US Debt Interest Costs Skyrocket 87% as New Federal Fiscal Year Begins

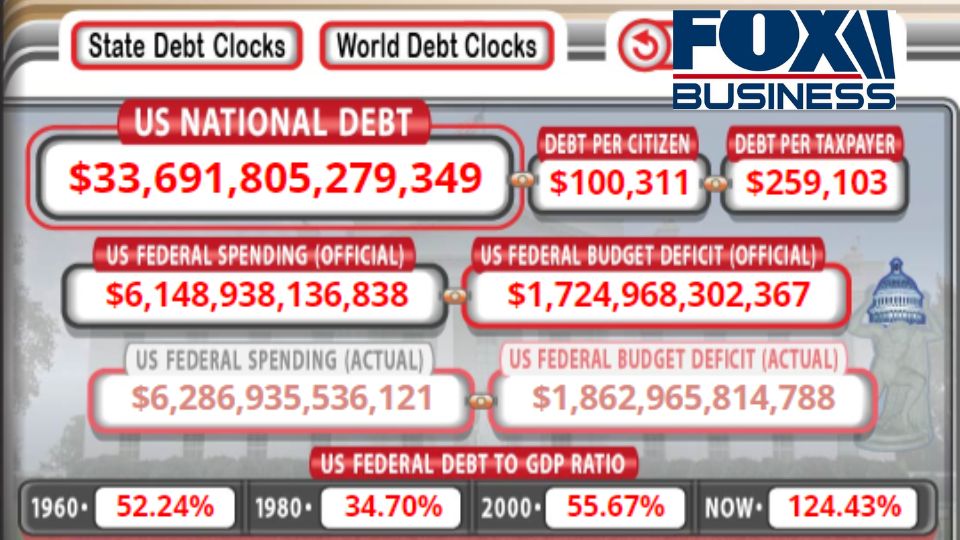

Moody’s lowered its US credit outlook on Friday to “negative,” signaling a possible downgrade in the future. The ratings agency cited ballooning deficits and political dysfunction. Gross interest on Treasury debt securities jumped 87% from a year ago, fresh data showed. Interest payments reached $88.9 billion last month, as the government finances higher deficit spending. […]

US Debt Interest Costs Skyrocket 87% as New Federal Fiscal Year Begins Read More »