Economists are sounding alarms after several major banks failed the Federal Reserve’s latest stress tests.

Notable institutions such as Citigroup, Bank of America, Goldman Sachs, and JPMorgan Chase fell short in meeting their liquidity requirements. While each bank had unique challenges, the overall results are concerning and raise questions about their ability to withstand financial instability. In today’s economically turbulent times, there is a growing fear that these shortcomings could trigger a broader banking crisis. With banks in China on the brink of collapse, the global banking system finds itself in a precarious position.

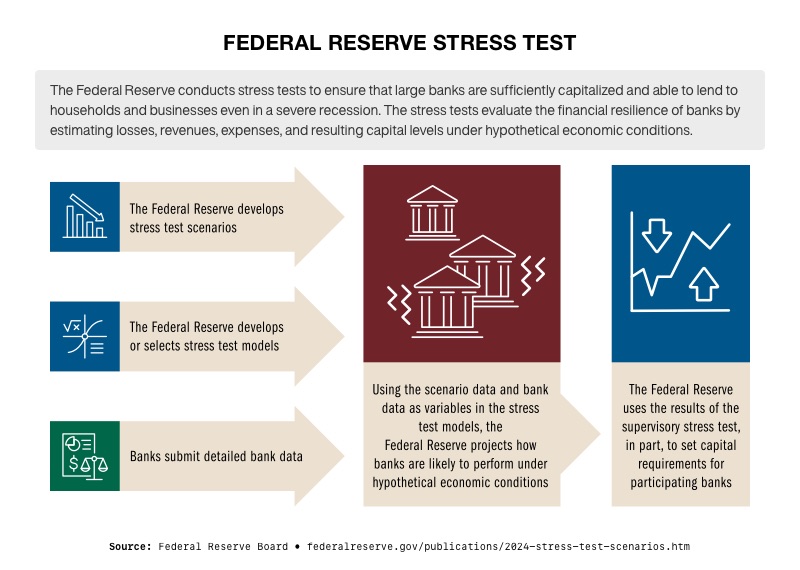

The stress test conducted by the Federal Reserve was implemented as part of the post-financial crisis reforms mandated by Congress. The recent test failures have left investors worried about the resilience of these major financial institutions. A significant area of concern is the banks' performance in managing derivatives. As derivatives are a crucial part of the financial landscape, any mismanagement could jeopardize market stability. The 2008 financial crisis, known as the Global Financial Crisis, was largely driven by a collapse in the derivative markets.

Goldman Sachs and Other Banks Under Scrutiny

Among the banks, Goldman Sachs was particularly notable for failing the stress test. The Federal Reserve has indicated that its staff collaborates with banks to adjust the tests for accuracy. However, commentators have pointed out that if a bank fails even the adjusted test, it is likely in a troubling financial position. Goldman Sachs currently has the weakest credit performance within its group, and the Federal Reserve’s test predicts a $40 billion loss for Goldman in the event of a severe economic downturn. Even Goldman’s internal stress test forecasts greater trading losses than the Fed’s projections for a hypothetical economic decline. As a result of this failure, Goldman may need to set aside approximately $6 billion to cover potential losses.

Meanwhile, regional banks are also experiencing failures. First Foundation Bank, for example, is struggling due to its commercial real estate holdings. Its shares dropped 24% following news of an unexpected capital requirement of a quarter-billion dollars. First Foundation is one of many smaller banks facing risk because of their exposure to commercial real estate (CRE).

Banking Challenges on a Global Scale

The Chinese banking sector is facing severe challenges. Within a single week, 40 banks vanished, and according to The Economist, about 3,800 Chinese banks are at risk, with assets totaling $6.8 trillion. This figure represents 13% of China's banking system, and experts warn that this could have significant repercussions for the global economy.

The issues facing Chinese banks arise from multiple factors, with a primary cause being the deep recession in China’s real estate market. Developers and local governments burdened with debt are struggling to repay loans, leading to plummeting property prices and stalled construction projects.

Another critical issue is the presence of hidden debts. Chinese banks have been known to offload toxic loans onto management companies, creating an illusion of financial stability. This maneuver removes debt from their books without addressing repayment, contributing to mounting debt burdens in Chinese cities. As the country enters a recession, these banking issues are likely to intensify.

“Years of credit-fueled growth have finally reached their limit, resulting in lower growth for China and a negative impact on the global economy. The slowdown in China’s economy will only worsen their banking problems,” warns Sina_21st.

What This Means for You

An unstable American banking system poses a threat to a critical pillar of retirement savings. As banks manage and invest these funds, instability could lead to diminished returns or losses. Economic uncertainty stemming from banking instability may also adversely affect stock markets, eroding the value of retirement portfolios. Moreover, bank failures could lead to panic-driven withdrawals, further destabilizing financial institutions and deepening economic crises, which could jeopardize retirees’ financial security.

In addition, Chinese bank failures could significantly impact the U.S. economy due to global financial interconnections and China’s economic size. Instability within Chinese banks could trigger market volatility worldwide, affecting U.S. stocks and bonds, and potentially impacting investors and retirement accounts. Furthermore, such failures could disrupt U.S.-China trade, leading to supply chain disruptions and increased prices for Chinese goods. The resulting economic slowdown in China might reduce demand for U.S. exports, harming U.S. businesses and jobs reliant on exports. Financial instability in China could also spread, tightening credit conditions and impacting U.S. financial institutions.

Conclusion

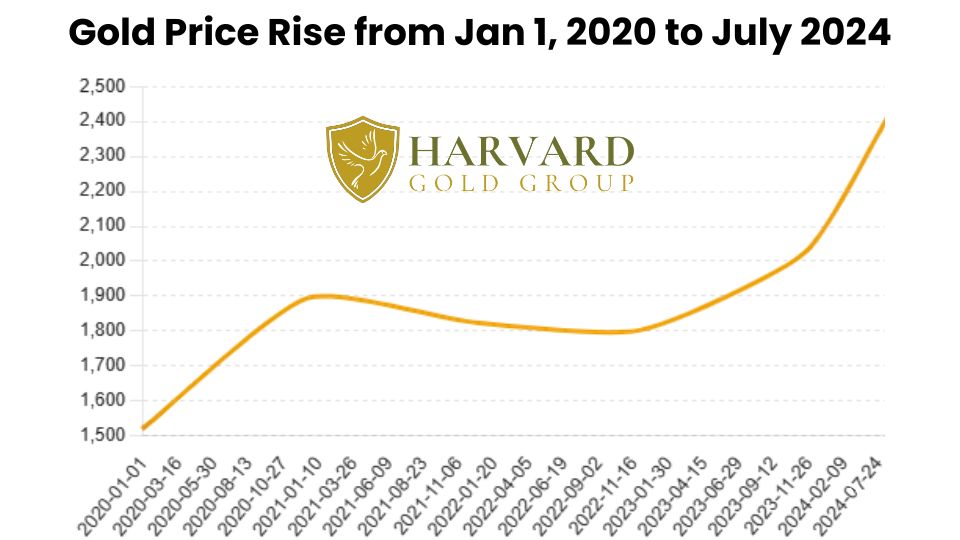

Both domestically and internationally, the banking sector is showing increasing signs of instability. To safeguard their savings against potential bank failures, many Americans are turning to physical precious metals. With no counterparty risk, physical gold and silver in a Gold IRA offer long-term security against a banking crisis. To learn more, contact us toll-free today at 844-977-GOLD

Investing in Gold Offers Several Benefits:

- Protection Against Inflation: Gold has historically maintained its value and purchasing power during inflationary periods, making it a reliable hedge.

- Safe Haven Asset: During economic downturns or geopolitical instability, gold tends to perform well as investors seek safety.

- Diversification: Including gold in an investment portfolio can provide diversification, reducing overall risk.

As inflation continues to impact the cost of living, gold remains a prudent choice for those looking to safeguard their financial future.

Ask us for your FREE investors’ guide, it’s full of charts and information revealing gold’s performance in response to the dollar decline in purchasing power, inflation, recessions, and U.S. debt.

Call toll-free at (844) 977-GOLD or Request for Free Guide below.

Harvard Gold Group, HGG

Specializing in Physical Gold & Silver Delivery

Private Direct Delivery | Precious Metals IRA/Retirement Accounts

HGG is America’s #1 Conservative Gold Company, as seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The New York Sun, and more. Exceptional customer service and value are the top priorities of Harvard Gold Group (HGG).

HGG is BBB-accredited, holds 5-star ratings across the board, and provides free consultations and metals overviews. We offer tax-free purchases, free 2-day shipping, the best pricing, and direct access to our co-owners, who have over 15 years of experience specializing in precious metals, moving over a hundred million dollars into tangible assets for people's IRAs/retirement accounts and for direct delivery. Customers enjoy lifetime account care and a straightforward buyback program without hassle or liquidation fees.

You can move almost any type of retirement account into a physical precious metals IRA. Retirement accounts like IRAs, 401Ks, Pension Funds, TSPs, 403Bs, Inherited accounts, and more. Harvard Gold Group offers 100% free rollovers. Qualify for up to 10 years. Qualifying purchases can also receive up to $15,000 in free metals match, delivered to your door or location of your choice.

Following years of hard work, the last concern you want to worry about is the risk of not being diversified. At Harvard Gold Group, we’re here to answer all your questions with no pressure. We make it easy to buy and easy to sell.

Get your FREE gold & silver investment guide today by filling out the request form below or call us toll-free at (844) 977-GOLD. Learn more at harvardgoldgroup.com

Protect Yourself Against These Events by Hedging with Gold & Silver

Request a FREE Investment Guide Today

Article by Harvard Gold Group