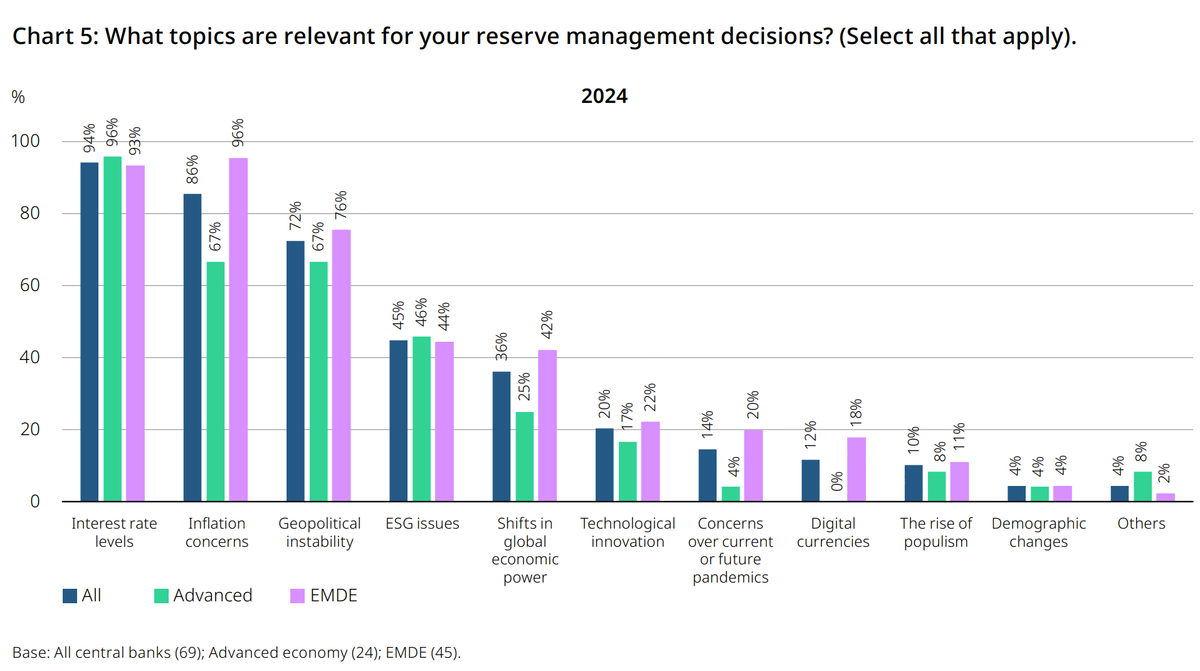

- As central banks look to diversify away from the U.S. dollar, the participants said that “interest rate levels,” “inflation concerns,” and “geopolitical instability” continue to be the leading factors in central bankers’ reserve management decisions, relatively in line with the responses last year.

- According to the survey, central banks are motivated to hold gold because it is seen as a “long-term store of value/inflation hedge,” its “performance during times of crisis,” an “effective portfolio diversifier,” and there is “no default risk.”

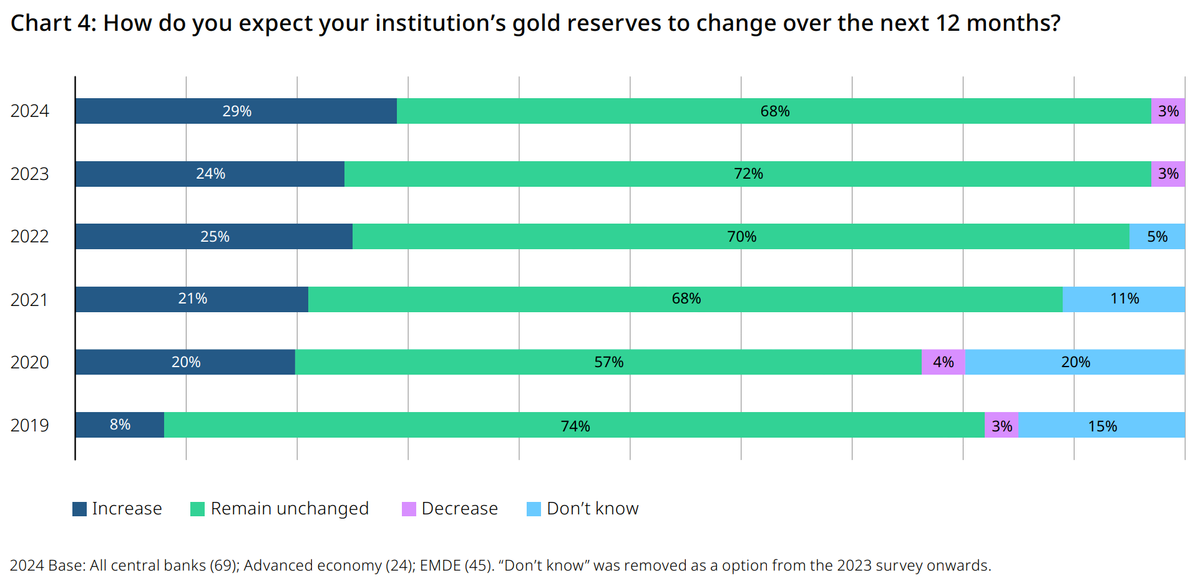

- On Tuesday, the WGC published the results of its annual Central Bank Gold Reserves survey. Of the 70 responses, 29% said they expect to increase their gold reserves in the next 12 months.

(Kitco News) - Central bank gold purchases continue to dominate and transform the gold market, and this trend is only getting stronger, according to the latest report from the World Gold Council.

On Tuesday, the WGC published the results of its annual Central Bank Gold Reserves survey. Of the 70 responses, 29% said they expect to increase their gold reserves in the next 12 months.

“While China has positively contributed to the level of annual demand from the official sector, we are still confident that central banks as a whole will remain net buyers. Buying has been broad-based, with several other central banks continuing to accumulate gold, even as the gold price has increased in recent months. As such, while central bank demand for 2024 may not reach the levels seen in 2022 or 2023, we still believe that it will remain healthy for the remainder of the year,” Krishan Gopaul, Senior Analyst at the World Gold Council, said in a recent comment to Kitco News before the survey data was released.

While nearly one-third of central banks surveyed look to buy gold this year, there is a broad-based expectation throughout the official sector that gold reserves will rise. The survey said that 81% of participants expect holdings to rise in the next 12 months, up sharply from 71% reported last year.

According to the survey, the growing diversification into gold comes as central banks see an increasing shift in global financial markets as the U.S. role as the world’s reserve currency continues to diminish.

Looking at the U.S. dollar’s role as the world’s reserve currency, 62% of respondents said they think the dollar’s share will diminish five years from now, up from 55% in 2023 and 42% in 2022.

Meanwhile, regarding gold, 69% of respondents thought the yellow metal would constitute a larger proportion five years from now, up from 62% in 2023 and 46% in 2022.

The World Gold Council noted that sentiment is significantly different when broken down between central banks in emerging markets and developing economies (EMDE) and those in developed nations. EMDE central banks generally see gold’s role as a monetary metal increasing as the U.S. dollar’s shine tarnishes.

However, while advanced economy central banks remain loyal to the greenback, they admit that gold’s role in the global landscape is changing.

“EMDE central banks, which have been the primary driver of gold buying since the 2008 global financial crisis, appear to be more pessimistic about the US dollar’s future share of global reserves and more optimistic about that of gold,” the analysts said in the report. “Nonetheless, it is notable too that the percentage of advanced economy respondents who believe that gold’s share of global reserves will rise has increased significantly from 38% in 2023 to 57% in 2024.”

As central banks look to diversify away from the U.S. dollar, the participants said that “interest rate levels,” “inflation concerns,” and “geopolitical instability” continue to be the leading factors in central bankers’ reserve management decisions, relatively in line with the responses last year.

According to the survey, central banks are motivated to hold gold because it is seen as a “long-term store of value/inflation hedge,” its “performance during times of crisis,” an “effective portfolio diversifier,” and there is “no default risk.”

“These results seem to reflect an underlying theme of EMDE central banks, but also increasingly advanced economy central banks, valuing gold’s strategic role amidst uncertain geopolitical times and renewed concerns about financial stability. This underscores the challenging economic and strategic circumstances faced by both groups,” the analysts said.

Story by Neils Christensen - Redacted shorter to keep to important points and bullet points added by HGG https://kitco.com/news/article/2024-06-18/why-central-banks-are-increasing-their-gold-reserves-29-plan-buy-more-2024