First, we’ll discuss why a shift to a gold-backed dollar would be a powerful and strategic move for the United States. Then, we’ll highlight current developments that suggest this transition may happen sooner rather than later.

There have been a lot of rumors about the U.S. going back on a gold standard or a partial gold backed dollar. Rather than a full return to the gold standard, which would require the government to back every dollar with gold, a partial gold backing is more than likely the compromise that is seriously being considered. A partially backed gold system reduces debt risk while avoiding the rigid constraints of a 100% gold-backed currency, which historically led to economic stagnation when credit was limited.

Why Would the U.S. Want a Partial Gold-Backed Dollar?

It would create an immediate currency and debt reset without war

+

It would restore world confidence in the dollar as the world’s most premier reserve currency, securing and extending our world power position

+

It would effectively inflate away a large part of our 36 trillion in debt, mitigating debt concerns while maintaining some monetary flexibility

Gold has regained its dominant and historical role in global finance.

- Gold remains the only asset that is not someone else’s liability.

- Countries have been off and on gold standards for thousands of years.

The massive surge in physical gold purchases at record-high levels indicates that major players and nations are strategically positioning for a major financial shift (U.S. banks, UK, China, BRICS, major countries, and Financial Institutions).

A gold-backed dollar would:

- Reduce the debt burden by making debt worth less in gold terms.

- Reduce future inflation and volatility.

- Strengthen the U.S. currency’s credibility.

- Restrict government overspending, forcing discipline.

- The U.S. would lose the ability to print unlimited money, requiring fiscal responsibility.

This move would domestically devalue the dollar, causing financial pain for citizens who do not own physical gold. However, it would strengthen the U.S.'s financial power globally in the long term. Additionally, it would allow America to reset its economy on a more sustainable foundation, fostering genuine prosperity in a relatively short time rather than relying on debt-driven growth that causes painful boom-and-bust cycles.

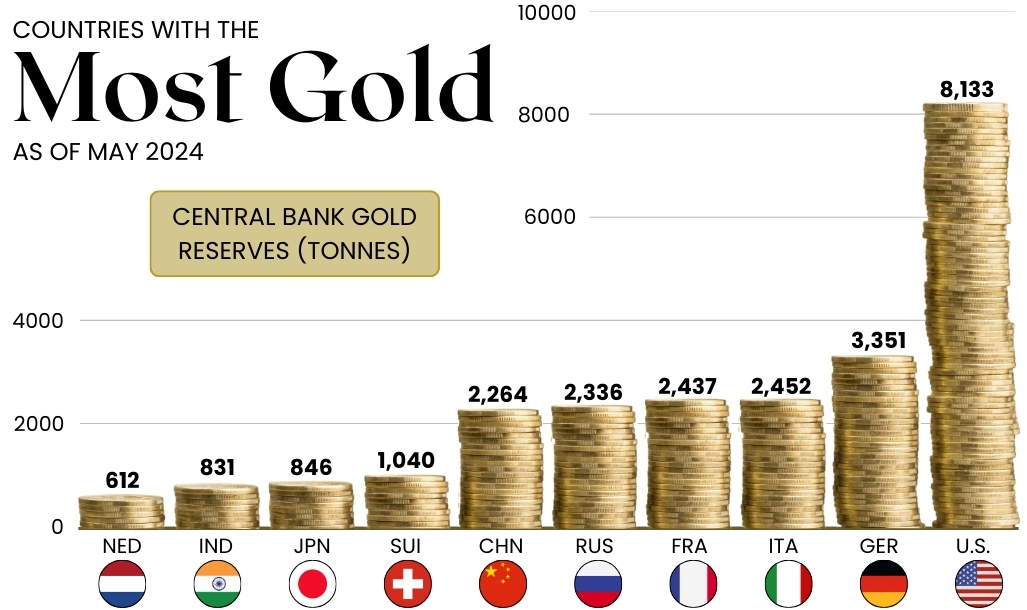

Source: ElementsVisualCapitalist.com

What Could This Look Like:

- The U.S. could revalue its gold holdings at a significantly higher rate through either a one-step order or a two-step process. For example, it might first value gold at its current market price during a preparatory phase while the government finalizes the necessary processes and systems. Then, upon launching a partial gold-backed dollar system, the government would likely revalue gold again at a much higher rate to strengthen the dollar’s global foundation and inflate away even more debt burdens.

- Introducing gold-linked bonds would provide stability while maintaining monetary flexibility.

- Encouraging gold-backed financial instruments (such as gold-backed Treasury bonds) would help build global confidence in the U.S. dollar, positioning it as a more trustworthy and resilient currency in global markets.

What is Happening Now to Indicate this Might be in the Works?

- There has been no indication from Trump that tariffs on precious metals are being considered, and they are unlikely to be targeted. However, since the election, massive amounts of gold have been flowing back into the U.S., despite the high costs of shipping and insuring gold transfers between international depositories. A staggering 20.4 million troy ounces (636 metric tons) of gold, valued at $60 billion at current prices, have been delivered to Comex-approved warehouses.

- Gold Revaluation is reportedly in the works at the government level.

- Gold audit in order at Fort Knox by DOGE.

- Trump has directed Elon Musk and the DOGE team to examine U.S. gold reserves, suggesting growing interest in monetary reform——possibly involving a gold revaluation, as the U.S. has not revalued gold since 1971, when it was set at $42.22 per ounce.

- Many believe the U.S. never revalued gold after abandoning the gold standard to maintain public confidence in the fiat dollar. By ignoring the gold's increasing value, the government likely prevented people from noticing or questioning its impact on the economy.

- It could also indicate blockchain gold tracking, tokenization, or increased gold-backed finance.

- It is important to note that if the gold were not there, or if Trump suspected it was missing, he likely would not have ordered an audit. The absence of gold would likely trigger a sudden decline in the dollar’s value and cause significant economic instability, including capital flight and market volatility. Although the U.S. is not currently on a gold standard, holding over 8,100 tons of gold makes it the largest gold holder in the world. The global perception of the dollar’s value is partially influenced by the U.S. gold reserves.

- Trump has directed Elon Musk and the DOGE team to examine U.S. gold reserves, suggesting growing interest in monetary reform——possibly involving a gold revaluation, as the U.S. has not revalued gold since 1971, when it was set at $42.22 per ounce.

- November 2024, Trump stated that he is likely to appoint Judy Shelton as Federal Reserve Chair when Jerome Powell’s term ends in May 2026.

- Shelton is a strong advocate for returning the U.S. to a gold-backed monetary system.

- She recently published her book, Good as Gold: How to Unleash the Power of Sound Money, emphasizing the importance of sound monetary policy.

- Shelton advocates for the issuance of gold-backed bonds as a way to strengthen the U.S. financial system and rebuild global confidence in the dollar.

U.S. Banks are Quickly Moving Physical Gold Holdings from Out-of-Country Depositories Back to U.S. Depositories. This Action Might Not be for ‘Tariffs’

- Since 2013, central banks, particularly in Germany, the Netherlands, and Poland, repatriated gold (brought it back home) from the Bank of England and Federal Reserve of New York.

- U.S. banks, too, are paying hefty costs to move their physical gold back to domestic vaults, which suggests they are anticipating monetary changes, a potential financial crisis, or geopolitical instability.

- Gold repatriation is not about tariffs—it is a hedge against counterparty risk and a sign that trust in foreign custodians is declining.

This suggests that banks see gold as more valuable in U.S. territory than abroad, hinting at future monetary shifts.

Our Closest and Strongest Ally, the UK, Just Moved Massive Amounts of Gold to the U.S. New York Depository

- The London Gold market, often referred to as the "London Gold Exchange," is considered the largest gold trading hub in the world, with the majority of global gold trading happening there, making it the biggest gold exchange globally.

- The UK has long stored gold at the Bank of England, acting as a reserve hub for many nations.

- The shift of British gold to New York suggests:

- Increased trust in U.S. security vs. European vaults amid global uncertainties.

- A strategic move before potential monetary shifts, ensuring gold is accessible in U.S. financial hubs.

- The U.S. and UK coordinating financial moves, potentially in anticipation of a gold-backed financial system or crisis hedge.

If gold becomes a major factor in future monetary systems, having it in a secure and aligned jurisdiction (U.S.) is a critical move.

Gold Remains the Ultimate Hedge, even if No Country Ever Returns to a Partial Gold Standard

Gold has a 5,000-year history of being a store of value, even in systems where fiat money dominates.

- During inflationary periods, gold retains its value when fiat currencies lose purchasing power.

- In economic downturns and bond market collapses, gold rises as investors seek the safe-haven asset.

- Even during booms, central banks and governments accumulate gold as a hedge against future crises.

- Owning physical gold has historically protected both nations and individuals through currency devaluations, debt cycle resets, and the rise and fall of world powers.

Since the end of the Bretton Woods system in 1971, gold has increased from $35/oz to over $2,940 per ounce as of February 20, 2025, demonstrating its enduring supremacy against fiat devaluation.

See What President Donald J. Trump Posted from Truth Social:

Gold Proves as an Exceptional Hedge

Hard resets bring financial pain, but gold has consistently proven to be an exceptional hedge, shielding those who hold it from the harshest economic blows

Historical Precedents:

- 1929 Great Depression: Gold protected wealth while fiat collapsed.

- 1971 Nixon Shock: Gold soared as the dollar plummeted due to the dollar being unpegged to gold, trashing the Bretton Woods Agreement.

- 2000-2001 Dot-Com Bubble Burst: The early 2000s saw the collapse of inflated tech stock valuations, leading to significant market losses. During this period, gold began a notable ascent, rising from around $270 in early 2001 to close 2005 at $444.84 per ounce.

- 2008 Financial Crisis: Gold hit new all-time highs as stocks, housing, and financial markets collapsed.

- 2020 COVID to today: Gold up 93% {Jan 1, 2020 $1,518.40 to Feb 20, $2,940.29}

- A massive gold paradigm shift emerged as trust in fiat currencies declined.

- U.S. bonds crashed while gold skyrocketed, signaling a shift in investor confidence.

- Countries started buying more physical gold than ever before, with central banks increasing reserves at record levels to hedge against monetary instability.

- The crisis exposed the weakness of massive money printing and debt-driven economies, reinforcing gold’s role as a safe-haven asset.