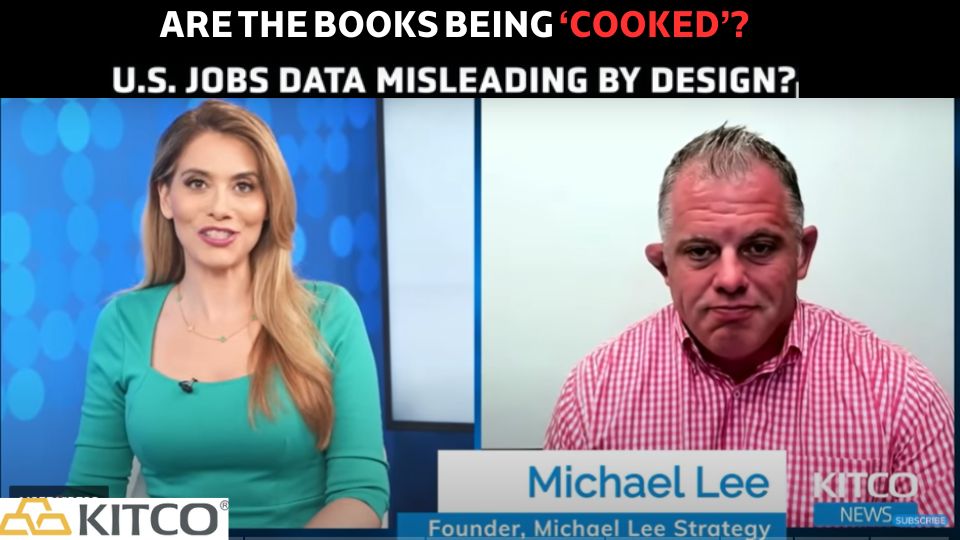

Gold Price to Hit $5,000 in 3 Years, Watch the Default Wave Kick Off a U.S. Recession in Q4 – Michael Lee

Prices will make a move and hit $5,000 an ounce within three years, according to Michael Lee, Founder of Michael Lee Strategy. … The macro data the market is basing its estimates on looks manipulated or flawed by design, according to Lee. “For a lot of the United States, they’re already in recession,” “Every single […]