- "It’s hard to believe, but the world is beginning to lurch toward a gold-based monetary system,” Forbes wrote in an article published May 21. “This, despite the fact that the historical gold standard is held in almost universal contempt by economists and financial officials.”

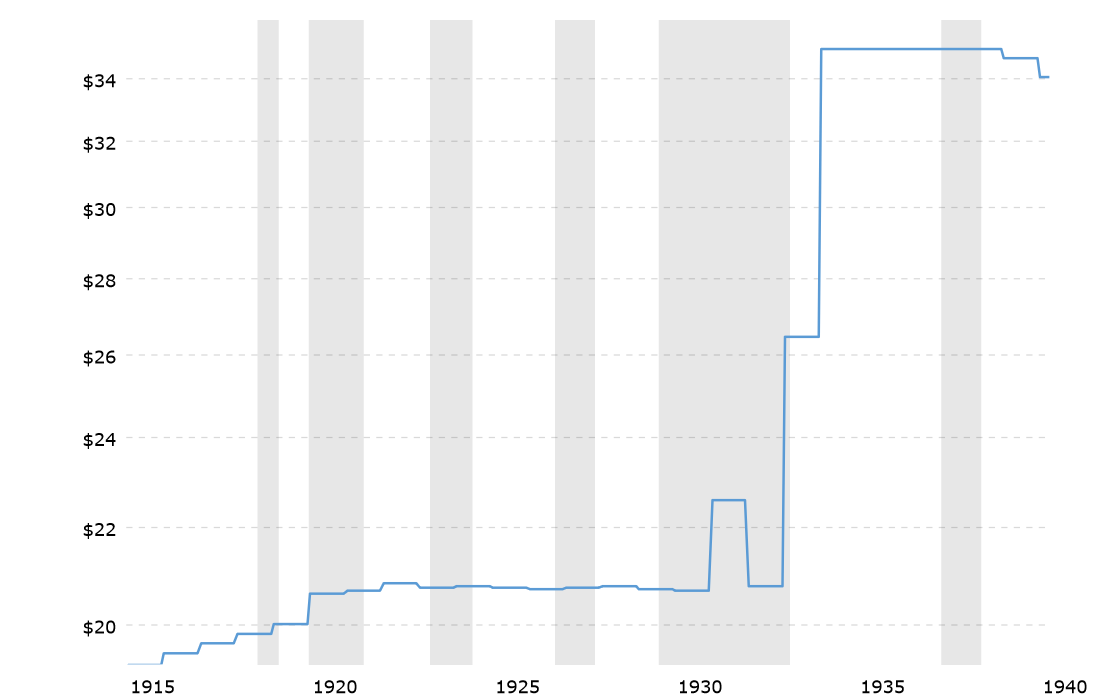

- He said that despite the many myths and pervasive ignorance surrounding gold-based money, it worked very well for a long time. “The U.S. was on a gold-based system for 180 years until the early 1970s,” Forbes wrote. “We never had inflation when the dollar’s value was tied to the yellow metal, and the U.S. experienced the greatest long-term economic growth in human history.”

- Forbes believes that he’s seeing several indications that a gold monetary system could be brought back.

(Kitco News) – There are multiple indications that the world is progressing towards a transition to a new gold standard, according to Steve Forbes, Chairman and Editor-in-Chief of Forbes Media.

“It’s hard to believe, but the world is beginning to lurch toward a gold-based monetary system,” Forbes wrote in an article published May 21. “This, despite the fact that the historical gold standard is held in almost universal contempt by economists and financial officials.”

He said that despite the many myths and pervasive ignorance surrounding gold-based money, it worked very well for a long time. “The U.S. was on a gold-based system for 180 years until the early 1970s,” Forbes wrote. “We never had inflation when the dollar’s value was tied to the yellow metal, and the U.S. experienced the greatest long-term economic growth in human history.”

Conversely, Forbes said that since the U.S. abandoned the gold standard, its average growth rates have declined by around 33%. “Median household income today would be at least $40,000 higher if our traditional pattern of growth for those 180 years had been maintained,” he said. “Nonetheless, the contumely and scorn for a gold-based monetary system is universal.”

Despite these prevailing attitudes, Forbes believes that he’s seeing several indications that a gold monetary system could be brought back.

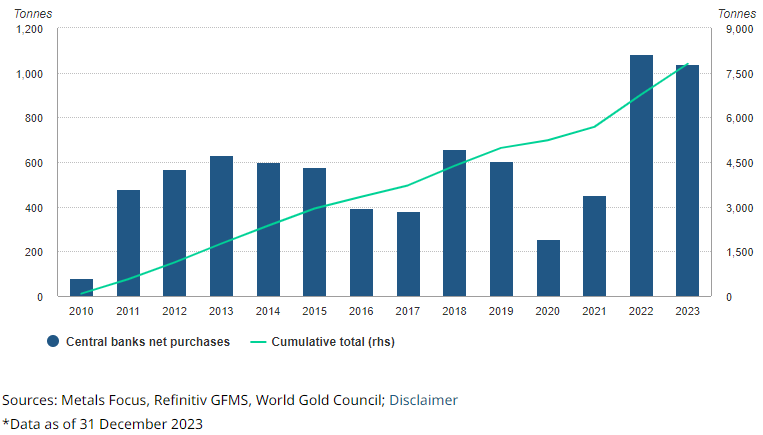

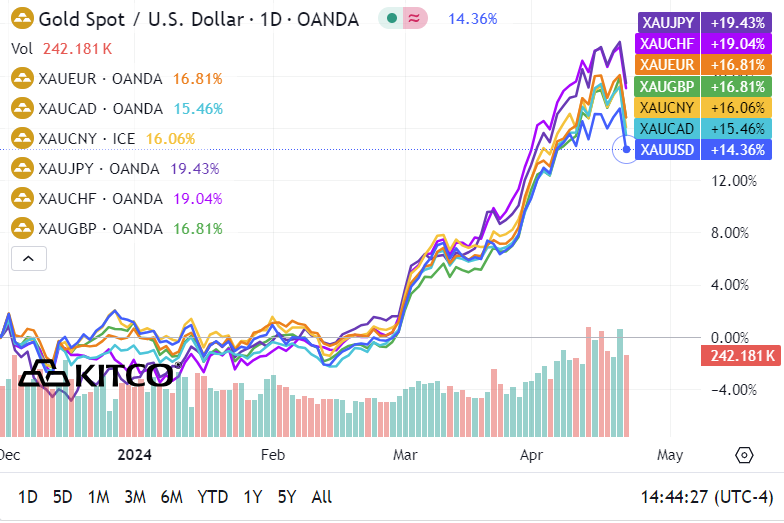

“One is that central banks in recent years have been purchasing gold at record levels,” he noted. “Buyers include China, India, Russia and a number of other nations such as Poland. These countries are reacting to growing doubts about the long-term value of the dollar, which in turn is a symptom of the perceived decline of the United States.”

The growing popularity of cryptocurrencies is another indication, which Forbes characterizes as “a high-tech cry for help in the face of increasingly unreliable fiat currencies.”

“The problem here has been that most creators of cryptos, notably Bitcoin, don’t understand that a currency must be stable in value if it’s going to be used to conduct commercial transactions, especially long-term contracts,” he said. “There are a handful of cryptos tethered to gold, but they haven’t yet achieved the credibility or built the mechanisms to be widely used. Nonetheless, as governments flounder in their monetary policies, that will change.”

The ongoing trend of runaway public and private debt creation “will inevitably kindle crises that cannot be easily extinguished,” he said. “Total debt in the world today is more than $300 trillion, an astonishing three times global GDP.”

Forbes also noted the activities of the BRICS, which doubled in size at last year’s meeting, and whose members have been collaborating on de-dollarization initiatives and alternative payment systems. “Their monetary machinations, so far, have amounted to little, but that’s starting to shift,” he said.

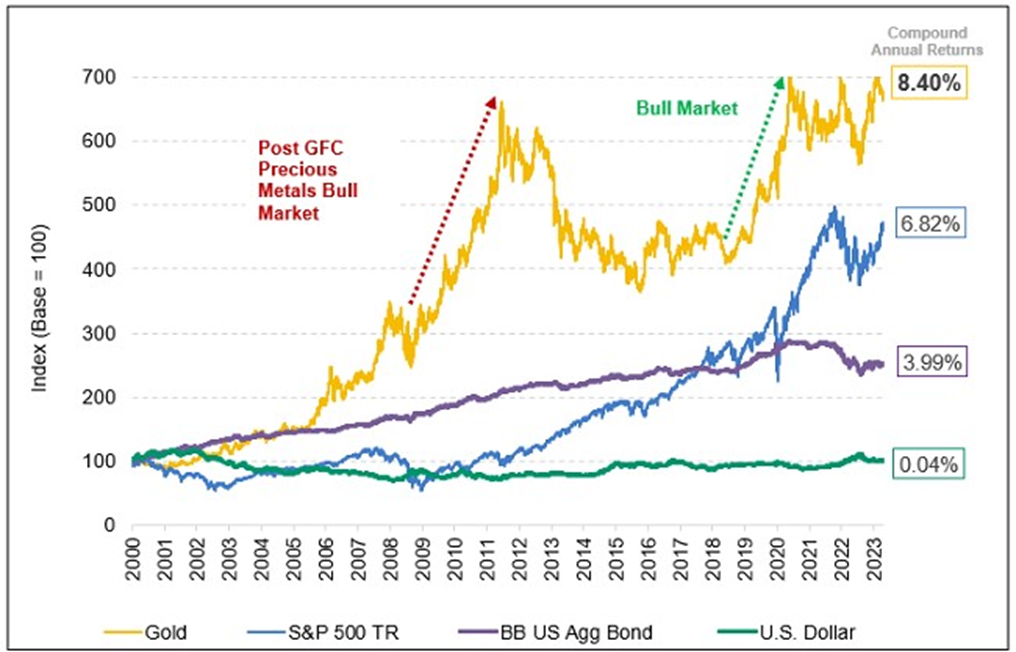

Forbes pointed out that India began experimenting with gold-backed government bonds last year, and quoted monetary expert Nathan Lewis who said “These would probably be very popular with investors worldwide. From the start of the floating [currency] era in 1971 to the present, a gold bond paying 4% would have outperformed all stock and bond markets worldwide.”

“Zimbabwe, which must hold the record for hyperinflation, recently announced the launch of a new currency fixed to gold,” he concluded. “Deep skepticism is warranted that this government has the discipline to make such an arrangement work. But the move is a sign of things to come.”

Story by Ernest Hoffman - Redacted shorter to keep to important points and bullet points added by HGG https://www.kitco.com/news/article/2024-05-22/signs-global-gold-standard-gaining-traction-steve-forbes