- The unemployment rate peaked at 14.7 percent, the highest in the post-World War II period.

- Inflation reached its highest rate in 40 years, prompting the Fed to raise short-term interest rates to their highest levels since 2007.

- Federal Reserve banks opened for business in November of 1914.

- Historical CPI data from MeasuringWorth show that the US price level rose by 2,920.2 percent from 1914 through 2022.

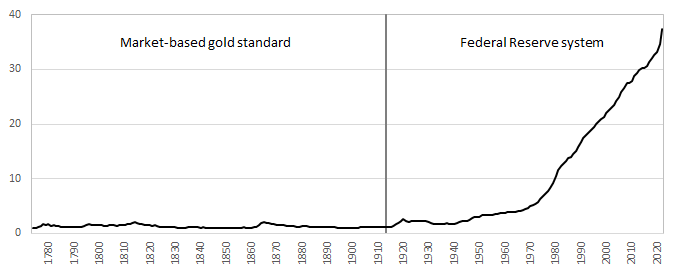

- Before the Fed, the purchasing power of the dollar was determined by the supply of and demand for gold. Consequently, the purchasing power of the dollar was relatively stable.

- That's approximately zero percent inflation over 130 years compared to 3,000 percent inflation in less than 90 years under the Fed.

The US economy was pushed to extremes during the pandemic recession and subsequent recovery. The unemployment rate peaked at 14.7 percent, the highest in the post-World War II period. Inflation reached its highest rate in 40 years, prompting the Fed to raise short-term interest rates to their highest levels since 2007.

As of June, the economy hit another dubious milestone: Inflation has now reached 3,000 percent under the Federal Reserve.

Inflation Under the Fed

The Federal Reserve Act was passed by Congress in December of 1913, and the regional Federal Reserve banks opened for business in November 1914. Comparing the price level at the end of 1914 to the level today tells us how much total price inflation the US economy has experienced under the Fed.

The consumer price index (CPI) is the most widely used and longest-running measure of the US price level, but there are disagreements about the accuracy of historical CPI. MeasuringWorth aggregates macroeconomic data such as interest rates, economic production, and the price level from the most reliable historical sources.

Historical CPI data from MeasuringWorth show that the US price level rose by 2,920.2 percent from 1914 through 2022.

While the MeasuringWorth dataset provides only annual data, we can add monthly data for the current year from the official CPI data from the Bureau of Labor Statistics (BLS). According to BLS data, the CPI rose by 2.74 percent (not seasonally adjusted) in the first half of 2023.

That brings total inflation under the Fed to 3,000.2 percent.

Compared to What?

US inflation was not always as persistently high as it has been under the Fed. Before the Fed, the purchasing power of the dollar was determined by the supply of and demand for gold. Consequently, the purchasing power of the dollar was relatively stable.

Figure 1. Index of the US price level, 1774-2022

Figure 1 shows the US price level back to 1774. After a brief turmoil during the American Revolutionary War, the price level was about the same in 1784 as it was in 1914.

That's approximately zero percent inflation over 130 years compared to 3,000 percent inflation in less than 90 years under the Fed.

Official Statistics

The MeasuringWorth dataset combines data from the best historical research to correct for shortcomings in the official economic data.

One key difference from the BLS CPI is that, for the early years of the Fed, MeasuringWorth uses a study by Paul Douglas, which fills in a few months of data missing from the BLS and "computes the US index as a population-weighted average of the city indexes, whereas BLS uses an unweighted average."

How different are the MeasuringWorth data from the official BLS statistics? Using the official CPI data, inflation under the Fed has been only 2,952 percent since 1914. But don't worry, we'll hit 3,000 percent on the official measure soon enough.

Story by Thomas L. Hogan - Redacted bullet points by Jody Davis https://www.aier.org/article/the-fed-hits-3000-percent-inflation/