- The combination of geopolitical risks, fiscal concerns, and monetary policy shifts form a bullish case for gold as a hard asset regardless of who wins the election in November, according to Ole Hansen, Head of Commodity Strategy at Saxo Bank.

- He said that “Trump wants to cut taxes with no credible plans for reducing spending,” while a Harris administration would most likely extend Biden’s massive fiscal programs. “Either administration would inevitably expand the deficit in an economic slowdown,” he added.

- “Gold has long been a safe haven in times of trouble, and we could be nearing the end of an incredible run for stocks if we are headed toward a recession."

- Hansen said. “A rate-cutting cycle will begin this month at the Fed’s 18 September FOMC meeting, and a lower interest rate environment would likely boost gold’s appeal, especially if the Fed ends up cutting more than expected in coming months.”

(Kitco News) – The combination of geopolitical risks, fiscal concerns, and monetary policy shifts form a bullish case for gold as a hard asset regardless of who wins the election in November, according to Ole Hansen, Head of Commodity Strategy at Saxo Bank.

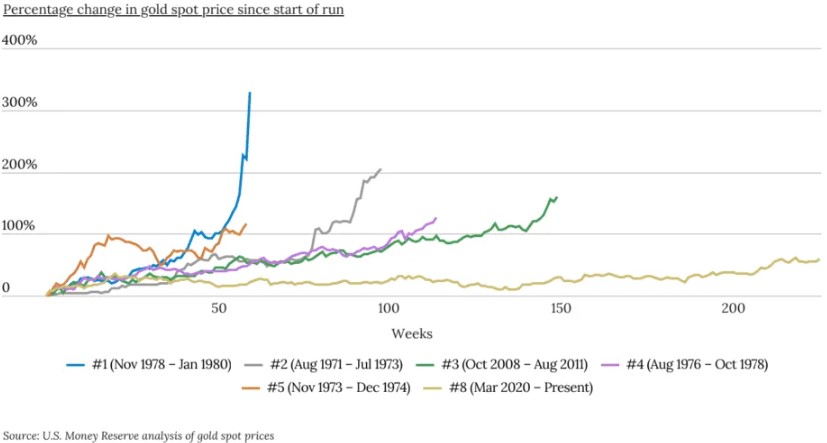

“Gold's recent strong performance, with a 20% rise year-to-date and a high of USD 2,531.75 in August, has been driven by a combination of factors that have made it an attractive investment,” Hansen wrote. “There are several reasons that the post-election environment could continue to support the gold price, which has handily outperformed the S&P 500 index and Nasdaq 100 index through early September of this year. As of 10 September, gold is up over 21%, while the S&P 500 index is up just shy of 15% and the Nasdaq 100 12.5%.”

Hansen lists the key reasons why Saxo Bank expects gold to continue its strong performance after the election and through 2025.

The first reason is “the uncertainty surrounding the upcoming US presidential election, which brings intense unease on the course of fiscal policy and overall market stability,” he said.

“First Trump and then Biden threw caution to the wind in blowing up the federal deficits in good times and especially bad (the pandemic response), with the US debt ripping above 120% of GDP,” Hansen noted. “It doesn’t appear either party is set to deliver on fiscal austerity, which raises inflation risks, a gold positive.”

He said that “Trump wants to cut taxes with no credible plans for reducing spending,” while a Harris administration would most likely extend Biden’s massive fiscal programs. “Either administration would inevitably expand the deficit in an economic slowdown,” he added. “And even if we have a president Harris or Trump with a divided Congress, meaning political gridlock, it means point 3 below – the Fed – has to work that much harder by easing policy.”

The second factor supporting gold regardless of who wins the presidency is general safe haven appeal.

“Gold has long been a safe haven in times of trouble and we could be nearing the end of an incredible run for stocks if we are headed toward a recession, something the bond market and its recent ‘dis-inversion’ seems to be telling us,” he said. “A dis-inversion happens when short term yields fall below long term yields, as the market expects the Fed to cut rates.”

The third key factor is the upcoming Fed rate-cutting cycle. “[W]hether we are heading toward a slight slowdown or a full-blown recession, the US Federal Reserve’s monetary policy decisions will play a significant role in shaping gold’s trajectory,” Hansen said. “A rate-cutting cycle will begin this month at the Fed’s 18 September FOMC meeting, and a lower interest rate environment would likely boost gold’s appeal, especially if the Fed ends up cutting more than expected in coming months.”

He pointed out that lower rates “reduce the opportunity cost of holding non-yielding assets like gold,” which makes them more attractive to investors. “Historically, gold has performed well during periods of falling interest rates,” he said.

The last key drivers of gold’s strength going into the election and beyond are geopolitical risks and the de-dollarization trend.

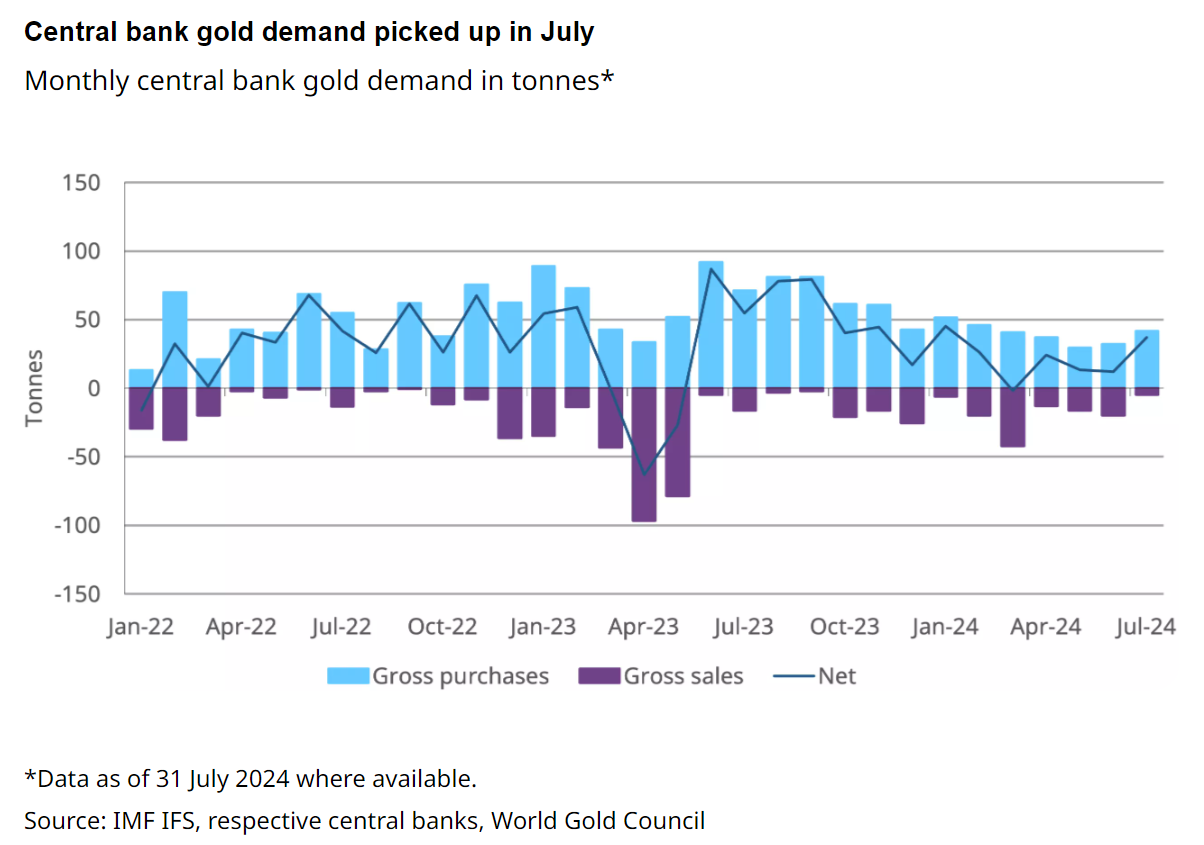

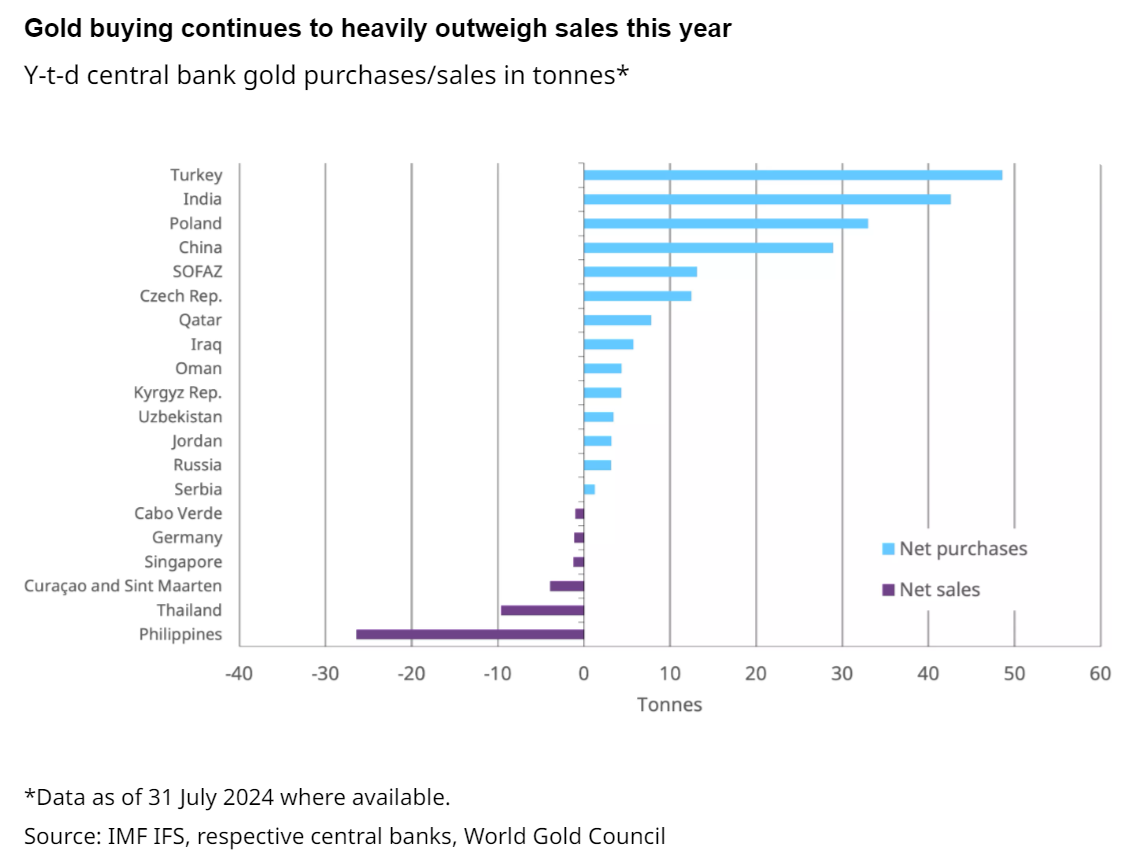

“[T]he broader global environment—characterized by geopolitical tensions, de-dollarization efforts by central banks, and economic uncertainty—continues to underpin demand for gold,” Hansen said. “In particular, central bank purchases of gold and strong retail demand in key markets like China have helped sustain the shiny metal’s rise, as investors seek stability amid volatile economic conditions. There may be more of an angle here if Trump wins and he delivers on his huge tariff threats as a widening group of countries look to transact outside the US dollar system.”

“Overall, the combination of geopolitical risks, fiscal concerns, and potential shifts in monetary policy, particularly in the wake of the US presidential election, makes a bullish case for gold as a hard asset,” he said, adding that “gold should always be seen mostly as something that preserves its value than as something that will go significantly higher in real terms (beyond the rate of inflation).”

“Investors are likely to continue viewing gold as a hedge against the uncertainties posed by both economic and policy forces,” Hansen concluded. “Over the past decade, gold has provided an average annual return of 8.4% in U.S. dollars, consistently outpacing inflation. This makes it an attractive option for long-term investors seeking to preserve purchasing power.”

Story by Ernest Hoffman - Redacted shorter to keep to important points and bullet points added by HGG https://www.kitco.com/news/article/2024-09-10/trump-vs-harris-gold-wins-either-way-saxo-banks-hansen