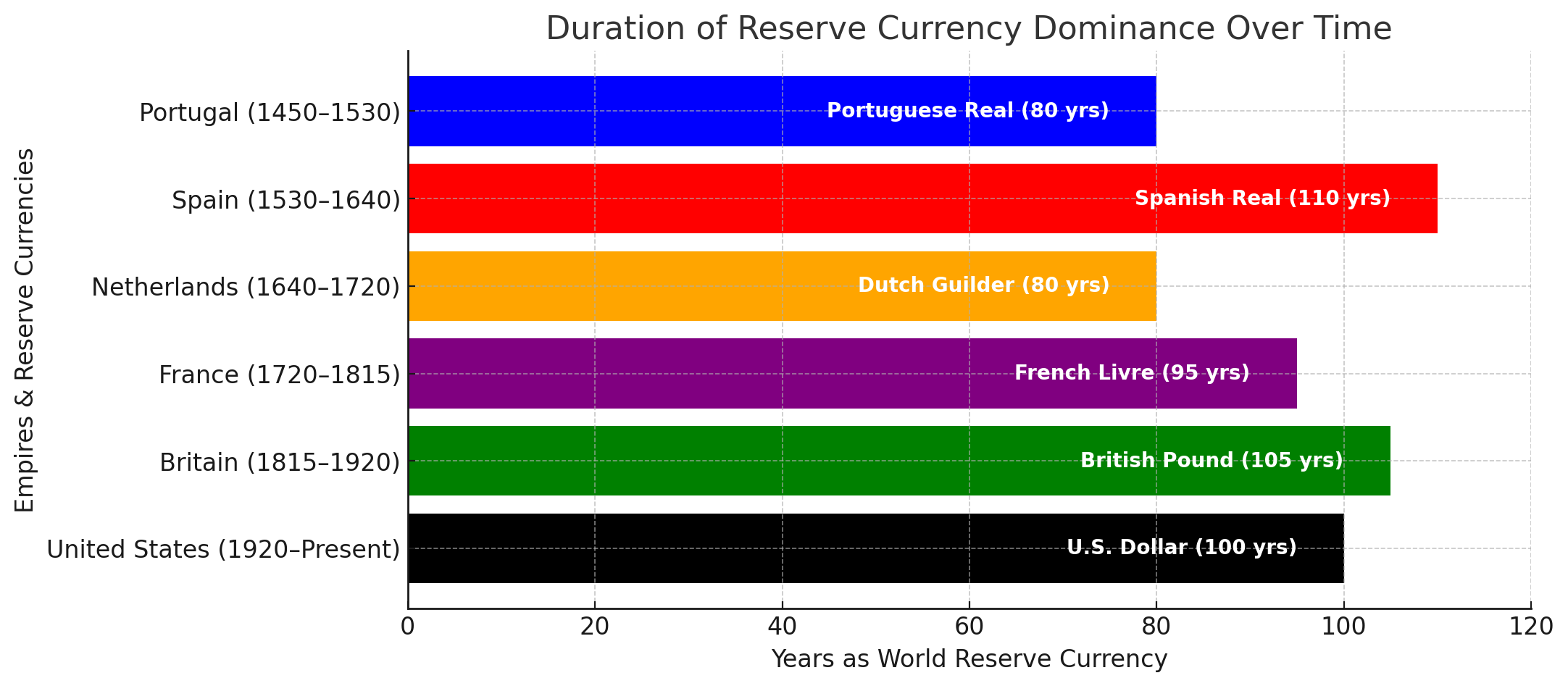

Hundreds of years of history show that global power shifts disrupt the monetary order on average every 75-100 years.

Looking at just the last 100 years, the U.S. has experienced several major shifts in the Monetary Order. In 1933 President Roosevelt initiated a recall of gold from the public. In 1934 he devalued the U.S. dollar by 41% by adjusting its value relative to gold. In 1944 the Bretton Woods Agreement pegged the gold-backed U.S. dollar to set fixed exchange rates for major currencies, making the dollar central to the global reserve currency. However, due to money printing and U.S. debt in the 1960s, countries like France and England sought to exchange dollars for gold. To stop these nations from exchanging their dollars for gold, which would have disrupted the U.S. dollar, President Nixon shocked the world by taking the U.S. off the gold standard in 1971, leading to a floating paper fiat-currency system. Fiat currency simply means that the paper note is not backed by anything other than that specific government’s promise to pay.

Nixon then negotiated with Saudi Arabia and Middle Eastern countries to link the dollar to oil. This created the OPEC agreement of 1973 which pegged the dollar to oil, referred to as petrodollars. This move meant that countries had to trade their currencies for dollars to buy oil. Oil is the most important commodity needed by all economies big and small. This is the reason the U.S. dollar has been the dominant world reserve currency.

Why Would the Dollar's Global Dominance Decline?

Monetary Order Changes typically take place when a large economy or dominant economy’s currency is close to failing. This transpires when confidence in a nation’s currency wanes, leading to other countries distancing themselves from its use.

Over the last thousand years, hundreds of fiat currencies have come and gone, in between periods of partial or full gold-backed monetary systems, commonly known as the gold standard. This gold-backed system is adopted to stabilize a country’s currency value, however, over time, nations often yield to pressures, resorting to excessive money printing to boost their economies. This prompts a default in the gold standard because you can’t print gold, therefore the country shifts back to a fiat currency. The primary catalyst for fiat currency failure is rampant money printing and mounting debt. This recurring cycle of currency demise eventually renders them worthless, becoming nothing but a piece of written history.

Governments resort to printing money and going into debt for various purposes including financing wars, social programs, securing electoral support, managing economic crises, and addressing governmental mismanagement, among other motives. However, this practice of unchecked money printing and accumulating debt invariably ushers in painful inflation, volatile market swings, financial crises, foments political instability, and in extreme cases, precipitates civil unrest and hyperinflation. These events typically signal the coming of a failed fiat currency.

U.S. Prints Massive Money During Financial Crises

U.S. Crisis 2001 Debt $5.81 Trillion

U.S. Crisis 2008 Debt $10.02 Trillion

U.S. Crisis 2020 Debt $26.95 Trillion

Debt Accelerates Faster & Faster - The Biden Administration

Jan 2021 Biden inaugurated $27.75 Trillion

Sept 30, 2022 - U.S. Year End $30,928 Trillion

Sept 30, 2023 - U.S. Year End $33,167 Trillion, about 2 Trillion more than last year.

Although printing money and accumulating debt might appear as a great immediate solution for the U.S. to stimulate its economy, its effects create far-reaching inflation which negatively influences economies across the globe. This is one of the reasons that nations have started distrusting U.S. policies and our dollar.

How to Recognize a Global Shift in Monetary Power:

While the onset of a global monetary shift might elude even the astute observer, it becomes glaringly evident as the pace of money printing accelerates rapidly. Discussions of de-dollarization have been circulating for years, but it wasn't until recently that the U.S. recognized its validity. In June 2023, Treasury Secretary Janet Yellen noted a forecasted 'gradual decline' in the U.S. dollar's dominance in global reserves.

Nation After Nation Distancing from the U.S. Dollar:

In 2008, a unique situation arose: a severe financial crisis struck developed countries while emerging nations experienced relative economic stability. This contrast triggered a crisis of legitimacy within the international financial system, subsequently leading to an extraordinary level of cooperation among emerging nations within the framework that established the BRICS nations. The BRICS Nations (Brazil, Russia, India, China, and South Africa) initiated efforts to establish their own banking system, independent of the U.S. dollar. This endeavor culminated in the creation of the New Development Bank (NDB) in 2015.

The years 2022 and 2023 witnessed remarkable developments in the global move away from the U.S. dollar. Following sanctions imposed on Russia after it invaded Ukraine, numerous countries within the BRICS nations including China and India, began further diminishing their reliance on the dollar. Instead, they favored their currencies or those closely aligned with their national interests. At the 2022 BRICS Nation Summit, sanctions were described as weaponizing currencies & economies for Western control that does not benefit BRICS Nations.

In August 2023, during the 15th BRICS Summit, South African President Cyril Ramaphosa revealed that Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates had received invitations to join the bloc, with full membership scheduled to commence on January 1, 2024. Although not all of these countries are likely to join, many most likely will.

BRICS Nations ~ A New Global Trade in Currency:

In the past year, there's been increasing chatter from various quarters about the BRICS Nations nearing the unveiling of a new currency. Recent statements, as of October 2023, indicate that the currency is in its final stages, awaiting the green light from member states. The BRICS nations aim for this new currency to rival established ones like the US dollar, Pound, and Euro in terms of appeal.

The proposed currency is said to be a blend of member nations' currencies linked to an array of exchange commodities, including gold, and is strategized to offer stability and a more compelling alternative than traditional currencies like the dollar.

This approach of tying a currency to commodities, a tactic with historical precedent like the gold standard, is seen by the BRICS nations as a pathway to stability and economic prosperity for developing countries. This new BRICS currency, grounded in both national currencies and tangible commodities, might offer a viable choice for international transactions, particularly appealing to countries seeking to reduce their dependence on the US dollar.

Challenges to the Petrodollar ~ Saudi Arabia and OPEC:

The long-standing OPEC agreement of 1973, mandating oil trade exclusively in dollars, no longer holds.

April 2023, Iraq's Central Bank announced its intention to conduct oil trade with China using the yuan.

March 2023, the United Arab Emirates was part of a historic transaction as China executed the first-ever yuan-settled energy deal involving Emirati liquefied natural gas (LNG).

August 2023, India and the United Arab Emirates initiated trade in their local currencies, marking a historic moment when the UAE accepted payment in Indian Rupees for over a million barrels of oil, bypassing the U.S. dollar.

For decades, OPEC countries adhered to the agreement of exclusively selling oil in U.S. dollars, solidifying the dollar's status as the world's primary reserve currency. This momentous shift underscores the increasing diversification away from the U.S. dollar as the dominant currency for global trade, serving as a clear signal of the evolving monetary landscape.

The Next Dominating World Reserve Currency Will Emerge from New Technology

In tandem with this paradigm shift, the rapid technological advancement of digital currencies has exploded. Central Bank Digital Currencies (CBDCs) have emerged as another notable trend fueling de-dollarization. Over 100 countries are actively engaged in developing their own CBDCs which serve as digital representations of national currencies. CBDCs hold the potential to streamline international transactions, making it easier for countries to conduct trade using each other's digital currencies. This development not only enhances financial independence and lowers costs to countries, but it also contributes to the ongoing process of de-dollarization. As nations embrace CBDCs and explore alternatives to the U.S. dollar in international trade, it becomes increasingly evident that the global monetary order is undergoing a profound transformation with CBDCs playing a pivotal role in reshaping the future of global finance. Click to learn What is the 'Digital Dollar' and how this will lead to the Demise of the US Paper Dollar.

Trust in a True Safe-Haven Asset

This erosion of the dollar's value underscores the enduring appeal of precious metals as "safe-haven" assets. Precious metals, notably gold, have earned this reputation due to their track record as stores of wealth for millennia. Unlike paper or digital currencies, physical gold has consistently proven its reliability in preserving value, making it a trusted choice for investors seeking a secure store of wealth.

LET'S EXAMINE THIS REMARKABLE TRACK RECORD:

Performance: Since the year 2000, gold has demonstrated remarkable performance surpassing stocks by more than a 2-to-1 margin, with a staggering rise of over 650%. During the same period, the dollar's purchasing power has crashed more than 40%.

Diversification: Incorporating gold and silver into your investment portfolio can effectively reduce overall risk and minimize exposure to paper assets, providing a tangible and reliable safeguard against market fluctuations. Historically, gold & silver go up significantly during recessions.

Convenience and Ownership: Gold and silver are straightforward to acquire, simple to own, offer privacy, and boast high liquidity. In contrast to stocks, ETFs, or cryptocurrencies, these precious metals offer a level of accessibility and security that can't be matched.

Privacy: Gold and silver can be bought and sold privately, while Central Banks' digital currencies and cryptocurrencies are maintained online and have an unerasable footprint. Although cryptocurrency transaction imprints are not directly sent to a Central Bank’s computer network, they too are not anonymous due to their permanent online transactional history across a massive worldwide network of computers.

Protection: Physical gold and silver are constitutional money outside the control of the government and banks.

Enhanced Peace of Mind: Gold and silver, whether in the form of coins or bars, serve as stabilizers for your portfolio, offer protection against inflation, and contribute to stress reduction. Effective diversification helps to smooth out the financial journey, particularly in today's uncertain world.

Harvard Gold Group is America's #1 Conservative Gold Company

As seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The New York Sun, and more. Exceptional customer service and value are the top priorities of Harvard Gold Group (HGG).

HGG is BBB-accredited, holds 5-star ratings across the board, and provides free consultations and metals overviews. We offer tax-free purchases, free 2-day shipping, the best pricing, and direct access to our co-owners, who have over 15 years of experience specializing in precious metals, moving over a hundred million dollars into tangible assets for people's IRAs/retirement accounts and for direct delivery. Customers enjoy lifetime account care and a straightforward buyback program without hassle or liquidation fees.

Learn more about us or call (844) 977-GOLD (4653) and make an appointment for a free consultation.

Article by: Harvard Gold Group | November 21, 2023

Get Prepared Today with Harvard Gold Group

Learn Which Solution is Best for Achieving Your Retirement Goals:

3 Simple Steps on How to Buy

One of the Founders will assist you

Choose Confidently

Understand the advantages of Gold & Silver and what options are best for your portfolio

Receive Your Metals

Private direct delivery of your physical Gold & Silver gives you full control

3 Simple Steps on How to Buy

Call 844-977-4653

One of the Founders will assist you

Choose Confidently

Understand the advantages of Gold & Silver and what options are best for you

Receive Your Metals

Private direct delivery of your physical Gold & Silver gives you full control

Ready to find out more?

Request our Investment Library of Reports!

*We respect your privacy and do not sell your information*