- In the last two years central bank gold purchases as its share in global demand has tripled, representing between 25% and 30% noted by Commodity analysts at ANZ.

- “[Emerging market] central banks could purchase over 600 tonnes of gold annually until 2030, to take its share in their foreign reserves to 10%. China will likely occupy the lion’s share in global official gold demand,” the analysts said.

- ANZ also noted that there is a practical reason behind central bank gold demand as governments try to diversify their bond holdings.

- ANZ estimates that around 50% of the decline in Asian central banks’ FX reserves during 2022 was from bond valuation losses.

- The move to diversify away from the U.S. dollar also adds momentum to the deglobalization trend, which ANZ said will also support central bank gold reserves.

(Kitco News) - Central banks have been solid gold buyers for more than a decade; however, their appetite has become insatiable in the last two years as global reserves have risen by more than 1,000 tonnes in both 2022 and 2023.

Commodity analysts at ANZ noted that in the last two years central bank gold purchases as its share in global demand has tripled, representing between 25% and 30%.

Although the pace of purchases could slow from the current record pace, the Australian bank expects central bank demand to remain a dominant factor in the gold market for at least the next six years.

“[Emerging market] central banks could purchase over 600 tonnes of gold annually until 2030, to take its share in their foreign reserves to 10%. China will likely occupy the lion’s share in global official gold demand,” the analysts said.

The analysts indicated that rising geopolitical uncertainty, growing economic risks and rising inflation pressures are major factors that will continue to drive central bank gold purchases; however, ANZ also noted that there is a practical reason behind central bank gold demand as governments try to diversify their bond holdings.

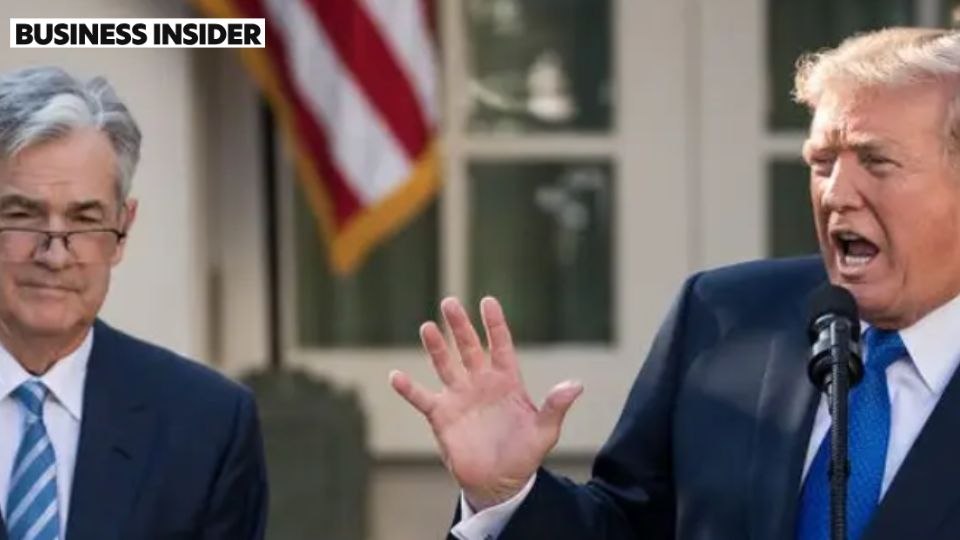

The analysts noted that U.S. Treasuries represent about 59% of the total global allocated foreign currency reserves. However, bond prices have suffered in the last two years as the Federal Reserve embarked on its most aggressive tightening cycle in the last 40 years.

At the same time, higher bond yields have pushed the U.S. dollar higher, making it more expensive for nations to serve their debt, which are primarily denominated in dollars.

ANZ estimates that around 50% of the decline in Asian central banks’ FX reserves during 2022 was from valuation losses.

“This was quite large and has likely left a lasting sour taste,” the analysts said. “It is unsurprising, therefore, that central banks are diversifying their reserves away from bonds.”

ANZ noted that gold is an attractive alternative to bonds as it has proved to be a stable asset in the last two years.

“Its solid run in 2022–23, despite a hefty rise in the global real rates, makes for a solid case,” the analysts said.

The move to diversify away from the U.S. dollar also adds momentum to the deglobalization trend, which ANZ said will also support central bank gold reserves.

“The global monetary system is evolving, with EMs pushing their own currencies for international payments. China is reportedly settling trades with Russia in RMB and has made clear its intention to internationalise its currency. Other regional players, like India, are also pushing to settle foreign trade in their own currency. This evolving multi-currency system will see a gradual shift in foreign currency reserve portfolios, and gold is likely to play an important role as this develops,” the analysts said.

Although the gold market continues to wait for a catalyst as prices consolidate above $2,000 an ounce, analysts at ANZ said that central bank demand should help support gold prices push back to record highs of around $2,200 by the end of the year.