The pound has risen to its highest value this year as the US Treasury said the Trump administration is considering currency manipulation as a potential trade bargaining chip.

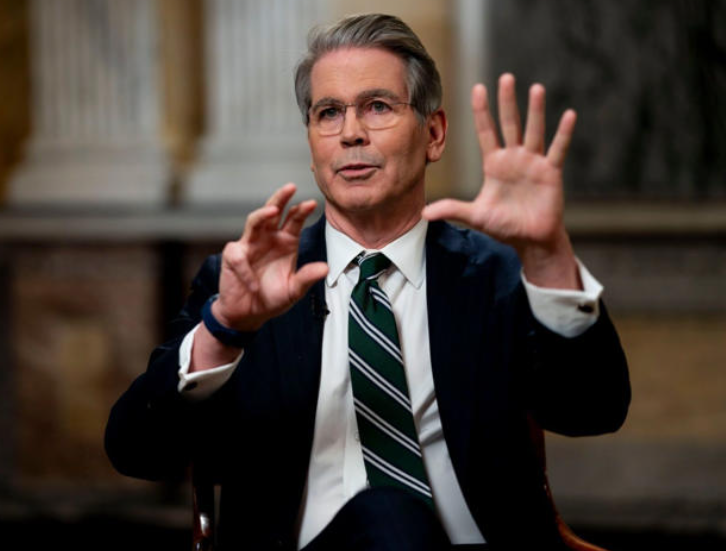

Scott Bessent, the US Treasury Secretary, said America’s trade policy would expand to what he called a “reciprocal index” of the impacts of tariffs and other trade barriers.

“We’re also looking at currency manipulation,” he told Fox Business Network.

“The US has a strong dollar policy, but because we have a strong dollar policy, it doesn’t mean that other countries get to have a weak currency policy.”

Currency manipulation involves a government or central bank altering the value of its currency to gain an unfair economic advantage, typically by buying or selling a foreign currency to impact the exchange rate or by devaluing its own currency.

Global markets have been on edge after Donald Trump announced plans for reciprocal tariffs on Thursday, vowing to impose levies on countries that charge VAT, leaving Britain at risk of a £24bn blow to its economy.

But sterling jumped 0.4pc to tip above $1.26 in afternoon trading, as it was also boosted by a steeper than expected drop in US retail sales.

The figures raised hopes that the Federal Reserve will cut interest rates this year, granting the US president his wish for lower borrowing costs.

Story by Chris Price, Jack Maidment, Alex Singleton, MSN