- Prices will make a move and hit $5,000 an ounce within three years, according to Michael Lee, Founder of Michael Lee Strategy.

- … The macro data the market is basing its estimates on looks manipulated or flawed by design, according to Lee. "For a lot of the United States, they're already in recession,"

- "Every single time a report came out [this year], it was later revised lower. That has happened every month this year. That is a 12-sigma deviation event — meaning, you're more likely to get struck by lightning five times on the way to work than this happening," he said.

- A U.S. recession is unavoidable, and the first thing to hit the economy will be a wave of defaults, Lee pointed out.

- "You typically need about 18 months into the yield curve inversion before the wheels start to come off employment, which puts us towards the end of this year. We've never had an inversion like this without some sort of recession."

(Kitco News) Even though the gold market lacks direction ahead of the Federal Reserve's September monetary policy meeting, prices will make a move and hit $5,000 an ounce within three years, according to Michael Lee, Founder of Michael Lee Strategy.

The stagnation in the price action is partly because of the strength of the U.S. dollar and the market's interest rate expectations. But the macro data the market is basing its estimates on looks manipulated or flawed by design, according to Lee.

"For a lot of the United States, they're already in recession," he told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News. "You've already seen some massive deterioration in the labor market, although it's not certainly being reported that way."

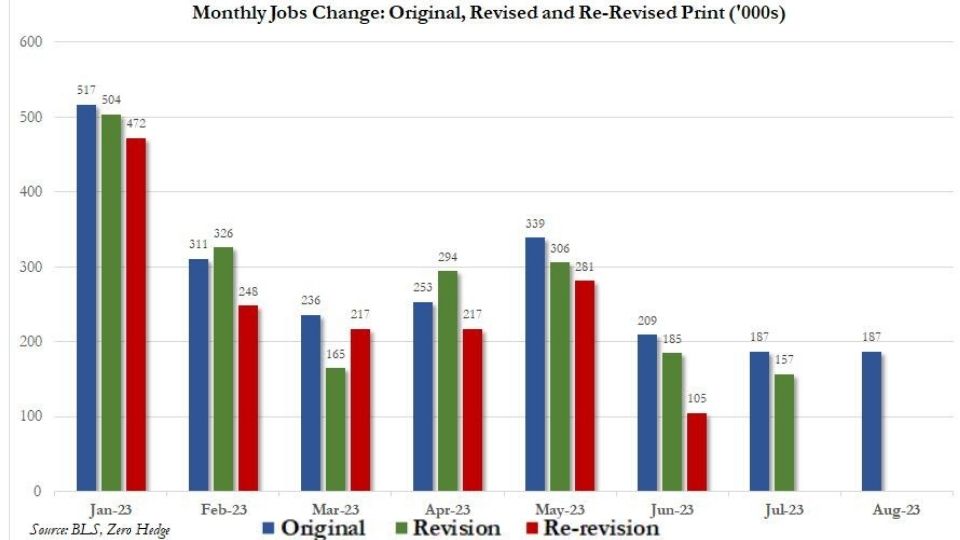

Lee broke down the U.S. jobs data releases from this year, pointing to a 12 standard deviation event, which is known as an extreme statistical outlier.

"Every single time a report came out [this year], it was later revised lower. That has happened every month this year. That is a 12 sigma deviation event — meaning, you're more likely to get struck by lightning five times on the way to work than this happening," he said. "You have to ask yourself, is this government bureaucracy, is this a flawed model, or is the Bureau of Labor Statistics cooking the books to favor the Biden administration?"

Lee also did not rule out a late-year inflation spike due to higher oil prices, which could force the Fed to introduce another hike. "I think that would be a mistake," he noted.

To find out why better-than-expected U.S. employment prints help the Fed's tightening cause and who the data really benefits, watch the video above.

Economic fallout to resemble 2001 recession

A U.S. recession is unavoidable, and the first thing to hit the economy will be a wave of defaults, Lee pointed out.

"This default wave will lead us to this next recession. I see lending getting tighter and capital getting restricted in the economy so that the default wave begins," he said. "You typically need about 18 months into the yield curve inversion before the wheels start to come off employment, which puts us towards the end of this year. We've never had an inversion like this without some sort of recession."

The economic fallout will look more like the 2001 recession than what was seen in 2008. To get Lee's forecast and what to expect from the 2001-like recession, watch the video above.

The Fed plays a crucial role in any recession cycle, according to Lee, who criticized the U.S. central bank's willingness to bail out troubled banks.

"As the labor market starts to deteriorate, spending declines, and it causes more defaults until the Fed finally cuts, and then we start all over again, and you need those default cycles to clean out the bad companies, and so you don't end up with a bunch of zombie companies," he said. "The Fed is making a mistake with their bank liquidity programs because the whole point of this rate hiking cycle was to flush out the excess."

Why gold is still below $2k: 'This is one of the most difficult periods to invest'

Lee questioned why the gold price is still below the key psychological level of $2,000 an ounce, drawing parallels to reports of price suppression in the silver market.

"One has to wonder how gold has not broken out materially above $2,000 given the amount of buying that these BRICS nations are doing at the moment. With silver, you're finally seeing some JPMorgan traders go to jail for what they did 15 years ago in containing the price of silver," he said. "Is there something like that going on in the gold markets to artificially deflate the price? When all these stars line up, and the price of something should be much higher, your mind just goes to these conspiracy theories because so many have become true over the last few years."

Lee added that gold is bound to break out materially higher given this recession, pointing to China and Europe as the first two triggers for the rally.

"At some point, there will be a flight to safety. If we have another breaking event, something like a Silicon Valley bank, then all of a sudden, you get above $2,000, and you really start moving," he said.

Lee identified the key mover for gold in the next couple of years, watch the video above for his thoughts on the U.S. deficit and the role it will play in driving the gold price higher.

On equities, Lee highlighted one specific stock to watch, which he sees as more than doubling in the next two years. Watch the video above for details.

Lee also shared his take on the BRICS summit, the expansion announcement, and the weaponization of the U.S. dollar. Watch the video above to get his insights.

Story by Anna Golubova & Michelle Makori - Redacted bullet points by Jody Davis https://www.kitco.com/news/2023-09-11/Gold-price-to-hit-5-000-in-3-years-watch-the-default-wave-kick-off-a-U-S-recession-in-Q4-Michael-Lee.html