The Dollar's Dominance of Global Trade and Reserves is Facing Several New Threats Getty Images

- The dollar’s supremacy in global trade faces fresh challenges as several countries float plans to use local currencies in commerce.

- Russia and Iran are working to create a gold-backed stablecoin, while China is increasingly using the yuan in its oil trades.

- Here are 5 rising challenges to the greenback’s dominance of international trade and investment flows.

The Dollar’s dominance of global trade and investment flows is facing a slew of new threats as many countries push plans to boost the use of alternative currencies.

Nations from China and Russia to India and Brazil are pushing for settling more trade in non-dollar units – with plans ranging from the use of local currencies to a gold-backed stablecoin and a new BRICS reserve currency.

For decades, the greenback has reigned supreme as the world's reserve currency and is widely used in cross border trade, especially for commodities such as oil. Thanks to its relative price stability, investors see it as a safe-haven asset in times of heightened economic and geopolitical uncertainty.

The dollar was further bolstered last year by a surge in US interest rates that made it attractive to foreign investors seeking higher yields. It surged 17% during the first nine months of 2022, but has since lost some of its shine.

Against this backdrop come the latest threats to the greenback's reign — here are five currency projects from across the world that are ultimately aimed at undermining the dollar's supremacy.

1. Russia and Iran Eye a Gold-Backed Stablecoin

- Russia and Iran are working together to launch a cryptocurrency backed by gold, Vedmosti reported.

- The stablecoin could replace the US dollar for payments if Russia legalizes crypto in cross border trade.

- A "de-dollarization" trend has already begun as the greenback's dominance makes purchases more expensive.

Stablecoins are cryptocurrencies that source their value from an asset like the US dollar or gold, which are less volatile in price than digital assets. That protects investors against wild swings in the wider crypto market.

In recent months, Russia and Iran have accelerated their push to "de-dollarize" — to move away from using the greenback in commerce — think tank the Jamestown Foundation has said. They aim to increase their volume of trade to $10 billion per year via moves such as developing an alternative international payments system to SWIFT, which they are banned from.

2. Brazil and Argentina Plan a Common Currency

Brazil and Argentina recently announced they are gearing up to launch a joint currency, named the "sur" (south), that could eventually become a euro-like project embraced by all of South America.

A common currency could help boost South American trade, the countries' leaders said in a joint statement, because it evades conversion costs and exchange rate uncertainty. That could erode the dollar's dominance in the region, given the greenback accounted for as much as 96% of the trade between North and South Americas from 1999 to 2019, according to the Federal Reserve.

3. UAE, India Look at Using Rupees in Non-Oil Trade

Meanwhile, the United Arab Emirates and India have floated the idea of conducting non-oil trade in rupees.

The move would build on a free trade agreement signed last year, which aims to boost trade excluding oil between the two countries to $100 billion by 2027.

China has also pondered on the idea of settling non-oil trade in local currencies that exclude the greenback, according to minister of state for foreign trade of the UAE Thani bin Ahmed Al Zeyoudi.

4. China Pushes for the Yuan to Replace the Dollar in Oil Trades

China, for another, is looking to weaken the dollar by pushing for the yuan to replace the greenback in oil deals, given its increased trade with Russia after it invaded Ukraine.

The move looks to chip away at the petrodollar regime in place since the 1970s, where global oil transactions are largely settled in dollars.

Toward the end of last year, Beijing began buying Moscow's crude at steep discounts, completing those purchases in yuan rather than dollars, giving rise to the so-called petroyuan.

With a stronger greenback, oil contracts become more expensive because the deals are largely priced in the US currency, and this also explains China's shift away from the dollar.

Kpler analyst Viktor Katona said Russia has effectively become "an Asian nation that in my opinion has introduced the yuan into large-scale oil trade."

5. Russia, China Propose a New Reserve Currency

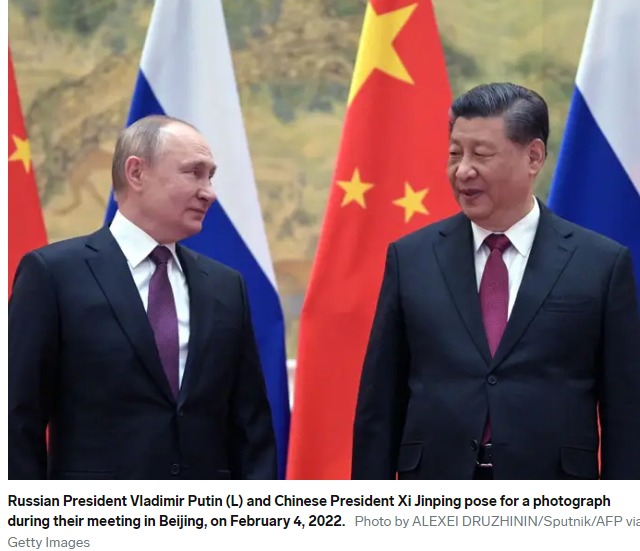

Last year, Russia and China kickstarted talks to develop a new reserve currency with other BRICS countries in a challenge to the dollar's dominance.

The new reserve unit would be based on a basket of currencies from the group's members: Brazil, Russia, India, China, and South Africa.

The dollar's reign as the chief reserve tender is already on the wane as central bankers diversify their holdings into currencies like the Chinese yuan, the Swedish krona and the South Korean won, according to the International Monetary Fund.

Story by Zahra Tayeb 1/29/2023 Redacted shorter to keep to important points and bullet points added by HGG. https://markets.businessinsider.com/news/currencies/dollar-dominance-russia-china-india-brazil-oil-trade-reserve-currency-2023-1