Several surveys from 2008 and 2020 estimate that only 10.8% to 12% of Americans own physical gold.

The simple truth is this: Americans are just beginning to wake up. Physical gold has been the most sought-after form of wealth, diversification, and money throughout history—valued across every culture and era. It has served—and continues to serve—as the foundation of central banks around the world. Gold is the protector of currency value across time and turmoil, making it an essential component of any well-balanced and diversified portfolio.

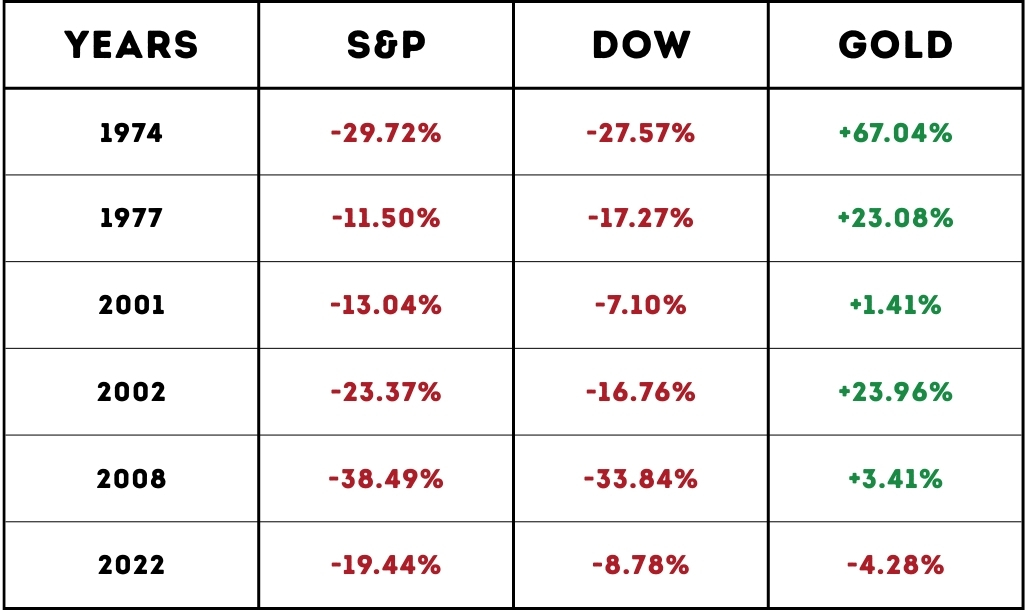

All data in the chart below refers specifically to physical gold.

It’s important to understand that gold ETFs, mining stocks, and mutual funds are forms of paper gold, and they have not performed nearly as well. In fact, many of these financial products and mining operations have failed since 1971. A quick look at their prospectuses reveals why: paper gold does not perform like the physical asset—nor does it serve the same purpose in times of currency failure, war, or civil unrest.

Why 1971?

That’s the year the U.S. removed the dollar from the gold standard

Worst Years in the Stock Markets

Through Great Years & Terrible Years... Gold Shines

Broader Picture - We have endured 3 major recessions since the year 2000

(1/1/2000 - 3/26/2025)

- Gold: Opened 2000 at $282.05 and closed 3/26/2025 at $3,019.57 = +970.60% gain

- S&P 500: Index opened 2000 at 1,455.22 and closed 3/26/2025 at 5,712.20 = +292.57% gain

- DOW: Index opened 2000 at 11,357.51 and closed 3/26/2025 at 42,454.79 = +273.86% gain

- Treasury Bond: January 1, 2000, 30-year bond at 6.59% interest annually; profit percentage 3/26/2025: +164.75%

How important has gold been since 1971, when the U.S. severed the dollar from gold? Shocking the world and breaking the Bretton Woods Agreement...

- Gold: Opened at $35 dollars in 1971 and closed 3/26/2025 at $3,019.57 = +8,527% gain

- S&P 500: Index opened 1971 at $91.15 and closed 3/26/2025 at 5,712.20 = +6,169% gain

- DOW: Index opened 1971 at $830.57 and closed 3/26/2025 at 42,454.79 = +5,011% gain

- Treasury Bond: Note: 30-year Treasury bonds were not available in 1971.

To estimate the profit percentage of long-term bond investing, this example assumes the purchase of three Treasury bonds, with the initial investment and earned interest rolled into each subsequent bond. This strategy spans the full 54-year period from January 1971 to March 31, 2025.- In January 1971, you purchase a 20-year Treasury bond at the prevailing rate of 6.5%.

- In January 1991, you roll the proceeds into a 30-year Treasury bond, also yielding 6.5%.

- Finally, in January 2021, you reinvest those funds into another 30-year Treasury bond at a rate of 1.65%.

- Total nominal profit percentage by 2025: +623.28%

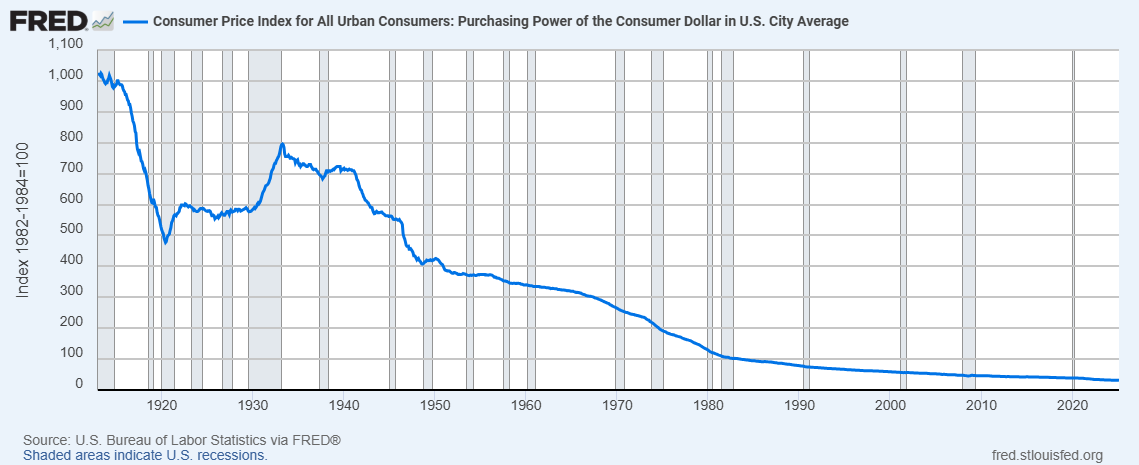

Purchasing Power of the Dollar

The most important reason to hedge and diversify your wealth with gold is the declining purchasing power of the U.S. dollar. Over time, the dollar’s value has eroded significantly due to inflation—primarily driven by excessive money creation (money printing) and debt expansion. These two forces are deeply interconnected. Historically, all fiat (paper) currencies have eventually failed due to inflation, leading to currency resets or radical shifts in monetary policy.

From January 2000 to February 2025:

(last update to the Fed website)

USD Purchasing Power Has Declined 47%

- January 2000: The CPI was approximately 168.8.

- March 2025: The CPI is approximately 319.1.FRED+1Bureau of Labor Statistics+1

An 89.1% increase in the CPI means that purchasing prices have nearly doubled since 2000. Consequently, the dollar's purchasing power has decreased by approximately 47% over this period.

From August 1971 to February 2025:

(last update to the Fed website)

USD Purchasing Power Has Declined 85-90%

- August 1971: The U.S. abandoned the gold standard, leading to significant inflationary pressures.

While exact figures can vary based on different CPI calculations, it's widely reported that the dollar has lost approximately 85% to 90% of its purchasing power since 1971. This means that what could be purchased for $1 in 1971 would cost between $6.50 and $10 today. FRED+1Bureau of Labor Statistics+1

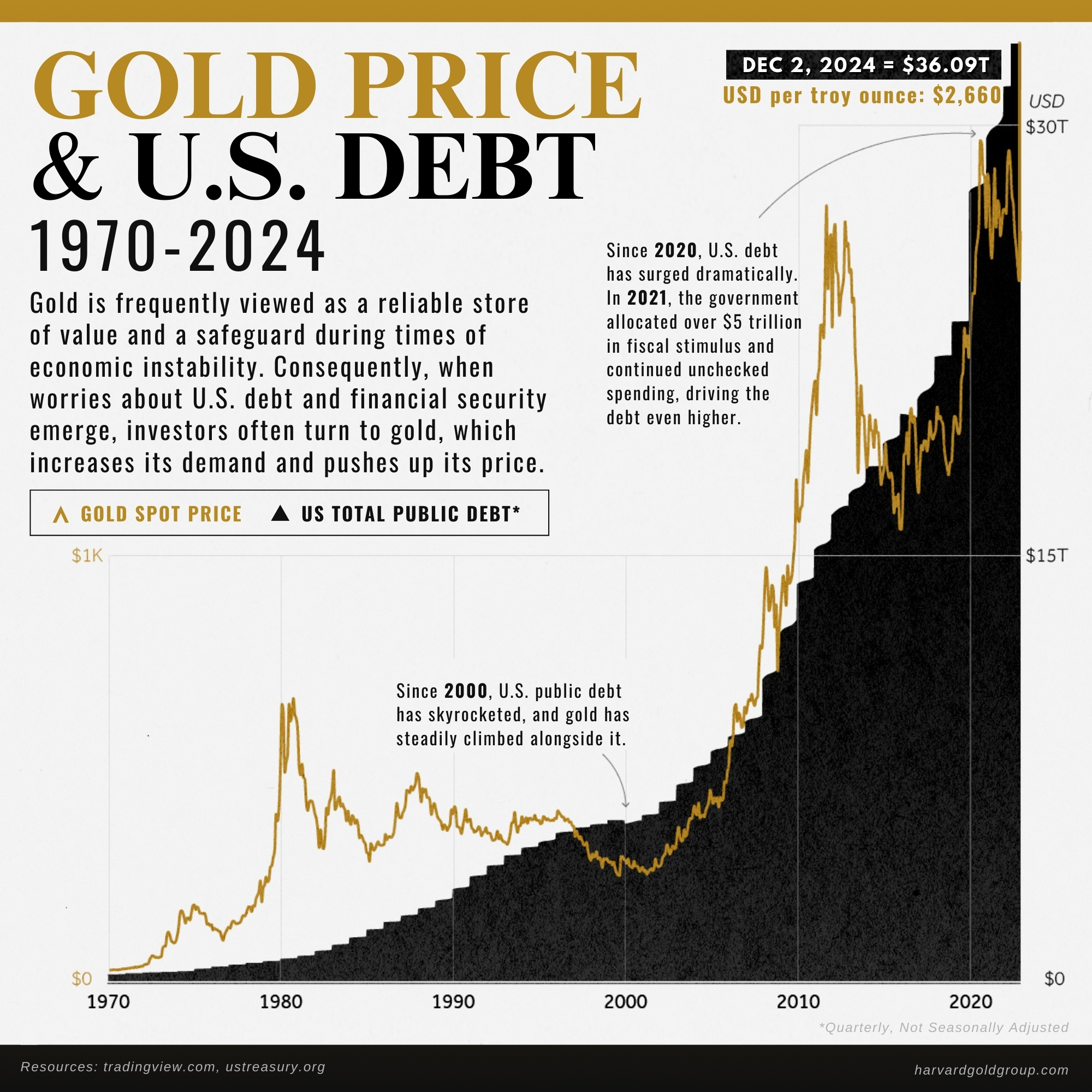

The Demand for Gold Increases as Investors Turn to Gold Amisdst U.S. Debt Concerns

Story by Harvard Gold Group