Gold prices continued to shrug off rising rate hike expectations and skyrocketing Treasury yields as they remain near $2000 per ounce, and while silver’s low prices supported coin sales, the precious metal remains oversold, according to analysts at Heraeus.

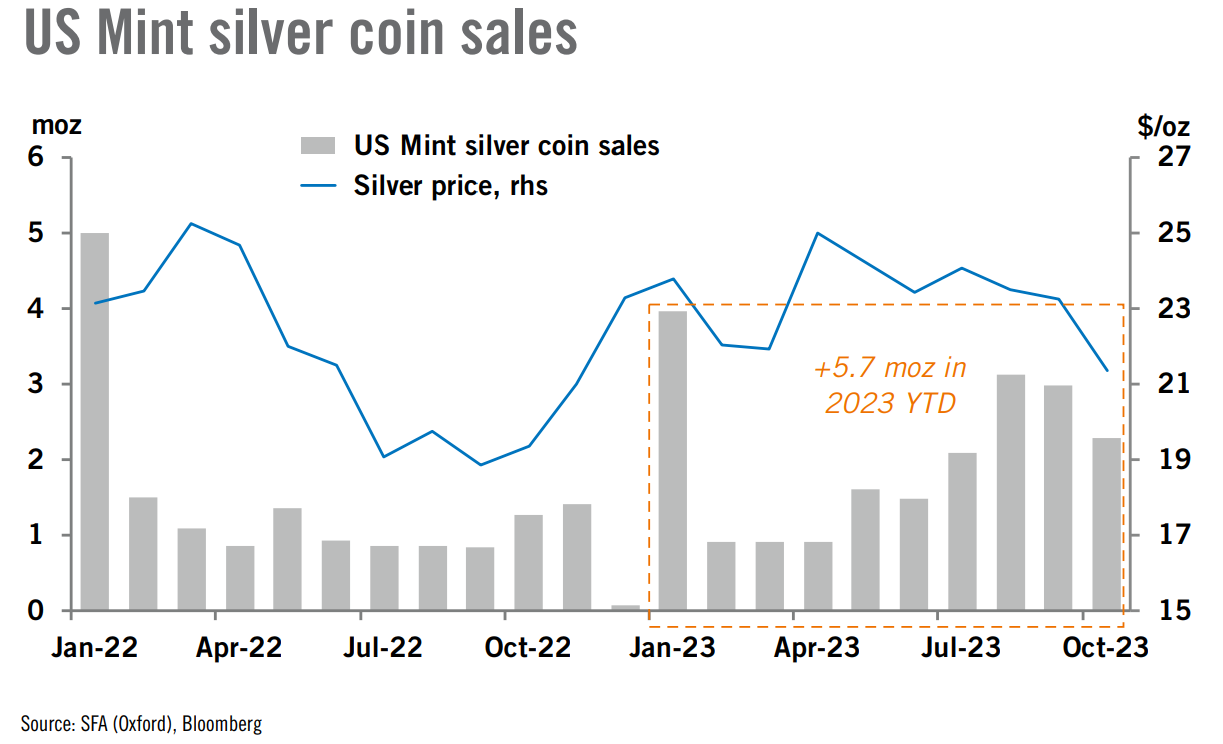

US Mint silver American Eagles “Cumulative sales year-to-date (including the first two weeks of October) were 20.2 moz, 5.7 moz (39%) higher than in the same period in 2022. This is despite a higher interest rate environment, and a greater opportunity cost of holding physical metal over short-dated US treasury bills.”

“The silver price rose less than the gold price last week and the gold-silver ratio sits at around 84.5, which considering the long-term average of 66.25, signals that silver is undervalued relative to gold.”

(Kitco News) - Gold prices continued to shrug off rising rate hike expectations and skyrocketing Treasury yields as they remain near $2000 per ounce, and while silver’s low prices supported coin sales, the precious metal remains oversold, according to analysts at Heraeus.

“Higher than expected US inflation in the previous week and retail sales above expectation last week boosted the odds of the Fed further tightening monetary policy in November,” the analysts wrote in their latest report. “Despite this, gold held its momentum from the week before, rising as high as $1,997/oz. Some of the rally was likely down to short covering, helped further by the escalation of the conflict in the Middle East motivating haven demand.”

They noted that even with prices appreciating, 7.97 million ounces of gold have flowed out of ETFs since the last peak in May. “It appears that, despite the recent rally in the gold price, investors are more focused on short-term pain caused by rapidly rising yields rather than opting to bet on potential longer-term gains once this trend reverses,” they said. “Gold has made a base above the previous upward trend line which may act as a support for the next few weeks.”

They added that ETF investors could jump back into gold-backed funds this week “if bearish sentiment shifts to a fear of missing out among institutional investors.”

Turning to silver, the analysts noted that the relatively low price of the precious metal spurred strong coin sales in the third quarter. “US Mint silver American Eagles were 8.19 moz in Q3’23, more than double the previous quarter when the quarterly average silver price was 2.6% higher, and also 5.6 moz higher than in Q3’22,” they wrote. “Cumulative sales year-to-date (including the first two weeks of October) were 20.2 moz, 5.7 moz (39%) higher than in the same period in 2022. This is despite a higher interest rate environment, and a greater opportunity cost of holding physical metal over short-dated US treasury bills.”

The analysts said the situation was very different in Australia, “with bullion sales from Perth Mint seeing a 46% decline in silver product sales quarter-on-quarter in Q3’23, and cumulative sales down 31% year-to-date.”

Heraeus also saw further declines for silver-backed exchange-traded products. “Silver Global silver ETF holdings fell by 6.93 moz (-0.8%) last week, a continuation of the trend set in February this year,” they said, with holdings declining by 34.5 moz, or 5% so far in 2023.

“The silver price rose less than the gold price last week and the gold-silver ratio sits at around 84.5, which considering the long-term average of 66.25, signals that silver is undervalued relative to gold.”

Both precious metals are holding at elevated levels after last week’s late rally, with spot gold last trading at $1,973.05, down 0.40% on the session, while silver has pulled back a little further with the spot price at $22.987 at the time of writing, down 1.63% today.

Story by Ernest Hoffman - Redacted bullet points by Jody Davis https://www.kitco.com/news/2023-10-23/Gold-shows-surprising-strength-despite-sky-high-Treasury-yields-silver-continues-to-be-undervalued-Heraeus.html?sitetype=fullsite