- "It is held by central banks for this reason," he said. "In fact, gold is the third-most-held reserve currency by central banks."

- Ray Dalio, the former Bridgewater Associates CEO said he is holding gold as a hedge against a potential debt crisis and higher inflation.

- The IMF projects that public debt in the world's two largest economies (the U.S. and China)could double by 2053.

- "History and logic show that when there are big risks that debts will either 1) not be paid back or 2) be paid back with money of depreciated value, the debt and the money become unattractive," Dalio said in his commentary.

- "Since debts are promises to pay money, when a government has too much debt to be paid, its central bank is likely to print money. This prevents a big debt squeeze from happening by devaluing the money (i.e., inflation)."

- "Gold, on the other hand, is a non-debt-backed form of money. It's like cash, except unlike cash and bonds, which are devalued by risks of default or inflation, gold is supported by risks of debt defaults and inflation," he added.

- Gold is good to own when governments can’t meet their debt obligations without printing money.

Kitco News) - Billionaire investor Ray Dalio has had a mixed relationship with the U.S. dollar over the last few years, and it appears he is once again raising doubts about the health of the greenback.

In a commentary posted to LinkedIn on Thursday, the former Bridgewater Associates CEO said he is holding gold as a hedge against a potential debt crisis and higher inflation.

The comments come as the U.S. government's burgeoning debt comes into greater focus. The U.S. national debt has surpassed $34.5 trillion. However, this is not just a United States-based threat.

During its annual spring meeting in Washington, D.C., the International Monetary Fund said in its Fiscal Monitor that China and the U.S. will drive global public debt over the next five years.

The IMF projects that public debt in the world's two largest economies could double by 2053. They also singled out the U.K. and Italy as two nations that face significant fiscal risks as their government debt rises.

"History and logic show that when there are big risks that the debts will either 1) not be paid back or 2) be paid back with money of depreciated value, the debt and the money become unattractive," Dalio said in his commentary. "Since debts are promises to pay money, when a government has too much debt to be paid, its central bank is likely to print money. This prevents a big debt squeeze from happening by devaluing the money (i.e., inflation)."

"Gold, on the other hand, is a non-debt-backed form of money. It's like cash, except unlike cash and bonds, which are devalued by risks of default or inflation, gold is supported by risks of debt defaults and inflation," he added.

Dalio said that debt and other financial assets are only attractive when the financial system works well and governments can meet their debt obligations without having to print money.

"On the other hand, when the reverse is the case, gold is a good asset to own," he said. "That's the main reason that gold is a good diversifier and why I have some in my portfolio."

In early 2020, Dalio made headlines across global financial markets as he declared in a LinkedIn post that "cash was trash" in a low-interest-rate environment.

However, in September 2023, Dalio declared that "cash is now good," as the Federal Reserve pushed interest rates to their highest level in more than 40 years.

In his latest post, he said that gold is one of just a few examples of "good money" in the world.

"It is held by central banks and other investors for this reason," he said. "In fact, gold is the third-most-held reserve currency by central banks, more so than the yen or renminbi. Cryptocurrencies are also non-debt monies. I don't know of any other types of non-debt monies, though some people might argue that gems and art act similarly because they are non-debt, portable, and widely accepted storeholds of wealth."

Rising levels of global debt are a big reason why many commodity analysts have turned significantly bullish on gold, with some looking for prices to hit $3,000 an ounce.

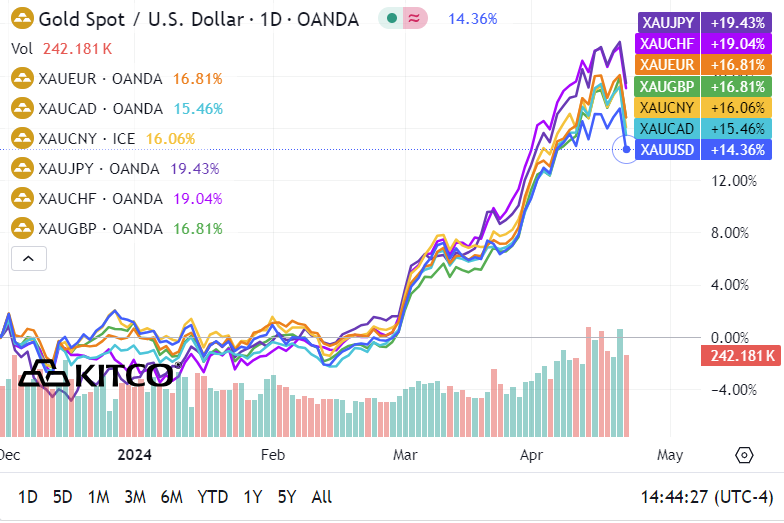

The gold market has seen broad-based gains to record highs against all major global currencies in the last few months.

Story by Neils Christensen - Redacted shorter to keep to important points and bullet points added by HGG https://www.kitco.com/news/article/2024-04-22/gold-good-money-hedge-against-inflation-and-default-risks-says-billionaire