Series 3 of 3:

Hard Reset Imminent — History They Don't Teach: World Power Cycle, U.S. Nearing An End

America Must Act Fast

To reverse its downward trajectory in the current World Power Order Cycle, the U.S. must take decisive action to maintain its global dominance. We will provide straightforward data and charts to illustrate where the U.S. stands today in the late phase of world power. Additionally, we will explain why the U.S. will likely (or at least should) return to a partially gold-backed standard. If it does not, history suggests that the U.S. will not remain the world’s supreme power for much longer. Either way, all roads lead to gold. Countries and massive institutions are buying hand over-fist with gold at all-time high’s… something big is in the works: If they are buying physical gold, should you?

** Don't Miss Series 1 of 3: U.S. Currency Cycles & Resets

(Hard Reset Imminent — History They Don't Teach: 17 U.S. Currency Resets)**

Link to Series at the bottom

** Don't Miss Series 2 of 3: U.S. Debt Cycles & Resets

(Hard Reset Imminent — History They Don't Teach: Boom to Bust)**

Link to Series at the bottom

World Power Cycles

Series 1 and 2 talked about currency and debt cycles/resets. These are also intertwined with World Power Cycles and reserve currencies.

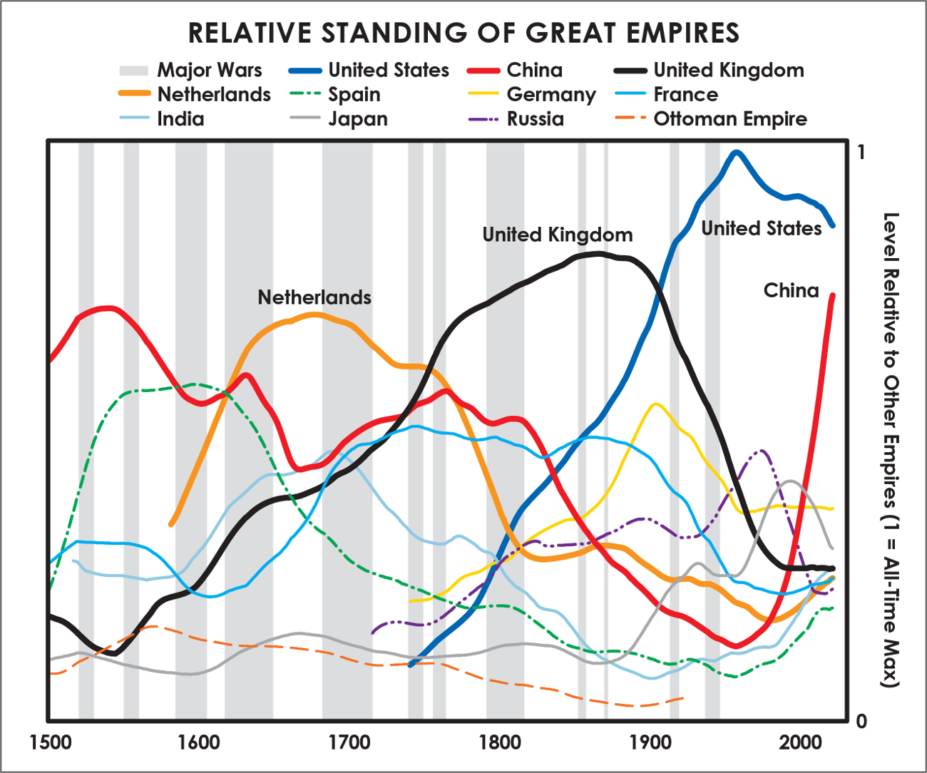

Source: Ray Dalio

High level overview of the last World Power Cycle:

World Power Cycles: The recurring rise and fall of dominant nations or empires that shape global politics, economics, and military influence. These cycles typically follow stages of emergence, expansion, peak dominance, overextension, decline, and replacement by a new power, often driven by debt, war, innovation, and trade shifts.

High level overview of the last World Power Cycle Shift

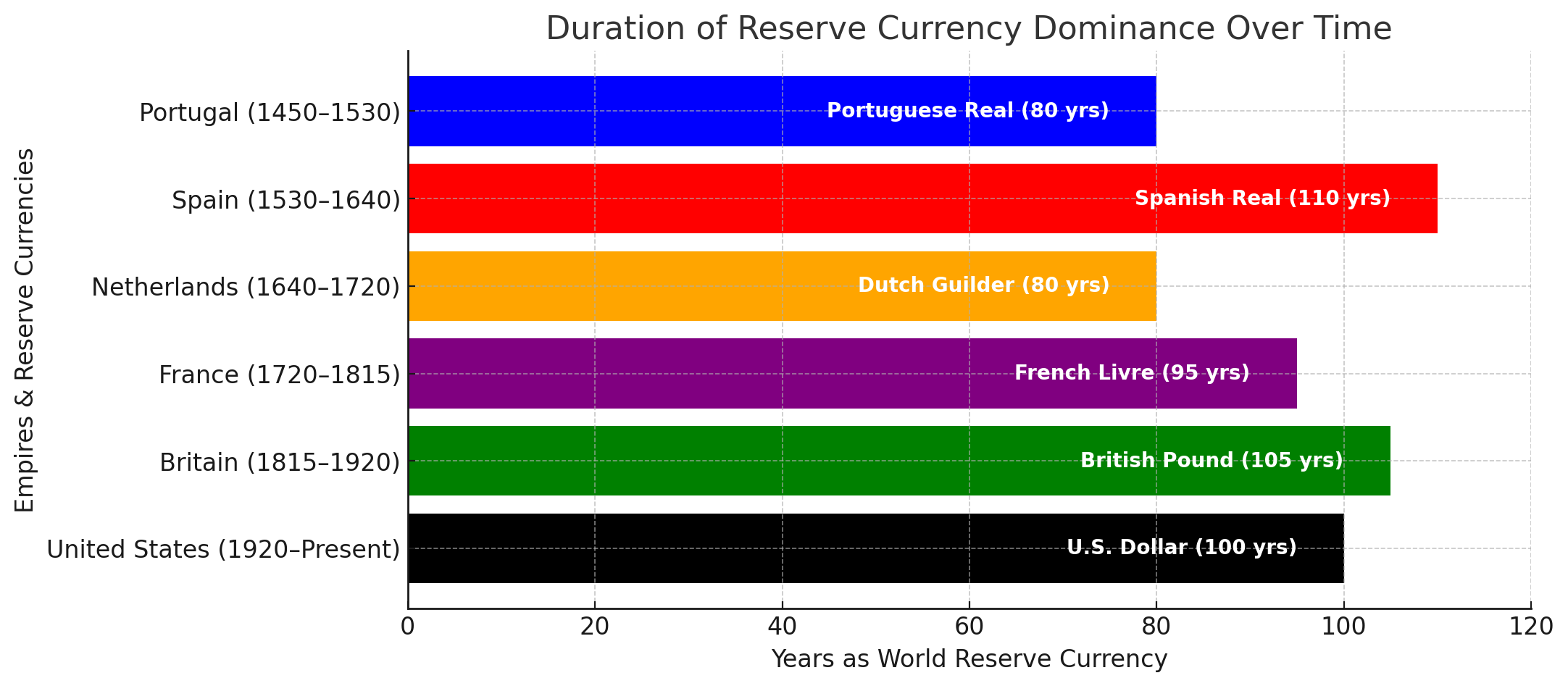

The last major power shift in world order occurred between 1920 and 1944, during which the British Pound remained the dominant reserve currency while the U.S. dollar rapidly gained influence. This period marked the overlap of Britain’s decline and the U.S.’s rapid ascent. Looking back at history, Britain’s decline was driven by massive debt overextension and economic stagnation. In an attempt to maintain power and confidence in the pound, Britain reinstated the gold standard in 1925 but ultimately abandoned it in 1931, further weakening trust in its currency. Meanwhile, the U.S. became the world’s largest creditor and industrial leader, accumulating gold and economic power. By 1944, the Bretton Woods Agreement officially established the U.S. dollar as the primary global reserve currency, solidifying America's rise as the new financial superpower.

Where is the Dollar Historically

Reserve Currency Changes & Timeline

In 1969, two years before Nixon would ‘temporarily’ remove the dollar from the gold standard, the International Monetary Fund (IMF) would create the Special Drawing Rights (SDR). SDR is a global reserve asset basket created to supplement international liquidity. The SDR is not a currency, but a basket that consisted of the U.S. dollar and most its ally’s currencies.

Aug 15, 1971 {The Nixon Shock} President Nixon, “I have directed Secretary Connally to suspend temporarily the convertibility of the dollar into gold” – tearing the tether between the dollar and gold, “sound money”. Response: The value of the US dollar went into freefall as inflation soared.

1973-74, Nixon made an agreement with Saudi Arabia to create the Petrodollar system. This system established that oil contracts would only be bought and sold in U.S. dollars in exchange for the U.S.’s military protection. This agreement solidified the dollar as the top reserve currency.

1981, the IMF streamlined the SDR valuation basket to five major currencies: the U.S. Dollar, Deutsche Mark, British Pound, French Franc, and Japanese Yen.

1999, the IMF replaced the Deutsche Mark (DEM) and French Franc (FRF) with the newly created Euro (EUR), the common currency of the European Union (EU).

2016 the Chinese Yuan (CNY) was added to the SDR basket of reserve currencies, reflecting a rising force in global finance and influence.

The U.S.-China Overlap in the World Power Cycle

In 2016, the Chinese Yuan (CNY) was added to the IMF’s Special Drawing Rights (SDR) basket of reserve currencies, marking China’s emergence as a rising force in global finance and international influence. This milestone signaled the beginning of a financial shift, positioning China as a key challenger to the U.S. dollar's dominance.

China Demonstrates Its Global Influence

China, the world’s largest importer and second-largest consumer of crude oil, established its own crude oil futures exchange on March 26, 2018, at the Shanghai International Energy Exchange (INE). For the first time, crude oil could be priced and traded in Chinese yuan (RMB), marking a pivotal step toward increasing the yuan’s influence in global energy markets. This move provided oil-exporting countries with an alternative to the U.S. dollar, accelerating the shift toward a multipolar financial system.

The Petrodollar OPEC Dismantled

In 2023, Saudi Arabia announced that it was considering conducting oil trade contracts in currencies other than the U.S. dollar. Analysts at JP Morgan projected that approximately 20% of global oil contracts were traded in non-dollar currencies that year.

On June 9, 2024, Saudi Arabia officially announced its decision to move away from the petrodollar agreement, a seismic shift that could deliver a significant blow to the U.S. economy and accelerate the global trend of de-dollarization. This move reflects Saudi Arabia’s objective to diversify its economy and expand trade relationships beyond the U.S. dollar, particularly with China. For instance, Saudi Arabia can now settle oil transactions with China using yuan, reducing its dependence on the dollar and signaling a broader transformation in the global energy market.

The Overlap Between the U.S. and China: A Shift in World Power

Just as 1920–1944 marked the power shift from Britain to the United States, future historians will likely recognize 2016 as the beginning of the overlap period between the U.S. and China. The inclusion of China’s yuan in the IMF’s SDR basket was a clear challenge to the U.S. dollar’s dominance, foreshadowing a shift in the global financial order.

This development mirrors the early stages of the U.S. surpassing Britain, signaling the emergence of a multipolar financial system where the dollar’s supremacy is increasingly challenged. As China continues to expand its economic influence through initiatives like the Belt and Road Initiative (BRI) and yuan-denominated trade, the world is witnessing a pivotal moment in the World Power Order Cycle—one where global financial leadership is gradually shifting from the United States to China.

At the bottom of this series, see the six stages of Dalio’s World Order Cycle. The U.S. is in late Stage 5, according to major experts

U.S. Preparing to Return to a Gold-Backed Dollar?

Why Would the U.S. Want a Partial Gold-Backed Dollar?

It would create an immediate currency and debt reset without war

+

It would restore world confidence in the dollar as the world’s most premier reserve currency, securing and extending our world power position

+

It would effectively inflate away a large part of our 36 trillion in debt

The massive surge in physical gold purchases at record-high levels indicates that major players and nations are strategically positioning for a major financial shift (U.S. banks, UK, China, BRICS, major countries, and Financial Institutions).

A gold-backed dollar would:

- Reduce the debt burden by making debt worth less in gold terms.

- Reduce future inflation and volatility.

- Strengthen the U.S. currency’s credibility.

- Restrict government overspending, forcing discipline.

- The U.S. would lose the ability to print unlimited money, requiring fiscal responsibility.

This move would domestically devalue the dollar, causing financial pain for citizens who do not own physical gold. However, it would strengthen the U.S.'s financial power globally in the long term. Additionally, it would allow America to reset its economy on a more sustainable foundation, fostering genuine prosperity in a relatively short time rather than relying on debt-driven growth that causes painful boom-and-bust cycles.

Read Our Entire Article: "U.S. Preparing to Return to a Gold-Backed Dollar?" for In-depth Details and Charts

Summary of Ray Dalio’s Debt and Power Cycles: The U.S., China, and the Shifting World Order

Billionaire investor Ray Dalio is known for his extensive research covering hundreds of years revealing World Power Cycles, that revolve around the longer-term debt cycles and the rise and fall of global superpowers. In his framework, nations go through predictable cycles of economic growth, debt accumulation, currency devaluation, and power shifts.

Today, the U.S. and China are in the late stages of a historical world global cycle, competing for dominance in a rapidly changing global order.

Summary: Dalio’s Cycle of Rising and Declining Empires

Dalio’s framework outlines the typical rise and fall of major powers over a 250-year cycle. The U.S. is now in a late-stage decline, while China is in a rapid ascent.

The 6 Stages of Dalio’s Cycle: We are in Late Stage 5 According to Major Experts

- New World Order Established

- A major power wins a war or conflict and sets global rules (e.g., the U.S. after WWII in 1944).

- A strong currency, military, and economy emerge.

- Period of Growth & Prosperity

- Innovation, investment, and trade lead to economic expansion.

- The global reserve currency strengthens.

- Bubble Phase (Excessive Debt Growth & Wealth Inequality)

- Government and the private sector borrow heavily, creating unsustainable debt.

- Wealth inequality grows, leading to internal tensions (e.g., the U.S. 1980s–2000s).

- Financial Crisis & Debt Burden Becomes Unsustainable

- The debt cycle reaches a breaking point.

- Governments print money to sustain growth, leading to inflation (e.g., 2008 financial crisis, 2020 stimulus).

- Currency Devaluation & Loss of Global Dominance >>> Happening Now

- The reserve currency weakens as trust declines.

- Rival nations challenge the dominant power (e.g., China, BRICS nations shifting away from the U.S. dollar).

- A New Global Order Emerges

- The declining power loses influence due to economic struggles and geopolitical shifts.

- War

- A new superpower rises to take its place (e.g., China’s rapid economic expansion and military growth).

The Lord is at the center of our business and interactions with all customers. That's why we are committed to providing you with the best possible experience and value when purchasing metals for direct delivery, storage, or setting up a Precious Metals Retirement Account/IRA.

With 5-star ratings across the board, BBB-A+, as seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The New York Sun; HGG stands out as America’s #1 Christian & Conservative Gold Company.

Our team prioritizes exceptional support and customer service for all your precious metal needs. Customers also benefit from our quick, easy, and hassle-free Buy-Back program with no liquidation fees. Your privacy is our priority—because, like time, once it’s gone, you can’t get it back. Harvard Gold Group, HGG is fully dedicated to building relationships founded on trust, one transaction at a time.