Banking Catastrophes &

Financial Crises Are Inevitable

Bank Bail-Ins threaten many retirement accounts, not just money directly deposited in a bank or CD

Financial Crises is One of the Reasons Central Banks Hold Gold

Worldwide, banks—since their inception in the 14th-century Europe—have been plagued by economic downturns, wars, and crises, inevitably leading to bank runs and failures throughout the centuries.

Your Money is Not Actually Your Money

U.S. Foley v. Hill (1848) — A bank customer’s deposit is, in essence, a loan to the bank, with legal ownership of the money transferring to the institution upon deposit. Consequently, the depositor instantly becomes a creditor of the bank. This rule applies to all bank accounts, whether personal, trust, or business.

Notably, the rule that a customer’s deposit makes them a creditor also applies to insurance companies, including annuity products.

In the landmark case Foley v. Hill (1848), the ruling established that a bank owes money to its depositors as a debtor, a principle that has formed the backbone of U.S. banking law.

The Dodd-Frank Act of 2010 paved the way for the institutionalizing of the ‘Bank Bail-In’ law founded in 2014 when the G20 nations, including the United States, approved their use through the Financial Stability Board (FSB). Originally an advisory body, the FSB has since been empowered to set global banking standards, establishing rules like the “Adequacy of Loss-Absorbing Capacity of Global Systemically Important Banks in Resolution.” This policy prioritizes the repayment of banks' derivative obligations over other creditors, including customer deposits, allowing financial institutions—and large holding companies such as insurance and annuity providers—to pass losses from failed investments onto their clients.

A Bail-In could have far harsher consequences for the public than a Bail-Out. While increased taxes from Bail-Outs may tighten finances, most people can still cover their basic needs. But if bank accounts, annuities, CDs, and pension funds are drained, it could lead to social unrest, businesses closing, and devastating personal impacts, potentially pushing people to live with relatives and forcing retirees to go back to work.

Bank Bail-Out vs Bank Bail-In

A Bank Bail-Out, as witnessed in the 07-08’ Financial Crisis was enacted to help keep bank customers (creditors) from losing money. The government removed bad insolvent debt from the balance sheets of banks, insurance companies, and financial institutions, along with chosen large businesses, and passed the bill to taxpayers.

In summary, the FDIC was overwhelmed by the scale and complexity of the 2008 financial crisis, necessitating federal intervention beyond its traditional role to prevent a total financial collapse. While the FDIC could handle smaller bank failures, such as Washington Mutual, which had $307 billion in assets, the crisis involved much larger institutions like JPMorgan Chase, Bank of America, and Citigroup, each with trillions in assets. The FDIC's resources were insufficient to manage failures of such magnitude that were so deeply entwined with the global economy, that this led to unprecedented measures. The U.S. Treasury and Federal Reserve stepped in with extraordinary tactics leaving American taxpayers on the hook for reckless banks and large institutions. Let us not forget, adding salt to the wound: These bailed-out entities were not given haircuts on their paychecks or yearly bonuses the way bondholders and stockholders were, so they elected to pay themselves in some cases millions of dollars in bonuses when their business should have actually gone completely bankrupt.

The People's Protection is Gone

In response to public outcry, the government pledged never to use taxpayer money to bail out banks and corporations again. However, instead of requiring these companies to stay nearly deleveraged after the 2008 Financial Crisis or limiting their size to "protect the people," they introduced rules and provisions that allow Bank Bail-Ins for Too Big to Fail (TBTF) banks and holding companies.

In a Bank Bail-In scenario, the government moves the losses to customers (depositors) instead of placing the burden on taxpayers.

In simple terms, a Bank Bail-In provides expanded powers to the Federal Reserve, the Securities and Exchange Commission (SEC), and the Federal Deposit Insurance Corporation (FDIC) to enact a Bail-In for banks and any non-bank holding company they deem significant. Without consent, these powers allow these agencies to take depositor funds to make an insolvent (bankrupt) bank or company solvent (not bankrupt).

The rule does provide the customer a share, otherwise known as ‘equity’, in the financially troubled institution. It is important to note that cash on an account is available to wire transfer and is very ‘liquid’, but stocks ‘equities’ are not. Stocks are much more volatile than cash, especially when a company has financial trouble. Historically financially troubled companies' stocks tend to plummet, even to zero, but the government has deemed this legal versus stealing.

The provision to only take monies above the FDIC-insured amount sounds good to those that have less than that in an account but the domino effect of small to large businesses not being able to pay payroll, health insurance premiums, or bills will topple industries and quickly choke the economy, triggering other businesses and industries towards bankruptcy.

Cyprus 2013 Bank Bail-In

The first Bank Bail-Ins were implemented during the 2012–2013 Cypriot financial crisis, where the two largest banks in the country of Cyprus collapsed. It is important to remember what happened.

Larger shareholders ‘magically’ managed to exit before the insolvency became public. According to a Wall Street Journal report, most shareholders were nearly wiped out, and 21,000 bank clients with deposits over 100,000 euros saw 47.5% of their unsecured savings converted to equity, leaving them with 81.4% ownership of an insolvent bank.

- Bank of Cyprus - The largest commercial bank in Cyprus, imposed Bail-Ins on depositors, meaning that account holders saw part of their deposits converted into bank shares as a rescue measure. The bank shares plummeted in value.

- Laiki Bank (Cyprus Popular Bank) - The second-largest bank in Cyprus at the time was Bank ‘Bail-In’ restructured but ultimately dissolved. The bank shares ultimately became worthless.

Case studies of the 2013 Cyprus Bank Bail-In serve as a powerful example of the far-reaching consequences of such measures on an entire population. When citizens in Cyprus woke up one morning to find their banks closed, ATM withdrawals halted, and their accounts frozen, significant civil unrest and protests began. Once allowed access to funds within accounts, strict measures were placed on account holders. These rules included daily withdrawal limits, restrictions on international transfers, and the temporary closure of banks to prevent runs on deposits.

When the government required people and businesses (customers) to forfeit major portions of funds above €100,000 in exchange for equity in struggling banks, it led to immediate financial hardship, particularly for individuals and businesses dependent on these funds.

This sudden financial loss shattered public trust in the banking system, as depositors became wary of keeping money in local banks, fearing future seizures during crises. The loss of money and distrust of the government and banks slowed economic recovery as people were forced to cut back on spending and investments.

The financial impact extended beyond wallets, as the loss of life savings caused psychological distress for many, exacerbating social inequalities. The economy contracted sharply, with unemployment soaring and the property market declining due to reduced investment capacity. Cypriots responded by shifting their savings to foreign accounts and investing in tangible assets like gold, destabilizing the local banking sector further. Public outrage grew, leading to continued protests. The Cyprus Bail-In, while a temporary stabilizer for the banking system, left lasting scars of financial and psychological hardship, a weakened local economy, and a profound distrust in both banks and government actions.

Even after the world witnessed these proceedings the U.S. and other countries adopted The Bank Bail-In law and extended this law to include large non-bank holding companies, such as insurance companies.

What is the US' Shadow Banking?

This Sector (aka the Non-Banking Holding Companies) is Extensive ~ Roughly $63 Trillion

Shadow banking refers to financial activities conducted by non-bank institutions, like investment funds, hedge funds, and insurance companies that handle annuities, that operate outside traditional banking regulations. These entities provide services similar to banks, such as lending and credit, but aren’t subject to the same oversight, which can lead to higher risks in the financial system.

The most recent data shows that the U.S. shadow banking sector is extensive, with assets totaling roughly $63 trillion globally, accounting for a significant portion of the financial system. This sector includes entities like hedge funds, private equity, and money market funds, which provide credit and investment options outside traditional banks. Globally, shadow banks are responsible for nearly half of all financial assets, have extensive leverage, and pose substantial risks due to their lack of regulation and transparency, which can create systemic vulnerabilities, particularly during economic downturns, recessions, and financial crises.

Where Are We Now?

Ironically, since this sweeping law to allow Bank Bail-Ins, the Federal Reserve—and central banks worldwide—have only become bolder in their stimulus efforts. Until 2022, Near-zero interest rates across borders encouraged institutional investors, global traders, and international bankers to resume business as usual, engaging in high-risk investments and unchecked credit expansion, much like the pre-2008 period. Meanwhile, the U.S. and global debt bubble continues to grow at an alarming rate.

The U.S. Fed is facing colossal challenges against inflation raising its ugly head, run-away debt deficits, and balancing growth along with monetary policy.

A Bank Bail-In Could Impact 401(k)s, IRAs, Pensions, CDs, and Annuites in Several Ways:

- Market Decline: Banking crises and recessions often lead to stock market downturns, which can reduce the value of 401(k)s and other retirement accounts.

- Lower Returns: After a major bank collapse, returns on investments typically decline.

- Debt Cancellation - Risk to Depositors' Funds: In a Bail-In scenario, a bank or annuity insurance company can cancel debts and use portions of depositors' funds, replacing them with shares (stock) of that company. Historically, stock shares plummet when a company is in financial trouble.

- Bank Bail-Ins: Historically, Bail-Ins have caused civil unrest and long-lasting negative effects on the economy and unemployment.

Derivatives 'Paper' Leveraged Tower

The FDIC Cannot Cover Mega Banks:

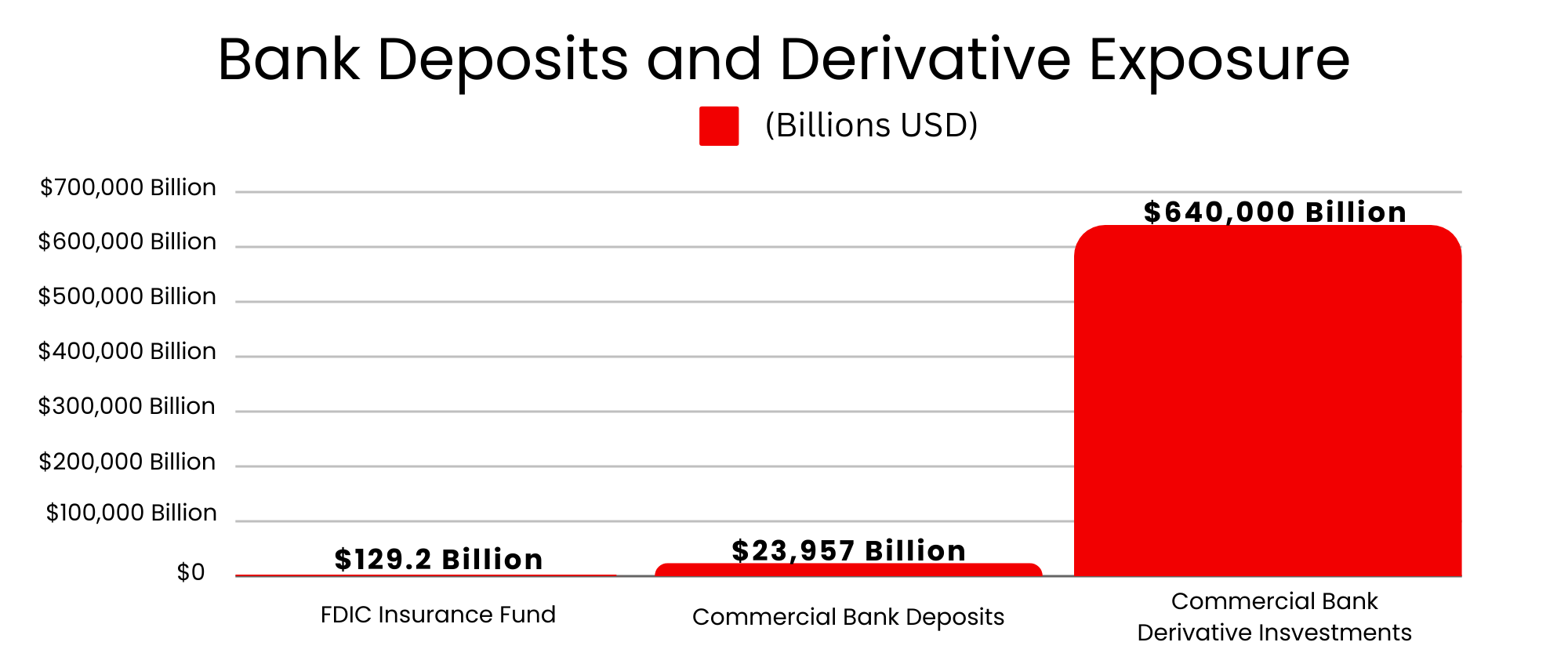

The derivatives market was one of the largest triggers of the 2008 Financial Crisis due to mortgage-backed securities (MBS) and credit default swaps (CDS). See Graph below to understand the enormity of the derivative house-of-cards.

Derivatives Market, aka, Contract Market: Recent reports indicate that the base value of the U.S. derivatives market is $12.4 trillion, however, in the financial world these base assets are borrowed (leveraged) against immensely, with estimates of its notional value reaching up to $558 trillion. Globally, (including the U.S.) the derivatives market is around $640 trillion. The derivatives markets include interest rate derivatives, equity derivatives, and commodity derivatives. Thus, the $640 trillion (640,000 billion) notional value is highly leveraged off the $12.4 trillion gross market value, because derivatives allow participants to put very little money down to gain exposure to large amounts of assets without having to directly buy or sell those assets. However, this also means that even a small change in the value of those underlying assets can create massive ripple effects, given the large amounts of "borrowed" money linked to them.

Sources: Bank for International Settlements, WorldMetrics, SIFMA

Warren Buffet, Derivatives are "weapons of financial mass destruction"

The FDIC is funded through premiums paid by banks and thrifts for insurance coverage, but this funding only represents a very small fraction relative to the total amount of bank deposits.

FDIC Fund is Severely Underfunded:

As of June 2024, the most recent reporting date, the Federal Deposit Insurance Corporation (FDIC) has set its required reserve ratio for insuring depositor funds at just 2%. Although this is a small fraction, the actual funds currently held are significantly lower due to heavy losses from the 2023 banking crisis, where the FDIC Fund Bailed-Out Silicon Valley Bank, Signature Bank, and First Republic Bank.

The FDIC reports overseeing $23.957 trillion (23,957 billion) in insured assets across U.S. banks and savings associations, meaning it would need $479.14 billion to meet its 2% target. However, as of June 30, 2024, the fund's balance stands at only $129.2 billion—far below the current required reserve level.

Even a minor disruption in derivative prices could swiftly exhaust the FDIC insurance fund, leading banks to cover the losses using depositor funds.

When will the U.S. Deploy Bank Bail-Ins?

No one knows when the U.S. government will deploy Bank Bail-Ins, but it seems they are preparing for it.

April 2024 saw two Big Government Moves:

- FDIC Insurance put together the first formal Bank Bail-In policy and manual.

- After the March 2023 FDIC Bail-Out, people thought they would raise coverage on accounts, but on April 1, 2024, new rules went into effect. The FDIC lowered levels of insurance coverage amounts on several account types such as Trust Accounts and CDs. For example, the FDIC insurance fund will no longer insure both revocable and irrevocable trusts, turning them into one category versus two. If you had set up both types of Trust accounts to spread and protect more wealth, this new rules means you now have half the coverage. They did however leave individual accounts at the same insured amount of $250,000.

hedging against Bank Bail-Ins and Recessions With Gold may be the most important step to preserving your hard-earned money and generational wealth.

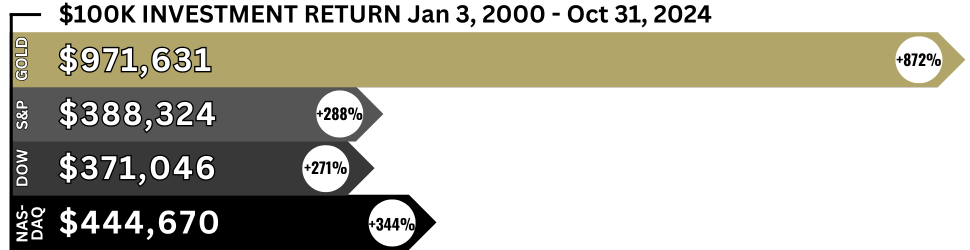

Central Banks' Physical Gold Holdings

Central banks have long held physical gold as a reserve currency, though traditionally at lower levels. However, since 2000, their gold purchases have surged as global currencies face devaluation from massive money printing and rising debt. This trend has accelerated sharply over the last decade, with a particularly steep increase since 2020. For example, the U.S. alone has experienced three major financial crises since 2000 (2001, 2008, and 2020), each met with unprecedented levels of monetary stimulus and debt accumulation. Meanwhile, gold prices have risen dramatically, from $282 per ounce in 2000 to $2,740 per ounce by October 31, 2024—a gain of approximately 872.63%. This reflects a global shift toward holding physical gold as central banks diversify reserves to hedge against economic uncertainties.

Physical Gold Can Protect Against Bail-In Risk

Diversifying across various asset types is a proven strategy essential for long-term financial success. With gold—whether inside or outside of a retirement account set up by Harvard Gold Group (HGG) —you’re safeguarding a portion of your wealth from the traditional financial system vulnerable to Bank Bail-Ins, while also reducing reliance on dollar-denominated investments. It’s a win-win for you and your wealth. You can choose direct delivery, or if you have a retirement account to protect, ask us for our Gold IRA Guide (which can also include physical silver).

Gold's Performance

From 2000 through Oct. 31, 2024, gold is up over 870% and has outperformed the broader equity / stock markets. Long-term investors who diversified with gold enjoyed steady portfolios with greater growth through the good economic times and cushioned the blows in the bad times in 2001, 2008, and 2020 market crashes.

During The Great Recession of 2008, many investors' 401K’s turned to 201K’s while home values plummeted 30-50% across America. This serves as a stark reminder of the perils of not hedging dollar-based assets and relying solely on the assurances of politicians and central bankers. In contrast, gold not only weathered the storm but thrived, exhibiting a 51% price increase from December 2008 to December 2009.

Physical Gold Has Outperformed the Broader Indexes

Gold's Role as a Safe Haven

As countries aim to protect their economies and diversify against shocks driven by dollar printing and escalating debt, gold’s role as a stable asset is poised to expand. Over the past 24 years of financial volatility, physical gold has become an essential reserve asset, reaching new highs and signaling a shift in global finance. This is not a passing trend but a fundamental change in how nations manage reserves and engage in trade. By holding gold, countries hedge against instability and reduce reliance on any single nation's economy, minimizing the risk of global financial contagion.

To protect your economic freedom and that of your family, it is prudent to join the ranks of central banks worldwide by diversifying your wealth with physical gold. Reducing dependence on banks and dollar-denominated assets may be the most crucial financial move you can make as it is only a matter of time before the next financial crisis.

This is for informational purposes and not to be taken as financial or tax advice.

Ready to Hedge with Gold?

Call America’s #1 Conservative & Christian Gold Co to Buy Your Physical Metals Today!

Why Harvard Gold Group?

Harvard Gold Group is America's #1 Conservative Gold Company

As seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The Christian Post, The New York Sun, and more. Exceptional customer service and value are the top priorities of Harvard Gold Group (HGG).

HGG is BBB A+, holds 5-star ratings across the board, and provides free consultations and metals overviews. We offer tax-free purchases, free 2-day shipping, the best pricing, and direct access to our co-owners, who have over 16 years of experience specializing in precious metals, moving over $100 million into tangible assets for people's IRAs/retirement accounts and for direct delivery. Customers enjoy lifetime account care and a straightforward buyback program without hassle or liquidation fees.

✔ Tax-Free & Penalty-Free: A Rollover or Transfer of your Retirement Account is almost always tax-free and penalty-free.

✔ Free Metals/Promos: Earn up to $15,000 in FREE Gold/Silver/Promos, on qualifying purchases.

✔ Free Retirement Account Rollover/Transfer: Zero cost to rollover/transfer/move retirement accounts or IRAs to a Gold/Silver IRA. *You can also earn up to 10 years of Precious Metals IRA yearly maintenance fees*.

✔ Privacy: We protect your privacy and believe it is a commodity as valuable as time, you can't get it back. We do not sell your information to third parties.

✔ HGG Lifetime Account Care: Providing a dedicated account specialist and keeping you updated with market news and trends.

✔ Harvard BuyBack Program: Hassle-free buyback of HGG metals with no liquidation fees.

✔ Guaranteed Precious Metals: We only deal in government-issued coins and branded bars.

✔ Free Shipping: Your precious metals are shipped privately and fully insured to the location of your choice. You can opt to have them delivered directly to your home, business, or an independent depository.

✔ Lowest Pricing: We are committed to offering you the best value possible, with a comprehensive price-match policy.

✔ Customer Satisfaction Guarantee: Harvard Gold Group is a 5-star rated company committed to maintaining exceptional customer service satisfaction.

✔ You work directly with the founders of HGG.