Elon Musk Sounds Alarm on America’s Impending Bankruptcy Amidst Skyrocketing National Debt

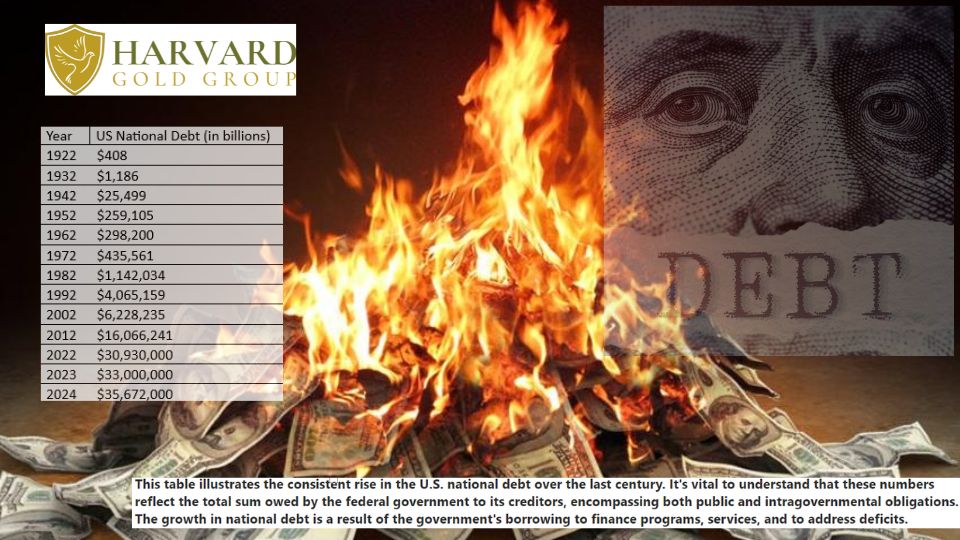

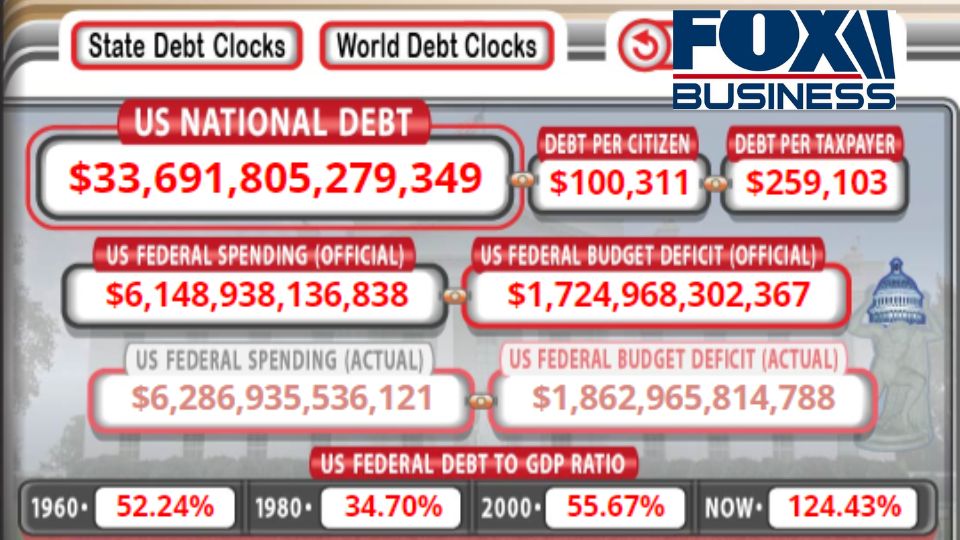

Elon Musk, “America is going bankrupt btw.” Warns of America’s Looming Bankruptcy Due to Its Addiction to Over Spending The issue of America’s rising national debt has caught the attention of Tesla CEO Elon Musk. In a recent post on the social media platform X, Musk issued a stark warning: “America is going bankrupt btw.” […]