Inherited Accounts - Rollover to a Gold IRA

Inherited

Retirement

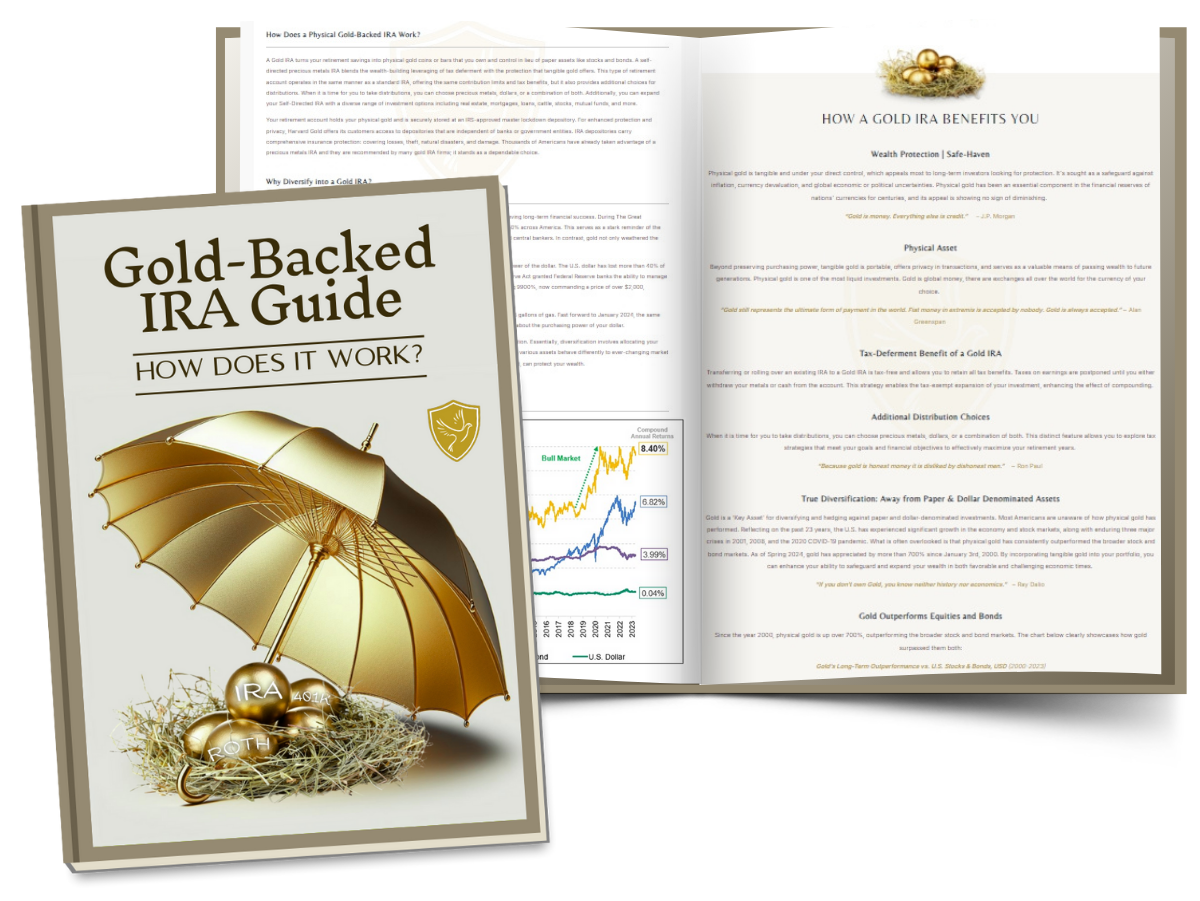

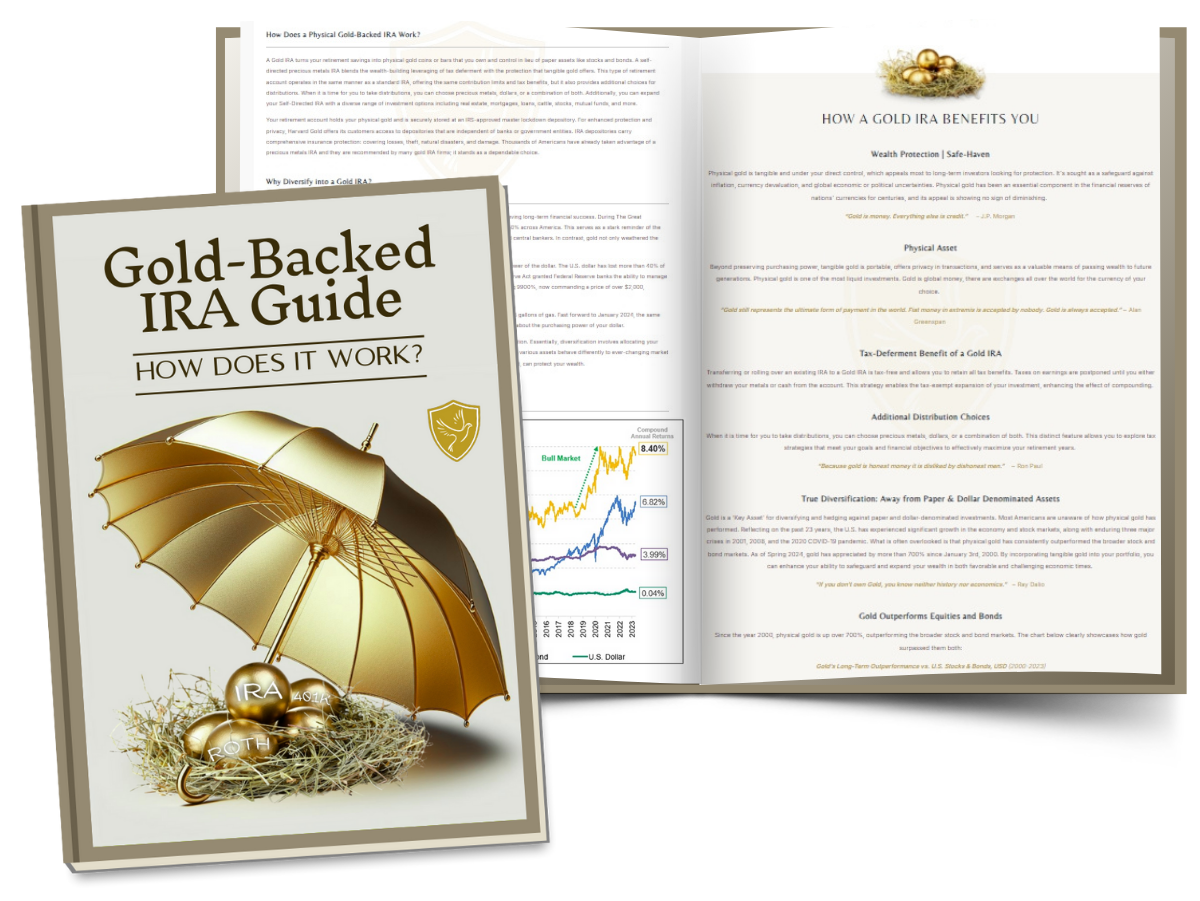

Claim Your Free Gold IRA Guide

All submissions agree to the risk disclosure + privacy policy. We respect your privacy & will not sell your information. Unsubscribe anytime.

Protecting Your Inherited Wealth with the Stability of Gold

Receiving an inheritance can provide a significant opportunity for building your financial future, especially if your loved one was a hard worker and good saver. If that inheritance comes in the form of a retirement account like an IRA, 401(k), 403(b), Pension Plan, or TSP, you have important decisions to make about its management. One increasingly popular strategy is to rollover your inherited retirement account into a Gold IRA.

At Harvard Gold Group, we recognize the importance of handling inherited funds with both wisdom and care. Many beneficiaries are seeking to shield their inherited wealth from market volatility, inflation, dollar devaluation, and the uncertainties of many traditional investments. A Self-Directed Gold IRA allows you to hold tangible, IRS-approved precious metals— providing you with safe-haven assets that have historically proven to provide steady long-term gains.

This guide will walk you through how to move inherited retirement funds into a Gold IRA, explain key benefits, highlight important rules, and show how Harvard Gold Group can help streamline the entire process.

Why Consider Rolling Over Your Inherited Retirement Account to Gold?

Inheriting a retirement account comes with specific rules and options. Here's why exploring a rollover to a Gold IRA might be the right choice for you:

- Preservation of Capital: Gold has a long history of holding value over time, especially during periods of inflation or currency devaluation. It serves as a reliable way to preserve the true purchasing power of inherited funds.

- Diversification: Most inherited accounts are heavily invested in paper assets like stocks and bonds. Gold often moves in the opposite direction of these markets, offering a unique layer of protection and balance.

- Growth: Gold has historically been one of the strongest assets for long-term value growth, providing critical stability for both individuals and countries.

- Control Over Your Assets: A Self-Directed Gold IRA gives you direct control over the specific physical gold and other precious metals you hold in your IRA— offering tangible assets that can be distributed in-kind, not just as cash. This structure enables access to legal tax advantages and long-term wealth-building strategies.

- Hedging Against Economic Uncertainty: Economic uncertainty, global conflict, and ballooning government debt are the new norm— each issue threatens traditional markets. Gold remains the go-to safe haven in times of upheaval.

Personalized Assistance with HGG

We Will Help You Understand What You've Inherited

- Expertise in Inherited Retirement Account Rollovers: We simplify the complexities of the rollover process with the IRS rules and regulations governing inherited IRAs, 401(k)s, and other retirement plans.

- Personalized Guidance for Beneficiaries: We recognize that each inheritance situation is unique. We provide tailored advice based on your relationship to the deceased, the type of account inherited, and your financial goals.

- Seamless Rollover Process: We handle the heavy lifting, assisting you with all the necessary paperwork for both the inherited account and the Self-Directed Gold IRA setup. We coordinate with custodians to ensure a smooth and compliant transfer of funds.

- Three-Way Calls for Efficiency: We facilitate communication with the original retirement account custodian through three-way calls to expedite the rollover process and ensure all necessary forms are acquired quickly.

- Five-Star BBB A+ Metals Dealer: As a reputable and trusted metals dealer, we offer transparent pricing and do not have commissioned and or bonused salespersons.

- Lifetime Account Care: Our commitment extends beyond the rollover. We provide ongoing support, including assistance with understanding your portfolio value and market updates. We can even assist your heirs with the complexities of inherited Gold IRAs in the future.

- RMD Assistance for Inherited IRAs: We understand the complexities of RMDs for inherited accounts and will provide guidance and assistance with the necessary paperwork throughout the lifetime of the account.

We Prevent Common Delays and Tax Penalties

- Required Minimum Distributions (RMDs) for Inherited IRAs: Even if you rollover to a Gold IRA, the RMD rules for inherited accounts still apply to non-spouse beneficiaries. We can help you understand these requirements and plan accordingly.

- The 10-Year Rule: For most non-spouse beneficiaries inheriting after December 31, 2019, the assets must be fully distributed within 10 years of the original owner's death. This impacts your distribution strategy from the Gold IRA as well.

- Spousal Rollover: Surviving spouses have more options, including treating the inherited IRA as their own, which has different RMD rules and allows contributions.

- Tax Implications: Rollovers themselves are generally not taxable events. However, distributions from inherited Traditional IRAs and pre-tax retirement accounts will be taxed as ordinary income. Roth IRA distributions, if they meet certain criteria, can be tax-free. Understanding the tax implications based on the type of inherited account is vital.

⚠️ Already Taken Possession of Funds?

If you’ve already received the funds, your 60-day rollover window has started. Contact us immediately to avoid costly tax penalties.

How to Rollover an

Inherited Retirement Account:

1. Open an Inherited Gold IRA with HGG

Our IRA Specialists will assist you in completing the paperwork and share a quick overview of the process, cost, and timing. See below the list of types of accounts that are eligible to move to a Self-Directed IRA.

2. Choose Your Precious Metals

Receive our customized asset overview. You can select all gold, all silver, or a combination of metals that resonates with your goals and objectives. HGG only buys and sells physical precious metals that meet IRS rules and regulations applied to an Inherited Gold IRA.

3. Select a Depository for Secure Storage

HGG knows all IRS-approved IRA-designated depositories. Whether you prefer a facility not affiliated with the government or a bank— or simply the one located closest to your home, we help match your preferences to the best option.

Protect Your Family’s Legacy

Don't let complexity delay important decisions. A Gold IRA can secure your inheritance in a time-tested, inflation-resistant asset class.

*Ask us how you can earn up to 10 years of free Hard Asset IRA yearly maintenance fees*

Common Questions About Gold IRAs

What Retirement Accounts Can Rollover?

All types of qualified retirement accounts can rollover, such as 401(k), 401k Roth, Pension Plans, 403(b), 457, TSPs, and all inherited IRA accounts.

Would My IRA Have Real Coins and Bars or is it Paper-Gold and Silver in the Account?

No paper assets are placed within the Precious Metals IRA established by Harvard Gold Group. The IRS permits the ownership and control of physical, premium-minted coins and bars made of gold, silver, platinum, and palladium. You can choose all gold or a combination of various precious metals assets.

What Are the Details of the Harvard Gold Group BuyBack Program?

If you need to liquidate and go back to dollars, Harvard Gold Group (HGG) does not charge its customers commissions or liquidation fees. There are no minimums. You can be in cash as quickly as 48 hours if metals are in a depository or 3 days if your metals are in your possession.

Disclaimer: All information above and any tax-related information is as of the 2023 tax year. HGG doesn’t offer tax advice but provides general tax rules and information from the IRS website. There can be exceptions in some cases and rules can change with no notice. You can visit www.irs.gov

IS GOLD BETTER THAN SILVER OR VICE VERSA?

IRS Approved Precious Metals

Self-Directed IRA accounts enable investment in precious metals such as gold and silver, offering a valuable avenue for asset diversification and financial safeguarding. However, IRS guidelines dictate specific requirements for approved precious metals.

The most popular gold IRA coin in America is the prestigious Gold American Eagle. The first American Eagle Gold Coins were released to the public in 1986, available in four denominations: one-ounce, one-half ounce, one-quarter ounce, and one-tenth of an ounce. The most sought-after is the one-tenth of an ounce. The IRS allows for several other countries minted and guaranteed coins within your IRA, but the main requirement is that the gold coin must have a minimum purity of 99.5%.

Examples of IRS-approved gold assets include:

Silver IRA coins and bars must be 99.99% pure. This fineness level is found in most assets sold by Harvard Gold Group.

Examples of IRS-approved silver assets include:

Considering Adding Platinum and/or Palladium to your IRA?

Ensure it meets the minimum purity requirement of 99.95%. Approved platinum options include American Platinum Eagles and the majority of platinum bars endorsed by the IRS.

Palladium is a sought-after precious metal that can be included in IRA portfolios. However, IRS regulations mandate that only palladium with a purity level of 99.95% or higher is eligible for deposition into an IRA account. Fortunately, many palladium bars and coins, such as the American Palladium Eagle, meet the IRS standards and are approved for IRA investment.

We Guide and Assist You Every Step of the Way!

Planning is essential when deciding when and how to retire. Harvard Gold, America’s #1 Christian Gold & Silver Company, is here to help you protect and diversify your retirement savings. Avoid letting rising inflation and the next financial crisis shatter your aspirations. A Precious Metals SDIRA can help give you peace of mind and help you enjoy the rest of your life.

Call our Precious Metals Specialist today at (844) 977-GOLD

Why Harvard Gold Group?

America's #1 Christian Gold Company

As seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The Christian Post, The New York Sun, and more— Harvard Gold Group (HGG) is trusted nationwide for exceptional service and unmatched value.

Harvard Gold Group does not employ commissioned salespeople— ensuring that your goals, not sales quotas, are always our top priority. HGG is BBB A + 5-star rated across the board, with zero complaints. Since 2010, our co-owners have helped Americans move over $100 million into tangible gold and silver, whether for retirement accounts or secure direct delivery.

Clients benefit from free consultations and metals overviews, tax-free purchases for eligible accounts, free 2-day insured shipping, a best-pricing policy, and lifetime account care. Every customer has direct access to our experienced co-owners, ensuring your precious metals investment is secure, straightforward, and backed by over a decade of expertise— along with a straightforward buyback program that has no hassle or liquidation fees.

✔ Tax-Free & Penalty-Free: A Rollover or Transfer of your Retirement Account is almost always tax-free and penalty-free.

✔ Free Metals/Promos: Earn up to $15,000 in FREE Gold/Silver/Promos, on qualifying purchases.

✔ Free Retirement Account Rollover/Transfer: Zero cost to rollover/transfer/move retirement accounts or IRAs to a Gold/Silver IRA. *You can also earn up to 10 years of FREE IRA yearly fees*.

✔ Privacy: We protect your privacy and believe it is a commodity as valuable as time— you can't get it back. We do not sell your information to third parties.

✔ HGG Lifetime Account Care: Providing a dedicated account specialist and keeping you updated with market news and trends.

✔ Harvard BuyBack Program: Hassle-free buyback of HGG metals with no liquidation fees.

✔ Guaranteed Precious Metals: We only deal in government-issued coins and qualified branded bars.

✔ Free Shipping: Enjoy free shipping and insurance on orders over $10k. You can opt to have them delivered directly to your home, business, or an independent depository.

✔ What is Our Lowest Price Guarantee? We are committed to offering you the best value possible, with a comprehensive price-match policy.

✔ Customer Satisfaction: Harvard Gold Group is a 5-star rated company committed to maintaining exceptional customer service satisfaction.

✔ You work directly with the founders of HGG.

Free Retirement Account Rollover/Transfer & Free Direct Delivery Shipping + Insurance

TALK TO AN EXPERT

ACCOUNT SPECIALIST