People often ask, what percentage should I allocate to physical gold?

While it is completely up to each person individually to decide their percentage allocation into physical gold, gold dealers are strongly guided by financial overseers to state to customers that the recommended allocation to gold should be 10-20%.

We wanted to highlight this great question because it often leads to misinformation. Many people Google, "Why should you only put 10% in gold for wealth diversification?" The top results often claim that gold is volatile and underperforms—but the facts and figures below will prove this wrong and demonstrate gold's excellent performance in hedging the purchasing power of your dollar.

Keep in mind that anyone can post anything online—including on Google and social media—without credentials. These posts often reflect personal agendas or biased opinions rather than accurate information. Additionally, it has been proven that Google, Facebook, and other major platforms have suppressed true information, historical facts, or ideas they disagree with for their own agendas; therefore, it is important to examine the numbers.

Since people can lie and numbers don’t, let's explore the real numbers and performance of physical gold versus the U.S. dollar. We emphasize "physical gold" because paper gold does not perform the same. Many gold ETFs, mining companies, mutual funds, and derivatives have plummeted while gold has soared for years. We commonly see critics who deal in paper investments "post" paper-gold information to contradict statements made about gold’s stellar performance when there is no comparison. Additionally, many paper-gold investment vehicles have gone completely out of business since 2000, while physical gold is arguably one of the best long-term investments anyone could have made.

Looking at the Numbers:

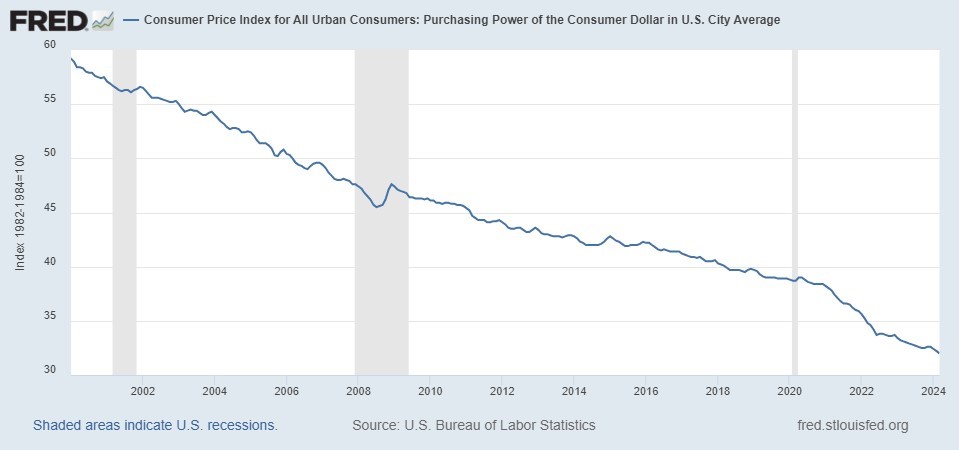

The dollar’s purchasing power has dropped more than 40% since 2000 (see the government's graph), while physical gold is up more than 700%.

Jan 1, 2000, the physical gold spot was USD $290.25 per ounce.

April 12, 2024, the physical gold spot was USD $2,401.50 per ounce.

Percentage Gain ≈ 727%

Based on accurate numbers, if you had just a mere 10% of your wealth in gold, you would have more than recovered your dollar loss.

This graph is directly from the government's website. It is based on the average loss of purchasing power of your dollar from 2000 to April 2024.

An Example of 10% Investment into Gold:

Example of Initial Wealth:

Let's assume an initial wealth of $100,000 for simplicity.

$90,000 in dollars (90% of your wealth).

$10,000 in gold (10% of your wealth).

Dollar's Purchasing Power Decrease:

You can see from the U.S. government website that the U.S. dollar has decreased by more than 40% since the year 2000. This decrease of 40% in the dollar's purchasing power means that your initial $90,000.00 will now only buy $54,000 worth of goods and services today.

Gold's Surge in Value:

Looking at gold's increase of 700% during the same time period, the initial $10,000 would increase an additional $70,000 in value. Original investment $10,000 + $70,000 makes the gold worth a total of $80,000.

New Total Wealth: +34%

Dollars: $54,000

Gold value: $80,000

Total: $54,000 + $80,000 = $134,000

Hence, having 10% of your wealth in gold would not only recover the lost value due to the depreciation of the dollar; but actually increase your total wealth by 34%.

What if you allocated 20% to gold?

New total wealth: $208,000 +108% gain

Step back to 1971:

According to the U.S. Bureau of Labor Statistics, the dollar has lost 85.05% in purchasing power since 1971, while physical gold is up 5,786%.

When President Nixon shockingly untied the U.S. dollar from gold in 1971, the average price of an ounce of gold was USD $40.80.

In 1971, the average price per ounce of gold was USD $40.80.

In April 12, 2024, the physical gold spot was USD $2,401.50 per ounce.

Percentage Gain ≈ 5,786%

How would your total wealth have fared by allocation?

10% Allocation to Gold:

Total New Wealth: $602,055

Wealth Percentage Gain: 502.06%

20% Allocation to Gold:

Total New Wealth: $1,189,160

Wealth Percentage Gain: 1,089.16%

Step back to 1913:

Step back to 1913 when our politicians set forth the establishment of the Federal Reserve and allowed them to control the money supply “monetary policy”:

According to the U.S. Bureau of Labor Statistics, the U.S. dollar has lost 96% of its purchasing power since 1913, while physical gold is up 11,518.3%.

In 1913, gold had a flat price of USD $20.67 per ounce.

In April 12, 2024, the physical gold spot was USD $2,401.50 per ounce.

Percentage Gain ≈ 11,518.3%

How would your total wealth have fared by allocation?

10% Allocation to Gold:

Total New Wealth: $1,165,430

Wealth Percentage Gain: 1,065.43%

20% Allocation to Gold:

Total New Wealth: $2,326,860

Wealth Prcentage Gain: 2,226.86%

These numbers prove the value of hedging your dollar and wealth with physical gold. Failing to allocate a good percentage may be a risk you simply cannot afford, especially during these challenging times. Unfortunately, the dollar's best days are long gone as its purchasing power continues to dwindle quickly, hurting savers and those on fixed incomes the most. We, the people, have a government addicted to debt and printing money, and regrettably, the damage is done. We are nearing the end of a debt cycle, which is why physical gold is now the third-largest reserve currency for all major countries' central banks. This worldwide gold paradigm shift began a few years ago and is increasing rapidly. Relying solely on stocks and bonds leaves your portfolio exposed and your retirement potentially at risk of recession, market swings, and inflation.

Ask for your free copy of our gold & silver investment guide. You'll find great information and charts showing how metals can hedge your savings and retirement accounts against market volatility, recessions, inflation, U.S. debt, and international de-dollarization.

This is for informational purposes and not to be taken as financial or tax advice.

Qualify up to $15,000 in FREE Precious Metals! Mention Code: FREE15

Ready to Diversify with Gold?

Call Harvard Gold Group Today!

Why Harvard Gold Group?

Harvard Gold Group is America's #1 Conservative Gold Company

As seen on 660AM The Answer with Mark Davis, The Babylon Bee, Not The Bee, The Christian Post, The New York Sun, and more. Exceptional customer service and value are the top priorities of Harvard Gold Group (HGG).

HGG is BBB A+, holds 5-star ratings across the board, and provides free consultations and metals overviews. We offer tax-free purchases, free 2-day shipping, the best pricing, and direct access to our co-owners, who have over 16 years of experience specializing in precious metals, moving over $100 million into tangible assets for people's IRAs/retirement accounts and for direct delivery. Customers enjoy lifetime account care and a straightforward buyback program without hassle or liquidation fees.

✔ Tax-Free & Penalty-Free: A Rollover or Transfer of your Retirement Account is almost always tax-free and penalty-free.

✔ Free Metals/Promos: Earn up to $15,000 in FREE Gold/Silver/Promos, on qualifying purchases.

✔ Free Retirement Account Rollover/Transfer: Zero cost to rollover/transfer/move retirement accounts or IRAs to a Gold/Silver IRA. *You can also earn up to 10 years of Precious Metals IRA yearly maintenance fees*.

✔ Privacy: We protect your privacy and believe it is a commodity as valuable as time, you can't get it back. We do not sell your information to third parties.

✔ HGG Lifetime Account Care: Providing a dedicated account specialist and keeping you updated with market news and trends.

✔ Harvard BuyBack Program: Hassle-free buyback of HGG metals with no liquidation fees.

✔ Guaranteed Precious Metals: We only deal in government-issued coins and branded bars.

✔ Free Shipping: Your precious metals are shipped privately and fully insured to the location of your choice. You can opt to have them delivered directly to your home, business, or an independent depository.

✔ Lowest Pricing: We are committed to offering you the best value possible, with a comprehensive price-match policy.

✔ Customer Satisfaction Guarantee: Harvard Gold Group is a 5-star rated company committed to maintaining exceptional customer service satisfaction.

✔ You work directly with the founders of HGG.

Free Retirement Account Rollover/Transfer & Free Direct Delivery Shipping + Insurance

TALK TO AN EXPERT

ACCOUNT SPECIALIST