- Americans consider gold the second-best long-term investment option, according to a recent Gallup poll. Gold beat out stocks, bonds, and savings accounts.

- On the contrary, the number of Americans naming gold as the best long-term investment almost doubled this year from last.

- Street speculated that inflation pressure on US consumers may be driving demand as people seek an inflation hedge.

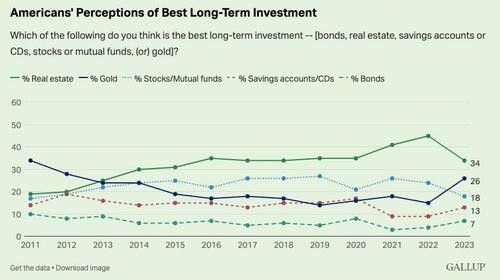

The perception that gold is the best investment over the long term rose from 15% in 2022 to 26% in the 2023 poll, overtaking stocks at the number two spot.

Real estate has held the top spot since 2013 with 35% of Americans rating it the best long-term investment in the most recent poll. That was down sharply from last year’s record high of 45%.

Stocks held third place with 18%, followed by savings accounts/CDs (13%) and bonds (7%).

World Gold Council senior market analyst Louise Street noted that while higher interest rates seem to have dampened investors’ perception of real estate as the best long-term investment, it hasn’t damaged the perception of gold.

On the contrary, the number of Americans naming gold as the best long-term investment almost doubled this year from last. This, despite interest rates climbing to a 16-year high in March.”

The Gallup poll dovetails with gold demand data. Demand hit an 11-year high in 2022, driven primarily by central bank gold buying and physical gold investment.

Gold bar and gold coin demand grew by 2% globally in 2022, building on strong demand in 2021. In total, global investors bought 1, 217 tons of gold bars and coins. The second half of the year was particularly strong for bar and coin buying, charting two successive quarters of demand of around 340 tons for the first time since 2013.

Investors in the West had a particularly strong appetite for gold and broke an annual record. Combined US and European purchases of gold bars and coins hit 427 tons. That exceeded the previous record of 416 tons set in 2011.

While institutional investors have sold gold on hot inflation news, thinking that means more rate hiking by the Federal Reserve, Street speculated that inflation pressure on US consumers may be driving demand as people seek an inflation hedge.

According to the Gallup poll, conviction in savings accounts/cash deposits as a good long-term investment increased only slightly this year, even with cash deposit rates reaching 5%. But these rates are still quite poor in real terms and anyone expecting persistent inflation may be tempted more by the long-term investment proposition of gold than that of savings accounts. Our research shows that gold’s potential to ‘protect against inflation/currency fluctuations’ is well recognized among gold investors.”

World Gold Council research shows Americans recognize gold’s “long-term value proposition and save haven attributes.” According to the WGC, around two-thirds of investors agree that “gold is a good safeguard against periods of political and economic uncertainty” and that “the price of gold increases over time.”

Story by Tyler Dugan 5-30-23 Redacted shorter to keep to important points and bullet points added by HGG. http://www.zerohedge.com/personal-finance/americans-rank-gold-second-best-long-term-investment