The U.S. Dollar is Under Threat From Digital Currencies

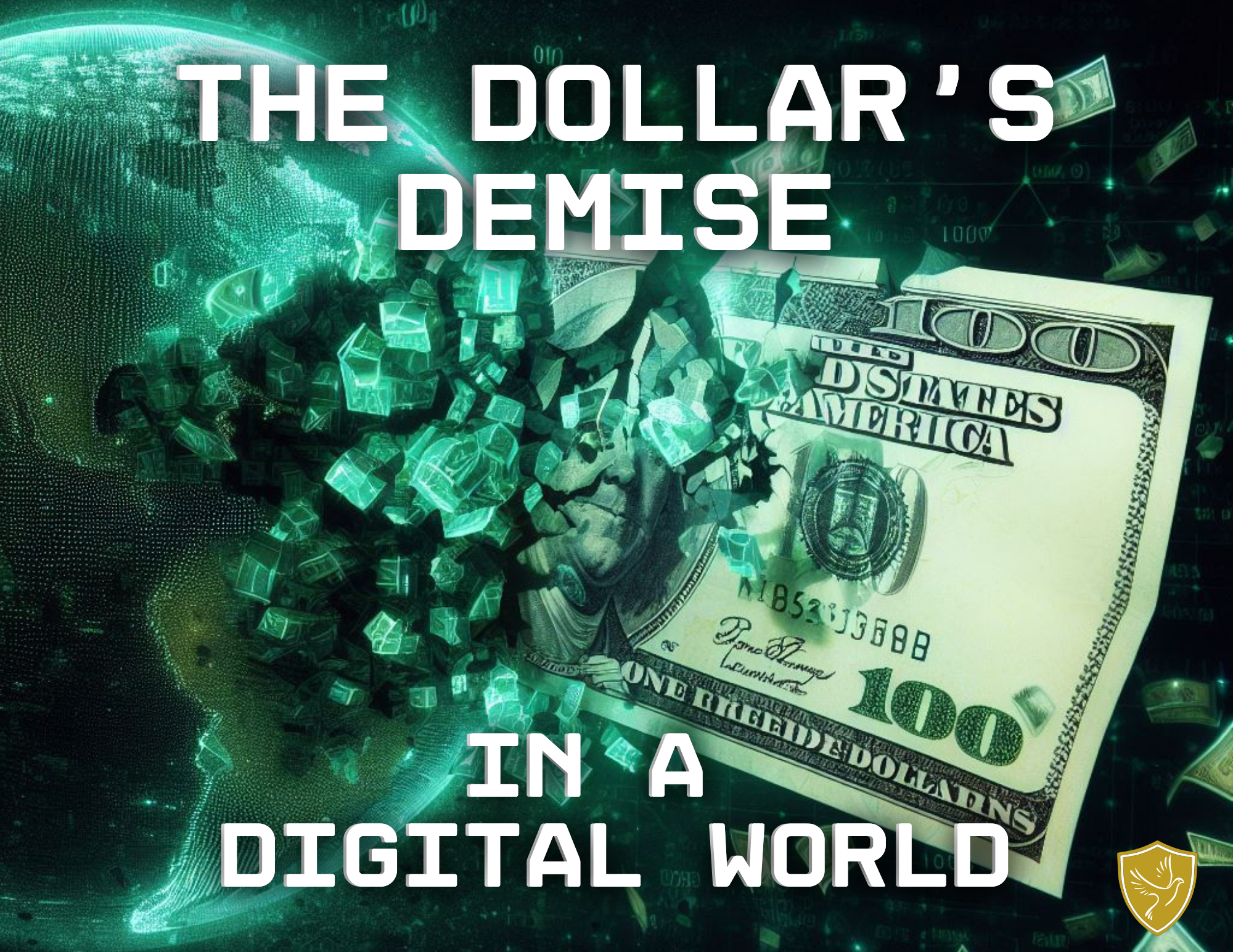

The History of the Changing Global Monetary Order:

The past 80 years have been bountiful for America whilst the dollar has hosted the position as the world’s dominant reserve currency. However, things are changing. Hundreds of years of history show that global power shifts disrupt the global monetary order on average every 75-100 years.

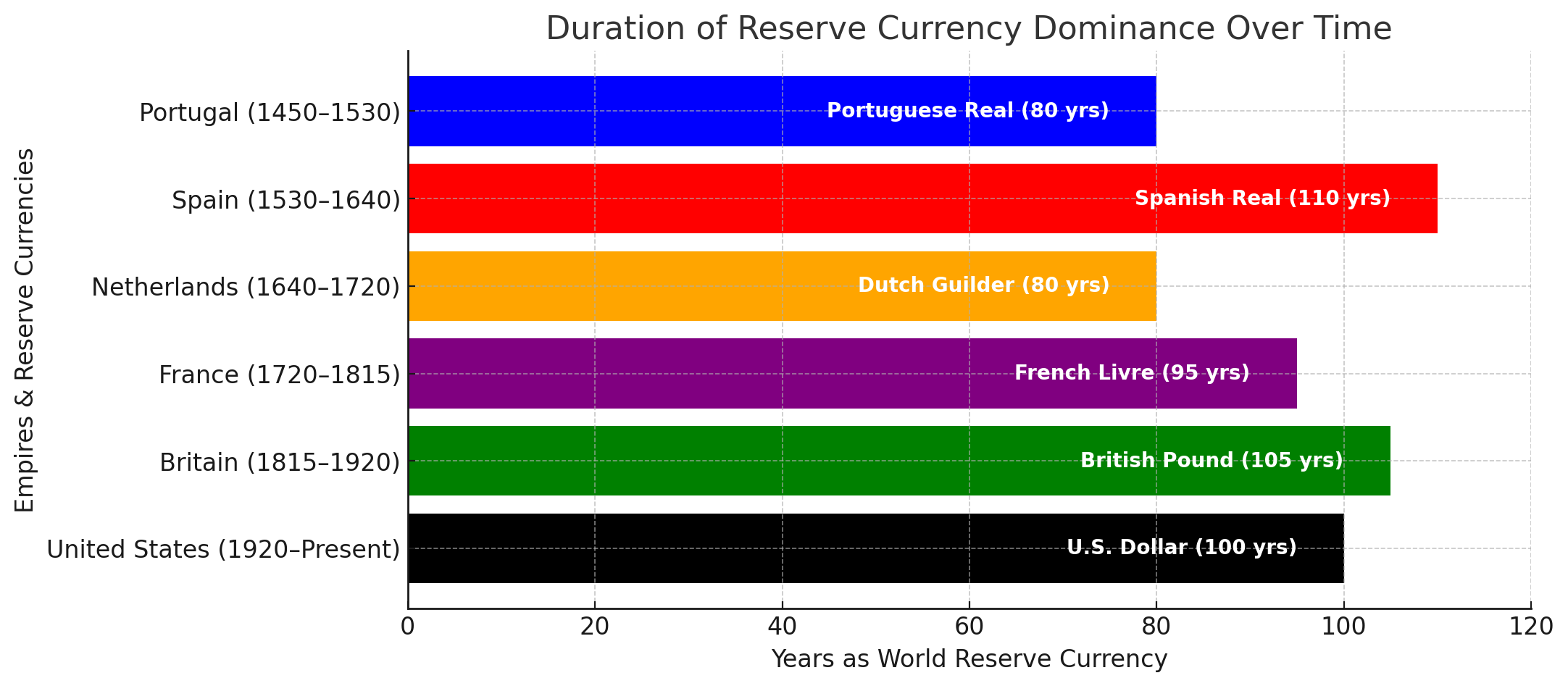

The Monumental Shift Has Begun!

The technological advancement of digital currencies has exploded. The global financial landscape is shifting profoundly, with Central Bank Digital Currencies (CBDCs) at the forefront of this transformation. The Global Monetary shift has begun with 11 countries having launched their CBDCs and 99 countries actively pursuing CBDCs which collectively account for approximately 90% of the world's gross domestic product (GDP).

At present, countries typically convert their currencies into dollars to buy oil and other commodities, but this conversion is expensive and makes them more dependent on the dollar. CBDCs hold the potential to streamline international transactions, making it easier for countries to conduct trade using each other's digital currencies. CBDCs will enhance countries' financial independence and lower their costs. As nations embrace CBDCs and explore alternatives to the U.S. Dollar in international trade, it becomes increasingly evident that CBDCs are playing a pivotal role in reshaping the future of global finance.

This imminent shift toward central bank-backed digital currencies promotes several advantages such as lower transactional costs and faster payment settlement periods. Central banks state CBDCs will strengthen the national and international payment systems and allow them to thwart illicit trade because they will know where every “dollar” came from and where it went, who sent it, and who received it. CBDCs also have the potential to address economic inequality by offering previously marginalized populations, often referred to as the "unbanked," direct access to the financial system through accounts with the central bank.

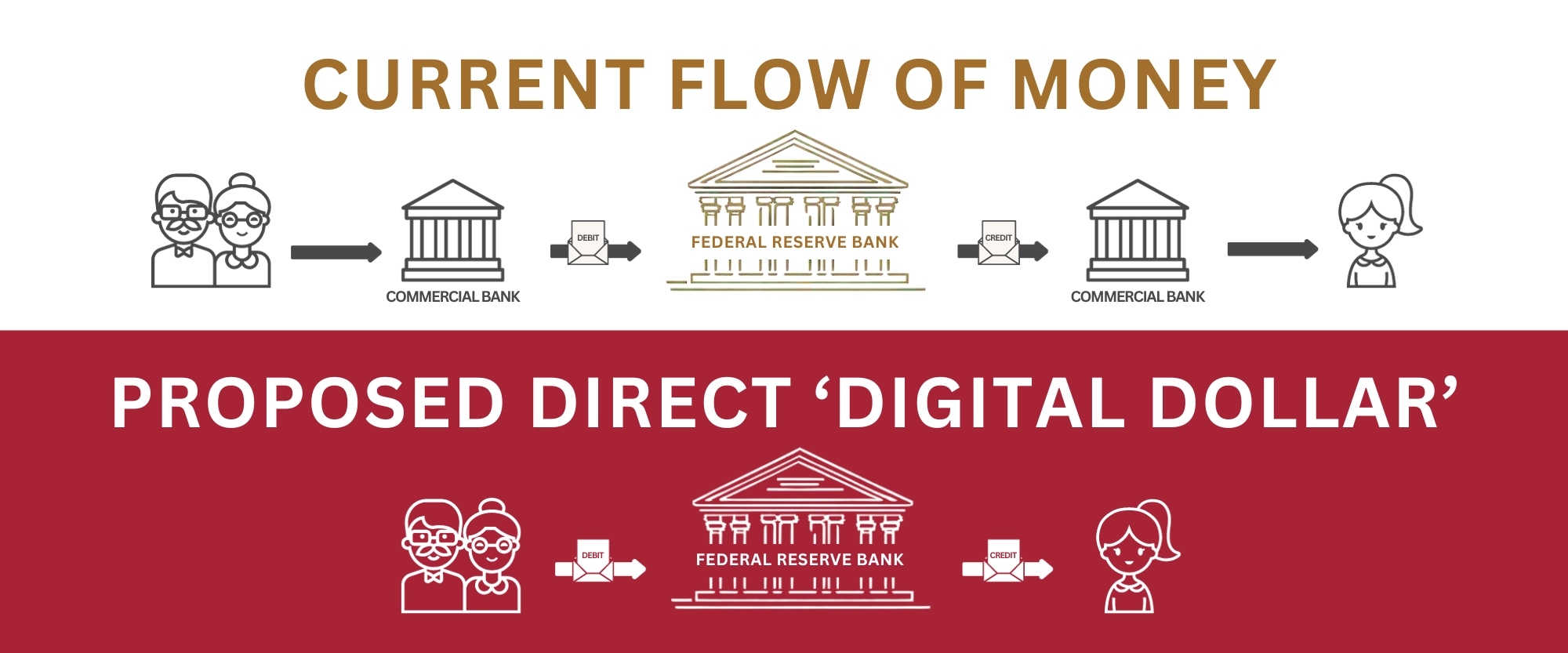

While CBDCs are promoted for their efficiency and convenience, they also raise foreboding questions. CBDCs differ significantly from today's monetary system. While viewing bank balances online may remain familiar, the similarities largely end there. Today’s banks serve as intermediaries between individuals and the government, offering a degree of privacy. In contrast, the CBDC allows direct transactions between The Fed and individual bank accounts, ensuring a permanent record of every transaction. The Fed claims that CBDCs are risk-free due to their status as direct liabilities of The Fed. However, this 'risk-free' label is based on The Fed's ability to tax and digitally create dollars, effectively enabling more direct taxation and money creation while also having access to individual accounts.

Governments, driven by incentives to simplify society for social control purposes, are keen to centralize commerce within these managed payment systems. The widespread use of CBDCs would grant central banks unprecedented influence over the financial system. Their transactional history is permanent and thus threatens financial privacy and enables the imposition of conditions on currency use to guide users in specific directions.

China has emerged as a noteworthy example in this digital currency revolution, having launched its own 'Digital Yuan' currency in March 2021. The 'Digital Yuan' now has over 250 million users. For tighter control, China even banned cryptocurrencies like Bitcoin. Concerned about falling behind in the global race for digital currency dominance, from the start of the Biden administration fast-tracked funding and research into U.S. CBDC technology 'Digital Dollar'. Major financial players such as Citibank, Wells Fargo, and Mastercard began actively collaborating and testing the concept.

Imagine the possibility of your digital balance gradually diminishing to stimulate increased consumer spending or the Federal Reserve intervening to block transactions of politically disfavored businesses.

The Fed has already ventured into social and environmental policy, strengthening initiatives aimed at economic equity and pressuring banks to disclose climate-change risk mitigation plans. The allure of shaping a central bank's digital currency to align with these agendas is undeniable.

Moreover, consider the incident in February 2022 when Canada's Prime Minister Justin Trudeau froze the bank accounts of 'Freedom Convoy' truckers who were protesting illegal forced vaccine mandates by blocking the border. It took several weeks to freeze their accounts using traditional banking systems. With the introduction of a U.S. 'Digital Dollar', the government could freeze accounts almost instantly, significantly amplifying its ability to exert control over financial activities. China, a pioneer in central bank digital currencies, employs its digital currency to closely monitor citizens' economic activity. From the launch of its digital yuan, China stated that people could use their current fiat yuan or the digital version and that its CBDC was voluntary. However, in Spring 2023, it was announced that the Chinese people’s paychecks would now be issued in digital yuan to lower costs to the government. This will ultimately phase out the old fiat yuan system. In the future, this could extend to restricting purchases, controlling access to money, or even disabling accounts altogether.

While constitutional safeguards in the U.S. might deter potential abuses, our constitutional rights are seemingly diminishing quickly. It seems unwise to grant the government the powers that CBDCs hold. No matter one’s political view, such power sets up the potential for extreme consequences that are not in the public's best interest. As Edmund Burke aptly noted, "The thing itself is the abuse," and the most prudent approach is to avoid constructing a financial prison altogether.

This is not the “America” we grew up in, and the future can seem pretty scary.

The Digital Yuan Could Threaten Our Financial Futures:

The rise of the Chinese digital currency, often referred to as the digital yuan, carries the potential to disrupt American financial stability in the coming years. Forecasts from experts suggest that the digital yuan could challenge the dominance of the U.S. Dollar in international trade within this decade. Given China's immense economic influence, it possesses the leverage to compel its international trading partners to adopt its digital currency over the U.S. Dollar. Consequently, the dollar's value could experience a further decline as its supremacy in global trade diminishes, triggering a potential sell-off of dollar holdings by governments and investors seeking refuge in stronger currencies. Such a scenario could lead to adverse consequences for U.S. markets, including stocks and bonds.

In this era of transitioning to digital currencies, astute investors are heeding the warning signs and preparing for the genuine risk associated with a depreciating U.S. Dollar. The evolving landscape underscores the importance of vigilance and strategic planning in safeguarding investments with assets like gold, in a world where currency dynamics are rapidly shifting.

Digital Currency: A Magnet for Scams and Criminals

Digital currency, despite its alluring features and compelling narrative, has emerged as a global magnet for criminals, both as a medium for illicit activities and as a target for theft. Notably, "ransomware" attacks afflicting major corporations and even government institutions routinely demand digital payments.

Startling research reveals that hackers pilfered $4.3 billion worth of cryptocurrency between January and November 2022, marking a staggering 37% increase from the previous year during the same period. One of the most significant cryptocurrency scandals was the TX collapse where experts estimate that between $1 to $2 billion in client funds have inexplicably vanished.

What Has Made Cryptocurrency an Irresistible Attraction for Scams?

- Cryptocurrency rallies allure inexperienced investors, rendering them susceptible targets for hackers

- A lack of regulation complicates transaction tracking

- Hackers are less likely to be stopped because of the anonymity of digital currencies

- Lost access details or forgotten keys will result in a complete asset loss.

Paper Currencies Depreciate: Not a Store of Value

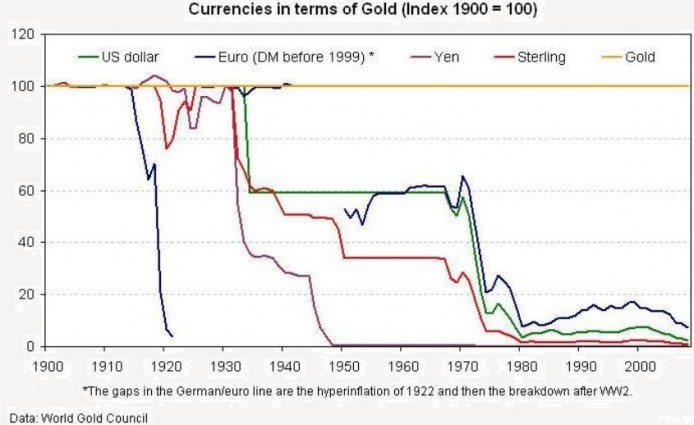

The U.S. Dollar has held a dominant position among paper currencies for an extended period. However, it's essential to note that its historical performance as a store of value has been less than stellar. Dating back to 1913, the U.S. Dollar has seen a staggering 97% loss in value compared to gold, revealing its susceptibility to inflation and central bank interventions over time which eroded the wealth of investors and savers holding assets denominated in dollars. This significant depreciation has affected virtually all investments and savings accounts tied to the dollar.

To the dollar's credit, when compared to some other reserve currencies, it has fared relatively better. Currencies like the Japanese Yen and the British Pound have experienced even more substantial declines over time. The only leg the dollar stands on is its current position as the largest reserve world currency for trading in oil and other commodities. Unfortunately, financial experts do not anticipate a reversal of de-dollarization - the dollar continues to depreciate nearly every year.

Trust in a True Safe-Haven Asset

This erosion of the dollar's value underscores the enduring appeal of precious metals as "safe-haven" assets. Precious metals, notably gold, have earned this reputation due to their track record as stores of wealth for millennia. Unlike paper or digital currencies, physical gold has consistently proven its reliability in preserving value, making it a trusted choice for investors seeking a secure store of wealth.

LET'S EXAMINE THIS REMARKABLE TRACK RECORD:

Performance: Since the year 2000, gold has demonstrated remarkable performance surpassing stocks by more than a 2-to-1 margin, with a staggering rise of over 650%. During the same period, the dollar's purchasing power has crashed more than 40%.

Diversification:Incorporating gold and silver into your investment portfolio can effectively reduce overall risk and minimize exposure to paper assets, providing a tangible and reliable safeguard against market fluctuations. Historically, gold & silver go up significantly during recessions.

Convenience and Ownership: Gold and silver are straightforward to acquire, simple to own, offer privacy, and boast high liquidity. In contrast to stocks, ETFs, or cryptocurrencies, these precious metals offer a level of accessibility and security that can't be matched.

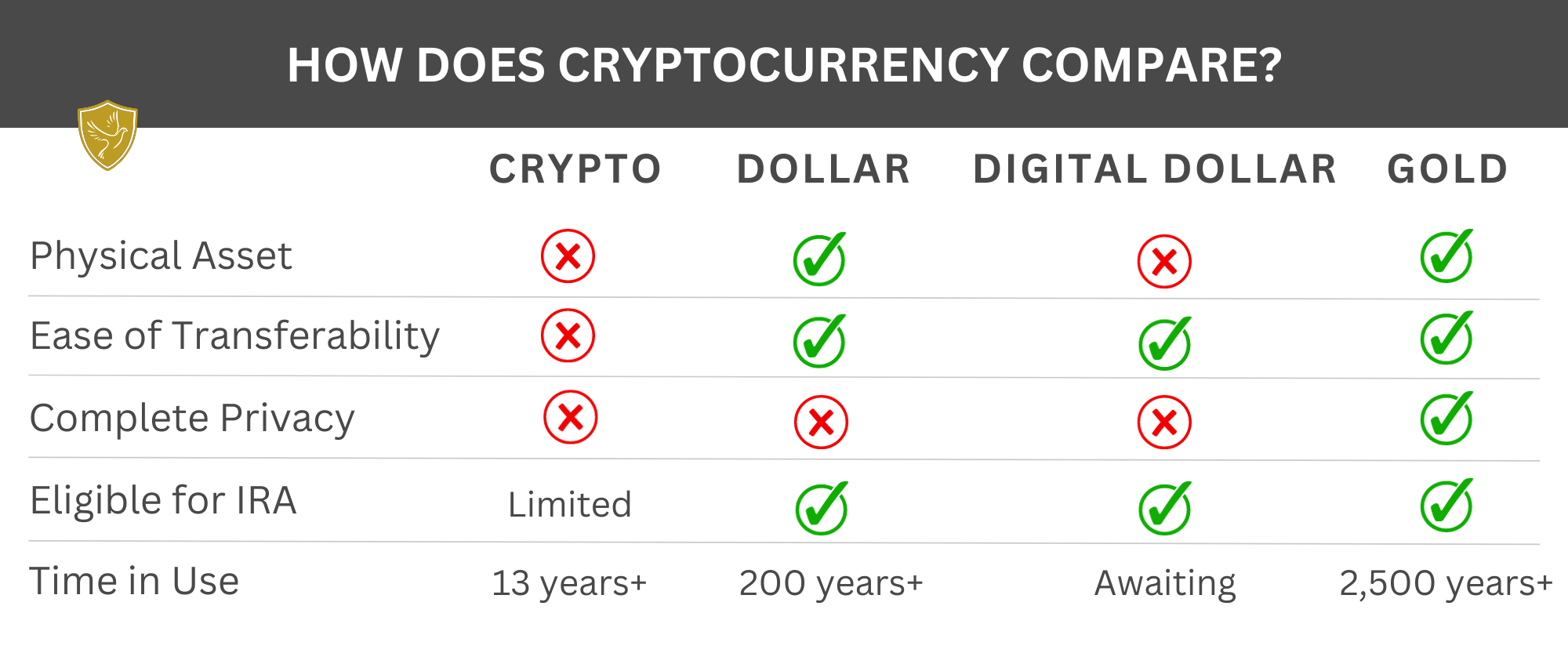

Privacy: Gold and silver can be bought and sold privately, while Central Banks' digital currencies and cryptocurrencies are maintained online and have an unerasable footprint. Although cryptocurrency transaction imprints are not directly sent to a Central Bank’s computer network, they too are not anonymous due to their permanent online transactional history across a massive worldwide network of computers.

Protection: Physical gold and silver are constitutional money outside the control of the government and banks.

Enhanced Peace of Mind: Gold and silver, whether in the form of coins or bars, serve as stabilizers for your portfolio, offer protection against inflation, and contribute to stress reduction. Effective diversification helps to smooth out the financial journey, particularly in today's uncertain world.

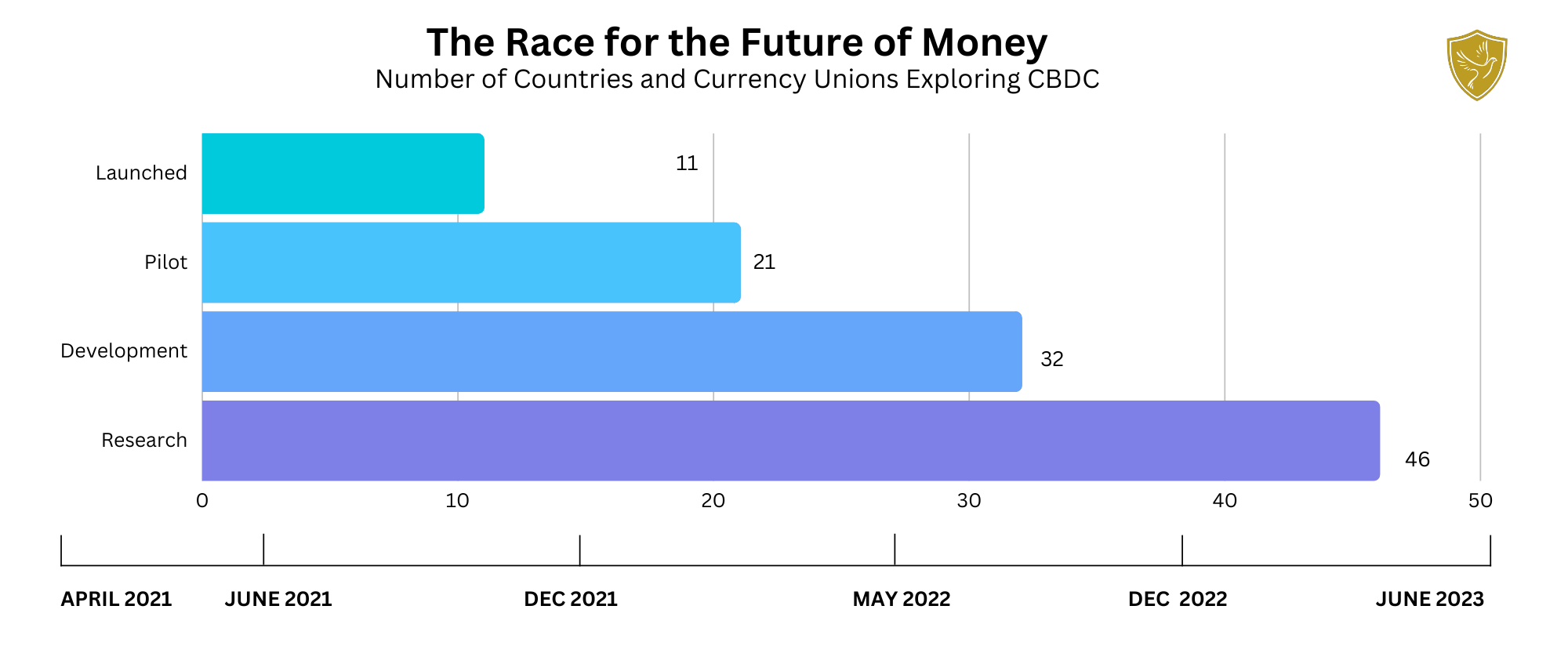

The U.S. Dollar Is Under Threat from Digital Currencies

Digital currency poses a significant threat to the U.S. Dollar. In the past, currency was tethered to the stability of gold, providing a reliable and fixed value. However, the introduction of a global floating fiat money system transformed the landscape where currency's worth became subject to government decree. This shift led to a pattern of governments attempting to address their economic challenges by relentlessly printing money, resulting in recurring cycles of inflation and recession. Today, we stand on the precipice of the next phase of currency evolution and monetary order, accompanied by a fresh set of threats and issues.

In a world where currency exists purely as lines of code, the possibilities for exploitation become limitless. Governments can engage in unrestrained spending, manipulate inflation, and impose taxes covertly. This new paradigm opens the door to various vulnerabilities including real estate bubbles, larger and more volatile stock market swings, and the risk of large-scale cryptocurrency thefts, all attainable at the swipe of a keystroke. Consequently, the wisest approach for investors is to remain optimistic but also prepare for inevitable and adverse scenarios. The technological advances of digital currencies push financial security and individual autonomy further out of reach for average people. In this context, physical gold and silver retain their historical significance as pillars of wealth preservation, having safeguarded prosperity for centuries while digital currencies are still in their infancy.

Click to learn What is the 'Digital Dollar' and click to read what De-dollarization means.

Get Prepared Today with Harvard Gold Group

America's #1 Conservative Gold Company

HGG is America’s #1 Conservative Gold Company, as seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The New York Sun, and more. Exceptional customer service and value are the top priorities of Harvard Gold Group (HGG).

HGG is BBB-accredited, holds 5-star ratings across the board, and provides free consultations and metals overviews. We offer tax-free purchases, free 2-day shipping, the best pricing, and direct access to our co-owners, who have over 15 years of experience specializing in precious metals, moving over a hundred million dollars into tangible assets for people's IRAs/retirement accounts and for direct delivery. Customers enjoy lifetime account care and a straightforward buyback program without hassle or liquidation fees.

✔ Tax-Free & Penalty-Free: A Rollover or Transfer of your Retirement Account is almost always tax-free and penalty-free.

✔ Free Metals/Promos: Earn up to $15,000 in FREE Gold/Silver/Promos, on qualifying purchases.

✔ Free Retirement Account Rollover/Transfer: Zero cost to rollover/transfer/move retirement accounts or IRAs to a Gold/Silver IRA. *You can also earn up to 10 years of Precious Metals IRA yearly maintenance fees*.

✔ Privacy: We protect your privacy and believe it is a commodity as valuable as time, you can't get it back. We do not sell your information to third parties.

✔ HGG Lifetime Account Care: Providing a dedicated account specialist and keeping you updated with market news and trends.

✔ Harvard BuyBack Program: Hassle-free buyback of HGG metals with no liquidation fees.

✔ Guaranteed Precious Metals: We only deal in government-issued coins and branded bars.

✔ Free Shipping: Your precious metals are shipped privately and fully insured to the location of your choice. You can opt to have them delivered directly to your home, business, or an independent depository.

✔ Lowest Pricing: We are committed to offering you the best value possible, with a comprehensive price-match policy.

✔ Customer Satisfaction Guarantee: Harvard Gold Group is a 5-star rated company committed to maintaining exceptional customer service satisfaction.

✔ You work directly with the founders of HGG.

Free Retirement Account Rollover/Transfer & Free Direct Delivery Shipping + Insurance

TALK TO AN EXPERT

ACCOUNT SPECIALIST