Use This Tax-Loophole While You Can!

Following years of hard work, the last thing you want to worry about is the risk of losing due to a lack of diversification.

In a world of increasing turbulence and uncertainty, we face a debt-burdened nation, financial institution overreach, and an unsettled world filled with war tensions. Sticky inflation and market volatility are the new norm. Amid this chaos, investors find stability and protection in their portfolios with physical gold.

Gold and silver are exceptional assets offering privacy, liquidity, and scarcity with no credit risk. For over 2,500 years, coins and bars have preserved wealth, delivered long-term returns, and protected against overreaching governments. Unlike paper investments and currencies, physical precious metals are strategic assets that cannot be printed or go to zero. Moreover, because they are considered both a safe-haven asset and have abundant commercial uses, they serve as dual investment vehicles, offering benefits you cannot attain with other assets.

As Americans, we hope and pray for the best— but prepare for the worst— to protect our families.

With 5-star ratings across the board and BBB A+ rating, partnering with Harvard Gold Group (HGG) gives you peace of mind. HGG provides direct access to its co-owners, who have over 16 years of experience specializing in Precious Metals IRAs and retirement accounts, as well as in direct delivery, moving over $100 million into tangible assets.

HGG is America’s #1 Conservative Gold Company, as seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The Christian Post, The New York Sun, and more. Exceptional customer service and value are our top priorities.

Learn more at About Harvard Gold Group (HGG).

How Does a Physical Gold-Backed IRA Work?

A Gold IRA turns your retirement savings into physical gold coins or bars that you own and control in lieu of paper assets like stocks and bonds. A self-directed precious metals IRA blends the wealth-building leveraging of tax deferment with the protection that tangible gold offers. This type of retirement account operates in the same manner as a standard IRA, offering the same contribution limits and tax benefits, but it also provides additional choices for distributions. When it is time for you to take distributions, you can choose precious metals, dollars, or a combination of both. Additionally, you can expand your Self-Directed IRA with a diverse range of investment options including real estate, mortgages, loans, cattle, stocks, mutual funds, and more.

Your retirement account holds your physical gold and is securely stored at an IRS-approved master lockdown depository. For enhanced protection and privacy, Harvard Gold offers its customers access to depositories that are independent of banks or government entities. IRA depositories carry comprehensive insurance protection: covering losses, theft, natural disasters, and damage. Thousands of Americans have already taken advantage of a precious metals IRA and they are recommended by many gold IRA firms; it stands as a dependable choice.

Why Diversify into a Gold IRA?

Diversifying your investments across various assets is a proven strategy that is critical for achieving long-term financial success. During The Great Recession of 2008, many investors 401K’s turned to 201K’s while home values plummeted 30-50% across America. This serves as a stark reminder of the perils of not hedging dollar-based assets and relying solely on the assurances of politicians and central bankers. In contrast, gold not only weathered the storm but thrived, exhibiting a 51% price increase from December 2008 to December 2009.

Gold is a reliable hedge against inflation. As inflation rises, it erodes the value and purchasing power of the dollar. The U.S. dollar has lost more than 40% of its purchasing power since the year 2000 and more than 96% since 1913 when the Federal Reserve Act granted Federal Reserve banks the ability to manage the U.S. money supply. In contrast, gold was valued at $20 in 1913 and has surged an astonishing 9900%, now commanding a price of over $2,000, showcasing its formidable resilience and status as a timeless hedge against dollar erosion.

Taking into consideration that in 1920, an ounce of gold was valued at $20 and could purchase 65 gallons of gas. Fast forward to January 2024, the same ounce of gold can now buy you over 590 gallons of gas. Owning gold can provide peace of mind about the purchasing power of your dollar.

You might be curious about why gold IRA firms consistently highlight the importance of diversification. Essentially, diversification involves allocating your investments among different types of assets to mitigate risk. No investment is entirely risk-free, as various assets behave differently to ever-changing market conditions. Hence, securing a well-rounded portfolio that includes a variety of assets, such as gold, can protect your wealth.

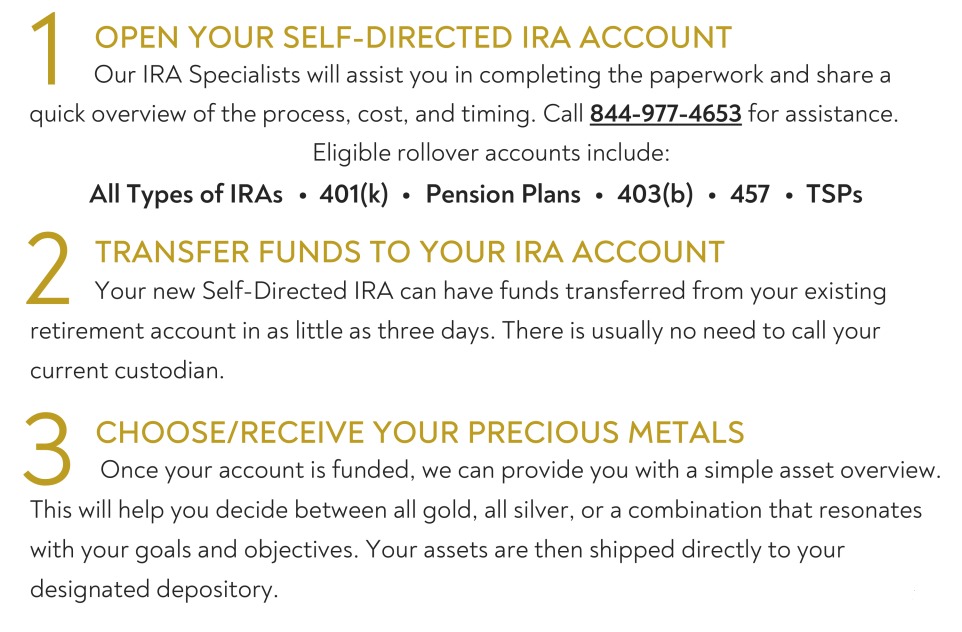

How to Setup a Gold IRA

3 Simple Steps to Transfer or Rollover:

*ABSOLUTELY FREE*

Establish your Gold IRA with Harvard Gold Group, completely free of charge. We're here to assist you in moving your retirement account tax-free and penalty-free. Our gold IRA Specialists are dedicated to helping you every step of the way, ensuring a simple and effective setup. Ask how you can get up to ten years of free annual custodian and depository costs {Yearly fee as of 2024, $50 - $275}.

Eligible Accounts Include:

All Types of IRAs | Inherited Retirment Accounts | 401(k) | Pension Plans | 403(b) | 457 | TSPs

HOW A GOLD IRA BENEFITS YOU

Wealth Protection | Safe-Haven

Physical gold is tangible and under your direct control, which appeals most to long-term investors looking for protection. It's sought as a safeguard against inflation, currency devaluation, and global economic or political uncertainties. Physical gold has been an essential component in the financial reserves of nations' currencies for centuries, and its appeal is showing no sign of diminishing.

“Gold is money. Everything else is credit.” – J.P. Morgan

Physical Asset

Beyond preserving purchasing power, tangible gold is portable, offers privacy in transactions, and serves as a valuable means of passing wealth to future generations. Physical gold is one of the most liquid investments. Gold is global money, there are exchanges all over the world for the currency of your choice.

“Gold still represents the ultimate form of payment in the world. Fiat money in extremis is accepted by nobody. Gold is always accepted.” ~ Alan Greenspan

Tax-Deferment Benefit of a Gold IRA

Transferring or rolling over an existing IRA to a Gold IRA is tax-free and allows you to retain all tax benefits. Taxes on earnings are postponed until you either withdraw your metals or cash from the account. This strategy enables the tax-exempt expansion of your investment, enhancing the effect of compounding.

Additional Distribution Choices

When it is time for you to take distributions, you can choose precious metals, dollars, or a combination of both. This distinct feature allows you to explore tax strategies that meet your goals and financial objectives to effectively maximize your retirement years.

“Because gold is honest money it is disliked by dishonest men.” ~ Ron Paul

True Diversification: Away from Paper & Dollar Denominated Assets

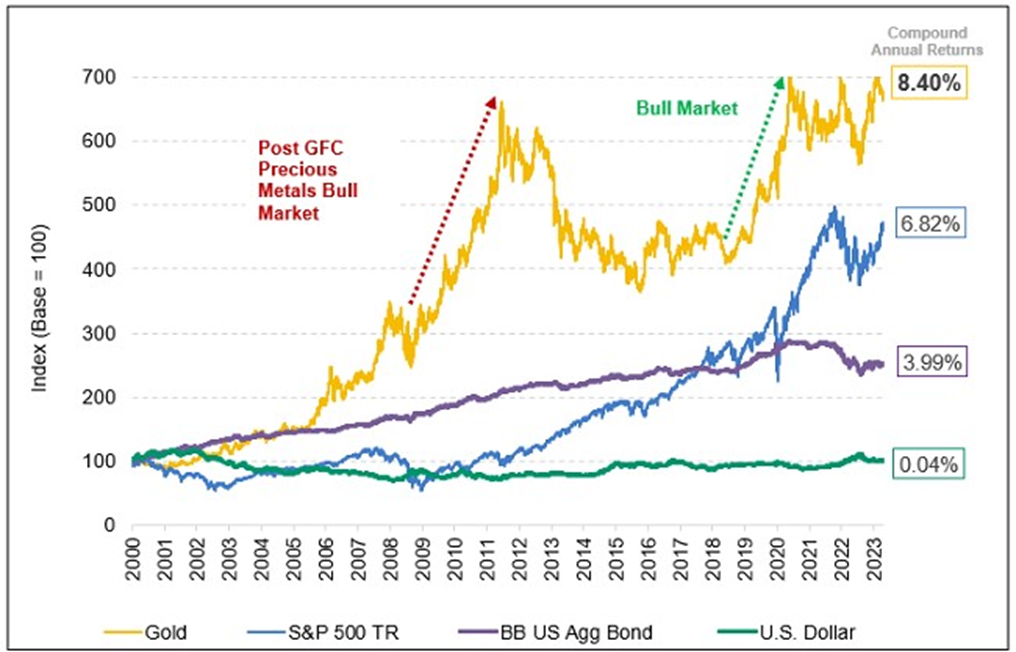

Gold is a ‘Key Asset’ for diversifying and hedging against paper and dollar-denominated investments. Most Americans are unaware of how physical gold has performed. Reflecting on the past 23 years, the U.S. has experienced significant growth in the economy and stock markets, along with enduring three major crises in 2001, 2008, and the 2020 COVID-19 pandemic. What is often overlooked is that physical gold has consistently outperformed the broader stock and bond markets. As of Spring 2024, gold has appreciated by more than 700% since January 3rd, 2000. By incorporating tangible gold into your portfolio, you can enhance your ability to safeguard and expand your wealth in both favorable and challenging economic times.

“If you don’t own Gold, you know neither history nor economics.” ~ Ray Dalio

Gold Outperforms Equities and Bonds

Since the year 2000, physical gold is up over 700%, outperforming the broader stock and bond markets. The chart below clearly showcases how gold surpassed them both:

Gold's Long-Term Outperformance vs. U.S. Stocks & Bonds, USD (2000-2023)

Gold is Easy to Establish and Maintain

Harvard Gold makes setting up a precious metals IRA simple and easy. We assist with the straightforward paperwork and ensure a seamless experience. Our IRA team is dedicated to answering all your questions and supporting you through every step. You can rely on an effortless setup and ongoing support for the lifetime of your precious metals, including for your heirs. For thousands of years, gold has been used to pass down generational wealth and stability.

You can move almost any type of retirement account above $20,000 into a Physical Precious Metals IRA. HGG offers 100% free conversion, as well as free storage, maintenance, and insurance for up to ten years. Qualifying purchases can also receive up to $15,000 in free metals match.

⭐⭐⭐⭐⭐

Customer Service

Harvard Gold Group is America's #1 Conservative Gold Company, as seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The Fish, The Christian Post, The New York Sun, and more. Exceptional customer service and value are Harvard Gold Group's (HGG) top priorities.

HGG is BBB A+, holds 5-star ratings across the board, and provides free consultations and metals overviews. We offer tax-free purchases, free 2-day shipping, the best pricing, and direct access to our co-owners, who have over 16 years of experience specializing in Precious Metals, moving over $100 million into tangible assets for people's IRAs/retirement accounts and for direct delivery. Customers enjoy lifetime account care and a straightforward buyback program without hassle or liquidation fees.

Their team of experts is available to assist you with any questions or concerns you may have at (844) 977-GOLD

Key Points to Understand About Your Gold IRA

Current rules and regulations for your gold IRA are the same as all other IRA accounts. For the year 2023, the highest allowable contribution is $6,500, increasing to $7,500 for individuals aged 50 and above. Mandatory minimum distributions for a Gold IRA begin at age 72. Without special exceptions, early withdrawals before reaching 59.5 may result in penalties.

You have the option to select from a variety of IRA-eligible coins and bars (collectibles are excluded). Havard Gold Group ensures IRS regulations are met by setting up an account to be overseen by a quality custodian. Custodial services encompass maintaining your account, statements, bookkeeping, and account administration. IRA-approved depositories are required by the IRS to undergo frequent audits, adhere to strict security protocols, and carry comprehensive insurance. To mitigate risk, you can choose from depositories that are not owned by any government or bank entity. IRA depositories insurance protection covers losses, theft, natural disasters, and damage. Additionally, depositories can start the shipping process for metal distributions as quickly as three days after receiving the paperwork.

We are well-versed in the nuances of establishing a Gold IRA—enjoy our promotional zero-cost setup. Our team of Precious Metals Specialists is here to assist you at every stage, ensuring a simple and effective Gold IRA process. Ask about current promotions that could qualify you for up to ten years of free annual custodian and depository fees {Yearly fee as of 2024, $50 - $275}.

Some or all of your IRA yearly costs could be eligible for a tax deduction, ask your CPA.

Protect Your Future Now

Planning is essential when deciding when and how to retire. Harvard Gold, America’s #1 Conservative Gold & Silver Company is here to help you protect and diversify your retirement savings. Avoid letting rising inflation and the next financial crisis shatter your aspirations. Gold can give you peace of mind and help you enjoy the rest of your life.

Reach out to our Precious Metals Specialist today at (844) 977-GOLD

✔ Tax-Free & Penalty-Free: A Rollover or Transfer of your Retirement Account is almost always tax-free and penalty-free.

✔ Free Metals/Promos: Earn up to $15,000 in FREE Gold/Silver/Promos, on qualifying purchases.

✔ Free Retirement Account Rollover/Transfer: Zero cost to rollover/transfer/move retirement accounts or IRAs to a gold/silver IRA. *You can also earn up to 10 years of Precious Metals IRA yearly maintenance fees*.

✔ Privacy: We protect your privacy and believe it is a commodity as valuable as time, you can't get it back. We do not sell your information to third parties.

✔ HGG Lifetime Account Care: Providing a dedicated account specialist and keeping you updated with market news and trends.

✔ Harvard BuyBack Program: Hassle-free buyback of HGG metals with no liquidation fees.

✔ Guaranteed Precious Metals: We only deal in government-issued coins and branded bars.

✔ Free Shipping: Your precious metals are shipped privately and fully insured to the location of your choice. You can opt to have them delivered directly to your home, business, or an independent depository.

✔ Lowest Pricing: We are committed to offering you the best value possible, with a comprehensive price-match policy.

✔ Customer Satisfaction Guarantee: Harvard Gold Group is a 5-star rated company and strives to maintain exceptional customer service satisfaction.

✔ You work directly with the founders of HGG.

FAQs About Gold IRAs

Would my IRA have real coins and bars or is it paper-gold and silver in the account?

No paper assets are placed within the Precious Metals IRA established by Harvard Gold Group. The IRS permits the ownership and control of physical, premium-minted coins and bars made of gold, silver, platinum, and palladium. You can choose all gold or a combination of various precious metals assets.

Why doesn’t my financial advisor recommend buying physical gold and silver?

Brokerage firms and financial advisors generate money in multiple ways, a main source is commissions and fees which are typically charged on the front and back end of transactions. They also typically enjoy income from ‘money under management’. These firms almost exclusively sell paper assets rather than physical assets. Therefore, they understand paper-gold and silver ETFs. ETFs are known for volatility, and they might be steering you away from that risk. Alternatively, they may be reluctant to suggest hedging with physical precious metals, as it would lead to a decrease in money under management.

Does a Physical Precious Metals IRA protect an individual from the US Bank Bail-In Law?

The Precious Metals IRA custodian established for your account is not tied to a bank or government institution. As a result, it can shield you from third-party counter risks, including those presented by the 2014 Bank Bail-In Law in the United States. This ensures that you maintain control over your funds and have actual ownership of them.

Tax-Deferment Benefit of a Gold IRA:

A distinctive benefit of a Gold IRA is its tax advantages, allowing for tax-deferred growth. This means the taxes on your earnings are postponed until you begin to withdraw from your account, facilitating more efficient asset accumulation over time.

For Roth IRA holders, the perks are even greater. Withdrawals from a Roth IRA may be entirely tax-exempt, further enhancing the tax benefits and elevating your financial gains. Delving into these tax advantages as part of your retirement planning can reveal significant opportunities and insights.

Consulting with a tax professional can help you explore tax strategies that meet your goals and objectives to effectively maximize the benefits of your Gold IRA.

Can I take distributions in gold and silver out of my Precious Metals IRA?

With a Physical Precious Metals IRA, you gain financial benefits and strategic advantages through distributions, including required minimum distributions (RMDs). This differs from standard IRAs or retirement accounts, which are limited to paper investments like stocks and bonds and typically only allow for cash distributions. A Precious Metals IRA offers greater flexibility and control by allowing you to choose distributions in precious metals, cash, or a combination of both, based on your financial goals and objectives. These features have the potential to significantly enhance your prosperity and generational wealth.

Why do my IRA Precious Metals need to be stored at a depository?

Like a standard IRA or retirement account, a Precious Metals IRA is a tax-advantaged investment vehicle. As such, you cannot maintain the tax-free status of your retirement funds if they are held in a personal bank account. In a Precious Metals IRA, your gold and silver - tangible forms of real money - must be stored in an IRA-approved depository. To mitigate risk, HGG offers depositories that are not owned by any government or bank entity. This independence enables you to take distributions even during bank closures or when banks impose withdrawal limit restrictions on accounts. Moreover, these depositories have protection through 'all-risk' insurance, ensuring comprehensive coverage against losses, theft, natural disasters, and damage. In contrast, paper assets like stocks, equities, and bonds do not even have FDIC insurance coverage.

Where are the depository locations?

You can choose from several IRA-approved Depository locations such as Salt Lake City, UT · Waco, Texas · Las Vegas, NV · Wilmington, Delaware · Los Angeles, CA. Contact us to inquire about additional locations that may be available soon at (844) 977-4653.

Are there taxes for transferring my IRA/401(k) into a Precious Metals IRA?

No, you will enjoy a tax-free/penalty-free rollover of your retirement account funds. This is simply moving funds from one retirement account to another. You only incur taxes if you take possession of retirement account funds.

What types of accounts are eligible for transfer/rollover?

You may rollover IRAs or other qualified retirement accounts into Precious Metals IRAs. Qualified retirement accounts include Inherited retirement accounts, Traditional, Roth, SEP, or a SIMPLE IRA, 401k, 403s, 457s, Pension plans, or Thrift Savings accounts, plus many types of Annuities. Some annuities have penalties. In some cases, some or all the penalty can be offset by promotions: Call us with questions ~ Harvard Gold IRA specialist (844) 977-4653.

Can I make contributions to my Precious Metals IRA?

Yes, a Precious Metals IRA has the same contribution rules as a regular paper IRA.

How do I know how my precious metals portfolio is performing?

Precious Metals custodians provide you with online access to your account. You can track the performance of your precious metals at your convenience. You will also receive a quarterly statement.

What is HGG Lifetime Customer Care?

Harvard Gold Group (HGG) is dedicated to keeping our customers informed about the dynamics of the precious metals market and relevant global events. We don't just facilitate a purchase; we nurture a lifelong partnership, excited to support you and your heirs throughout the life of your precious metals ownership. Our commitment extends to every generation in your family that continues to own precious metals with us, reflecting our promise of enduring service.

What are the Details of the Harvard Gold Group BuyBack Program:

If you need to liquidate and go back to dollars, Harvard Gold Group (HGG) does not charge its customers commissions or liquidation fees. There are no minimums. You can be in cash as quickly as 48 hours if metals are in a depository or 3 days if your metals are in your possession.

Ready to Convert Your Retirement Account to a Gold-Backed IRA?

Call or fill out an online form today:

Free Retirement Account Rollover/Transfer & Free Direct Delivery Shipping + Insurance

TALK TO AN EXPERT

ACCOUNT SPECIALIST