spell trouble

However, this is far from the only economic indicator raising eyebrows at the moment.

For instance, U.S. commercial bank credit is signaling trouble. Over the past half-century, commercial banks have been steadily increasing the amount they've loaned out with virtually no interruption. That's because banks have to cover the costs of taking on deposits.

Since 1973, there have been four instances where commercial bank credit declined by at least 1.5% from an all-time high. Three of these periods coincided with the benchmark S&P 500 losing about half of its value, give or take a bit in each direction. The fourth such instance has been ongoing over the past three months.

The failure of SVB Financial's Silicon Valley Bank, followed by Signature Bank and First Republic Bank being seized by regulators, has banks very clearly tightening their lending standards. When banks begin pulling back on lending, it typically bodes poorly for the U.S. economy and stock market.

Additionally, we're witnessing something truly historic from M2 money supply. M2 incorporates everything in M1 money supply (physical coins, cash bills, demand deposits in a checking account, and traveler's checks), and adds money market funds, savings accounts, and certificates of a deposit under $100,000.

During the COVID-19 pandemic, M2 money supply surged at its fastest pace in 150 years. Stimulus money was flying out of Washington, D.C., to ensure that the U.S. economy didn't completely fall on its face during pandemic-related lockdowns.

Now, it's a different story. M2 has fallen 4.8% from its all-time high set last summer, which marks the first decline in M2 money supply in 90 years! While a dip in money supply may be logical after its historic expansion, declining money supply with above-average inflation has never been a winning combination. The four previous instances since 1870 where M2 declined by at least 2% resulted in three depressions and one panic.

Although the Federal Reserve is far more knowledgeable and we hope more prepared to tackle economic tumult than it was during the Great Depression (i.e., the last time M2 substantially declined), the sizable drop in M2 we're witnessing may spell trouble for the U.S. economy and stock market.

Story by Sean Williams 6-20-23 Redacted shorter to keep to important points and bullet points added by HGG. https://www.msn.com/en-us/news/other/supreme-court-rules-against-navajo-nation-in-water-rights-dispute/ar-AA1cTr5A?ocid=winp2fptaskbarhoverent&cvid=86b74729865a409eb054b85b8a1d6e4e&ei=11