- The Government is Stacking $1 Trillion of Debt Every 100 Days

- What is Really Going On?

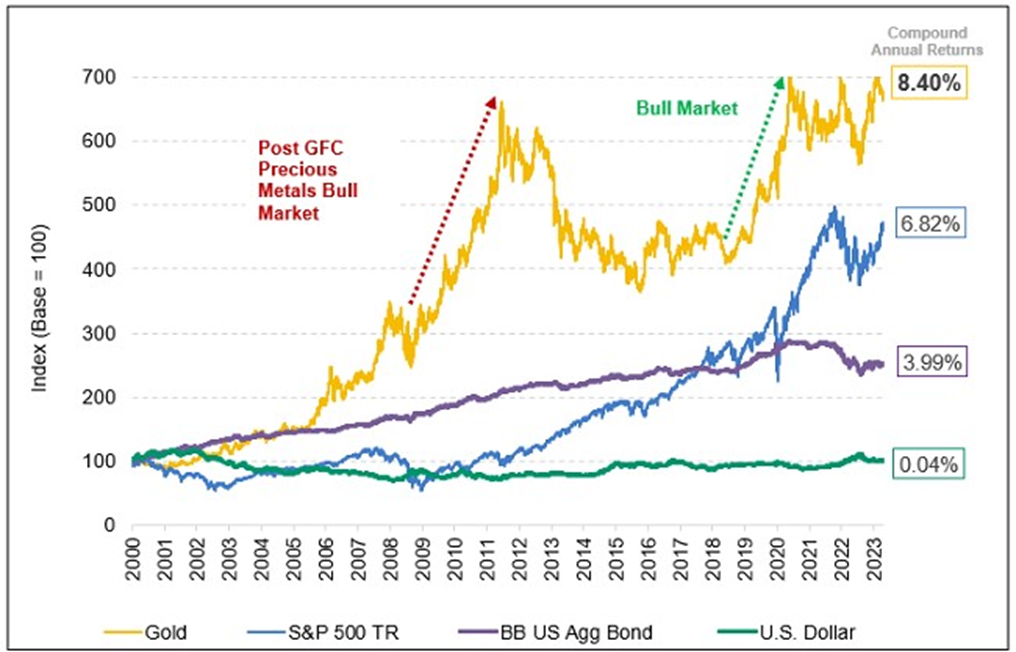

- U.S. Dollar Down 40% Since 2000 - Gold Up 700%

The current Administration's Neck-Breaking Spending Spree has no end in sight!

The U.S. national debt has ominously soared and is shattering records with each passing quarter. Since Spring 2023, the government has racked up a staggering $1 trillion debt nearly every 100 days, BofA strategists alarmingly note. The current rate of spending puts the 2024 fiscal year on pace to eclipse $3.5 trillion.

To put this in context, the fiscal year debt for 2020 ranked as the worst debt year in U.S. history at $3.1 trillion, when the whole world was shut down.

Historically, the government doesn’t rack up huge debt deficits during good economic times. The neck-breaking speed of spending during 2023 and this current 2024 year is unprecedented.

This indicates that something is very wrong. This relentless surge should be setting off deafening alarm bells in the financial world.

As the debt mountain has grown, so too has the value of GOLD, signaling deepening concern over the dollar's future amidst this daunting fiscal trajectory.

Reflecting on the past 23 years, the dollar's purchasing power has crashed by more than 40%. Americans have endured three major crises in 2001, 2008, and the 2020 COVID-19 pandemic. What is often overlooked is that gold has outperformed the broader stock and bond markets, appreciating by more than 700% since January 2000. By incorporating physical gold into your portfolio, you can enhance your ability to safeguard and expand your wealth in both favorable and challenging economic times.

As seen below, GOLD is a great hedge against rising U.S. debt:

This graphic explores the gold price's relationship with the U.S. national debt and uses data from the Federal Reserve Bank St. Louis and In Gold We Trust.

Gold's Impressive Track Record

Source: Bloomberg. Period from 12/31/1999 to 06/30/2023. Gold is measured by GOLDS Commodity Spot Price; S&P 500 TR is measured by the SPX; US Agg Bond Index is measured by the Bloomberg Barclays IS Agg Total Return Value Unhedged USD (LBUSTRUU Index); and the U.S. Dollar is measured by DXY Currency. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

With 5-star ratings across the board and BBB-approved, partnering with Harvard Gold Group (HGG) gives you more than peace of mind. HGG specializes in physical gold and silver delivery, offering two programs: Private Direct Delivery & Precious Metals Retirement Account IRAs. They make buying and selling simple and easy. Customers enjoy lifetime account care and a no-hassle/no-liquidation fee buyback program. Perhaps best of all, clients can qualify for tax-free transactions, free shipping, and free insurance.

HGG is America’s Most Conservative Gold Company and is recommended by Mark Davis, The Babylon Bee, Not The Bee, The New York Sun, The Fish, and more. Learn more about us or call (844) 977-GOLD (4653) and make an appointment for a free consultation.

Other Free Articles & Reports You Might Like: