Fitch Warns Multiple US Banks Face Credit Downgrade: Report

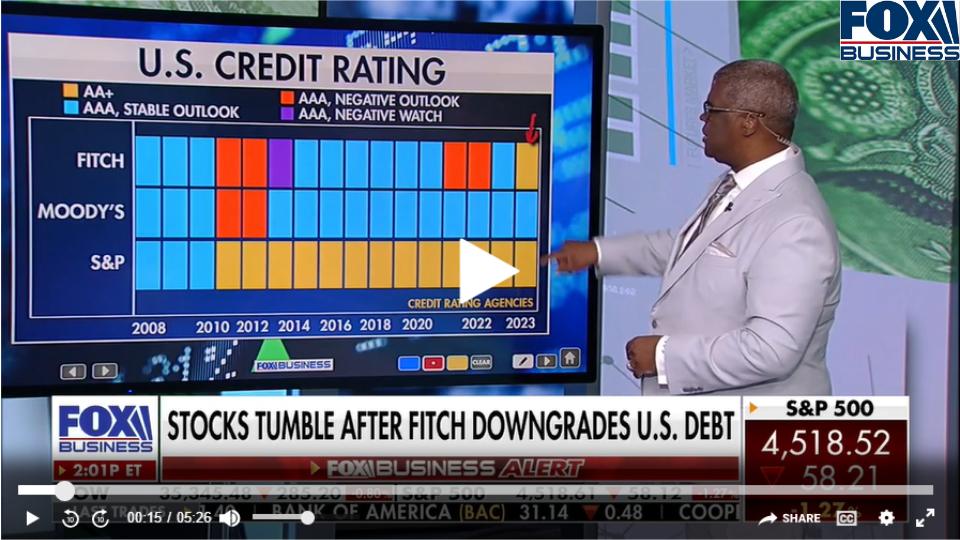

A Fitch Ratings analyst on Tuesday warned the agency may be forced to cut the credit ratings of more than a dozen banks, including some major Wall Street lenders. Another one-notch downgrade of the industry’s score, to A+ from AA-, would force Fitch to reassess ratings on each of the more than 70 U.S. banks it […]

Fitch Warns Multiple US Banks Face Credit Downgrade: Report Read More »