- Gold prices saw a 15% gain, despite challenging headwinds as the Federal Reserve maintained its aggressive monetary policies, supporting the higher bond yields and the U.S. dollar.

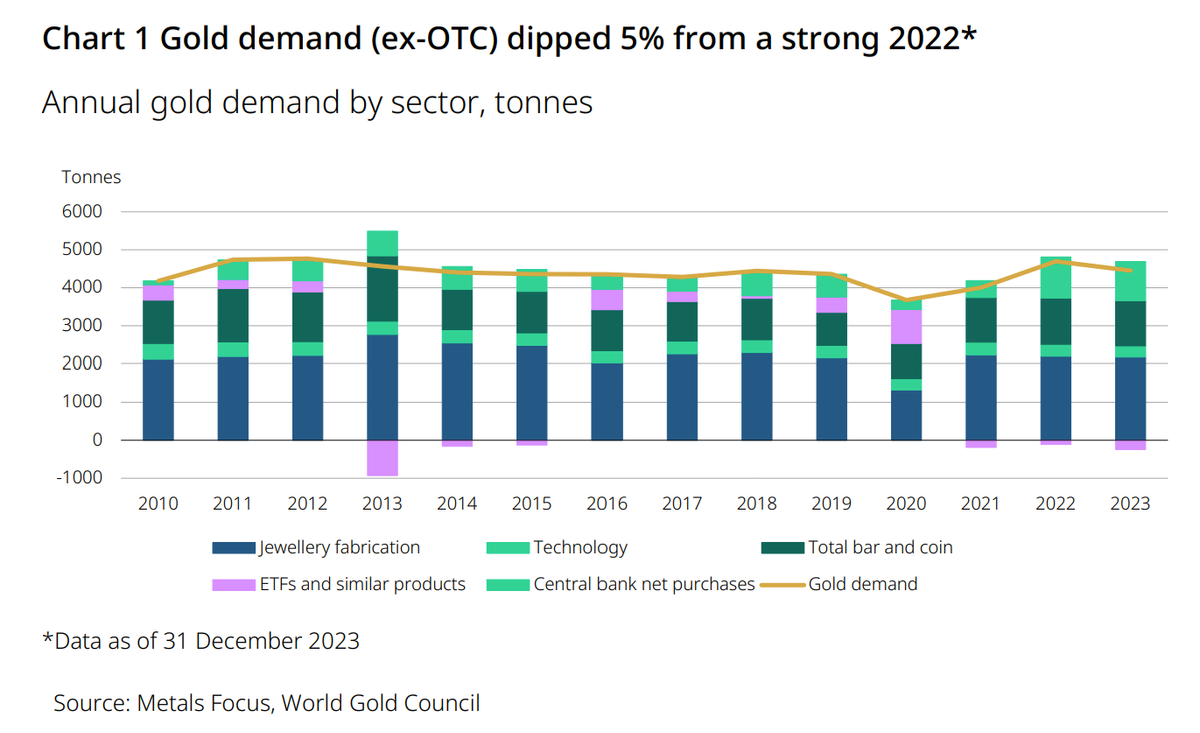

- The World Gold Council published its 2023 fourth quarter and full-year gold demand trends report, saying that annual gold demand, excluding over-the-counter markets, totaled 4,448 tonnes, a 5% drop below robust demand reported in 2022; however, when including OTC markets and stock flows, total gold demand rose to a record 4,899 tonnes last year.

- “There is still a lot of potential from the central bank community,” said Artigas. “Foreign Reserves are certainly not saturated with gold. There is more room to grow at a global level, partly because emerging market central banks generally hold a much smaller percentage of their reserves in gold.”

(Kitco News) - An “invisible hand” along with central bank purchases helped drive record physical demand for gold in 2023, leading to an all-time high price in the final month of the year, according to the latest report from the World Gold Council.

Wednesday, the WGC published its 2023 fourth quarter and full-year gold demand trends report, saying that annual gold demand, excluding over-the-counter markets, totaled 4,448 tonnes, a 5% drop below robust demand reported in 2022; however, when including OTC markets and stock flows total gold demand rose to a record 4,899 tonnes last year.

In an interview with Kitco News, Juan Carlos Artigas, head of Research at the WGC, said that despite challenging headwinds as the Federal Reserve maintained its aggressive monetary policies, supporting the higher bond yields and the U.S. dollar, gold prices saw a 15% gain.

Quoting the final LBMA gold price, the precious metal ended 2023 at $2,078.40 an ounce with an average price of $1,940.54 an ounce, also a record and up 8% from 2022.

“The net outcome of a double-digit gold price return (USD) suggests that hidden within the opaque OTC and Other category was some healthy demand from investors. The main themes underlying these developments were the avoidance of a US recession, continued weakness and asset volatility in China, as well as no let-up in global geopolitical tension,” the analysts said in the report.

OTC demand, was a stark contrast to visible investment demand as global gold-backed exchange-traded funds, saw a third consecutive year of outflows. The WGC noted that 244 tonnes of gold flowed out of the ETF market last year, a drop of 7% compared to 2022 holdings.

However, Artigas noted that the data continues to demonstrate gold’s role as a globally significant asset. He pointed out that most of the outflows last year were based in European markets as investors faced a weakened economy and elevated interest rates.

The report said that 180 tonnes of gold flowed out of European-listed funds last year, compared to 82 tonnes that flowed out of North American-listed products.

“Aside from a brief interlude in March, when the US mini-banking crisis sparked a surge of safe-haven demand, the region saw persistent monthly losses throughout the year. Rocketing interest rates, the hawkish stance of local central banks, strong currencies, and surging living costs were among the likely factors driving profit-taking,” the analysts said in the report.

Meanwhile, Chinese-led Asian funds saw inflows of 10 tonnes.

“Global geopolitical tensions, local economic uncertainties, as well as the eye-catching performance of gold in different currencies fueled positive gold ETF demand in these markets,” the analysts said.

Along with the ETF market, the physical bar and coin demand also declined last year, falling to 1,190 tonnes, a drop of 3% from 2022. Like ETF markets, bar and coin demand was driven lower by weak European demand.

Looking ahead, with central banks expected to lower interest rates at some point this year, Artigas said the WGC expects to see renewed ETF inflows. At the same time, he added that OTC markets should remain a solid source of support.

“Based on what we have seen in 2022 and again and in 2023, these sources of demand reflect fundamental factors in the marketplace.

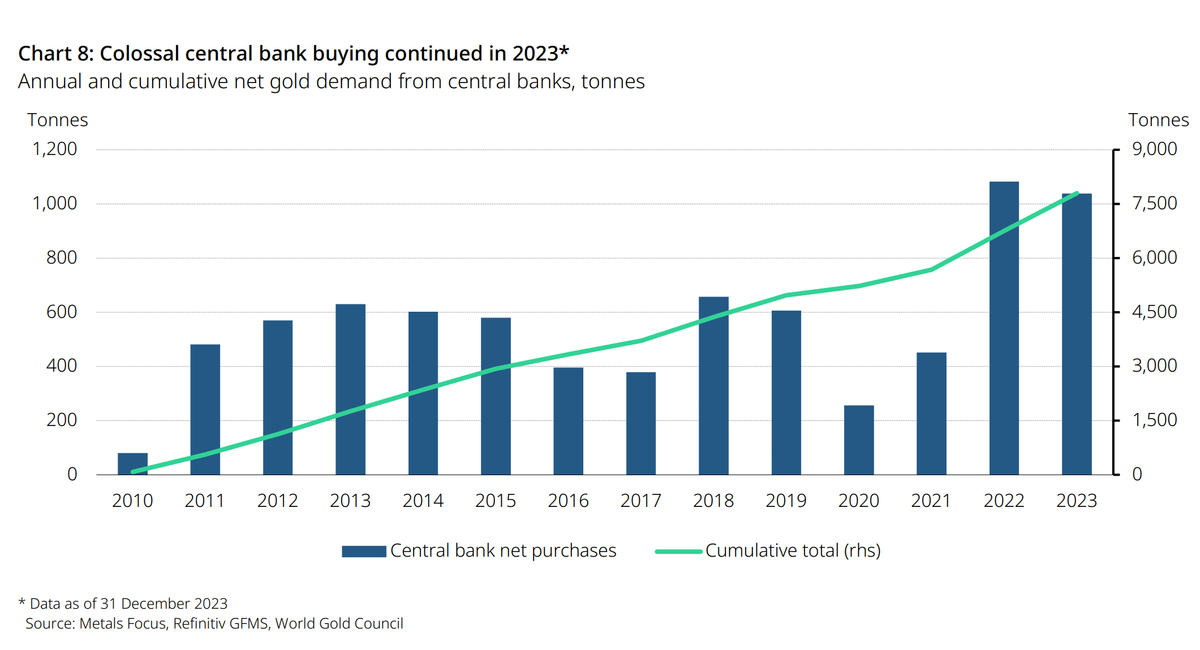

Central banks continue to see insatiable demand for gold, even if the 2022 record holds

Another major pillar of strength for the gold market in 2023 was near-record demand from central banks.

Artigas noted that at the start of last year, the WGC was cautiously optimistic that central banks would be steady buyers of gold; however, by the third quarter of last year, demand was on pace to surpass the previous year’s record.

According to the final estimates, central banks bought 1,037 tonnes of gold last year, missing the 2022 record by only 45 tonnes. Artigas noted that central bank demand has nearly doubled the average in the last ten years.

Artigas added that the WGC continues to see solid central bank purchases in 2024 and beyond.

“There is still a lot of potential from the central bank community,” said Artigas. “Foreign Reserves are certainly not saturated with gold. There is more room to grow at a global level, partly because emerging market central banks generally hold a much smaller percentage of their reserves in gold.”

Although central banks may not continue their “blistering” pace seen in the last two years, Artigas said that the trend clearly shows that gold has become an important tool for risk management.

For 2024, the WGC said that it expects central bank demand to return to average pre-record levels of around 500 tonnes

“We believe that a longer-term strategy is at play here and err on being more open-minded to another solid year of buying,” the analysts said in the report.

The jewelry market also remained an important pillar of strength for the gold market last year. The WGC said that gold jewelry demand in 2023 totaled 2,092.6 tonnes, roughly unchanged from 2022.

Analysts note that the modest gains came as consumers faced higher gold prices and heightened economic uncertainty, which can weigh on luxury spending.

Chinese gold consumption drives the market in 2023

One inter-connected theme within the gold market points to China’s growing influence.

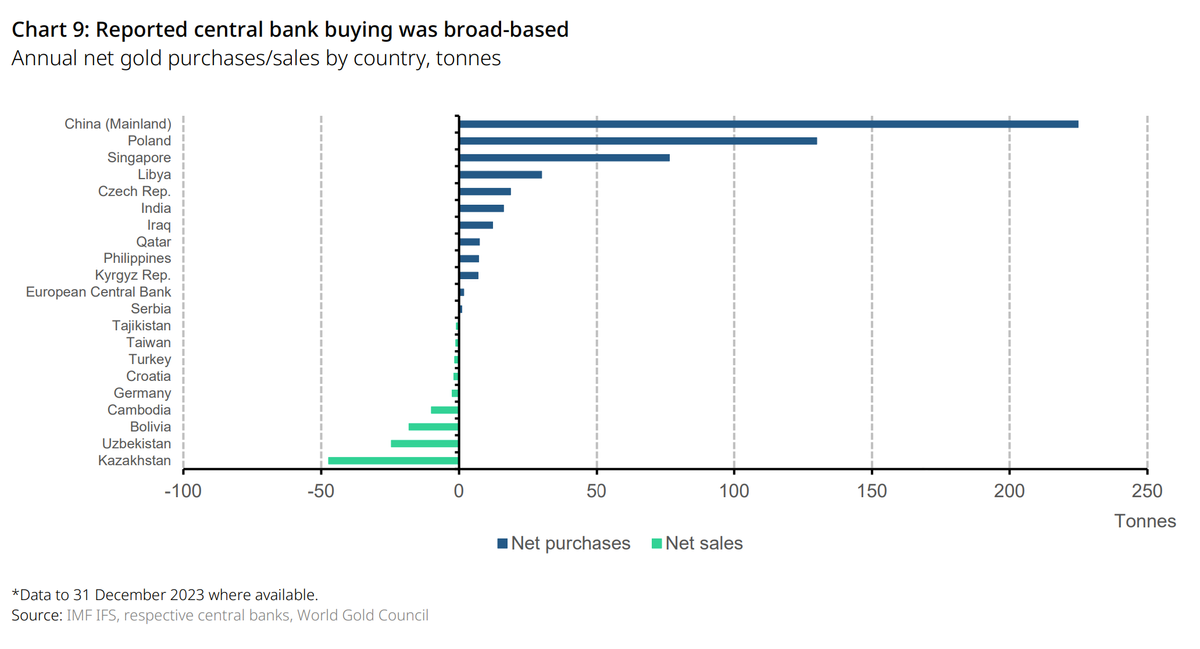

The analysts noted that the People’s Bank of China led central banks in gold purchases last year, buying 225 tonnes in 2023. In comparison, The National Bank of Poland was the second largest gold buyer last year, purchasing 130 tonnes and increasing its gold holdings by 57%.

Meanwhile, gold-backed ETF demand was driven by Chinese investors last year; at the same time, the report noted annual gold bar/coin investment in China reached 280 tonnes, a substantial 28% recovery from COVID-hit 2022.

China’s jewelry market also saw a healthy recovery, totaling 603 tonnes last year, an increase of 10% from 2022.

“The removal of COVID restrictions in late 2022 laid the foundations for a 2023 revival in China’s gold jewelry consumption. Gold also benefited from its increasing appeal to consumers as they sought value preservation,” the analysts said in the report.

Looking ahead, China’s economy faces growing headwinds and economic uncertainty; however, Artigas said the precious metal could attract some safe-haven demand from Chinese investors.

“Generally speaking, I do think that there is more appetite and potential growth in overall investment, including Chinese investment,” he said.

Supply increases by 3% in 2023

While the gold market saw solid demand in essential pillars of the marketplace, supply also increased as producers took advantage of record prices. The total gold supply increased 3% last year, the report said.

“Annual production of 3,644t was the highest since 2018 as major production disruptions were generally absent,” the WGC said in its report.

Along with primary mine supply, higher prices also led to a 9% increase in recycling, which rose to 1,237 tonnes last year.

Story by Neils Christensen - Redacted shorter to keep to important points and bullet points added by HGG https://www.kitco.com/news/article/2024-01-31/central-banks-and-otc-markets-drive-record-gold-demand-2023-wgc