Elon Musk, "America is going bankrupt btw." Warns of America's Looming Bankruptcy Due to Its Addiction to Over Spending

The issue of America's rising national debt has caught the attention of Tesla CEO Elon Musk. In a recent post on the social media platform X, Musk issued a stark warning: "America is going bankrupt btw." This statement was in response to a post by Billy Markus, the creator of Dogecoin.

Markus had shared a headline that read, "Interest Payments on US National Debt Will Shatter $1,140,000,000,000 This Year – Eating 76% of All Income Taxes Collected: Report." Musk expressed his frustration by adding, "I am glad 76% of the income tax I pay goes directly to important things like interest on past government incompetence."

Understanding the Severity of the Situation

The headline Markus posted originated from an article on The Daily Hodl, which included an analysis by economist E.J. Antoni. Antoni, a research fellow in the Heritage Foundation's Grover M. Hermann Center for the Federal Budget, analyzed the latest Monthly Treasury Statement from the Bureau of the Fiscal Service.

He highlighted that in June 2024, the U.S. government spent $140.238 billion on interest for Treasury debt securities, while collecting $184.910 billion in individual income taxes that same month. This indicates that 76% of June's individual income tax revenue was allocated solely to interest payments on the national debt, excluding principal repayment.

Antoni voiced his concerns about America's fiscal challenge on X, writing, "Interest on the federal debt was equal to 76% of all personal income taxes collected in June - that's the Treasury's largest source of revenue and three-quarters of it gets consumed just by interest; does Congress know? Do they even care?”

Financial Realities

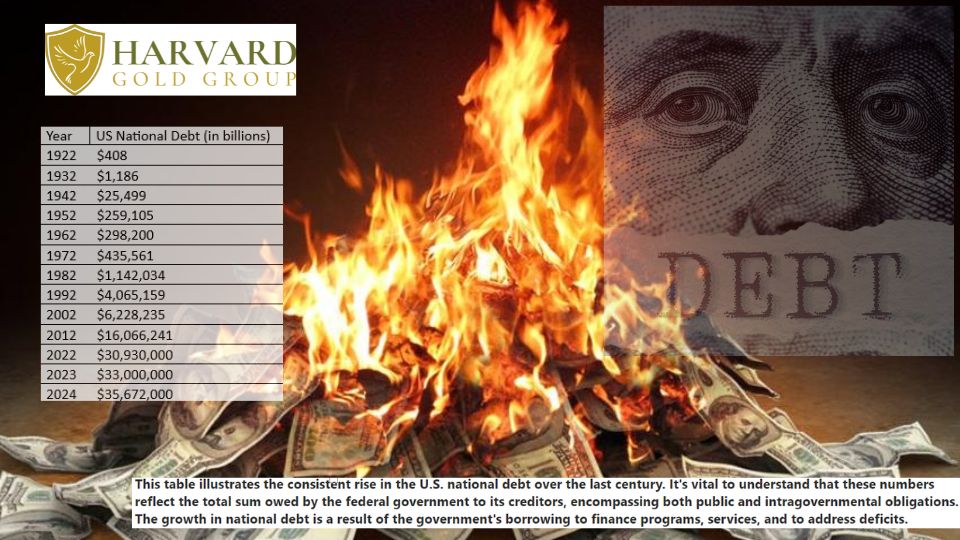

Despite America's strong and expanding economy, its national debt has been growing at an alarming rate. To put this into perspective, the U.S. federal government debt stood at $5.77 trillion at the start of 2000. This figure more than doubled to $12.77 trillion by the beginning of 2010 and escalated to $23.22 trillion at the start of 2020. The latest figures from the Treasury Department show that the national debt has now reached $34.94 trillion.

This rapid increase in debt has led to soaring interest payments, exacerbated by the Federal Reserve's significant interest rate hikes since March 2022. As a result, interest costs are mounting.

Preparing for Dollar Collapse

Understanding and then preparing for the inevitable dollar collapse may be the most important step an individual and family can take. Physical gold and silver have served as ‘back-up’ currency and as a store of wealth against currency crises and collapses for thousands of years. Join the thousands of people who have protected their wealth and generational wealth, with gold.

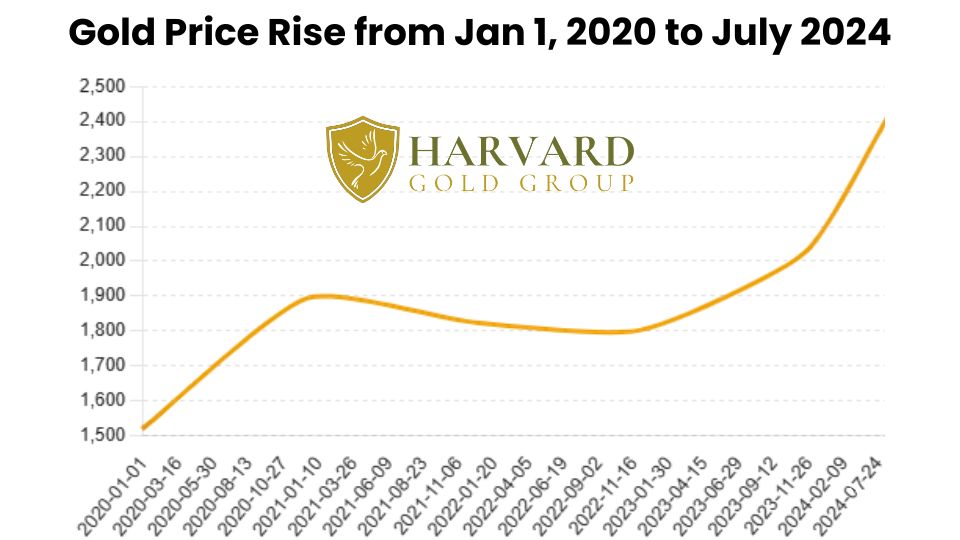

Gold has risen 57.9% since Jan 1st, 2020.

The price of gold on January 1st, 2020 was $1,520 per ounce. The price of gold on July 24th, 2024 was over $2,400 per ounce.

Investing in Gold Offers Several Benefits:

- Protection Against Inflation: Gold has historically maintained its value and purchasing power during inflationary periods, making it a reliable hedge.

- Safe Haven Asset: During economic downturns or geopolitical instability, gold tends to perform well as investors seek safety.

- Diversification: Including gold in an investment portfolio can provide diversification, reducing overall risk.

As inflation continues to impact the cost of living, gold remains a prudent choice for those looking to safeguard their financial future.

Ask us for your FREE investors’ guide, it’s full of charts and information revealing gold’s performance in response to the dollar decline in purchasing power, inflation, recessions, and U.S. debt.

Call toll-free at (844) 977-GOLD or Request for Free Guide below.

Harvard Gold Group, HGG

Specializing in Physical Gold & Silver Delivery

Private Direct Delivery | Precious Metals IRA/Retirement Accounts

HGG is America’s #1 Conservative Gold Company, as seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The New York Sun, and more. Exceptional customer service and value are the top priorities of Harvard Gold Group (HGG).

HGG is BBB-accredited, holds 5-star ratings across the board, and provides free consultations and metals overviews. We offer tax-free purchases, free 2-day shipping, the best pricing, and direct access to our co-owners, who have over 15 years of experience specializing in precious metals, moving over a hundred million dollars into tangible assets for people's IRAs/retirement accounts and for direct delivery. Customers enjoy lifetime account care and a straightforward buyback program without hassle or liquidation fees.

You can move almost any type of retirement account into a physical precious metals IRA. Retirement accounts like IRAs, 401Ks, Pension Funds, TSPs, 403Bs, Inherited accounts, and more. Harvard Gold Group offers 100% free rollovers. Qualify for up to 10 years. Qualifying purchases can also receive up to $15,000 in free metals match, delivered to your door or location of your choice.

Following years of hard work, the last concern you want to worry about is the risk of not being diversified. At Harvard Gold Group, we’re here to answer all your questions with no pressure. We make it easy to buy and easy to sell.

Get your FREE gold & silver investment guide today by filling out the request form below or call us toll-free at (844) 977-GOLD. Learn more at harvardgoldgroup.com

Protect Yourself Against These Events by Hedging with Gold & Silver

Article by Harvard Gold Group

Source: U.S. Bureau of Labor Statistics

Source: Dec 30, 2023: https://www.resumebuilder.com/due-to-inflation-1-in-5-retirees-likely-to-go-back-to-work-this-year/