- Ray Dalio says the Silicon Valley Nank failure is a “Canary in the Coal Mine” for what’s to come.

- Dalio wrote Tuesday that this is part of the classic “bubble-bursting part” of the short-term debt cycle.

- He explained how it fits into broader historical trends and debt cycles.

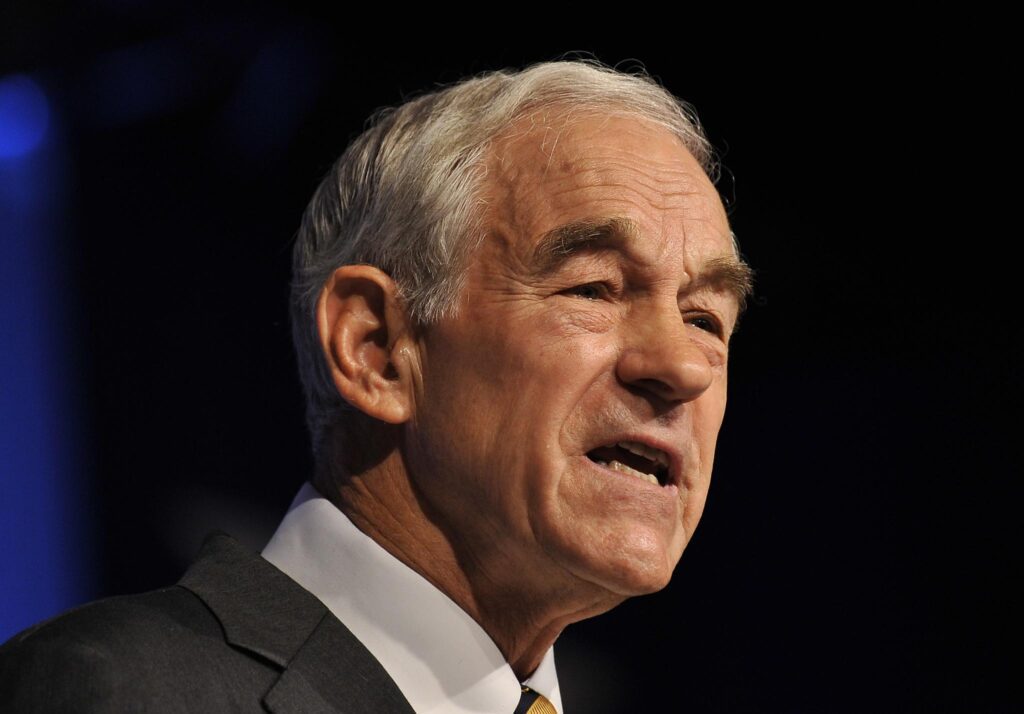

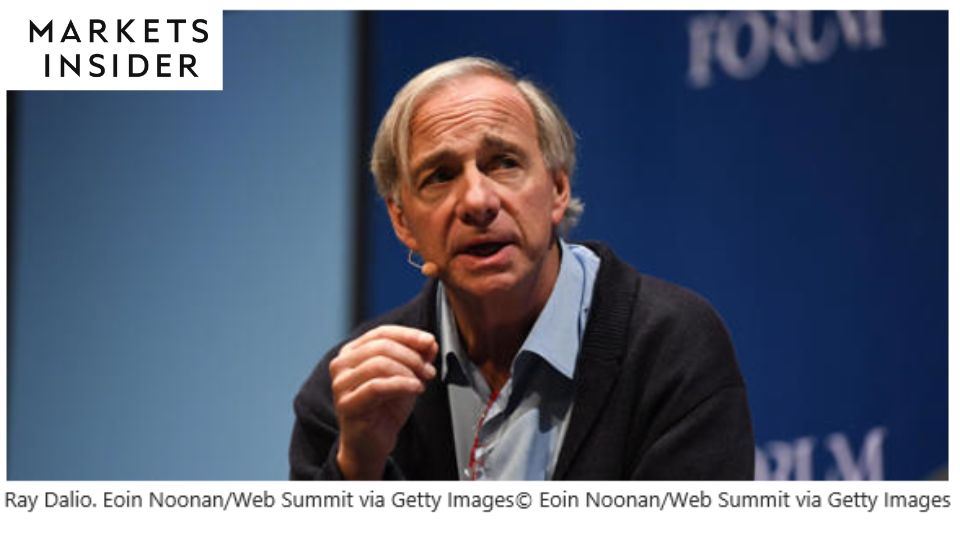

Billionaire investing veteran Ray Dalio said the Silicon Valley Bank failure marks a "canary in the coal mine" moment that will spark steep repercussions across the financial world.

In his newsletter Tuesday, the Bridgewater Associates founder called the bank turmoil a "very classic event in the very classic bubble-bursting part of the short-term debt cycle."

Regulators shut down Silicon Valley Bank on Friday, with Signature Bank closed down two days later.

The cycle lasts roughly seven years, Dalio explained. In the current phase, inflation and curtailed credit growth catalyze a debt contraction, according to Dalio, and that causes contagion until the Federal Reserve returns to a policy of easy money.

"Based on my understanding of this dynamic and what is now happening (which line up), this bank failure is a 'canary in the coal mine' early-sign dynamic that will have knock-on effects in the venture world and well beyond it," Dalio wrote

He said history illustrates that it's usually the case for lenders and banks to emerge from an extended period of low-interest rates and easy credit holding leveraged assets long, and then for those assets to lose value.

Given that the Fed has hiked interest rates more than 1,700% over the last year—and could continue to do so—more dominoes are poised to fall, in Dalio's view.

Citing previous trends, the hedge fund founder said it's likely that more firms will be forced to sell assets at low prices for big losses, and that will cause further decreases in lending volumes.

"Looking ahead, it's likely that it won't be long before the problems pick up, which will eventually lead the Fed and bank regulators to act in a protective way," Dalio maintained. "So I think we are approaching the turning point from the strong tightening phase into the contraction phase of the short-term credit/debt cycle."

In response to the fall of SVB, rating agency Moody's on Tuesday downgraded its outlook for the US banking system, citing the rapid deterioration of the conditions facing the sector.

"Pandemic-related fiscal stimulus along with more than a decade of ultralow interest rates and quantitative easing resulted in significant excess deposit creation in the US banking sector," Moody's strategists said. "This has given rise to asset-liability management challenges, with some banks having invested excess deposits in longer-dated fixed-income securities that have lost value during the rapid rise in US interest rates."

Story by Phil Rosen 3/14/2023 Redacted shorter to keep to important points and bullet points added by HGG. https://markets.businessinsider.com/news/stocks/ray-dalio-silicon-valley-bank-failure-markets-economy-fed-rates-2023-3