- While geopolitical uncertainty is important for gold, there are other factors we need to pay attention to: growing fears of a credit event leading to a recession.

- The chaos in the Middle East caused by the Israel-Hamas war is providing solid momentum for gold but there is more going on in the market than just the safe-haven trade.

- We just have to look at gold’s price action on Thursday to see that there is a lot of economic uncertainty underneath the positive façade that is economic growth.

- The only true safe harbor is gold…

(Kitco News) - It’s hard to deny the safe-haven trade that has propelled gold prices back to $2,000 an ounce. The chaos in the Middle East caused by the Israel-Hamas war is providing solid momentum for gold, but there is more going on in the market than just the safe-haven trade.

We just have to look at gold’s price action on Thursday to see that there is a lot of economic uncertainty underneath the positive façade that is economic growth. The precious metal held its ground as U.S. GDP increased by nearly 5% in the third quarter, significantly beating expectations.

Meanwhile, gold is solidly above $2,000 an ounce heading into the weekend. This comes after U.S. core PCE Index showed inflation rising 3.7% in the last 12 months. Yes, inflation has fallen to its lowest level since August 2021; however, it is still nearly double the Federal Reserve’s target of 2%.

Also released Friday was the updated University of Michigan consumer sentiment survey. While this report isn’t market-moving, it shows a sharp rise in inflation expectations. The report said that survey respondents see consumer prices rising 4.2% by this time next year, up from the initial estimate of 3.8%.

Putting these three reports together would indicate that the Federal Reserve must maintain its hawkish monetary policy stance next week. Interest rates are not expected to rise next week. Still, we can expect Fed Chair Jerome Powell to hold a firm line that the central bank’s work is not done and that interest rates will remain in restrictive territory for the foreseeable future.

An argument could be made that because of the UofM report, the Fed might have to be even more aggressive as inflation threatens to become unanchored.

In this environment, gold prices should be struggling around $1,900; instead, the precious metal is seeing its highest weekly close on record, above $2,000 an ounce.

While geopolitical uncertainty is important for gold, there are other factors we need to pay attention to: growing fears of a credit event leading to a recession.

According to a growing chorus of economists and market analysts, the third-quarter GDP numbers could be the last gasp of economic activity as stubborn inflation and a cooling labor market start to impact consumption.

Growing recession fears also coincide with concerns over the burgeoning U.S. deficit. While positive economic growth supports the bond market selloff, driving 10-year yields to 5%, some analysts have said the market is also impacted by weak demand.

There is a growing concern that there are fewer and fewer foreign investors who are willing to buy U.S. debt. Yields have to go higher to encourage buyers in the marketplace. However, at this point, nobody wants to be the first to step in because there are concerns that yields are nowhere near a peak. Nobody wants to catch the falling knife in the bond market.

However, the higher yields go, the bigger the impact they will have on the broader economy: raising borrowing costs, squeezing credit markets, and driving mortgages higher, just to name a few.

The U.S. economy is being choked off by the very asset many see as a safe haven. In this environment, the only true safe harbor is gold and that will remain the case unless Powell does something unexpected to cap bond yields.

Gold’s push back to $2,000 could be the start of something bigger.

Have a great weekend.

Postmortems about the Oct. 19, 1987, stock-market crash, when the Dow Jones Industrial Average slid 22.6%, often point to program-trading strategies—with names like portfolio insurance and index arbitrage—that snowballed into giant losses. Margin calls ensued, and the computerized trading systems of that era couldn’t handle the transaction volumes.

But interest rates and currency markets were crucial drivers. The dollar had been weakening against the West German mark, while the 30-year Treasury yield rocketed past 10% from 7.5% in March. When rates go higher, stocks often decline because companies’ future earnings are worth less. Stocks kept going up anyway that summer, setting the stage for a swift fall.

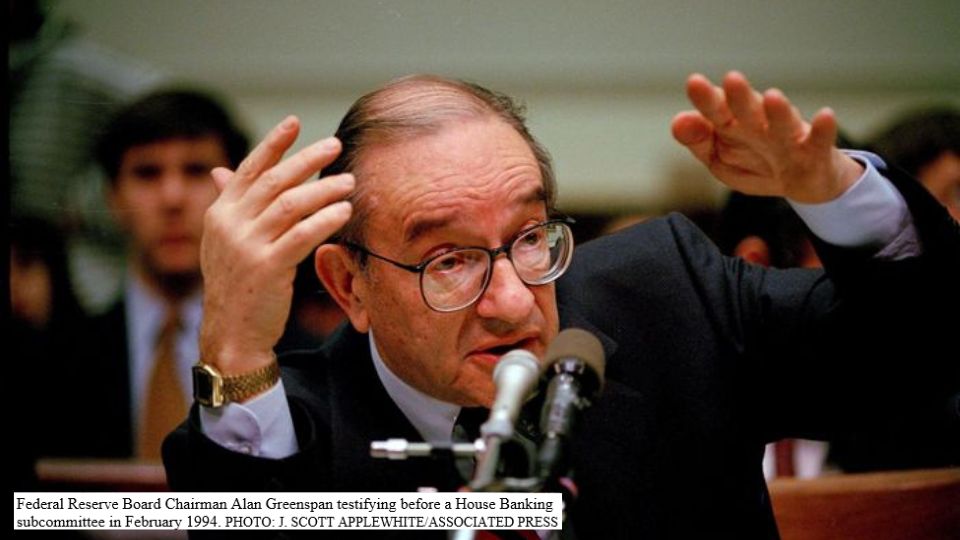

1994

The Fed surprised the market by doubling interest rates to 6% in 12 months. The increases tanked bond portfolios, along with Mexico’s economy, and exposed a scandal over phony trading profits that sank the Wall Street brokerage firm Kidder Peabody.

The hikes included a 0.75-point increase in November. The next month, Orange County, Calif., filed for bankruptcy, after a series of disastrous, wrong-way bets on rates. The county treasurer resigned and later pleaded guilty to fraud.

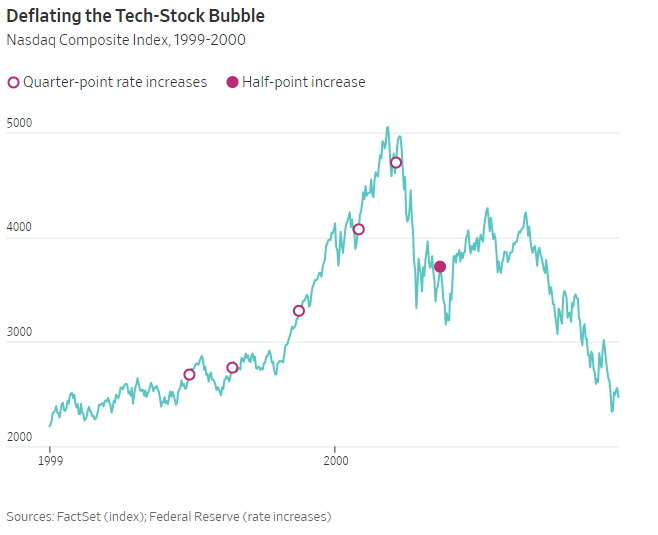

The 2000 dot-com crash

Speculators taking fliers on the next cash-torching, dot-com darling didn’t care about investment fundamentals. The deflating of the internet-stock bubble had many culprits.

But it is true that the Fed did raise rates six times from June 1999 to May 2000. The last of those was by a half-point to 6.5%. By then, the bubble already had been pricked. Rates fell to 1% by 2003, setting the stage for nearly two decades of mostly low rates.

The 2007-09 recession

Here, the Fed is more often blamed for leaving rates too low for too long than for raising them too high. It increased rates 17 times from June 2004 to June 2006, in each instance by a quarter-point. Signs of a housing downturn were surfacing when it stopped. By 2007, the start of the financial crisis was under way, and the Fed resumed rate cuts again later that year.

For millions of Americans, the impact of higher interest rates hit home directly, because they had taken on adjustable-rate mortgages that reset higher after their rock-bottom introductory rates expired. Often the customers could afford to pay only the initial teaser rates, while the lenders didn’t care because they quickly sold off the loans to investors in bundles backing complex mortgage bonds.

The ensuing credit losses might have been more about lax underwriting standards than rising rates. But the higher rates when the loans reset contributed to record numbers of foreclosures, nonetheless.

Story by Jonathan Weil - Redacted bullet points by Jody Davis https://www.wsj.com/finance/with-interest-rates-up-get-ready-for-financial-drama-6c055fb5