Tariff Threats Will Quietly Supercharge De-Dollarization & Gold's Paradigm Shift

Understanding gold's significance on the global stage can help you determine whether investing in physical gold is right for you

Can Trump's Tariff Threat Stop De-Dollarization & the BRICS Unit?

- Or Quietly Propel the Movement & Continue to Catapult Gold -

Trump is trying to slow down de-dollarization efforts by threatening 100% tariffs and or sanctions on any BRICS nation that pushes to create a currency to dethrone the U.S. dollar.

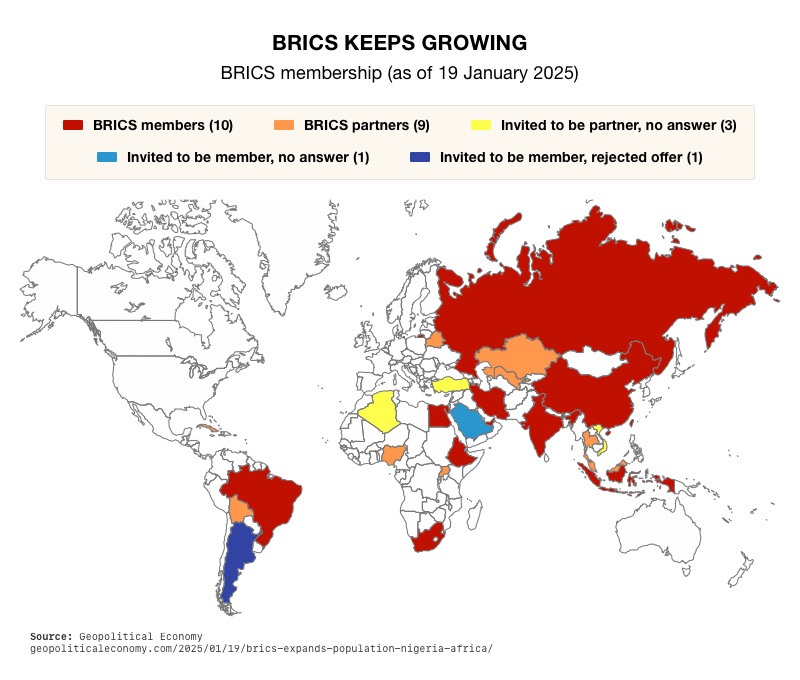

These threats will likely only achieve one thing during the next four years: Slow them down as they QUIETLY press forward to finish developing their international payment system called BRICS Pay, which will utilize blockchain technology to facilitate secure and efficient transactions among member countries. BRICS is short for 5 initial nations (Brazil, Russia, India, China, and South Africa) who originally started the movement. In the past four years, many other countries have joined the BRICS bloc as they have loudly touted their new currency project and payment system to offer nations a less expensive option and way around the U.S. dollar and the SWIFT international payment system. They call the alternative currency the ‘unit’, which is said that it will comprise at least 20% gold and the remaining will be a collection of the BRICS countries’ currencies. Their mission and promise ring loud and appealing to any country’s economy whose currency is not close to equal in value to the dollar. These economies face significant costs when converting their local currency to U.S. dollars for international trade, making an alternative BRICS-backed currency system very beneficial. Why is Trump taking BRICS+ countries seriously? They have successfully recruited nations and now account for 35% of the world’s GDP and 45% of the world’s population.

SWIFT (Society for Worldwide Interbank Financial Telecommunication) international payment system benefits the United States the most, primarily due to its global dominance and integration into international finance:

- U.S. Dollar Dominance: The U.S. dollar is currently used in the majority of international trade and financial transactions. SWIFT facilitates these transactions, reinforcing the dollar's central role in global commerce.

- Sanctions Power: The U.S. can use its influence on SWIFT to enforce economic sanctions against nations or entities. Exclusion from SWIFT essentially cuts off a country's banking system from SWIFT international trade.

- Global Financial Influence: The U.S. benefits from the fees and liquidity associated with global dollar transactions, giving it significant leverage in geopolitical and economic matters.

SWIFT disproportionately benefits the U.S., developed economies, and large international banks, as it reinforces the dominance of the U.S. dollar and its control over global trade and finance. This dynamic is one of the reason nations like those in the BRICS bloc push for de-dollarization and their alternative system.

The New Development Bank (NDB) is the BRICS counterpart to the International Monetary Fund (IMF). This effort aligns with the bloc's objective of diversifying reserves away from the U.S. dollar. This effort aligns with the bloc's objective of diversifying reserves away from the U.S. dollar. Since 2010, in anticipation of a shift away from the dollar, central banks worldwide have been purchasing gold. Since 2020, there has been an explosive acceleration of countries' central banks acquiring tons of gold at record levels while reducing their holdings of dollars and treasuries. This trend has already contributed to rising gold prices, a momentum likely to persist in the coming years.

As for tariffs and sanctions, sometimes they work, and oftentimes they do not. Historically, the outcomes derived from tariffs and sanctions have often included amplified inflationary pressures, tit-for-tat trade wars, countries devaluing their currencies in response to trade barriers to ease some of their pain, and the creation of import and export agreements designed to circumvent the sanctions and tariffs entirely. This was most recently witnessed with the sanctions placed on Russia for invading Ukraine. Russia, China, and other countries have successfully worked around the sanctions. One of the main contributing factors to this success was Russia pegging its currency, the ruble, to gold, instantly giving it credibility and stability it would otherwise not have had.

Since 2008, the U.S.'s use of financial leverage as a tool of influence has prompted many nations to not only reduce their reliance on the dollar but also to repatriate their gold reserves stored abroad. For instance, Germany and other countries have requested the return of their gold held at the New York Federal Reserve, where a significant portion of European central banks' gold has been stored since the 1930s—a time when capital flowed into the U.S. as World War II loomed on the horizon.

Following World War II, the U.S. Treasury managed to secure control of 80% of the world’s central bank monetary gold by 1950, around the time of the Korean War. This occurred as other nations, in need of U.S. dollars to purchase American exports and settle dollar-denominated debts, sold off their gold reserves to acquire the necessary currency. For many years now, the opposite is occurring. Nations are dumping dollars as a reserve currency and buying physical gold.

The BRICS nations versus NATO nations are oftentimes referred to as the dividing line for World War III.

Central Banks' Physical Gold Holding as a Reserve Currency

U.S. Dollar Reserves Held by Central Banks Worldwide:

Central banks have always held physical gold as a reserve backup currency, but typically at lower levels. Since 2000, there has been a gradual decline in the share of U.S. dollar reserves held by central banks, while their purchases of physical gold have significantly increased. This trend accelerated after the 2008 financial crisis and more avidly over the last decade, with a sharp rise since 2020. According to the International Monetary Fund (IMF), the share of US dollar reserves fell to 58% by the fourth quarter of 2023. Analysts attribute this decline to central banks diversifying their reserves and increased competition from gold and other lesser currencies. This trend reflects a paradigm shift towards diversifying reserves and hedging against economic uncertainties with physical gold.

U.S. Dollar Reserves Held by Central Banks Worldwide:

THE YEAR 2000:

71%

THE YEAR 2023:

58%

This shift reflects a broader strategy of financial diversification and stability. By holding gold, countries can hedge against economic instability and inflation while reducing their reliance on any single currency, particularly the U.S. dollar.

To protect your economic freedom and that of your family, it is prudent to join the ranks of central banks worldwide by diversifying your wealth with physical gold. Reducing dependence on dollar-denominated assets may be the most crucial financial move you can make as the new monetary order takes shape.

It is not out of the question for the U.S. to return to a gold standard; if not, another country will likely adopt a gold-backed system that could dethrone the dollar. Countries have been on and off various types of gold standards for thousands of years.

Ask for your No-Obligation Free Gold Investment Guide

Learn how you can acquire precious metals privately for direct delivery or through retirement account funds.

*We keep your information private*

History of the Mighty Dollar – America Witnessing the Rise of De-Dollarization - The Gold Paradigm Shift

Many Americans, even the poorest among us, enjoy a significantly better life than most of the world. However, many often view their standard of living as the baseline, lacking an understanding of the great financial privileges all Americans have enjoyed since our dollar catapulted to the #1 world reserve currency status after winning World War II.

This perspective is so ingrained because too many generations have passed since the sacrifices of WWII. As a result, younger generations no longer carry the same sense of gratefulness for opportunity and hard work. Instead, this has transformed into a pervasive sense of entitlement, disconnected from the tears, blood, and sweat that every household in America felt and paid for coming out of WWII.

See below the massive benefits the American people view as ‘normal,’ whereas the rest of the world peers in with envy. We will also answer what is de-dollarization and why countries would want not want America to be the world’s most dominant country financially.

American Privilege and the Coming Economic Awakening

As the U.S. dollar continues to gradually lose its dominance as the world’s primary reserve currency, the reality check for Americans will be stark. The privileges we see as everyday entitlements will diminish as well — such as strong stock and bond markets with relatively low volatility, along with lower overall inflation and borrowing costs compared to other countries. We enjoy exceptional trade advantages, financial global dominance, and worldwide monetary policy influence, which provides Americans with relatively stable prices and access to abundant goods and services.

In contrast, other countries, especially developing ones, face much higher volatility in their currencies and markets, inflation, and economic instability. The struggle to secure basic needs is a daily reality for much of the world's population, highlighting the disparity in living standards.

What is De-dollarization?

The global financial landscape is undergoing a seismic transformation as countries increasingly seek alternatives to the U.S. dollar, a process known as de-dollarization. In essence, de-dollarization involves a significant decline in the utilization of U.S. dollars in international trade and financial transactions, leading to reduced demand for the dollar from nations, institutions, and corporations. This shift weakens the dominance and demand of the U.S. dollar in the global capital market, where borrowing and lending activities are currently conducted predominately in dollars.

Since the mid-1940s, countries purchased dollars as a reserve currency because it helped stabilize their economies and currencies from volatility. Additionally, in the early 70s, America made strategic agreements with Saudi Arabia and then the OPEC countries securing an oil trade agreement that all oil must be purchased in dollars. This is also known as “The Petrodollar,” which further cemented the U.S. dollar as the most dominant reserve currency in the world. The de-dollarization trend started in 2001 but formally began when the BRICS nations (Brazil, Russia, India, China, and South Africa) held the BRICS Summit in Russia in 2009 in response to the 08’ financial crisis. The main purpose of this meeting was to discuss how to create a better financial world for their countries and financial independence to create more economic stability.

These countries did not come together to overthrow America and the U.S. dollar because they detested us. Although they envied our powerhouse financial position since WWII, it is often unknown in the U.S. how our economic policies negatively impacted other nations.

Why Do Economic Policies In the U.S. Negatively Affect Other Countries?

The ’08 financial suffering for most Americans was castastrophic. We faced massive job loss that was prolonged and painful. For years, wages dropped like a rock in addition to the benefits companies offered. Many Americans’ 401Ks turned into 201Ks as stock markets dropped 50% from their peak in 2007 to March 2009. Real estate values plummeted by 30-50%. This crisis witnessed the largest bank, insurance company, and business failures in America since the Great Depression. The multi-market plunge into the abyss was so bad that the government halted trading and had to pump printed money into nearly every market in the U.S. to stop the free fall, proving the frailty of the house-of-cards. The government printed staggering amounts of dollars, aka Quantitative Easing (QE) to bail out nearly every bank, many insurance companies, and their chosen businesses deemed ‘Too Big to Fail’.

The "Great Recession," as 2008 was coined, was devastating in the States, with many losing everything and very few remaining unscathed. However, our pain was nothing compared to what most of the rest of the world endured. Unbeknownst to the average American, the dominance of the U.S. dollar as the world's reserve currency cushioned the inflation and volatility blow here and stopped our bleeding out, but the printing of dollars has had a significant impact on other countries, causing negative ripple effects globally.

Printing too many dollars leads to excess liquidity, which often flows into emerging markets, creating bubbles in search of higher returns. This influx of capital can cause other countries' currencies to appreciate since the dollar is depreciating at home. This makes these countries' exports more expensive and less competitive globally. Higher liquidity flows into developing economies also cause inflation, especially through increased commodity prices and higher interest rates for lending by local banks. This inflation can erode purchasing power and create economic distortions, making it difficult for central banks in developing countries to maintain stable economic growth and control inflationary pressures. Additionally, the rapid influx and then withdrawal of capital—often referred to as "hot money"—can lead to significant volatility in their financial markets.

Therefore, the benefits of the dollar stabilizing these countries' currencies and economies began to decline more steeply than during the U.S. 2001 dot-com market crash, fueling the BRICS nations to start a yearly summit to actively coordinate steps to build an alliance that would provide more stability. This was vital for them as the trajectory of U.S. economic policies continued to create tsunamis on their shores.

Global Shift: De-dollarization Takes Hold in 2020

In response to the economic fallout from the COVID-19 pandemic in 2020, governments and central banks worldwide, including the U.S., implemented aggressive monetary policies. The trillions the U.S. printed during the 2008 financial crisis to prop up the economy looked like pennies in an ocean of dollars.

These efforts included astronomical scaling of money printing (quantitative easing) and fiscal stimulus packages to shore up economies. These unprecedented and exorbitant amounts of money printing led to widespread inflation in every country. However, the global interconnectedness and the status of the U.S. dollar provided a unique situation where American inflation pressures, while significant, were less severe compared to other nations. For example, interest rates in the United States were only raised just above 5%, whereas our closest ally, the UK, saw interest rates at 10%. This underscores the continued advantages the U.S. holds through its currency, though it also highlights the potential for future economic shifts as global dynamics evolve.

This also means that emerging countries likely suffered much more since 2020. De-dollarization efforts have intensified among BRICS nations, leading to far-reaching cooperation and collaboration in exploring alternatives to the U.S. dollar for trade settlements and reserves. Among these unions, many countries have been invited and are now included among the BRICS nations. Notably, this includes several OPEC, oil-controlling nations like the United Arab Emirates, Iran, Ethiopia, and Saudi Arabia. These nations have good reason to work together to establish alternative financial systems and agreements that bypass the dollar and U.S. financial dominance, thereby insulating their economies from the next massive crash that will surely usher in even larger amounts of money printing.

De-dollarization Accelerates: OPEC and the 2023 Petrodollar Shift

2023 saw the most significant development in the de-dollarization trend by the actions of OPEC countries.

The long-standing OPEC agreement of 1973, creating the U.S. Petrodollar, no longer holds. This agreement mandated that oil was to trade exclusively in dollars. As of 2023 OPEC countries started trading barrels of oil in other currencies. This is unprecedented and will reduce the demand for the U.S. dollar in global oil transactions, which has been a cornerstone of the dollar's dominance. It also signifies a strategic alignment with BRICS nations, including the world's two most populous countries—China and India—which together account for approximately 2.85 billion people, representing 36.9% of the global population as of 2023.

TIMELINE:

April 2023, Iraq's Central Bank announced its intention to conduct oil trade with China using the yuan.

March 2023, the United Arab Emirates was part of a historic transaction as China executed the first-ever yuan-settled energy deal involving Emirati liquefied natural gas (LNG).

August 2023, India and the United Arab Emirates initiated trade in their local currencies, marking a historic moment when the UAE accepted payment in Indian Rupees for over a million barrels of oil, bypassing the U.S. dollar.

This momentous shift underscores the increasing diversification away from the U.S. dollar as the dominant currency for global trade, serving as a clear signal of the evolving monetary landscape.

What De-dollarization Effects Is America Already Witnessing?

Consider the massive stock market volatility, which has many contributing factors but is largely underpinned by money printing and monetary policy. Money printing and the Fed holding interest rates too low for too long have significantly contributed to all of our market volatility, including the financial crisis of 2001, 2008, and 2020. In Fall 2023, we witnessed the worst U.S. bond market crash in more than 100 years.

March 2023 saw the worst bank failure in the U.S. since the 2008 financial crisis. Banks continue to struggle in 2024, while the Fed U.S. central bank has posted the worst losses in history due to absorbing bank and bond losses to prop up the banking system. Commercial loans remain a substantial outstanding liability due in 2023 and 2024. The U.S. has posted unprecedented and continually growing debt deficits over the past few years.

Despite this, the government maintains that America is experiencing one of the best economies ever. At home, however, the masses are facing painful challenges due to the high costs of groceries, housing, insurance, and overall cost of living. These challenges are far from over.

Lastly, Americans have lost more than 40% of their dollar's purchasing power since 2000. If we are feeling the pain, imagine the ripple effects on other countries suffering due to our money printing.

BRICS Summit Currency Initiative:

- Gold-Backed Digital Currency: The BRICS nations are planning a new currency that will be backed by gold and a mixture of BRICS currencies. This is intended to create a stable medium of exchange, facilitating smoother trade settlements among member countries and reducing the complexities and risks associated with foreign exchange.

- Economic Sovereignty: The goal of a gold-backed currency is to enhance the economic sovereignty of BRICS nations. By lessening their reliance on the US dollar, these countries aim to gain better control over their monetary policies and stabilize their economies against global financial disruptions.

- Trade Facilitation: Introducing this currency is expected to make trade within the BRICS bloc more efficient by minimizing the risks and costs associated with currency exchanges. This would promote economic integration and improve trade among BRICS countries, potentially boosting their influence in global trade negotiations.

- Financial Resilience: By backing their currency with gold, BRICS nations hope to provide a safeguard against currency crises and market volatility. This approach aims to build confidence in the stability and value of their currency, both domestically and internationally.

These initiatives represent a strategic effort to move away from the US dollar, diversify reserves, and reduce economic dependency on the dollar. If successful, the new currency could significantly impact the global financial system, challenging the long-standing dominance of the US dollar.

Gold Opened at $282/oz in Jan 2000 & Stands at $2,440/oz in mid-July 2024

In 2023, U.S. Treasury Secretary Janet Yellen was questioned during a congressional hearing about her concerns regarding global de-dollarization. This marked the first time she admitted that the dollar is losing its percentage share as the top reserve currency worldwide. However, she pointed out that it will take time for something to replace its current number one position.

Gold's Role as a Safe Haven

As countries seek to protect their economic interests and diversify to shield against economic shocks exacerbated by dollar printing and stacking enormous debt, gold's role as a stable and secure asset is likely to grow. Amid the de-dollarization shift, physical gold has emerged as a crucial reserve currency, catapulting to new highs and reflecting a new paradigm in global finance. This movement is not just a fleeting trend but a significant shift that promises to reshape how countries manage their reserves and engage in international trade. This shift reflects a broader strategy of financial diversification and stability. By holding gold, countries can hedge against economic instability and reduce their reliance on any single currency, particularly the U.S. dollar.

To protect your economic freedom and that of your family, it is prudent to join the ranks of central banks worldwide by diversifying your wealth with physical gold. Reducing dependence on dollar-denominated assets may be the most crucial financial move you can make as the new monetary order takes shape.

What Should You Know About Gold?

“Gold is money. Everything else is credit.”

– J.P. Morgan

“Gold still represents the ultimate form of payment in the world. Fiat money in extremis is accepted by nobody. Gold is always accepted.”

– Alan Greenspan

“Because gold is honest money it is disliked by dishonest men.”

– Ron Paul

“The desire of gold is not for gold. It is for the means of freedom and benefit.”

– Ralph Waldo Emerson

“If you don’t own Gold, you know neither history nor economics.”

– Ray Dalio,

“I like gold because it is a stabilizer; it is an insurance policy.”

– Kevin O'Leary

SOURCES: Foreign Affairs: The Future of the Dollar; J.P. Morgan | Official Website; IMF; Richmond Fed ; World Economic Forum ; Beroe Inc.; INN; Ray Dalio; The Balance: How the U.S. Dollar Became the World's Reserve Currency; Council on Foreign Relations: The Dollar's Global Role; Brookings Institution: The Dollar and U.S. Power; Reuters: Impact of Losing Reserve Currency Status; Financial Times: Risks to Dollar Dominance; World Gold Council; Global Payments Insights; Chards; Sophisticated Investor

Ready to Diversify with Gold?

Call Harvard Gold Group Today!

Qualify up to $15,000 in FREE Precious Metals! Call for more info

Why Harvard Gold Group?

Harvard Gold Group is America's #1 Conservative Gold Company

As seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The Christian Post, The New York Sun, and more. Exceptional customer service and value are the top priorities of Harvard Gold Group (HGG).

HGG is BBB A+, holds 5-star ratings across the board, and provides free consultations and metals overviews. We offer tax-free purchases, free 2-day shipping, the best pricing, and direct access to our co-owners, who have over 16 years of experience specializing in precious metals, moving over $100 million into tangible assets for people's IRAs/retirement accounts and for direct delivery. Customers enjoy lifetime account care and a straightforward buyback program without hassle or liquidation fees.