Treasury Secretary Janet Yellen has brushed aside concerns about 'sticker shock' in American grocery stores, even though food prices have surged by 25% since before the COVID-19 pandemic.

During a June interview with Yahoo Finance senior reporter Jennifer Schonberger, Yellen was asked if she had noticed the price hikes while grocery shopping. Yellen confirmed she shops weekly but did not agree with the notion of 'sticker shock.'

Schonberger highlighted the discrepancy between decreasing global shipping and food commodity costs and persistently high grocery prices. Yellen acknowledged the situation, attributing the price hikes to increased costs, including labor, faced by grocery stores. She also mentioned that there might be some increase in profit margins.

Recent inflation data from the Bureau of Labor Statistics shows a 1.1% rise in average food prices at home over the past year, with a 0.1% increase from the previous month. Prices for four of the six major grocery categories also went up, including a 2.4% rise in butter and margarine, a 0.6% rise in dairy products, and a 0.2% increase in meats, poultry, fish, and eggs.

Despite the 25% increase in food prices from pre-COVID levels noted by Schonberger, Yellen believes grocery executives are aware of the burden on American households. She mentioned meeting with CEOs, including Target's Brian Cornell, who have acknowledged the struggle and announced price cuts on essential items like bread, milk, and diapers.

Yellen does not see the need for further government intervention to address food prices. When asked about increasing agricultural investment to enhance food supply, she expressed reluctance to support more subsidies for agriculture.

Gold as a Hedge Against Inflation and a Safe Haven Asset

In light of the rising cost of living and inflation, many investors are turning to gold as a reliable hedge. Historically, gold has been viewed as a safe haven asset, particularly during times of economic uncertainty and inflation.

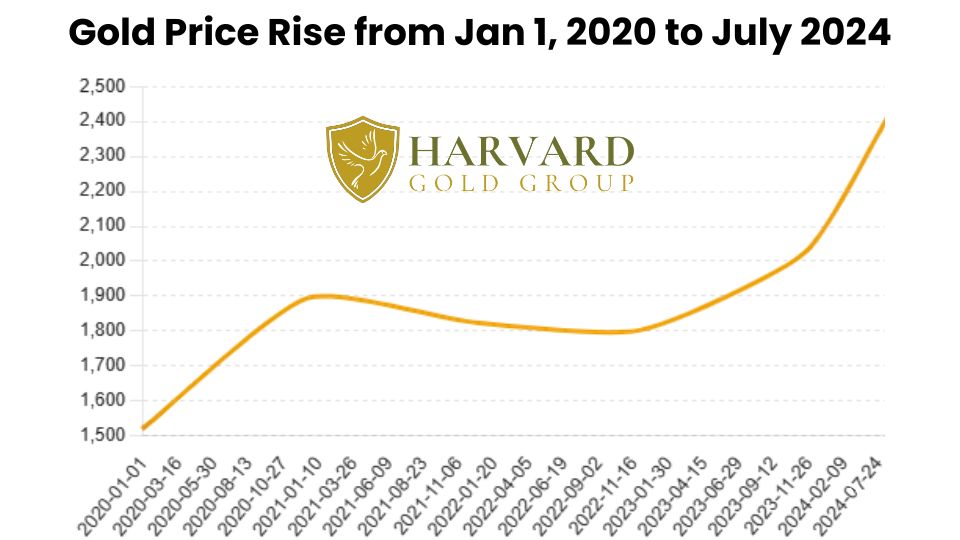

The performance of gold over the past few years underscores its value as a protective investment. On January 1, 2020, the price of gold closed at $1,519.50 per ounce. Today, it has reached $2,411.20 per ounce, marking an impressive increase of nearly 59%. This significant rise in gold prices contrasts sharply with the 25% increase in food prices since pre-COVID, demonstrating gold's ability to preserve wealth and purchasing power.

Investing in Gold Offers Several Benefits:

- Protection Against Inflation: Gold has historically maintained its value and purchasing power during inflationary periods, making it a reliable hedge.

- Safe Haven Asset: During economic downturns or geopolitical instability, gold tends to perform well as investors seek safety.

- Diversification: Including gold in an investment portfolio can provide diversification, reducing overall risk.

As inflation continues to impact the cost of living, gold remains a prudent choice for those looking to safeguard their financial future.

Why should you expect Gold to continue to Climb higher?

Gold is up over 750% over the past 25 Years

Gold's enduring status as a timeless store of value has remained steadfast throughout the centuries, with its allure undiminished. Widely regarded as the premier asset worldwide, its value steadily climbs year after year. Serving as a reliable hedge against economic uncertainties and inflation, gold stands tall as a cherished haven for investors, making it one of the most coveted investments in global markets.

Now, let's rewind 25 years and delve into the performance of gold prices over the past quarter-century. For investors with a long-term perspective, gold has consistently delivered substantial returns. In this piece, we'll examine the profits generated by gold investments from 1999 to 2024.

Profits in Gold Between 1999 to July 2024

In 1999, the average price of gold stood at $278 per ounce, rebounding from its historical low of $252 earlier that year. Fast forward to this week, and gold prices have surged past the $2,400 mark, fueling robust bullish sentiment. From July 11th, 2024, profits in gold range from $278 to $2,400 per ounce.

Imagine investing $10,000 in gold back in 1999 at an average price of $278 per ounce. With that investment, you could have accumulated approximately 36 ounces of gold. Fast forward to 2024, where gold prices now hover above $2,400 per ounce. That initial $10,000 investment could have blossomed into a remarkable $76,328 in profits.

This translates to an impressive return on investment (ROI) of approximately 763% from 1999 to 2024. To put it into perspective, the average compound annual growth rate (CAGR) of this investment is approximately 10.36%, reaffirming gold's status as a lucrative investment choice.

Harvard Gold Group, HGG

Specializing in Physical Gold & Silver Delivery

Private Direct Delivery | Precious Metals IRA/Retirement Accounts

HGG is America’s #1 Conservative Gold Company, as seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The New York Sun, and more. Exceptional customer service and value are the top priorities of Harvard Gold Group (HGG).

HGG is BBB-accredited, holds 5-star ratings across the board, and provides free consultations and metals overviews. We offer tax-free purchases, free 2-day shipping, the best pricing, and direct access to our co-owners, who have over 15 years of experience specializing in precious metals, moving over a hundred million dollars into tangible assets for people's IRAs/retirement accounts and for direct delivery. Customers enjoy lifetime account care and a straightforward buyback program without hassle or liquidation fees.

You can move almost any type of retirement account into a physical precious metals IRA. Retirement accounts like IRAs, 401Ks, Pension Funds, TSPs, 403Bs, Inherited accounts, and more. Harvard Gold Group offers 100% free rollovers. Qualify for up to 10 years. Qualifying purchases can also receive up to $15,000 in free metals match, delivered to your door or location of your choice.

Following years of hard work, the last concern you want to worry about is the risk of not being diversified. At Harvard Gold Group, we’re here to answer all your questions with no pressure. We make it easy to buy and easy to sell.

Get your FREE gold & silver investment guide today by filling out the request form below or call us today @ (844) 977-GOLD. Learn more at harvardgoldgroup.com

Protect Yourself Against These Events by Hedging with Gold & Silver

Article by Harvard Gold Group

Source: U.S. Bureau of Labor Statistics

Source: Dec 30, 2023: https://www.resumebuilder.com/due-to-inflation-1-in-5-retirees-likely-to-go-back-to-work-this-year/