When you envision retirement, do you think of site seeing the U.S., traveling across Europe, or spending more time with grandchildren, friends, and family? While past generations were able to enjoy these retirement pastimes as early as age 55, the reality now is that many Americans may never gain the opportunity to fully retire.

Data from the U.S. Bureau of Labor Statistics indicates that since 1971, inflation has diminished Americans' purchasing power by about 87%, impacting retirement plans significantly. A study by Resume Builder revealed that 69% of retirees are returning to work or "un-retiring" mainly due to increased living costs. However, there are ways you can backstop your retirement savings to ensure your future is secure.

It is worth a strong consideration: Position your retirement savings into a physical gold IRA/Retirement Account.

Look at gold's track record and discover how gold can help you hedge your financial future and grow toward your retirement dreams and goals.

Diversifying and Hedging Dollar-Denominated Assets

Diversifying your investments across various assets is a proven strategy critical for achieving long-term financial success. During The Great Recession of 2008, many investors 401K’s turned to 201K’s while home values plummeted 30-50% across America. This serves as a stark reminder of the perils of not hedging dollar-based assets and relying solely on the assurances of politicians and central bankers. In contrast, gold not only weathered the storm but thrived, exhibiting a 51% price increase from December 2008 to December 2009.

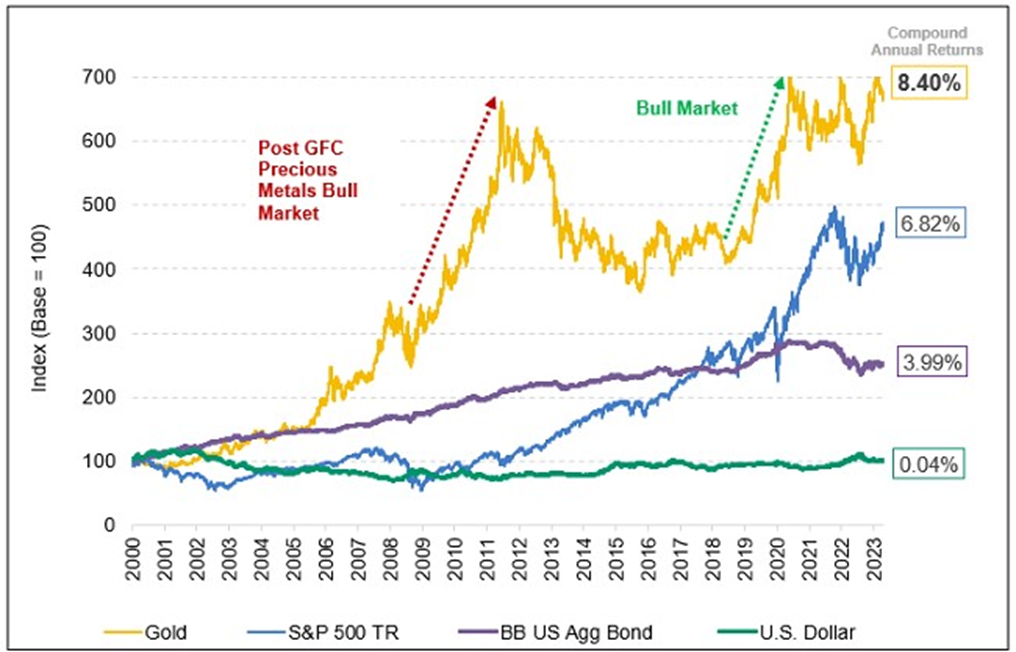

Since 2000, gold is up over 700% and has outperformed the broader equity and bond markets. Long-term investors who diversified with gold enjoyed steady portfolios with greater growth through the good economic times and cushioned the blows in the bad times in 2001, 2008, and 2020 market crashes.

Source: Bloomberg. Period from 12/31/1999 to 06/30/2023. Gold is measured by GOLDS Commodity Spot Price; S&P 500 TR is measured by the SPX; US Agg Bond Index is measured by the Bloomberg Barclays IS Agg Total Return Value Unhedged USD (LBUSTRUU Index); and the U.S. Dollar is measured by DXY Currency. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Harvard Gold Group specializes in physical gold and silver delivery, offering two programs: Private Direct Delivery & Precious Metals IRA/retirement accounts. They are BBB-approved, and 5-star rated across the board, offering free consultations and metals overviews. Customers enjoy lifetime account care and a no-hassle/no-liquidation fee buyback program. Perhaps best of all, clients can qualify for tax-free transactions, free shipping, and free insurance.

You can move almost any type of retirement account above $25,000 into a physical precious metals IRA. Retirement accounts like IRAs, 401Ks, Pension Funds, TSPs, 403Bs, and more. Harvard Gold Group offers 100% free conversion, as well as free storage, maintenance, and insurance for up to five years. Qualifying purchases can also receive up to $15,000 in free metals, delivered to your door or location of your choice.

To learn how Harvard Gold Group, America’s Most Conservative Gold Company can help you protect your nest egg, download their free 2024 information guide, or call them today at (844) 977-GOLD. Havard Gold Group is trusted and recommended by Mark Davis, The Babylon Bee, Not The Bee, The Fish, and more. Learn more at harvardgoldgroup.com

Protect Yourself Against These Events by Hedging with Gold & Silver

Article by Harvard Gold Group

Source: U.S. Bureau of Labor Statistics

Source: Dec 30, 2023: https://www.resumebuilder.com/due-to-inflation-1-in-5-retirees-likely-to-go-back-to-work-this-year/