President-elect Donald Trump has sent a firm warning to the BRICS nations, signaling that the United States would impose a 100% tariff on any attempt to introduce a new currency by the group. Trump made his stance clear, stating, “The notion that BRICS countries could move away from the U.S. Dollar without facing consequences is finished. We will demand assurances that these nations will not create a new currency or support any other currency to replace the U.S. Dollar. If they do, they will face 100% tariffs and will be cut off from selling into the U.S. market.”

Trump’s comments reflect his commitment to safeguarding the U.S. dollar’s dominance in international trade. He further emphasized, “They can go find another ‘sucker.’ There’s no way the BRICS will replace the U.S. Dollar in global trade. Any nation that attempts to do so should say goodbye to America.”

The Rising Influence of BRICS

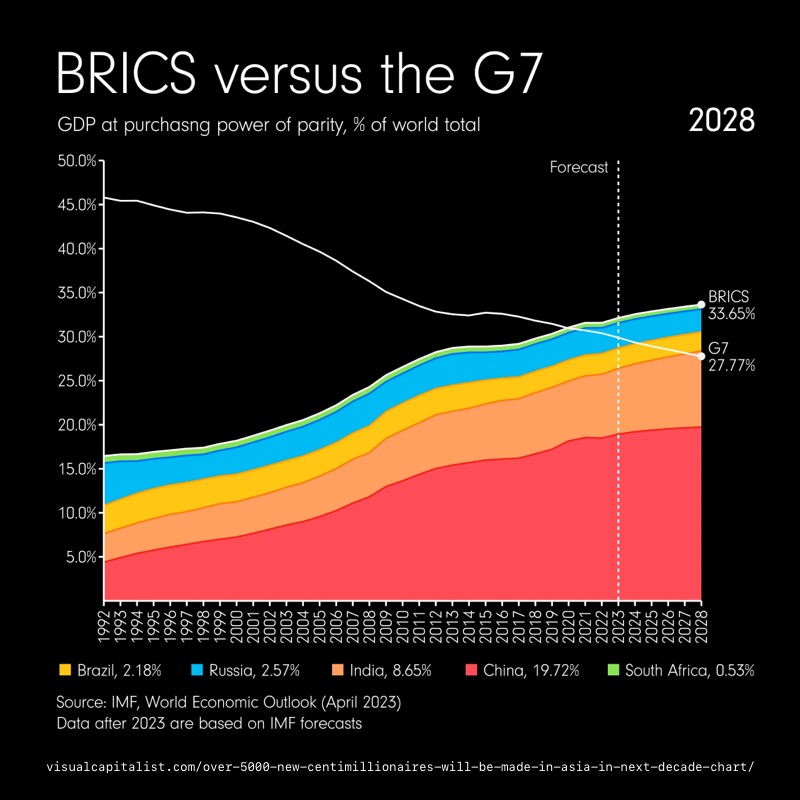

The BRICS alliance, which was originally formed in 2011 with Brazil, Russia, India, China, and South Africa, has grown in recent years. By 2024, Iran, the UAE, Ethiopia, and Egypt had joined, with 34 more nations expressing interest in becoming members. The group has been considering the creation of a new currency to reduce reliance on the U.S. Dollar and to counteract Western economic influence and sanctions.

Although still in the conceptual phase, the proposed currency, tentatively named the "Unit," could be pegged 40% to gold and 60% to the national currencies of BRICS countries. If adopted by other non-Western nations, this currency could challenge the U.S. Dollar’s global dominance. It would likely reduce demand for U.S. dollars and Treasury bonds, which could have significant negative repercussions for the U.S. economy.

The Path to a New Global Economic Framework

Russian President Vladimir Putin has emphasized the importance of gradual action in shifting away from the dollar. He said, “Its time hasn’t arrived yet. We must proceed carefully, without rushing.” Meanwhile, BRICS nations are actively working to reduce their dependency on the U.S. Dollar. This includes engaging in direct trade using their own currencies and collaborating on central bank initiatives aimed at bypassing the dollar. At their October summit, BRICS introduced the Cross-Border Payment Initiative, which seeks to eliminate the need for U.S. Dollar conversions in international trade.

Trump’s Tariff Threats and Global Reactions

Trump’s threats to impose tariffs reflect his broader strategy of using economic pressure to achieve U.S. policy goals. For example, he recently threatened tariffs on Canada and Mexico unless they address issues related to drugs and crime. However, Russian officials have downplayed Trump’s warnings, arguing that the declining global demand for the dollar is a result of the U.S. using the dollar as a tool of political leverage. Kremlin spokesperson Dmitry Peskov stated, “If the U.S. forces countries to use the dollar, it will only accelerate the trend toward using national currencies instead.”

The process of “de-dollarization” is already underway. The U.S. Dollar’s share of global reserves has dropped to its lowest level in 25 years. In response, central banks are diversifying their reserves, with many shifting to gold and other alternative currencies. Some are also repatriating their gold holdings, once stored in London, to prepare for potential changes in the global economic landscape.

Gold’s Role in the Economic Transition

Gold has been on the rise, gaining 30% in value this year due to strong demand from central banks and rate cuts. Financial institutions like Goldman Sachs and UBS predict that gold prices could reach new record highs in 2025.

While Trump’s warning about BRICS could temporarily boost the dollar, it might also have unintended effects that could drive up gold prices. Increased tariffs could escalate trade tensions and inflation, pushing investors toward gold as a safe haven asset.

Russia is also positioning itself as a key player in this shift. The country has proposed the creation of a BRICS Precious Metals Exchange, which would fundamentally change the way gold is traded and valued, potentially disrupting the global precious metals market.

Conclusion

President-elect Trump is making a strong effort to defend the U.S. dollar’s position as the world’s primary trade and reserve currency. He has recognized the growing threat posed by the de-dollarization trend. Last year, Trump remarked that if the U.S. Dollar loses its dominant role in global trade, it would be like “losing a war.”

However, the tariffs that Trump is relying on to protect the dollar could have unintended side effects, such as contributing to trade wars and inflation. As the battle over global currencies continues, Americans may find themselves caught in the middle of a shift in the world’s economic order. One way to safeguard individual financial futures in such uncertain times is through investing in precious metals, such as through a Gold IRA, which offers long-term value protection. To learn more about how to protect your financial future, contact us at 844-977-4653.

Story by Harvard Gold Group