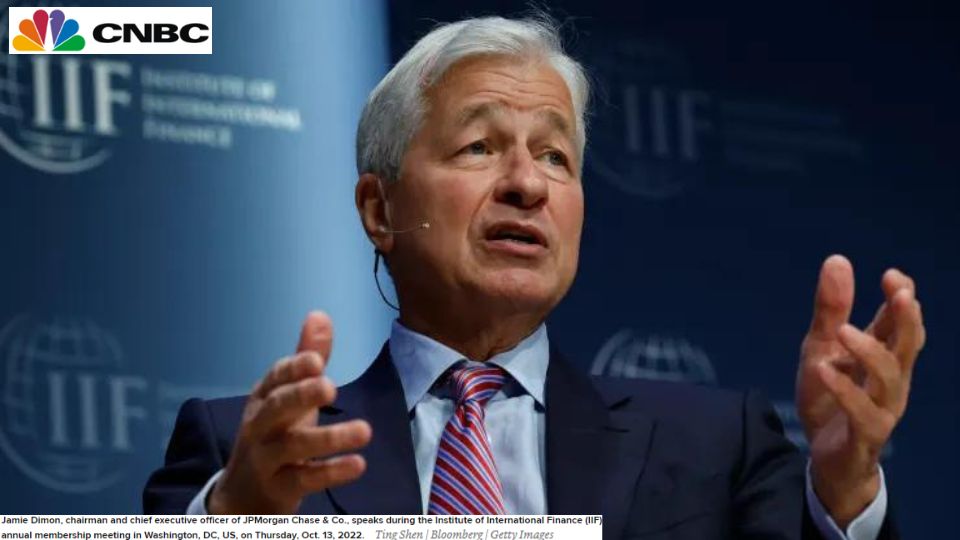

“Jamie Dimon Says It’s a ‘Huge Mistake’ to Think Economy Will Boom with So Many Risks Out There”

Topping his concerns include central banks reining in liquidity programs via “quantitative tightening,” the Ukraine war, and governments around the world “spending like drunken sailors.” “If and when you have a recession, which you’re eventually going to have…,” Dimon said. “In a normal credit cycle, something always does worse than expected,” he added. “I think […]