- The deal features a major black swan event that could lead to higher demand for gold and silver.

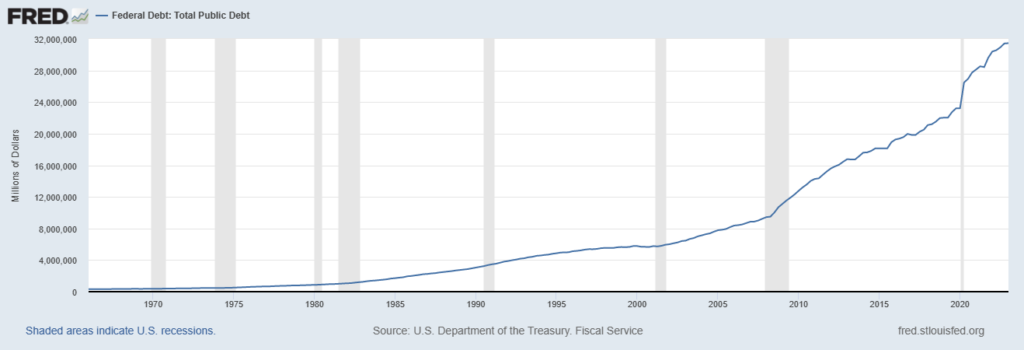

- As shown below, the US has over $31.4 trillion in public debt. This is a significant increase considering that the debt amounted to $9.7 trillion in 2008 and only $345 million in 1968.

- This new deal is expected to increase US debt by more than $4 trillion over the next few years. This will see the US National debt rise to over $35 trillion.

- Meanwhile, there is a big risk that US Social Security will run out of money in 2034. The timeline may be shorter as government estimates are always wrong.

- There is a black swan event as confidence in US debt could erode over the next few years. And with future debt ceiling deliberations, there is a possibility that the US will default.

- The emerging market is up in arms against the US dollar. As we wrote here, the de-dollarization discourse has never been louder.

- All of these factors could be bullish for gold prices as it is the better-known alternative to the USD.

- This explains why many countries like Russia, China, and Turkey are buying a lot of gold.

- Although the price of gold has declined, it is likely to recover in the coming months. If that happens, silver will also benefit.

Commodity prices have eased in recent weeks as worries about the economy worsen. The metals of electric vehicles such as lithium and nickel all plummeted, while crude oil prices fell ahead of the latest OPEC+ meeting. The price of gold, which recently hit a record high, fell to around $1,950. Similarly, the price of silver entered a correction after falling 11% from its year-to-date high.

Black swan event

The biggest news recently has been the debt ceiling agreement reached between Democrats and Republicans. This deal, if approved, will allow the US to avoid a default and keep the government open. Most importantly, it will prevent a credit rate downgrade by key companies like S&P Global, Moody’s and Fitch.

However, the deal features a major black swan event that could lead to higher demand for gold and silver. While the deal is expected to reduce the deficit by freezing spending, the reality is that public debt will continue to soar.

As shown below, the US has over $31.4 trillion in public debt. This is a significant increase considering that the debt amounted to $9.7 trillion in 2008 and only $345 million in 1968.

The growth rate of public debt has increased in recent years, thanks to spending on Covid-19. When Trump took office in 2016, the US debt exceeded $19 trillion.

This new deal is expected to increase US debt by more than $4 trillion over the next few years. This will see the US national debt rise to over $35 trillion. Analysts believe that US debt will exceed $50 trillion by 2030.

Unfortunately, there is no way to reduce this trajectory. To reduce debt, the US must cut spending, including on defense, which both sides reject. Additionally, the government must raise taxes, which Republicans oppose.

US debt and gold prices

Meanwhile, there is a big risk that US Social Security will run out of money in 2034. The timeline may be shorter as government estimates are always wrong. Therefore, there is a black swan event as confidence in US debt could erode over the next few years. And with future debt ceiling deliberations, there is a possibility that the US will default.

Also, the US will suffer a black swan event when Social Security runs out of money. As we are seeing in France, tampering with social security can lead to chaos. French citizens are in revolt after the government decided to raise the retirement age by two years.

Furthermore, the emerging market is up in arms against the US dollar. As we wrote here, the de-dollarization discourse has never been louder. All of these factors could be bullish for gold prices as it is the better-known alternative to the USD. This explains why many countries like Russia, China, and Turkey are buying a lot of gold. It also explains why gold prices have soared to a record high this year.

Although the price of gold has declined, it is likely to recover in the coming months. If that happens, silver will also benefit.

Story By Invezz via QuoteMedia 5-31-23 Redacted shorter to keep to important points and bullet points added by HGG. https://www.investorsobserver.com/news/qm-news/7824787644116740