The Fuse on America’s Debt Bomb Just Got Shorter

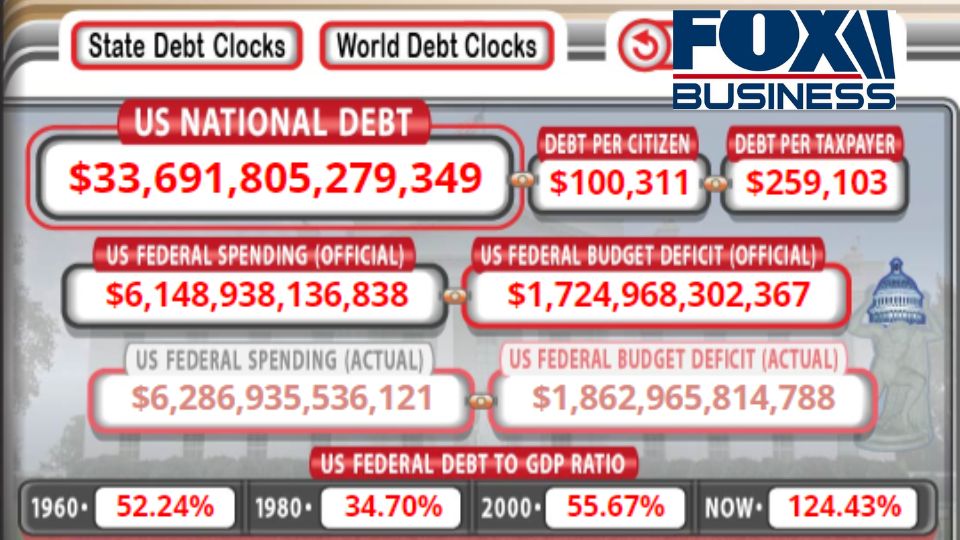

The Treasury is on track to borrow over $3 trillion this fiscal year, 50 percent more than previously estimated by the Congressional Budget Office. Bidenomics, perhaps best defined as the government spending, borrowing, and printing too much money, not only made the bomb larger but also caused inflation, which forced up interest rates. That was the […]

The Fuse on America’s Debt Bomb Just Got Shorter Read More »