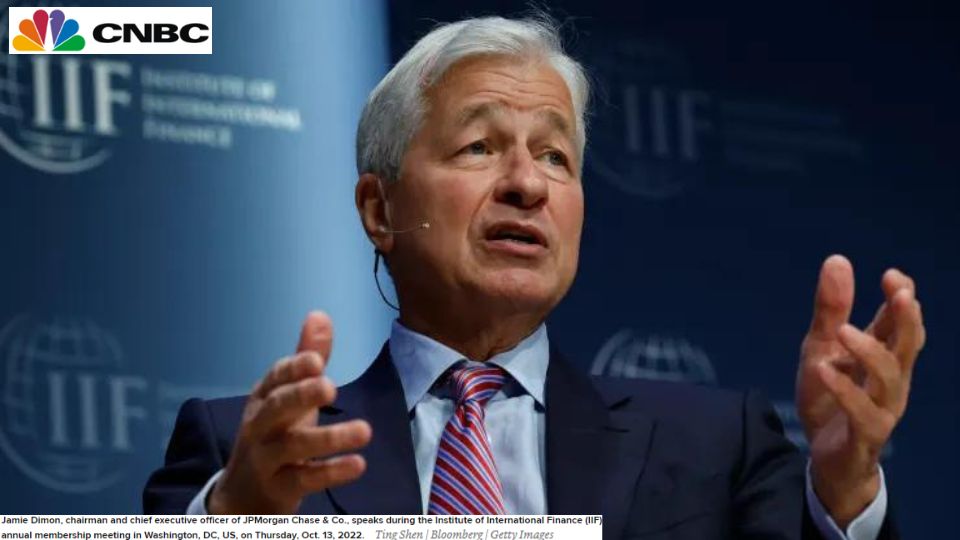

Nation’s Largest Commercial Banker Blasts World’s Largest Central Banker

Jamie Dimon said, “I want to point out the central banks 18 months ago were 100% dead wrong,” he added, “I would be quite cautious about what might happen next year….” The last time US government bond yields climbed so far, so fast, the nation plunged into back-to-back recessions. The Fed’s record of predicting recessions […]

Nation’s Largest Commercial Banker Blasts World’s Largest Central Banker Read More »