NY Community Bancorp, which is a regional bank such as SVB, experienced a staggering 38% drop in its stock price 2 days ago. This was a direct result of the shocking disclosure of a $252 million loss. In response, the bank took immediate action to address its financial situation by reducing its quarterly dividend and bolstering its loan-loss reserves with an infusion of half a billion dollars. This disconcerting turn of events prompted Moody's, the credit rating agency, to initiate a review of the bank's credit rating with a potential downgrade looming on the horizon.

As of early February 2nd, NYCB stock is down 45%, adversely affecting the market value of many other regional banks. This alarming setback has reawakened concerns regarding the stability of the banking system. Regional banks, in particular, find themselves more exposed and vulnerable to commercial real estate loans. Goldman Sachs expects more pain for regional banks stating that an estimated 80% of all bank loans for commercial properties come from regional banks. The looming specter of significant defaults, especially in the office sector, is an outcome of the persistent challenges faced since the pandemic forced millions of Americans into remote work arrangements, casting a shadow of uncertainty over the entire banking industry.

Furthermore, with interest rates exceeding 5% and more than $1.5 trillion in commercial mortgages set to mature over the next three years, it is estimated that potentially 30% of these loans will not qualify for refinancing, leading to a substantial increase in defaults. As the commercial real estate market experiences a severe downturn, the billions of dollars in loans and investments pose a critical risk to the banking sector and by extension, the wider economy. Gregg Williams, principal receiver at Trident Pacific, a receivership firm specializing in defaulted commercial mortgages remarked, "What we're witnessing is the unfortunate convergence of the most rapid interest rate increase within a single year and the evolving dynamics of the modern workforce."

In July 2023, MSCI Real Assets estimated that commercial property sales were down more than 70% from the prior year. According to Michael Comparato, head of commercial real estate at Benefit Street Partners, a debt-oriented investment firm, the market will face considerable turmoil when buying resumes in the commercial property sector. They are also forecasting significantly reduced prices which is expected to hit the banks hard. He predicts, "It's going to be really nasty."

Only time will tell if the March 2023 banking crisis was just the beginning of a larger banking meltdown, but it's noteworthy that gold appreciated by 13.5% last year, with the central banks of leading nations being its largest purchasers.

Let's Examine Gold's Remarkable Track Record:

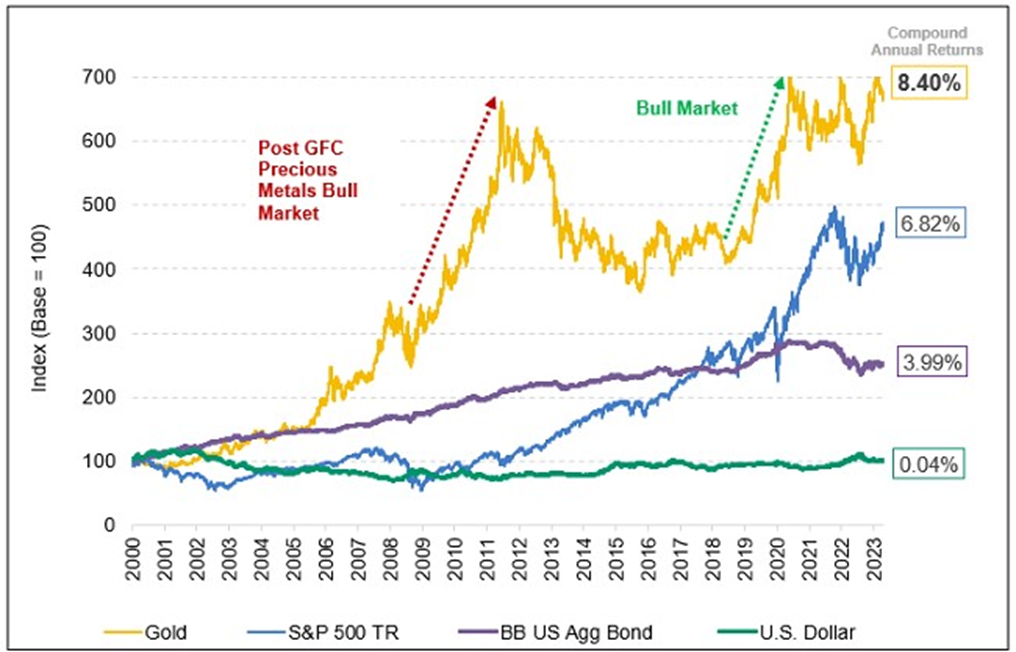

Performance: Since the year 2000, gold has demonstrated remarkable performance surpassing stocks by more than a 2-to-1 margin, with a staggering rise of over 650%. During the same period, the dollar's purchasing power has crashed more than 40%.

Diversification:Incorporating gold and silver into your investment portfolio can effectively reduce overall risk and minimize exposure to paper assets, providing a tangible and reliable safeguard against market fluctuations. Historically, gold & silver go up significantly during recessions.

Convenience and Ownership: Gold and silver are straightforward to acquire, simple to own, offer privacy, and boast high liquidity. In contrast to stocks, ETFs, or cryptocurrencies, these precious metals offer a level of accessibility and security that can't be matched.

Privacy: Gold and silver can be bought and sold privately, while Central Banks' digital currencies and cryptocurrencies are maintained online and have an unerasable footprint. Although cryptocurrency transaction imprints are not directly sent to a Central Bank’s computer network, they too are not anonymous due to their permanent online transactional history across a massive worldwide network of computers.

Protection: Physical gold and silver are constitutional money outside the control of the government and banks.

Enhanced Peace of Mind: Gold and silver, whether in the form of coins or bars, serve as stabilizers for your portfolio, offer protection against inflation, and contribute to stress reduction. Effective diversification helps to smooth out the financial journey, particularly in today's uncertain world.

Diversifying and Hedging Dollar-Denominated Assets

Diversifying your investments across various assets is a proven strategy critical for achieving long-term financial success. During The Great Recession of 2008, many investors 401K’s turned to 201K’s while home values plummeted 30-50% across America. This serves as a stark reminder of the perils of not hedging dollar-based assets and relying solely on the assurances of politicians and central bankers. In contrast, gold not only weathered the storm but thrived, exhibiting a 51% price increase from December 2008 to December 2009.

Since 2000, gold is up over 700% and has outperformed the broader equity and bond markets. Long-term investors who diversified with gold enjoyed steady portfolios with greater growth through the good economic times and cushioned the blows in the bad times in 2001, 2008, and 2020 market crashes.

Source: Bloomberg. Period from 12/31/1999 to 06/30/2023. Gold is measured by GOLDS Comdty Spot Price; S&P 500 TR is measured by the SPX; US Agg Bond Index is measured by the Bloomberg Barclays IS Agg Total Return Value Unhedged USD (LBUSTRUU Index); and the U.S. Dollar is measured by DXY Curncy. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Harvard Gold Group specializes in physical gold and silver delivery, offering two programs: Private Direct Delivery & Precious Metals IRA/retirement accounts. They are BBB-approved, and 5-star rated across the board, offering free consultations and metals overviews. Customers enjoy lifetime account care and a no-hassle/no-liquidation fee buyback program. Perhaps best of all, clients can qualify for tax-free transactions, free shipping, and free insurance.

You can move almost any type of retirement account above $25,000 into a physical precious metals IRA. Retirement accounts like IRAs, 401Ks, Pension Funds, TSPs, 403Bs, and more. Harvard Gold Group offers 100% free conversion, as well as free storage, maintenance, and insurance for up to five years. Qualifying purchases can also receive up to $15,000 in free metals, delivered to your door or location of your choice.

To learn how Harvard Gold Group, America’s Most Conservative Gold Company can help you protect your nest egg, download their free 2024 information guide, or call them today at (844) 977-GOLD. Havard Gold Group is trusted and recommended by Mark Davis, The Babylon Bee, Not The Bee, The Fish, and more. Learn more at harvardgoldgroup.com