- Silver followed on gold’s steps in May and dropped from the 2023 highs as the dollar strengthened. But despite the steep correction, silver might be a good addition to a portfolio for investors with a medium to long-term horizon.

So here are three reasons to buy silver:

- Silver outperformed main fiat currencies in the last 22 years

- The 2050 net zero target implies strong demand for silver in the years ahead

- The medium to long-term technical picture remains bullish

Silver outperformed main fiat currencies in the last two decades

Historical performance is one of the best reasons to add silver to a portfolio. That is, besides the fact that it is not correlated with the stock market. As a rule of thumb, the less the correlation, the better the decision to add an asset to a portfolio.

When compared to a basket of currencies made of the US dollar, euro, British pound, Australian dollar, Canadian dollar, Chinese Yen, Japanese yen, Swiss franc, and the Indian rupee, silver has outperformed on average in the last 22 years by: 9.4%, 9%, 10.2%, 7.8%, 8.1%, 8.5%, 10.4%, 6.5%, 11.5%, 9.1%.

So, in the end, it is not about having a preference for precious metals, but it is about adding the right asset to a portfolio.

Strong demand for silver should support higher prices

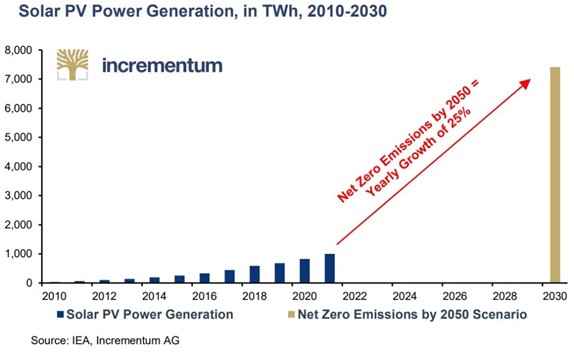

The price of silver also depends on industrial demand. Most of it derives from solar photovoltaics, and demand grew 28% YoY in 2022.

Moreover, to meet the net zero emissions goal by 2050, solar PV power generation will need to grow a staggering 25% YoY until 2030.

Silver’s medium to long-term technical picture remains bullish

What has followed the COVID-19 pandemic, looks like a bullish pattern.

Story by Invezz via QuoteMedia 5-25-23 Redacted shorter to keep to important points and bullet points added by HGG https://www.investorsobserver.com/news/qm-news/6427645530525804#:~:text=So%20here%20are%20three%20reasons,term%20technical%20picture%20remains%20bullish