- Summer will be gold’s time to shine, according to metals strategists at Bank of America.

- Metals and Mining Outlook for 2024, the BofA analysts said that while the war in the Middle East has boosted gold in the near term, “the yellow metal ultimately remains a trade on rates, so once the Fed announces a decisive end to the hiking cycle in 2Q, new buyers should come into the market.”

- If the Fed cuts earlier, they believe gold could finish 2024 at $2,400 per ounce.

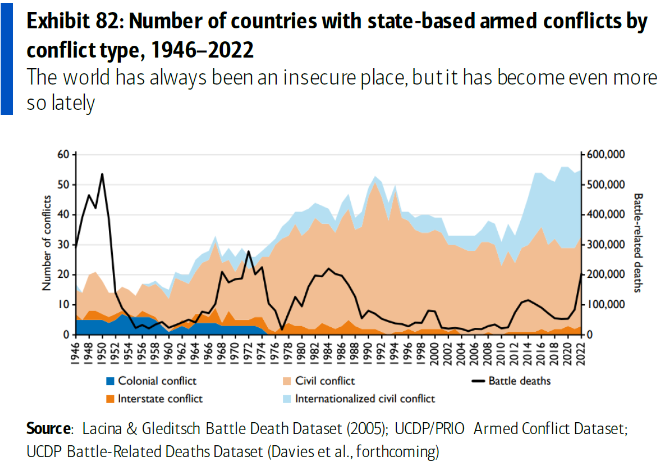

- The analysts also pointed out that defense spending is an area to keep a close eye on, “considering that the number of countries engaged in armed conflicts has risen to a record high.”

- “This is why Tudor’s Paul Tudor Jones has suggested that we are going through ‘the most threatening and challenging geopolitical environment that I’ve ever seen,’ which is occurring at the same time the United States is at its weakest fiscal position since World War 2.’ He added that gold (and Bitcoin) should ‘probably take on a larger percentage of your portfolio than historically,’” they said.

(Kitco News) - Steel will be the strongest trade in the first quarter of 2024, and base metals will rally during the second half of the year, but summer will be gold’s time to shine, according to metals strategists at Bank of America.

In their recently published Metals and Mining Outlook for 2024, the BofA analysts said that while the war in the Middle East has boosted gold in the near term, “the yellow metal ultimately remains a trade on rates, so once the Fed announces a decisive end to the hiking cycle in 2Q, new buyers should come into the market.”

If the Fed cuts earlier, they believe gold could finish 2024 at $2,400 per ounce.

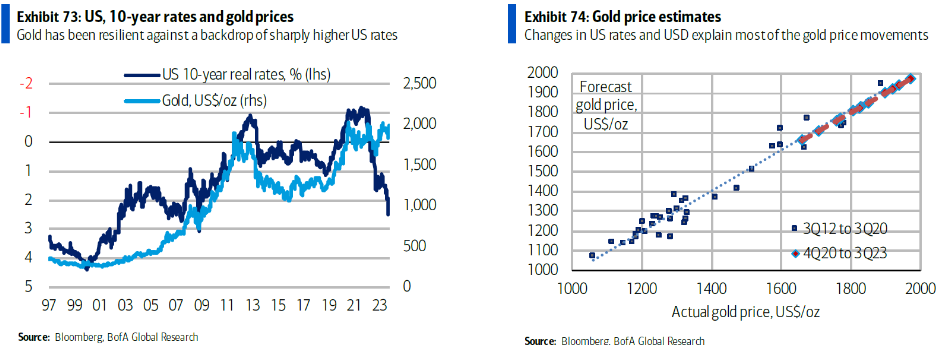

“Gold prices have held up against the backdrop of sharply higher US rates in recent weeks,” they wrote. “Exhibit 73 highlights that a visible gap has opened up between the assets – a development market participants are increasingly picking up on. While we acknowledge the dislocation, that chart comes with a significant caveat: Exhibit 74 shows that our traditional gold price model, which runs on US 10-year real rates and the dollar, continues to perform well."

The analysts explain how these seemingly contradictory factors can both be true. “That model factors in changes of gold prices, rates and the USD, not levels,” they said. “The bottom line: rates and USD matter, with changes in direction more important than the actual levels. As such, the next leg higher will come when the Fed cuts rate, likely in 2024.”

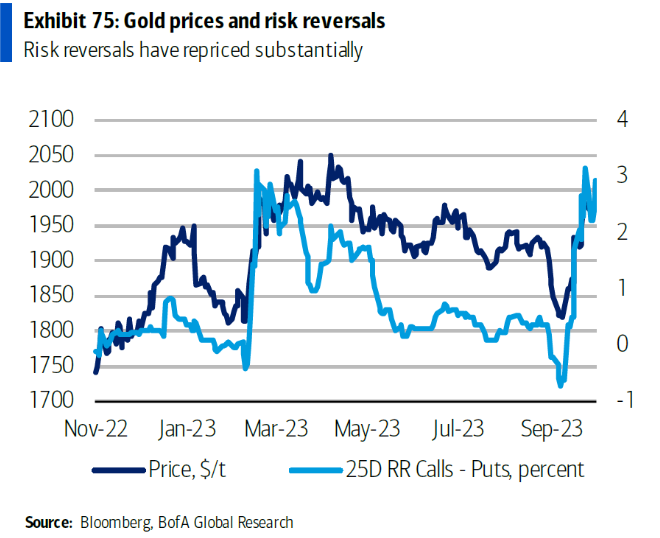

BofA believes that geopolitics matter, but rates remain the key for gold prices. “[G]old has rallied as the conflict between Hamas and Israel has escalated,” they wrote. “The repricing of gold has been particularly visible in the options space, with risk reversals pushing visibly higher, confirming topside buying.”

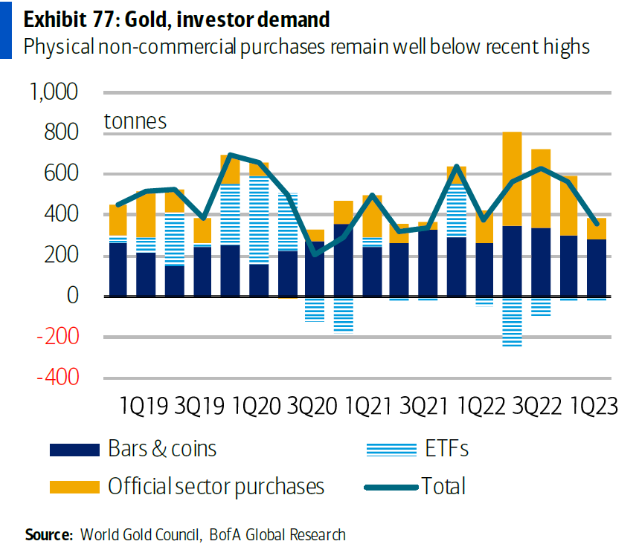

“That said, pure directional position-taking has been much more muted,” they said. “Aggregate investor purchases, visible in faltering demand for physical gold ETFs, remain well below the levels seen since the onset of the Covid pandemic.”

According to the analysts, this confirms their view that, “beyond an oil-related price spike, the next sustained leg higher in gold prices is unlikely to come until rates start falling.”

Wars intensify as fiscal firepower falls.

Looking at the broader macro environment, BofA sees the U.S. economy slowing while Europe is barely managing to stay out of recession. “Accordingly, the possible causes of the recent rally in US rates, which was accompanied by falls in wider metals prices have been much discussed,” they said. “We would caution that the bond vigilantes have come out in force. In fact, we believe rates have pushed higher since the market has been repricing the Fed rate path. That said, fiscal policy remains a concern.”

They added that the impact of central bank rate increases is starting to show in the real economy. “Keeping in mind high public debt and net interest payments, there is a case to be made for the Fed to lower interest rates,” they said. “Lower rates, accompanied by a weaker dollar, are supportive of gold.”

The analysts also pointed out that defense spending is an area to keep a close eye on, “considering that the number of countries engaged in armed conflicts has risen to a record high.”

“This is why Tudor’s Paul Tudor Jones has suggested that we are going through ‘the most threatening and challenging geopolitical environment that I’ve ever seen,’ which is occurring at the same time the United States is at its weakest fiscal position since World War 2.’ He added that gold (and Bitcoin) should ‘probably take on a larger percentage of your portfolio than historically,’” they said.

Even though the impact of armed conflicts and gold prices “has not always been straightforward,” the analysts believe the Middle East conflict still has the potential to drive gold to all-time highs through its relationship with oil.

“Indeed, the concept of ‘energy fragility’ has again reared its head,” they wrote. “We recently outlined four scenarios for the oil market, expecting prices to hit $150/bbl or higher if a broadening regional conflict resulted in damage to Middle East energy infrastructure.”

“All else equal, gold could rally to $2,400/oz if this known unknown came to pass,” they said.

Story by Ernest Hoffman - Redacted shorter to keep to important points and bullet points added by HGG https://www.kitco.com/news/2023-11-28/Gold-will-shine-in-summer-oil-shock-could-send-spot-prices-above-2-400-oz-Bank-of-America.html