The U.S. CBDC's 'Digital Dollar'

- It's at Your Doorstep -

Bank of America Says US CBDC 'Inevitable'

Rep. Warren Davidson of Ohio has likened the Central Bank digital currency (CBDC) to the financial equivalent of the “Death Star”.

He accuses the Fed of quietly working on what he calls an 'Orwellian-Style Payment System'. He believes it would create similar authoritarian powers for the nation’s central bank to “corrupt … [coerce] and control” Americans through their money.

The Federal Reserve is talking out of both sides of its mouth about the 'Digital Dollar'. They officially stated that it has not yet made a definitive decision regarding the issuance of a central bank digital currency (CBDC), emphasizing that any such move would necessitate authorization through legislation. However, recent developments suggest that the Federal Reserve is actively preparing in this direction. Representative Warren Davidson's social media outburst included a glimpse of a job posting on Indeed for a "Senior Crypto Architect - CBDC" role within the Federal Reserve Bank of San Francisco. These recent developments hint at the Federal Reserve's proactive steps toward CBDC readiness, despite the official stance of awaiting legislative authorization.

What Does the Bank of International Settlements “the Central Bank of Central Banks” Say About Central Bank Digital Currencies (CBDC)?

Agustin Carstens is the general manager for the Bank of International Settlements (BIS), which oversees many countries' central banks. Central Banks are responsible for implementing monetary policy, managing the currency of a country or group of countries, and controlling the money supply.

October 19, 2020, Agustin states his explanation of the intent behind this new centrally-controlled digital currency:

Simply put, he states that the BIS wants to know where every “dollar” is, who spent it, where it came from, where it is going, and have absolute control of the rules and regulations of money in this world. CBDCs, like the 'Digital Dollar', were largely played down before 2020, but Carstens's words exonerate those who warned of the potential for CBDCs to enable totalitarian control.

CBDCs Open the Door to Many Dystopian Scenarios, Making Them Possible, if not Sadly, Inevitable!

Consider the incident in February 2022 when Canada's President Justin Trudeau froze the bank accounts of 'Freedom Convoy' truckers who were protesting illegally forced vaccine mandates by blocking the border. It took several weeks to freeze their accounts using traditional banking systems. However, with the introduction of a 'Digital Dollar', the government could freeze accounts almost instantly, significantly amplifying its ability to exert control over financial activities.

It's not far-fetched to imagine the government restricting purchases based on known income or spending habits. The ultimate concern is the eventual complete eradication of physical cash, allowing the government unprecedented oversight over financial transactions including political contributions, potentially leading to punitive actions like freezing accounts based on donation choices.

To Navigate the U.S. CBDC 'Digital Dollar' - Let’s Take a Step Back to Understand

What is a Digital Currency or Digital Coin?

A digital coin is a digital currency. At its core, it is a record of information distributed on a ledger, which is a “record book”. A digital coin isn't "made up of" financial transactions but is intrinsically linked to a record of transactions. A digital coin in essence is a unique digital stamp stored in an online record book. Every time this coin changes hands, the transaction is noted down in this record book. The record book ensures that the coin's history is transparent, safe, and can't be deleted. Think of the coin as a special digital item, and the record book as the permanent diary that keeps track of everywhere the coin was spent across a vast, centralized network of computers.

What is a Central Bank?

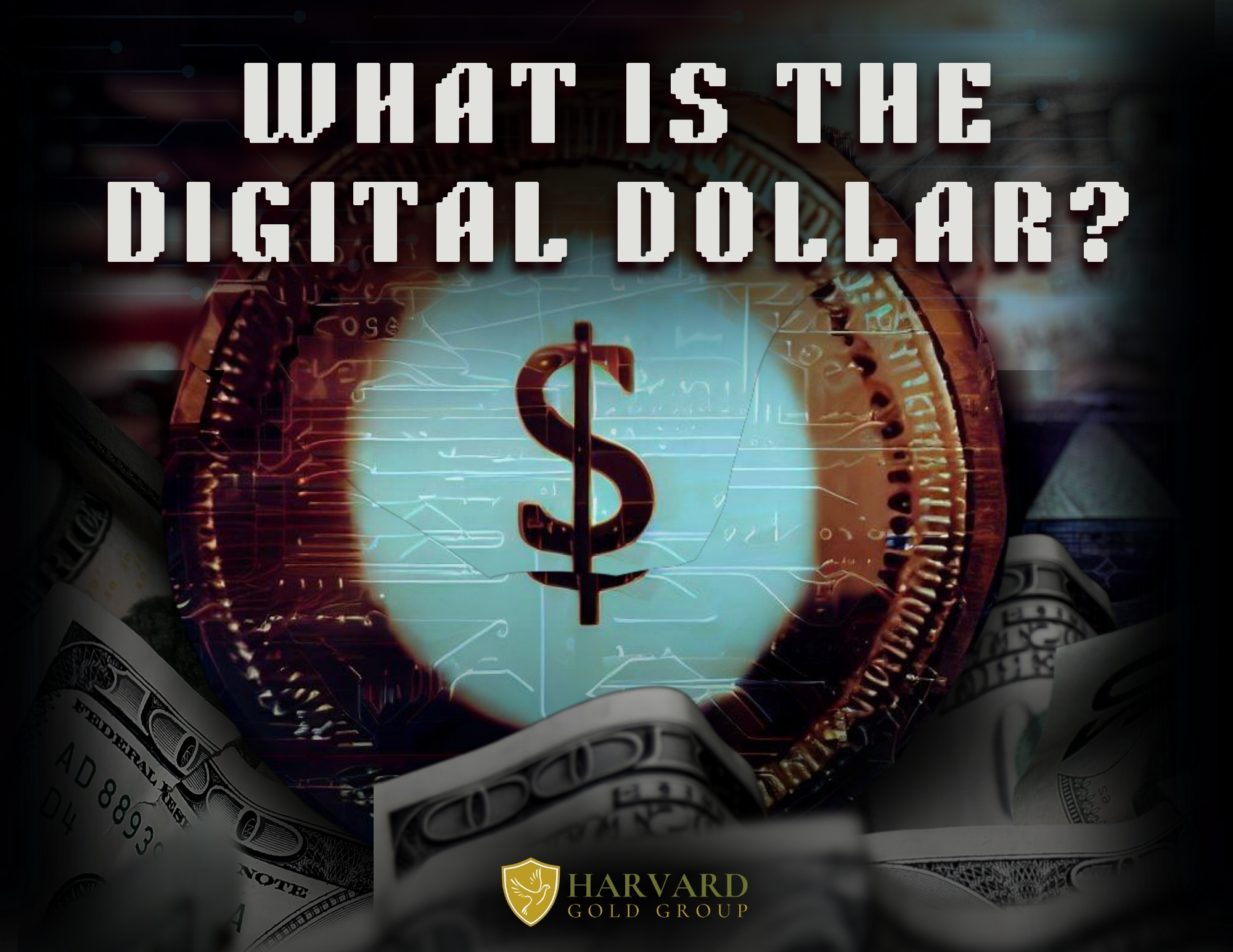

Most countries worldwide have a Central Bank regulating that country's banking system and monetary policy. The U.S. Central Banking system is called The Federal Reserve, referred to as “The Fed”. The Fed Banking System consists of 12 regional Federal Banks. These are technically private entities established, in essence, to conduct the nation’s monetary policy and regulate its banking institutions, including commercial banks. People in general use Commercial Banks for their everyday banking needs, such as checking and savings accounts, loans, and other financial services. The largest Commercial Banks in the U.S. are JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, and U.S. Bancorp.

To Navigate the U.S. CBDC 'Digital Dollar' - We Must Understand What It Is

What is the 'Digital Dollar'?

The term 'Digital Dollar' is simply the name that refers to the U.S. digital currency The Fed is currently developing. The abbreviation "CBDC" stands for any country’s Central Bank’s Digital Currency. China has by far been the leader when it comes to its CBDC, having launched its own 'Digital Yuan' currency in March 2021.

People are accustomed to looking into their bank account balances on apps or websites. This familiarity can make it easier for policymakers to introduce the 'Digital Dollar' without facing significant scrutiny or resistance from The Public. In simple terms, despite its similar-sounding name, the 'Digital Dollar' isn't merely a digital representation of our current paper dollar bills; it's a distinct, brand-new tech-savvy currency backed and controlled by the U.S. Fed Central Bank.

CBDCs can be Programmable, Traceable, and Monitorable:

Currently, commercial banks are a barrier between our finances and the government. The specific dollar you receive and spend today has no significant information stored, therefore each dollar operates identically to any other dollar. However, the defining characteristic of these new digital dollars lies in their fungibility. CBDCs disrupt this status quo. Beyond a CBDC having the capability to be programmed, tracked, and monitored, the 'Digital Dollar' transactional history is automatically stored with personal information, making this information owned and controlled by The Fed. This inherent trait creates the ability for endless surveillance. This centralizes all financial transactions and balances in databases managed by the government or their designated entities. Hence, Big Brother will have access to your wallet!

Shocked and Frightened? You Should Be!

The introduction of the 'digital dollar' (CBDC) means you lose two of your most valuable commodities: privacy and control of your money.

THE 'DIGITAL DOLLAR' WILL EMPOWER THE GOVERNMENT TO:

- Monitor your every dollar and account activity spending

- Restrict your purchases and the causes you stand for

- Seize your funds with a simple click

What does a CBDC signify? The answer lies in one word: control. This might explain the strong support for the idea from Treasury Secretary Janet Yellen and President Joe Biden. A 'Digital Dollar' would grant them and future administrations an unprecedented level of power that even George Orwell could not have envisioned. Following the economic ramifications of federal intervention, the government is hardly deserving of additional authority.

CBDCs Could Further Extend the Already Substantial Reach of Central Banks

A Central Bank Digital Currency is created and owned by the Central Bank. Therefore, they not only have ownership of the collecting of information, but they effectively provide The Fed with more direct tools to execute monetary and fiscal policy that they do not currently have. For central banks, CBDCs concentrate on planning and decision-making, as well as having a way to maintain taxation. These central banks could digitally issue and retire money as they see fit, which allows them to control the money supply – a key lever. The 'Digital Dollar' could allow The Fed to instantly devaluate our money.

A Warning from 1832 About Central Banks & Giving Them Too Much Power.

In 1832, President Andrew Jackson had an important message that may be more relevant today than in his time. Jackson felt Central Banks had too much concentrated financial power. He was especially unhappy that a private corporation held so much power. He said before Congress:

“It is to be regretted that the rich and powerful too often bend the acts of government to their selfish purposes.”

He hated that the Central Bank was pushing to control the government and not for the greater good of the American people. He made an unprecedented veto against a Central Bank in the U.S. He wanted them to never have a foothold here. Here is a quote in which he warns Congress and future generations:

“…these are but premonitions of the fate that await the American people should they be deluded into a perpetuation of this institution or the establishment of another like it."

How Did We Get This Far? U.S. CBDC, the 'Digital Dollar' Timeline:

Amidst the chaos of COVID, The Biden administration pushed the U.S. CBDC efforts further, saying they were wary of falling behind. The Federal Reserve Bank of Boston teamed up with the Massachusetts Institute of Technology (MIT), to facilitate what would be required to create a central bank digital currency (CBDC).

In February 2022, the Fed released a report describing its initial findings. The report reflected that they successfully accomplished a codebase that supported 1.84 million transactions per second with settlement – meaning those transactions were completed in under one second. This is extraordinarily fast and concise. That’s more than 2.5 times the number of transactions Visa can handle on its payment network, according to statistics cited by Visa CFO Vasant Prabhu in early 2022.

The program researchers moved to the next phase of research to enhance the coding with additional features (for instance, programmability and audit capabilities). This provides the ability to have audited and recorded transactional history over everything money-related. Key players such as Citibank, Wells Fargo, and Mastercard are collaborating with the New York Federal Reserve to utilize the technology for test piloting and further refinement.

The Fed showcased its successful Live-Data Prototype results to select government officials. Soon after, Fed Chairman Powell said he was ready to introduce the 'Digital Dollar' but would need Congress’s approval.

One month later, on March 9, 2022, President Biden introduced Executive Order 14067, effectively going around Congress, which mandated a six-month study, as the White House stated, “harnessing the potential benefits of digital assets and their underlying technology…”. In short, acquire the groundwork and information on how to introduce the US 'Digital Dollar'.

Congress’s Summary of the 6-Month Study

Executive Order 14067 Summary, Mid-September 2022

“Reports Pursuant to Executive Order 14067, the heads of various federal departments, offices, and agencies were required to prepare more than a dozen reports, assessments, action plans, policy frameworks, legislative proposals, and technical evaluations related to digital assets—the majority of which are now complete. The Biden Administration asserts that the reports provide a “first-ever comprehensive framework for responsible development of digital assets.”

In short, it lays out that they have the foundation to establish a 'Digital Dollar' Fed Coin.

The CBDCs ability to be turned into massive oversight, no matter how good the intent sounds, means it could be turned into malicious intent for The People. Let’s take a look at the pros and cons of a 'Digital Dollar' for The People.

Pros and Cons of a 'Digital Dollar' for The People: Our Assessment

Pros:

- Decreases costs: The 'Digital Dollar' would reduce intermediaries which means fewer transaction fees.

- Faster settlement periods. The 'Digital Dollar' would inherently be faster than methods like credit cards.

- The Fed believes that 'Digital Dollar' could present an opportunity to bridge the financial divide, granting those without bank access a direct gateway to the central bank.

- The Fed is touting that the 'Digital Dollar' will be a well-designed currency that will be safer and more stable compared to unbacked crypto assets like bitcoin which are extremely volatile.

- The 'Digital Dollar' will eventually allow The Fed to settle international inbound funds, and due to the permanent transactional record, the 'Digital Dollar' could help them combat illicit activities, (if they wanted to sift transactions).

- Policymakers believe that CBDC, 'Digital Dollar', instantaneous payments could help the U.S. maintain its higher position as the world’s dominant reserve currency.**(Sidenote: That might work, but only if The World Bank nor the Bank of International Settlements (BIS) does not create its own digital world dollar to police the world). It is worth a reminder, that essentially The Bank of International Settlements is effectively the “Central Bank of Central Banks”.

Cons:

- Digital currencies are prone to malicious intents. Cyberattacks demanding digital ransoms are on the rise. In 2022 alone, cybercriminals siphoned off $4.3 billion in cryptocurrencies. This vulnerability stems from the blend of novice investors, limited oversight, the inherent anonymity of digital transactions, and the ease of asset misplacement.

- The most alarming aspect of a potential CBDC 'Digital Dollar' is its traceability. Built on a ledger resembling a bank account, a government entity like the Fed would have access to monitor all transactions. Thus, the introduction of the 'Digital Dollar' (CBDC) means you lose two of your most valuable commodities: privacy and control of your money.

- While one might argue that transactions via debit cards or phones are already traceable, there are many layers between the government's piggy bank and The People. Transactions over $600 have already been flagged on platforms like Venmo and PayPal. With order 14067, similar surveillance might become commonplace. Which also brings the possibility of immediate transaction taxation capability.

- A CBDC is a longer-term power grab for The Fed Central Bank. As it stands, the 12 Central Banks are the regulators of commercial banks. With ownership of the CBDC 'Digital Dollar', they would be stepping in to directly compete with the banks they regulate. This means that the umpire is joining the game, which obviously makes it an unfair game. Ultimately, this could drive out the private commercial banking sector competition, which is also not beneficial for The People.

- We also face another massive issue. Every time there's a banking or financial crisis, regulators tend to gain more authority. Their argument is that each crisis is unique, implying they need even more power to prevent the next one. This presents a regulatory dilemma. When regulators are awarded more authority following their failures, it almost guarantees more crisis failures.

- Most recently, in March 2023, SVB Regional Bank failed, and other regional banks subsequently followed suit, creating a banking crisis in the U.S. Two developments have come about with this regional banking crisis. First, there was a massive shift of funds within the U.S. as people were moving funds from smaller banks to the largest banks in the country. This centralizes more and more money. Secondly, regulators are of course saying there needs to be more regulation thus giving them more room for promoting CBDCs as safe alternatives to paper currencies and a means of protection against bank runs.

- Looking back at the history of U.S. money, we have abandoned a gold-backed currency to fiat-paper money and are now transitioning to digital code which exposes the system to numerous threats. The prospect of additional unchecked governmental spending, inflation manipulation, and stealth taxation looms large.

How Soon Will the 'Digital Dollar' Launch?

The new FedNow payment system went live in July 2023. What is this? It is a new payment processing service for The Fed to send funds. The FedNow Service is a new instant payment infrastructure developed by The Fed to deliver funds almost instantly 24x7x365. In comparison, the old system called the FedWire, can take days to settle funds and does not operate 24/7. Basically, they said they wanted to update technology to provide better services, which of course sounds great. The murky waters here lie in the timing. The Fed says that the new payment system has nothing to do with their research to create the CBDC, 'Digital Dollar’, but this new payment infrastructure was built in the same time period. Whether they admit it or not, the truth is that the old system could not support the delivery of the new currency, the 'Digital Dollar'.

In layman's terms, they now have a new high-tech payment system to deliver the 'Digital Dollar'.

To Navigate the 'Digital Dollar', You Need to Know How to Protect Yourself and Your Privacy

What Steps Can You Take Before It Is Too Late?

You can't control how fast the government will unleash the US 'Digital Dollar', but you can control how you prepare for this reality. Navigate the digital age by diversifying a portion of your wealth with tangible safe-haven assets like physical gold and silver. Gold and silver have been money for over 2,500 years, never failing, and never going to zero. It is global money, exchangeable into any other currency. Gold is a choice reserve currency for the governments of the world. According to the World Gold Council, the U.S. itself holds the most amount of gold reserves compared to all other countries. Gold and silver are money outside the control and surveillance of the government and banks. By sidestepping centralized control, gold and precious metals could play a pivotal role in preserving financial freedom and autonomy in a future dominated by CBDCs, cybercrime, volatile swings in cryptocurrencies like Bitcoin, and the digital world as a whole.

You can have precious metals delivered privately to your door or have a physical gold and silver-backed retirement account. Thousands of Americans have already used this legitimate IRS-compliant loophole to shift their retirement savings, tax-free (IRA, 401k, 403B, Pensions, TSP, Inherited Retirement Accounts, etc.) into tangible assets that can shield against the impact of the 'digital dollar' and CBDCs. (How does a Gold-Backed IRA work?)

How Can Gold Protect Your Wealth?

- Privacy: Gold and silver can be bought and sold privately, while Central Banks' digital currencies and cryptocurrencies are maintained online and have an unerasable footprint. Although cryptocurrency transaction imprints are not directly sent to a Central Bank’s computer network, they too are not anonymous, due to their permanent online transactional history across a massive worldwide network of computers.

- Financial Control: Physical gold & silver are outside the control of the government and banks. They allow users to maintain control over their funds without relying on third parties like banks or a cryptocurrency trade platform with extensive fees. This independence can empower individuals to manage their finances without interference or censorship from governments.

- Protection/Safe-Haven: Historically, gold & silver go up significantly during recessions when stocks typically go down. Additionally, both physical gold and silver have outperformed the S&P and DOW over the last 20 years. The reason is most likely from the unprecedented money printing of the US dollar and massive government deficits, which hurt savers and people on fixed incomes the most.

- Hedge Inflation: Both the current paper dollar system and the 'Digital Dollar' are subject to the monetary policies of the Central Bank. These include inflationary measures such as quantitative easing. Gold and silver can’t be printed and are not merely digital codes within the internet.

- Portability/Tangible: Gold and silver have all the key defining characteristics required to be considered actual “MONEY” - portable, divisible, scarce, durable, and acceptable. This contrasts with centralized systems like CBDCs and cryptocurrencies which you cannot hold in your hand and place in someone else’s hand as a means of payment. You can only spend these digital items by connecting to the internet. Additionally, CBDCs are not scarce; trillions can be manifested with a swipe of a key, as seen in the 2008 and 2020 financial crises.

Gold and silver have been portable “real-money” for more than 2,500 years and offer a safe-haven alternative to both the current paper dollar system and the inevitable 'Digital Dollar'.

Get Prepared Today with Harvard Gold Group

America's #1 Conservative Gold Company

HGG is America’s #1 Conservative Gold Company, as seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The New York Sun, and more. Exceptional customer service and value are the top priorities of Harvard Gold Group (HGG).

HGG is BBB-accredited, holds 5-star ratings across the board, and provides free consultations and metals overviews. We offer tax-free purchases, free 2-day shipping, the best pricing, and direct access to our co-owners, who have over 15 years of experience specializing in precious metals, moving over a hundred million dollars into tangible assets for people's IRAs/retirement accounts and for direct delivery. Customers enjoy lifetime account care and a straightforward buyback program without hassle or liquidation fees.

✔ Tax-Free & Penalty-Free: A Rollover or Transfer of your Retirement Account is almost always tax-free and penalty-free.

✔ Free Metals/Promos: Earn up to $15,000 in FREE Gold/Silver/Promos, on qualifying purchases.

✔ Free Retirement Account Rollover/Transfer: Zero cost to rollover/transfer/move retirement accounts or IRAs to a Gold/Silver IRA. *You can also earn up to 10 years of Precious Metals IRA yearly maintenance fees*.

✔ Privacy: We protect your privacy and believe it is a commodity as valuable as time, you can't get it back. We do not sell your information to third parties.

✔ HGG Lifetime Account Care: Providing a dedicated account specialist and keeping you updated with market news and trends.

✔ Harvard BuyBack Program: Hassle-free buyback of HGG metals with no liquidation fees.

✔ Guaranteed Precious Metals: We only deal in government-issued coins and branded bars.

✔ Free Shipping: Your precious metals are shipped privately and fully insured to the location of your choice. You can opt to have them delivered directly to your home, business, or an independent depository.

✔ Lowest Pricing: We are committed to offering you the best value possible, with a comprehensive price-match policy.

✔ Customer Satisfaction Guarantee: Harvard Gold Group is a 5-star rated company committed to maintaining exceptional customer service satisfaction.

✔ You work directly with the founders of HGG.

Free Retirement Account Rollover/Transfer & Free Direct Delivery Shipping + Insurance

TALK TO AN EXPERT

ACCOUNT SPECIALIST